UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section

14(c) of the

Securities Exchange Act of 1934

Check the appropriate box:

[ ] Preliminary Information Statement

[ ] Confidential, for Use of the Commission

Only (as permitted by Rule 14c-5(d)(2))

[X] Definitive Information Statement

COSMOS GROUP HOLDINGS INC.

(Name of Registrant as Specified In Its

Charter)

Payment of Filing Fee (Check the appropriate

box)

[X] No fee required.

[ ] Fee computed on table below per Exchange

Act Rules 14c-5(g) and 0-11.

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset

as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify

the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

COSMOS GROUP HOLDINGS INC.

Rooms 1309-11, 13

th

Floor,

Tai Yau Building,

No. 181 Johnston Road

Wanchai, Hong Kong

NOTICE OF CORPORATE ACTION TAKEN BY WRITTEN

CONSENT

OF MAJORITY STOCKHOLDERS WITHOUT SPECIAL

MEETING OF THE STOCKHOLDERS

Dear Stockholders:

We are writing to advise you that stockholders

of Cosmos Group Holdings Inc., a Nevada (“COSG,” “the Company,” “we” or “us”),

holding a majority of the voting rights of our common stock executed a written consent in lieu of a special meeting dated December

29, 2017, authorizing our Board of Directors to take all steps necessary to effect a 1-for-20 reverse stock split of our common

stock (the “Reverse Stock Split”). Our Board of Directors also approved the proposed Reverse Stock Split

on December 29, 2017. Upon implementation of the Reverse Stock Split, each holder of common stock will receive one share

of common stock for every twenty shares of common stock held immediately prior to effecting the Reverse Stock Split. Any

fractional shares of common stock resulting from the Reverse Stock Split will “round up” to the nearest whole number.

No cash will be paid to any holders of fractional interests in COSG.

The accompanying information statement,

which describes the Reverse Stock Split in more detail, is being furnished to our stockholders for informational purposes only,

pursuant to Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the rules and

regulations prescribed thereunder. The consent that we have received constitutes the only stockholder approval required for the

Reverse Stock Split under the Nevada Revised Statutes, our Articles of Incorporation and Bylaws. Accordingly, the Reverse Stock

Split will not be submitted to the other stockholders of the Company for a vote.

The record date for the determination of

stockholders entitled to notice of the action by written consent is December 29, 2017. Pursuant to Rule 14c-2 under

the Exchange Act, the Reverse Stock Split will not be implemented until at least twenty (20) calendar days after the mailing of

this information statement to our stockholders. This information statement will be mailed on or about January 12, 2018

to stockholders of record on December 29, 2017.

No action is required by you to effectuate

this action. The accompanying information statement is furnished only to inform our stockholders of the action described above

before it takes effect in accordance with Rule 14c-2 promulgated under the Exchange Act.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU

ARE REQUESTED NOT TO SEND US A PROXY.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY

OF OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE REVERSE STOCK SPLIT. THE NUMBER OF VOTES RECEIVED

IS SUFFICIENT TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS MATTER.

By order of the Board of Directors,

/s/ Koon Wing Cheung

Koon Wing Cheung

Chairman of the Board of Directors

January 12, 2018

COSMOS GROUP HOLDINGS INC.

INFORMATION STATEMENT REGARDING

CORPORATE ACTION TAKEN BY WRITTEN CONSENT

OF

OUR BOARD OF DIRECTORS AND HOLDERS OF

A MAJORITY OF OUR VOTING CAPITAL STOCK

IN LIEU OF SPECIAL MEETING

Cosmos Group Holdings, Inc. (“COSG,”

“the Company,” “we” or “us”) is furnishing this information statement to you to provide a description

of actions taken by our Board of Directors and the holders of a majority of our outstanding voting capital stock on December 29,

2017, in accordance with the relevant sections of the Nevada Revised Statutes of the State of Nevada (the “NRS”).

This information statement is being mailed

on or about January 12, 2018 to stockholders of record on December 29, 2017 (the “Record Date”). The information statement

is being delivered only to inform you of the corporate action described herein before such action takes effect in accordance with

Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). No action is requested

or required on your part.

WE ARE NOT ASKING YOU FOR A PROXY AND

YOU ARE REQUESTED NOT TO SEND US A PROXY.

