Current Report Filing (8-k)

January 05 2018 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

December 31, 2017

Northwest Biotherapeutics, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

001-35737

|

94-3306718

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

(240) 497-9024

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

Growth Company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

Northwest Biotherapeutics, Inc. (the “Company”)

previously disclosed in its Quarterly Report on Form 10-Q for the quarter ended September 30, 2017 that the Company and Cognate

BioServices, Inc. (“Cognate”) had, subsequent to September 30, 2017, reached an agreement in principle for settlement

of amounts still owed by the Company to Cognate for the years 2016 and 2017 (the “2016 Obligations” and “2017

Obligations”) under the Company’s existing DCVax®-L and DCVax®-Direct services agreements with Cognate (the

“Services Contracts”), at a substantial reduction from the amounts that would otherwise have been due from the Company

under the respective contract terms.

The Company has now entered into two Settlement

and Amendment Agreement with Cognate, dated as of December 31, 2017, reflecting these arrangements (the “2016 Obligations

Agreement” and “2017 Obligations Agreement”). These Agreements provide for temporary amendment of the Services

Contracts relating to past periods.

Pursuant to the 2016 Obligations Agreement,

approximately $11,961,990 of the 2016 Obligations is being satisfied through the issuance to Cognate of 5,200,865 shares of the

Company’s Series B Preferred Stock, on the same terms as the Company’s recently completed offering of Series B Preferred

Stock to unrelated investors (the “Series B Offering”). The terms of the Series B Offering are disclosed in the Company’s

Current Report on Form 8-K filed on January 4, 2018 (the “Series B Terms”). In accordance with the Series B Terms,

each share of Series B Preferred Stock that is issued to Cognate will be convertible into ten shares of Common Stock, and the Class

D-2 Warrants will be exercisable for a number of shares of Common Stock equal to the number of Common Shares issuable upon conversion

of the Series B Preferred. In addition to the 2016 Obligations satisfied by the issuance of stock, the temporary amendments of

the Services Contracts reduced the amounts that would otherwise have been due by a further $5,000,000.

Pursuant to the 2017 Obligations Agreement,

approximately $5,000,000 of the 2017 Obligations is being satisfied through the issuance to Cognate of 2,941,176 shares of the

Company’s Series A Preferred Stock and Class D-1 Warrants, on the same terms as the recent $12 million offering of Series

A Preferred Stock to unrelated investors (the “Series A Offering”). The terms of the Series A Offering are disclosed

in the Company’s Current Report on Form 8-K filed on December 7, 2017 (the “Series A Terms”). In accordance with

the Series A Terms, each share of Series A Preferred Stock that is issued to Cognate will be convertible into ten shares of Common

Stock, and the Class D-1 Warrants will be exercisable for a number of shares of Common Stock equal to the number of Common Shares

issuable upon conversion of the Series A Preferred. In addition to the 2017 Obligations satisfied by the issuance of stock, the

temporary amendments of the Services Contracts reduced the amounts that would otherwise have been due by a further approximately

$13.5 million. In addition, approximately $4.5 million remains to be paid in cash.

|

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

The discussion in Item 1.01 of this Current

Report on Form 8-K is hereby incorporated by reference in this Item 3.02. The Series A Preferred Stock, Series B Preferred Stock,

Class D-1 Warrants and Class D-2 Warrants described in this Item 3.02 will be issued pursuant to the exemption from the registration

requirements afforded by Section 4(a)(2) of the Securities Act.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

|

Date: January 5, 2018

|

By:

/s/ Linda Powers

|

|

|

Name: Linda Powers

Title: Chief Executive Officer

and Chairman

|

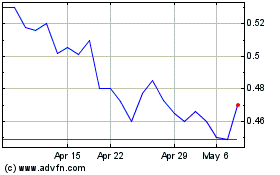

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024