Apple to Pay $38 Billion in Repatriation Tax; Plans New U.S. Campus -- 2nd Update

January 17 2018 - 4:38PM

Dow Jones News

By Tripp Mickle

Apple Inc. said it would make a one-time tax payment of $38

billion to repatriate overseas cash holdings and also ramp up its

spending in the U.S., as it seeks to emphasize its contributions to

the U.S. economy after years of taking criticism for outsourcing

manufacturing to China.

The tech giant said Wednesday it plans $30 billion in capital

spending in the U.S. over five years that will create more than

20,000 new jobs. It didn't specify how much of that spending was

already planned, but said the total will include building a new

facility that initially will house customer-service operations, and

$10 billion toward data centers across the country. Apple also is

expanding from $1 billion to $5 billion a fund it established last

year for investing in advanced manufacturing in the U.S.

Chief Executive Tim Cook touted the plans as building on Apple's

support for the U.S. economy. "We have a deep sense of

responsibility to give back to our country and the people who help

make our success possible," he said in a statement.

Apple said its one-time tax payment was the result of recent

changes to U.S. tax law, under which companies can pay a one-time

tax of 15.5% on overseas cash holdings repatriated to the U.S. The

company said in November that it had earmarked $36 billion to cover

deferred taxes on its $252.3 billion in overseas cash holdings,

assuming that it would eventually pay some tax for bringing that

home.

Apple has faced criticism over the past decade for the overseas

manufacturing of its iPhone, of which it has sold more than 1

billion units, rather than manufacturing devices domestically.

President Donald Trump during the presidential campaign blasted the

company for outsourcing. He later called on Apple to build a

factory in the U.S. and last year said Mr. Cook promised to build

three manufacturing plants in the U.S.

Apple's announcement left many details of its plans unclear, and

a spokesman declined to elaborate. The company didn't say how much

it planned to return of its $252.3 billion in cash and marketable

securities held overseas. It also didn't specify whether it plans

to increase dividends or share repurchases, which is something its

top executives had said would be a priority following the change in

U.S. tax law.

The company previously said it planned $16 billion of capital

expenditures world-wide in the current fiscal year ending in

September, up from $14.9 billion the previous year. However, Apple

doesn't break out its spending in the U.S., making it difficult to

gauge how much of the $30 billion over five years is new.

Apple's announcement said it currently employs 84,000 people in

the U.S. A year ago, it said it employed 80,000, suggesting its

plans for job creation are consistent with what it has been doing.

Its annual report, which doesn't break out the number of U.S.

employees, said it had a total of 123,000 full-time equivalent

employees as of Sept. 30.

The company said it would offer more information later this year

on its planned new campus, which will initially house technical

support for customers. It already operates multiple campuses across

the U.S., such as a facility in Austin, Texas; and its new $5

billion headquarters, Apple Park, in Cupertino, Calif.

Combining the new investments and current spending with U.S.

suppliers, Apple estimated it would contribute $350 billion to the

U.S. economy over the next five years. The bulk of that spending,

estimated at about $55 billion this year, goes to U.S. suppliers,

such as glass-maker Corning Inc. The remainder is for capital

expenditures, estimated at about $30 billion over five years, and

the one-time tax hit of $38 billion. It's unclear if the $4 billion

increase in its advanced manufacturing fund is included in its

anticipated payments to suppliers or in addition to that

spending.

Apple announced its $1 billion advanced manufacturing fund last

year. It subsequently committed $200 million to Corning for

improvements to a glass manufacturing plant in Harrodsburg, Ky.,

and committed to $390 million in future purchases from laser

manufacturer Finisar Corp., which plans to open a

700,000-square-foot plant in Sherman, Texas.

Apple said it works with more than 9,000 suppliers in the U.S.

across 50 states.

Write to Tripp Mickle at Tripp.Mickle@wsj.com

(END) Dow Jones Newswires

January 17, 2018 16:23 ET (21:23 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

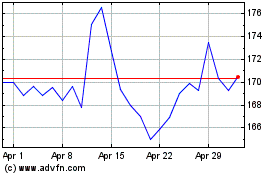

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

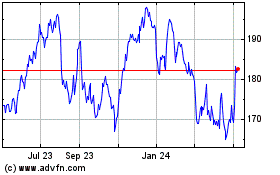

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024