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS

AND NO STOCKHOLDERS' MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

PLEASE NOTE THAT THE HOLDERS OF A MAJORITY

OF OUR OUTSTANDING SHARES OF COMMON STOCK HAVE VOTED TO AUTHORIZE THE REVERSE STOCK SPLIT. THE NUMBER OF VOTES RECEIVED IS SUFFICIENT

TO SATISFY THE STOCKHOLDER VOTE REQUIREMENT AND NO ADDITIONAL VOTES WILL CONSEQUENTLY BE NEEDED TO APPROVE THIS MATTER.

GENERAL DESCRIPTION OF CORPORATE ACTION

On December 29, 2017, our Board of Directors

(the “Board”) unanimously authorized and approved a 1-for-20 reverse stock split of all issued and outstanding shares

of our common stock (the “Reverse Stock Split”). On December 29, 2017, the holders of a majority of

our outstanding voting capital stock delivered an executed written consent of stockholders authorizing and approving the Reverse

Stock Split.

VOTING AND VOTE REQUIRED

Pursuant to COSG’s Bylaws and

the NRS, a vote by the holders of at least a majority of COSG’s outstanding capital stock is required to effect the

action described herein. Each common stockholder is entitled to one vote for each share of common stock held by such

stockholder. As of the Record Date, COSG had 429,848,898 shares of common stock issued and

outstanding. The voting power representing not less than 214,924,450 shares of common stock is required to pass

any stockholder resolutions. Pursuant to Chapter 78.320 of the NRS, the following stockholders holding an

aggregate of 389,608,051 shares of common stock, or approximately 90.64% of the issued and outstanding shares of our common

stock on the Record Date, delivered an executed written consent dated December 29, 2017, authorizing the Reverse Stock

Split.

|

Name

|

Beneficial Holder

and Affiliation

|

Common Shares

Beneficially

Held

|

Percentage of

Issued and

Outstanding

|

|

Koon Wing Cheung

|

Director and Chief Executive Officer

|

219,222,938

|

51%

|

|

Miky Wan*

|

Director, President and Interim Chief Financial Officer

|

170,385,113*

|

39.64%

|

*Shares of common stock are held of record

by Asia Cosmos Group Limited. Miky Wan, our President, Interim Chief Financial Officer and director owns 100% of Asia Cosmos Group

Limited which directly owns 170,385,113 shares of our common stock. As a result, Ms. Wan is deemed to beneficially own shares held

by Asia Cosmos Group Limited.

NO APPRAISAL RIGHTS

Under the NRS, stockholders

are not entitled to appraisal rights with respect to the Reverse Stock Split, and we will not provide our stockholders with such

rights.

INTEREST OF CERTAIN PERSONS IN MATTERS

TO BE ACTED UPON

Except in their capacity

as stockholders, none of our officers, directors or any of their respective affiliates has any interest in the Reverse Stock Split.

APPROVAL TO EFFECT A REVERSE STOCK SPLIT

OF

ALL ISSUED AND OUTSTANDING SHARES OF

COMMON STOCK

AT A RATIO OF ONE-FOR-TWENTY

On December 29, 2017,

our Board and the consenting stockholders adopted and approved a resolution to effect a one-for-twenty (1:20) reverse stock split

of all issued and outstanding shares of common stock of COSG. Upon the effectiveness of the Reverse Stock Split, each

holder of common stock will receive one share of common stock for every twenty shares of common stock held immediately prior to

effecting the Reverse Stock Split. The Reverse Stock Split will not change the number of authorized shares of common

stock or the par value of COSG’s common stock. Except for any changes arising from the treatment of fractional shares,

each stockholder of COSG will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split

as such stockholder held immediately prior to the Reverse Stock Split.

The Reverse Stock

Split is implemented in connection with the Company’s plans to attract additional financing and potential business

opportunities. COSG is actively considering financing and business candidates and opportunities. There are

currently no definitive plans, proposals or arrangements to issue shares of COSG or which may result in a change in control

of COSG.

Under Rule 14c-2, promulgated

pursuant to the Securities Exchange Act of 1934, as amended, the Reverse Stock Split shall be effective twenty (20) days after

this Information Statement is mailed to stockholders of COSG. No further action on the part of stockholders is required

to authorize or effect the Reverse Stock Split.

