Securities Registration (section 12(b)) (8-a12b)

January 11 2018 - 4:47PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20459

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF

SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE

SECURITIES EXCHANGE ACT OF 1934

|

Lloyds Banking Group plc

(Exact name of registrant as specified in

its charter)

|

|

|

|

|

United Kingdom

(State of incorporation

or organization)

|

None

(I.R.S. Employer

Identification No.)

|

|

|

|

25 Gresham Street

London EC2V 7HN

United Kingdom

(Address of principal executive offices)

|

|

|

|

|

Title of each class to be so registered

|

Name of each exchange on which each class is to

be registered

|

|

|

|

|

4.344% Fixed Rate Subordinated Debt Securities due 2048

|

New York Stock Exchange

|

|

|

|

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), check the following box:

x

|

|

|

|

If this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box:

o

|

|

|

|

Securities Act registration statement file number to which this form relates: 333-211791

|

|

|

|

Securities to be registered pursuant to Section 12(g) of the Act: None.

|

INFORMATION REQUIRED IN REGISTRATION

STATEMENT

The Registrant has filed with the Commission

pursuant to Rule 424(b) under the Securities Act of 1933, the prospectus supplement dated January 4, 2018 (the “Prospectus

Supplement”) to a base prospectus dated June 2, 2016 (the “Prospectus”) relating to the securities to be registered

hereunder. The Registrant incorporates by reference the Prospectus and the Prospectus Supplement to the extent set forth below.

Item 1.

Description of Registrant’s

Securities to be Registered

The information required by this item is

incorporated herein by reference to the information contained in the sections captioned “Description of Debt Securities”

on pages 3 through 14 of the Prospectus, “Description of the Subordinated Notes” on pages S-16 through S-26 and “Certain

U.K. and U.S. Federal Tax Consequences” on pages S-27 through S-30 of the Prospectus Supplement.

Item 2.

Exhibits

|

|

4.1

|

Subordinated Debt Securities Indenture between Lloyds Banking Group plc, as issuer, and The Bank of New York Mellon acting through its London branch, as trustee, dated as of November 4, 2014 (incorporated herein by reference from Exhibit 4.1 to the Form 8-A12B filed with the Commission on November 4, 2014).

|

|

|

4.2

|

Seventh Supplemental Indenture to the Subordinated Debt Securities Indenture between Lloyds Banking Group plc, as Issuer, and The Bank of New York Mellon acting through its London Branch, dated as of January 9, 2018 (incorporated herein by reference from Exhibit 4.1 to the Form 6-K filed with the Commission on January 9, 2018).

|

|

|

4.3

|

Form of Global Note for the 4.344% Fixed Rate Subordinated Debt Securities due 2048.

|

|

|

99.1a

|

Prospectus (incorporated herein to the extent provided above by reference to the Registrant’s filing under Rule 424(b) on June 2, 2016).

|

|

|

99.1b

|

Prospectus Supplement (incorporated herein to the extent provided above by reference to the Registrant’s filings under Rule 424(b) on January 8, 2018).

|

SIGNATURE

Pursuant to the requirements of Section 12

the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on behalf by the undersigned,

thereto duly authorized.

Lloyds Banking Group plc

/s/ Peter Green

Name: Peter Green

Title: Head of Public Senior Funding & Covered Bonds, Capital

Markets Issuance

January 11, 2018

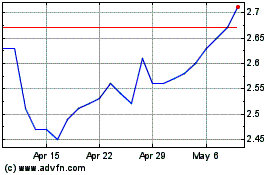

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Mar 2024 to Apr 2024

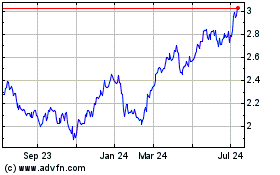

Lloyds Banking (NYSE:LYG)

Historical Stock Chart

From Apr 2023 to Apr 2024