Current Report Filing (8-k)

January 16 2018 - 6:03AM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, DC 20549

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 8-K

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT REPORT

|

|

|

|

|

|

|

|

|

|

Pursuant to Section 13 or 15(d) of

|

|

|

|

|

|

|

|

|

|

The Securities Exchange Act of 1934

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 12, 2018

|

|

|

|

|

|

|

|

|

Date of Report (Date of earliest event reported)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S

&

T BANCORP, INC

|

|

|

|

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania

|

0-12508

|

25-1434426

|

|

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

800 Philadelphia Street, Indiana, PA

|

|

15701

|

|

|

|

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant's telephone number, including area code: (800) 325-2265

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Former name or former address, if changed since last report)

|

|

|

|

|

|

|

|

(Not applicable)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2. below):

|

|

|

|

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

¨

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

¨

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

¨

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 2.02 Results of Operations and Financial Condition

Information contained in Item 8.01 below with respect to the fourth quarter ended December 31, 2017, incorporated by reference in this Item 2.02.

Item 8.01 Other Events

On December 22, 2017, H.R.1, known as the "Tax Cuts and Jobs Act," was signed into law. Among other things, the Tax Cuts and Jobs Act permanently lowers the corporate tax rate to 21 percent from the existing maximum rate of 35 percent, effective for tax years including or commencing January 1, 2018. As a result of the reduction of the corporate tax rate to 21 percent, U.S. generally accepted accounting principles require companies to revalue their deferred tax assets and liabilities with resulting tax effects accounted for in the reporting period of enactment.

We will record a revaluation of our deferred tax assets and liabilities as of December 31, 2017, at the new rate of 21 percent, based upon balances in existence at the date of enactment. We are in the process of evaluating the impact of the new law and currently estimate that our net deferred tax assets will be written down by $13.4 million in the fourth quarter of 2017 recorded as an increase to our income tax expense. This noncash, one-time charge is expected to decrease our fourth quarter earnings per share by $0.38 per share based on our estimated fourth quarter average diluted shares outstanding.

This estimate is based upon a review and analysis of our net deferred tax assets, as well as expected adjustments to various deferred tax assets and liabilities in the fourth quarter, including those accounted for in accumulated other comprehensive income. Our actual write-down may vary materially from the estimate due to a number of uncertainties and factors, including the completion of our consolidated financial statements as of and for the year ending December 31, 2017, and is subject to further clarification of the new law that cannot be reasonably estimated at this time.

This document may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve risks and uncertainties that could cause actual results to differ materially from the results discussed in these statements. These risks are detailed in the company’s latest form 10-K filed with the Securities and Exchange Commission and any subsequently filed reports containing updates to these risks. Any such forward-looking statement or other information herein speaks only as of the particular dates referenced or the date such information or statement is made, and S&T undertakes no obligation to update any such information.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

S

&

T Bancorp, Inc.

|

|

|

/s/ Mark Kochvar

|

|

January 12, 2018

|

Mark Kochvar

Senior Executive Vice President,

Chief Financial Officer

|

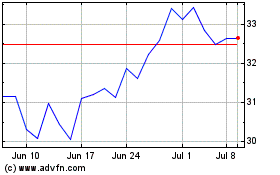

S and T Bancorp (NASDAQ:STBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

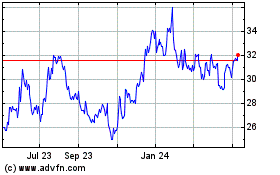

S and T Bancorp (NASDAQ:STBA)

Historical Stock Chart

From Apr 2023 to Apr 2024