THE PURPOSE OF THE REVERSE STOCK SPLIT

The Board believes

that the Reverse Stock Split is in the best interest of the stockholders of the Company because it will better position the Company

to attract potential financing and business candidates and opportunities. The Board believes that the reduction in the

number of issued and outstanding shares of Common Stock resulting from the Reverse Stock Split will provide the Company with additional

authorized but unissued shares which could be utilized for future acquisitions or financings or general corporate purposes such

as stock dividends, stock splits or other recapitalizations and grants of stock options.

The Company currently

has no definitive plans, proposals or arrangements for the issuance of Company shares, although opportunities for acquisitions

and equity financings could arise at any time. No assurances can be given that such financing candidates or business

opportunities will be found.

On December 29, 2017,

the Board and stockholders holding a majority of the voting power of our capital stock approved the 1-for-20 Reverse Stock Split

of our common stock. The approval becomes effective twenty (20) days after the mailing of this information statement

to our stockholders. Upon this approval becoming effective, our Board of Directors will be authorized to implement the

Reverse Stock Split as it determines is advisable.

POTENTIAL EFFECTS OF THE PROPOSED REVERSE

SPLIT

Upon the implementation

of the Reverse Stock Split, the number of shares of the outstanding common stock will be reduced. We believe that

the decrease in the number of shares of outstanding common stock as a consequence of the proposed Reverse Stock Split should increase

the per share price of the common stock, which may encourage greater interest in the common stock and possibly promote greater

liquidity for the Company's stockholders. However, the increase in the per share price of the common stock as a consequence

of the proposed Reverse Stock Split, if any, may be proportionately less than the decrease in the number of shares outstanding,

and any increased liquidity due to any increased per share price could be partially or entirely off-set by the reduced number of

shares outstanding after the proposed Reverse Stock Split. The effect the Reverse Stock Split upon the market price

of the common stock, however, cannot be predicted, and the history of reverse stock splits for companies in similar circumstances

includes cases where stock performance has and has not improved. There can be no assurance that the trading price of

the common stock after the Reverse Stock Split will rise in proportion to the reduction in the number of shares of our common stock

outstanding as a result of the Reverse Stock Split or remain at an increased level for any period. The trading price

of the common stock may change due to a variety of other factors, including our operating results, other factors related to our

business and general market conditions.

The following table

summarizes the approximate effect of the Reverse Stock Split on our authorized and outstanding shares of common stock and preferred

stock.

|

|

|

|

Prior to Reverse Stock Split

|

|

|

After Reverse Stock Split

|

|

|

Common Stock, par value $0.001

|

|

|

|

|

|

|

|

|

|

Authorized Shares

|

|

|

|

500,000,000

|

|

|

|

500,000,000

|

|

|

|

Outstanding Shares

|

|

|

|

429,848,898

|

|

|

|

*21,492,445

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock, par value $0.001

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Shares

|

|

|

|

30,000,000

|

|

|

|

30,000,000

|

|

|

|

Outstanding Shares

|

|

|

|

0

|

|

|

|

0

|

|

*

Approximate

Effects on Ownership by Individual Stockholders

As a result of the

Reverse Stock Split, the number of shares of our common stock held by each stockholder will be reduced by multiplying the number

of shares held immediately before the Reverse Stock Split by the 1-for-20 exchange ratio. All stockholders holding a

fractional share will have the fractional share rounded and adjusted to the nearest whole share. The Reverse Stock Split

will affect all of our stockholders uniformly and will not affect any stockholder's percentage ownership interests in the Company

or proportionate voting power, except to the extent that the Reverse Stock Split results in any of our stockholders owning additional

shares as a result of adjustments made to fractional interests.

Other Effects on outstanding Shares

The rights and preferences

of the outstanding shares of the common stock will remain the same when the Reverse Stock Split occurs. Each share of

common stock issued pursuant to the Reverse Stock Split will be fully paid and non-assessable.

