Pearson 2017 Results to Be at Upper End of Guidance; Tax Rate to Remain Unchanged

January 17 2018 - 3:00AM

Dow Jones News

By Maryam Cockar

Pearson PLC (PSON.LN) said Wednesday that full-year results will

be at the upper end of its guidance and that its effective tax

remains unchanged between 20% and 22% following tax reform in the

U.S.

The education publisher said it also expects to have a small,

one-off deferred tax charge in 2017.

The tax law passed by U.S. Congress late last year and signed by

President Donald Trump on Dec. 22 includes a reduction of the

corporate-tax rate to 21% from 35% and limits on the deductibility

of corporate interest payments.

Pearson said it expects to report adjusted operating profit of

between 600 million pounds ($826.1 million) and GBP605 million for

2017, which is at the upper end of its October 2017 guidance range

of between GBP576 million and GBP606 million. At average effective

exchange rates, Pearson expects to report adjusted operating profit

between GBP570 million and GBP575 million.

Adjusted earnings per share is anticipated to be between 53.50

pence and 54.50 pence, which is also above the October 2017

guidance range of between 49 pence and 52 pence.

In the fist nine months of 2017, underlying revenue fell 2% in

line with expectations as North America revenue fell 4%. Pearson

said sales for U.S. higher education courseware fell 3% on an

underlying basis, which was in line with the lower end of its

guidance range.

Write to Maryam Cockar at maryam.cockar@dowjones.com

(END) Dow Jones Newswires

January 17, 2018 02:45 ET (07:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

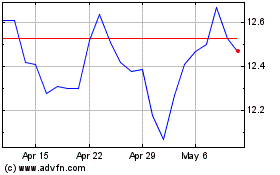

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

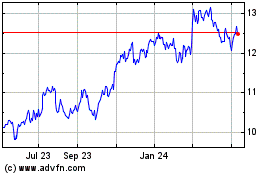

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024