Fed Fines 5 Big Banks $35 Million for Foreclosure, Mortgage-Servicing Issues

January 12 2018 - 11:30AM

Dow Jones News

By Ryan Tracy

WASHINGTON -- The Federal Reserve fined five big banks $35.1

million for issues related to financial-crisis-era mortgage

servicing and foreclosures, while also moving them out of the

penalty box for what it said was a "substantial improvement" in

their practices.

The fines relate to deficiencies regulators saw in the wake of a

meltdown in the U.S. housing market around the 2008-09 financial

crisis. Goldman Sachs Group Inc. was fined $14 million, Morgan

Stanley $8 million, CIT Group Inc. $5.2 million, U.S. Bancorp $4.4

million and PNC Financial Services Group Inc. $3.5 million.

Separately, the Fed said it was terminating enforcement actions

against those five firms as well as five others: Ally Financial

Inc., Bank of America Corp., HSBC Holdings PLC's U.S. unit,

JPMorgan Chase & Co. and SunTrust Banks Inc.

The 10 firms had been slapped with enforcement actions in 2011

and 2012 for what the Fed said were "deficiencies in residential

mortgage loan servicing and foreclosure processing." The Fed said

the firms have made "substantial improvement" in their

practices.

Separately, the Fed penalized Goldman Sachs $90,000 for

violations related to the National Flood Insurance Act.

Write to Ryan Tracy at ryan.tracy@wsj.com

(END) Dow Jones Newswires

January 12, 2018 11:15 ET (16:15 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

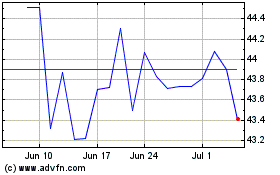

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

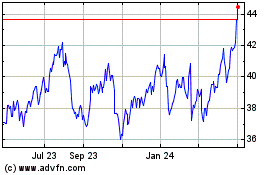

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024