Reduction in Stated Capital

The Reverse Stock Split

will not affect the par value of our common stock. As a result, on the effective date of the Reverse Stock Split, the stated capital

on our balance sheet attributable to our common stock will be reduced in proportion to the size of the Reverse Stock Split, and

the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. The per share net

income or loss and net book value of COSG’s common stock will be increased because there will be a lesser number shares of

COSG’s common stock outstanding. Our stockholders’ equity, in the aggregate, will remain unchanged.

Potential Dilution

The Reverse Stock Split

will not change the number of authorized shares of our common stock as designated by our Articles of Incorporation. As

a result, the number of shares remaining available for issuance under our authorized pool of common stock will increase. Our

Board of Directors may authorize, without further stockholder approval, the issuance of such shares of common stock or preferred

stock to such persons, for such consideration, and upon such terms as the Board of Directors determines. Such issuance

could result in a significant dilution of the voting rights and the stockholders' equity of the then existing stockholders.

Anti-Takeover Implications and Anti-Takeover Provisions of the NRS

The additional shares

of common stock that will become available for issuance as a result of the Reverse Stock Split may be used by our management to

oppose a hostile takeover attempt or delay or prevent changes of control or changes in or removal of management, including transactions

that are favored by a majority of the stockholders or in which the stockholders might otherwise receive a premium for their

shares over then-current market prices or benefit in some other manner. Although the Reverse Stock Split is prompted by business

and financial considerations, stockholders nevertheless should be aware that the Reverse Stock Split may facilitate future efforts

by our management to deter or prevent a change in control of our company. The Board has no plans to use any of the additional shares

of common stock that will become available when the Reverse Stock Split occurs, for any such purposes.

Nevada law generally

prohibits a Nevada corporation, with shares registered under section 12 of the Exchange Act and with 200 or more stockholders of

record, from engaging in a combination (defined in the statute to include a variety of transactions, including mergers, asset sales,

issuance of stock and other actions resulting in a financial benefit to the Interested Stockholder) with an Interested Stockholder

(defined in the statute generally as a person that is the beneficial owner of 10% or more of the voting power of the outstanding

voting shares), for a period of three years following the date that such person became an Interested Stockholder unless the board

of directors of the corporation first approved either the combination or the transaction that resulted in the stockholder's becoming

an Interested Stockholder. If this approval is not obtained, the combination may be consummated after the three year period expires

if either (a) (1) the board of directors of the corporation approved the combination or the purchase of the shares by the Interested

Stockholder before the date that the person became an Interested Stockholder, (2) the transaction by which the person became an

Interested Stockholder was approved by the board of directors of the corporation before the person became an interested stockholder,

or (3) the combination is approved by the affirmative vote of holders of a majority of voting power not beneficially owned by the

Interested Stockholder at a meeting called no earlier than three years after the date the Interested Stockholder became such; or

(b) the aggregate amount of cash and the market value of consideration other than cash to be received by all holders of common

stock and holders of any other class or series of shares not beneficially owned by an Interested Stockholder meets the minimum

requirements set forth in NRS Sections 78.441 through 78.444.

A Nevada corporation

may adopt an amendment to its articles of incorporation expressly electing not to be governed by these provisions of the NRS,

if such amendment is approved by the affirmative vote of a majority of the disinterested shares entitled to vote; provided, however,

such vote by disinterested stockholders is not required to the extent the Nevada corporation is not subject to such provisions. Such

an amendment to the articles of incorporation does not become effective until 18 months after the vote of the disinterested stockholders

and does not apply to any combination with an Interested Stockholder whose date of acquiring shares is on or before the effective

date of the amendment.

The NRS also limits

the acquisition of a controlling interest in a Nevada corporation with 200 or more stockholders of record, at least 100 of who

have Nevada addresses appearing on the stock ledger of the corporation, and that does business in Nevada directly or through an

affiliated corporation. According to the NRS, an acquiring person who acquires a controlling interest in an issuing corporation

may not exercise voting rights on any control shares unless such voting rights are conferred by a majority vote of the disinterested

stockholders of the issuing corporation at a special or annual meeting of the stockholders. In the event that the control shares

are accorded full voting rights and the acquiring person acquires control shares with a majority or more of all the voting power,

any stockholder, other than the acquiring person, who does not vote in favor of authorizing voting rights for the control shares

is entitled to demand payment for the fair value of such person's shares.

Under the NRS, a controlling

interest means the ownership of outstanding voting shares of an issuing corporation sufficient to enable the acquiring person,

individually or in association with others, directly or indirectly, to exercise (1) one-fifth or more but less than one-third,

(2) one-third or more but less than a majority, or (3) a majority or more of the voting power of the issuing corporation in the

election of directors. Outstanding voting shares of an issuing corporation that an acquiring person acquires or offers to acquire

in an acquisition and acquires within 90 days immediately preceding the date when the acquiring person became an acquiring person

are referred to as control shares.

The control share provisions

of the NRS do not apply if the corporation opts-out of such provisions in the articles of incorporation or bylaws of the corporation

in effect on the tenth day following the acquisition of a controlling interest by an acquiring person.

We have opted out of

the business combination or acquisition of a controlling interest statutes, and these statutes do not currently apply to us.

Other than as discussed

in this information statement, there are no provisions of our articles, bylaws, employment agreements or credit agreements have

material anti-takeover consequences.

STOCK CERTIFICATES

As of the effective

date of the Reverse Stock Split, each certificate representing shares of our common stock before the Reverse Stock Split will be

deemed, for all corporate purposes, to evidence ownership of the reduced number of shares of our common stock resulting from the

Reverse Stock Split. All shares, underlying options and warrants and other securities will also be automatically adjusted on the

effective date of the Reverse Stock Split, if any such securities are outstanding on the effective date. In order to

avoid the expense and inconvenience of issuing and transferring fractional shares of common stock to stockholders who would otherwise

be entitled to receive fractional shares of common stock following the Reverse Split, any fractional shares which result from the

Reverse Stock Split will be adjusted so that such stockholders will be entitled to receive, in lieu of such fractional share, one

full share of common stock.

If you hold your

shares of common stock in a brokerage account or in "street name," you will not be required to take any further

action. If you hold stock certificates, you will not have to exchange your existing stock certificates for new stock

certificates reflecting the Reverse Stock Split, except that holders of unexchanged shares will not be entitled to receive

any dividends, if any, or other distributions payable by us after the Reverse Stock Split until they surrender their old

stock certificates for exchange. Any stockholder desiring a new form of stock certificate may submit the existing stock

certificate to our transfer agent for cancellation, and obtain a new form of certificate. The transfer agent may impose a

reasonable fee for a voluntary exchange of certificates. Stockholders should not destroy any stock certificate.

Contact information for our transfer agent

is as follows:

Corporate Stock Transfer, Inc.

3200 Cherry Creek Drive South, Suite 430

Denver, CO 80209

Telephone: (303) 282-4800

Facsimile: (303) 282-5800

FEDERAL INCOME TAX CONSEQUENCES

The following discussion

is a summary of certain United States federal income tax consequences of the Reverse Stock Split to us and stockholders of our

common stock. It does not purport to be a complete discussion of all of the possible federal income tax consequences

of the Reverse Stock Split and is included for general information only. This discussion is based on laws, regulations,

rulings and decisions in effect on the date hereof, all of which are subject to change (possibly with retroactive effect) and to

differing interpretations. This discussion only applies to stockholders that are U.S. persons as defined in the Internal

Revenue Code of 1986, as amended, and does not describe all of the tax consequences that may be relevant to a stockholder in light

of his particular circumstances or to stockholders subject to special rules (such as dealers in securities, financial institutions,

insurance companies, tax-exempt organizations, foreign individuals and entities, and persons who acquired their common stock as

compensation). In addition, this summary is limited to stockholders that hold their common stock as capital assets.

This discussion also does not address any tax consequences arising under the laws of any state, local or foreign jurisdiction or

alternative minimum tax consequences. The tax treatment of each stockholder may vary depending upon the particular facts and circumstances

of such stockholder.

We have not sought

and will not seek an opinion of counsel or a ruling from the Internal Revenue Service regarding the federal income tax consequences

of the Reverse Stock Split. We believe, however, that because the Reverse Stock Split is not part of a plan to periodically increase

or decrease any stockholder’s proportionate interest in the assets or earnings and profits of our company, the Reverse Stock

Split should have the federal income tax effects described below:

|

|

·

|

The exchange of pre-split shares for post-split shares should not result in recognition of gain or loss for federal income tax purposes.

|

|

|

·

|

The stockholder’s aggregate tax basis in the post-split shares would equal that stockholder’s aggregate tax basis in the pre-split shares.

|

|

|

·

|

The stockholder’s holding period for the post-split shares will include such stockholder’s holding period for the pre-split shares.

|

|

|

·

|

Provided that a stockholder held the pre-split shares as a capital asset, the post-split shares received in exchange therefor would also be held as a capital asset.

|

We believe that our Company should not

recognize gain or loss as a result of the Reverse Stock Split. Our view regarding the tax consequences of the Reverse

Stock Split is not binding on the Internal Revenue Service or the courts. We urge all stockholders to consult their

own tax advisers to determine the particular federal, state, local and foreign tax consequences to each of them of the Reverse

Stock Split.

TO ENSURE COMPLIANCE

WITH TREASURY DEPARTMENT CIRCULAR 230, STOCKHOLDERS ARE HEREBY NOTIFIED THAT: (A) ANY DISCUSSION OF FEDERAL TAX ISSUES IN THIS

INFORMATION STATEMENT IS NOT INTENDED OR WRITTEN TO BE RELIED UPON, AND CANNOT BE RELIED UPON BY STOCKHOLDERS FOR THE PURPOSE OF

AVOIDING PENALTIES THAT MAY BE IMPOSED ON STOCKHOLDERS UNDER THE INTERNAL REVENUE CODE; (B) SUCH DISCUSSION IS INCLUDED HEREIN

BY THE COMPANY IN CONNECTION WITH THE PROMOTION OR MARKETING (WITHIN THE MEANING OF CIRCULAR 230) BY THE COMPANY OF THE TRANSACTIONS

OR MATTERS ADDRESSED HEREIN; AND (C) STOCKHOLDERS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT

TAX ADVISOR.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table

sets forth certain information with respect to the beneficial ownership of our common stock, as of December 29, 2017, for: (i)

each of our named executive officers; (ii) each of our directors; (iii) all of our current executive officers and directors as

a group; and (iv) each person, or group of affiliated persons, known by us to be the beneficial owner of more than 5% of our outstanding

shares of common stock.

Except as indicated

in footnotes to this table, we believe that the stockholders named in this table will have sole voting and investment power with

respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders.

Unless otherwise indicated, the address for each director and executive officer listed is: c/o Cosmos Group Holdings, Inc., Rooms

1309-11, 13th Floor, Tai Yau Building, No. 181 Johnston Road, Wanchai, Hong Kong.

|

|

|

|

Common Stock Beneficially Owned

|

|

|

Name and Address of Beneficial Owner

|

|

|

Number of Shares

and Nature of

Beneficial

Ownership

|

|

|

|

Percentage of

Total Common

Equity (1)

|

|

|

Koon Wing CHEUNG

|

|

|

219,222,938

|

|

|

|

51%

|

|

|

Yongwei HU

|

|

|

0

|

|

|

|

–%

|

|

|

Kwai Yau HO

|

|

|

0

|

|

|

|

–%

|

|

|

Weiming CHEN

|

|

|

0

|

|

|

|

–%

|

|

|

Miky Y.C. WAN (2)

|

|

|

170,385,113

|

|

|

|

39.64%

|

|

|

Connie Y.M. KWOK

|

|

|

1,053,130

|

|

|

|

0.25%

|

|

|

Jenher JENG

|

|

|

0

|

|

|

|

–%

|

|

|

All executive officers and directors as a Group (8 persons)

|

|

|

390,661,181

|

|

|

|

90.89%

|

|

|

|

|

|

|

|

|

|

|

|

|

5% or Greater Stockholders:

|

|

|

|

|

|

|

|

|

|

Asia Cosmos Group Limited (2)

|

|

|

170,385,113

|

|

|

|

39.64%

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

Applicable percentage ownership is based on 429,848,898 shares of common stock outstanding as of December 29, 2017, together with securities exercisable or convertible into shares of common stock within 60 days of December 29, 2017. Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission and generally includes voting or investment power with respect to securities. Shares of common stock that a person has the right to acquire beneficial ownership of upon the exercise or conversion of options, convertible stock, warrants or other securities that are currently exercisable or convertible or that will become exercisable or convertible within 60 days of December 29, 2017, are deemed to be beneficially owned by the person holding such securities for the purpose of computing the number of shares beneficially owned and percentage of ownership of such person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

|

|

|

|

|

|

(2)

|

|

Miky Wan, our President, Interim Chief Financial Officer and director owns 100% of Asia Cosmos

Group Limited which directly own 170,385,113 shares of our common stock. As a result, Ms. Wan is deemed to beneficially own

shares held by Asia Cosmos Group Limited.

|

CHANGE IN CONTROL

On February 15, 2016,

the Company sold to Asia Cosmos Group Limited, a private limited liability company incorporated under the laws of British Virgin

Islands (“ACOSG”), 10,000,000 shares of its common stock at a per share price of $0.027. ACOSG’s sole shareholder

is Miky Wan. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation

S promulgated under the Act in selling the Company’s securities to ACOSG.

In connection with

the private placement to ACOSG, a change of control occurred and Bryan Glass resigned from his position as President, Secretary,

Treasurer and Chairman of the Company. Miky Wan was appointed to serve as Chief Executive Officer, Chief Operating Officer, President

and Director, effective February 19, 2016. Peter Tong, our Chief Financial Officer, Secretary and director continued in his positions

with the Company. Calvin K.W. Lai, Anthony H.H. Chan, Jenher Jeng, Alice K.M. Tang, Connie Y.M. Kwok were appointed to serve on

our Board of Directors effective February 19, 2016. Effective February 26, 2016, the Company changed its name to Cosmos Group Holdings

Inc. and filed a Certificate of Amendment to such effect with the Nevada Secretary of State. The name change and the related stock

symbol change to “COSG” were approved by the Financial Industry Regulatory Authority on March 31, 2016. The Company

also increased the number of its authorized common stock, par value $0.001, from 90,000,0000 shares to 500,000,000 and its preferred

stock, par value $0.001, from 10,000,000 to 30,000,000 shares. After the private placement, the Company shifted its business plan

to focus on acquiring undervalued companies including those in the Greater China region.

On September 27, 2016,

Peter Tong and Calvin Lai resigned from all of their positions with the Company. Connie Y.M. Kwok was appointed to serve as the

Secretary and Miky Wan, our Chief Executive Officer, was appointed to serve as the interim Chief Financial Officer.

On January 13, 2017,

the Company sold 200,000,000 shares of its common stock to ACOSG at a per share price of $0.001 per share for aggregate consideration

of US $200,000. The Company relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation

S promulgated under the Act in selling the Company’s securities to ACOSG.

Acquisition of Lee

Tat, Our Logistics Business

On May 12, 2017, we

acquired all of the issued and outstanding shares of Lee Tat from Mr. Koon Wing CHEUNG, Lee Tat’s sole shareholder, in exchange

for 219,222,938 shares of our issued and outstanding common stock. In connection with the Lee Tat acquisition, Miky Wan resigned

from her positions as Chief Executive Officer and Chief Operating Officer and Koon Wing CHEUNG and Yongwei HU were appointed to

serve as our Chief Executive Officer and Chief Operating Officer, respectively, and also as our directors. In addition, Anthony

H.H. CHAN and Alice K. M. TANG resigned from their positions as directors, and Zhigang LIAO and Weiming CHEN were appointed to

fill the vacancies created by their resignations. The Company relied on the exemption from registration pursuant to Section 4(2)

of, and Regulation D and/or Regulation S promulgated under the Act in selling the Company’s securities to the shareholders

of Lee Tat.

Prior to the acquisition,

the Company was considered as a shell company due to its nominal assets and limited operation. Upon the acquisition, Lee Tat will

comprise the ongoing operations of the combined entity and its senior management will serve as the senior management of the combined

entity, Lee Tat is deemed to be the accounting acquirer for accounting purposes. The transaction will be treated as a recapitalization

of the Company. Accordingly, the consolidated assets, liabilities and results of operations of the Company will become the historical

financial statements of Lee Tat, and the Company’s assets, liabilities and results of operations will be consolidated with

Lee Tat beginning on the acquisition date. Lee Tat was the legal acquiree but deemed to be the accounting acquirer. The Company

was the legal acquirer but deemed to be the accounting acquiree in the reverse merger. The historical financial statements prior

to the acquisition are those of the accounting acquirer (Lee Tat). Historical stockholders’ equity of the accounting acquirer

prior to the merger are retroactively restated (a recapitalization) for the equivalent number of shares received in the merger.

Operations prior to the merger are those of the acquirer. After completion of the share exchange transaction, the Company’s

consolidated financial statements include the assets and liabilities, the operations and cash flow of the accounting acquirer.

In order to have further

expand in China, we intend to make additional acquisitions in the same industry, and if opportunities arise, in other industries,

in the future. Accordingly, we do not expect to engage in a name change in the near future.

Effective November

1, 2017, Zhigang Liao and Yongwie Hu resigned from their positions as Director and Chief Operating Officer, respectively, of the

Company. Mr. Hu has retained his position as a Director of the Company. On the same day, Huan-Ting Peng was appointed to serve

as the Chief Operating Officer, and Kai Yau (Tony) Ho was appointed to serve as the Director of the Company.

FORWARD-LOOKING STATEMENTS

This Information Statement

may contain certain “forward-looking” statements (as that term is defined in the Private Securities Litigation Reform

Act of 1995 or by the U.S. Securities and Exchange Commission in its rules, regulations and releases) representing our expectations

or beliefs regarding our company. These forward- looking statements include, but are not limited to, statements regarding

our business, anticipated financial or operational results and objectives. For this purpose, any statements contained

herein that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the generality

of the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,”

“intend,” “could,” “estimate,” “might,” or “continue” or the negative

or other variations thereof or comparable terminology are intended to identify forward-looking statements. These statements, by

their nature, involve substantial risks and uncertainties, certain of which are beyond our control, and actual results may differ

materially depending on a variety of important factors, including factors discussed in this and other filings of ours with the

Securities and Exchange Commission.

GENERAL INFORMATION

COSG will pay all costs

associated with the distribution of this Information Statement, including the costs of printing and mailing. COSG will reimburse

brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending this Information

Statement to the beneficial owners of COSG’s common stock.

COSG will deliver only

one Information Statement to multiple security holders sharing an address unless COSG has received contrary instructions from one

or more of the security holders. Upon written or oral request, COSG will promptly deliver a separate copy of this Information Statement

and any future annual reports and information statements to any security holder at a shared address to which a single copy of this

Information Statement was delivered, or deliver a single copy of this Information Statement and any future annual reports and information

statements to any security holder or holders sharing an address to which multiple copies are now delivered. You should

direct any such requests to the following address: Cosmos Group Holdings Inc., Rooms 1309-11, 13

th

Floor,

Tai Yau Building, No. 181 Johnston Road, Wanchai, Hong Kong, Attn: Secretary. The Secretary may also be reached by telephone

at +852 3188 9363.

ADDITIONAL AND AVAILABLE INFORMATION

COSG is subject to

the informational filing requirements of the Exchange Act and, in accordance therewith, is required to file periodic reports, proxy

statements and other information with the SEC relating to its business, financial condition and other matters. Such reports, proxy

statements and other information can be inspected and copied at the public reference facility maintained by the SEC at 100 F Street,

N.E., Washington, D.C. 20549. Information regarding the public reference facilities may be obtained from the SEC by telephoning

1-800-SEC-0330. Our filings are also available to the public on the SEC’s website (www.sec.gov).

|

Dated: January 12, 2018

|

By order of the Board of Directors

/s/ Koon Wing Cheung

By: Koon Wing Cheung

Its: Director, Chief Executive Officer and Principal Executive

Officer

|

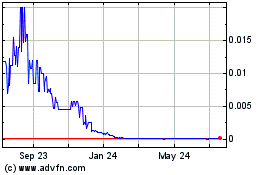

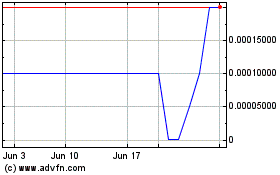

Cosmos (PK) (USOTC:COSG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cosmos (PK) (USOTC:COSG)

Historical Stock Chart

From Apr 2023 to Apr 2024