Current Report Filing (8-k)

December 27 2017 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

December 27

, 2017

|

Camber Energy, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

001-32508

|

|

20-2660243

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

4040 Broadway, Suite 425, San Antonio,

Texas 78209

(Address of principal executive offices)

(713) 528-1881

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☒

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act.

☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

As previously disclosed,

on October 5, 2017, Camber Energy, Inc. (the “

Company

”, “

we

” and “

us

”)

and an institutional investor (the “

Investor

”), entered into a Stock Purchase Agreement (the “

October

2017 Purchase Agreement

”), pursuant to which the Company agreed to sell, pursuant to the terms thereof, 1,684 shares

of our Series C Redeemable Convertible Preferred Stock (the “

Series C Preferred Stock

”) for $16 million (a 5%

original issue discount to the face value of such shares), subject to certain conditions set forth therein.

On October 5, 2017,

in connection with the entry into the October 2017 Purchase Agreement, the Investor purchased 212 shares of Series C Preferred

Stock for $2 million (the “

Initial Closing

”).

On November 21,

2017, pursuant to the terms of the October 2017 Purchase Agreement, we sold the Investor an additional 106 shares of Series C Preferred

Stock for $1 million (the “

Second Closing

”).

On December 27,

2017, pursuant to the terms of the October 2017 Purchase Agreement, we sold the Investor an additional 105 shares of Series C Preferred

Stock for $1 million (the “

Third Closing

”).

The Company plans

to use the proceeds from the sale of the Series C Preferred Stock for working capital, workovers on existing wells, drilling and

completion of additional wells, acquisitions, repayment of vendor balances and payments to International Bank of Commerce (“

IBC

”),

in anticipation of regaining compliance.

The terms of the

October 2017 Purchase Agreement, the conditions which are required to be met prior to the sale of additional shares of Series C

Preferred Stock under the October 2017 Purchase Agreement, the rights and preferences of the Series C Preferred Stock (which Series

C Preferred Stock sold pursuant to the October 2017 Purchase Agreement currently has a dividend rate of 24.95% per year) and related

items are described in greater detail in the Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission

on October 5, 2017.

The terms of the

October 2017 Purchase Agreement and the Series C Preferred Stock are subject to, and qualified in their entirety by, (a) the form

of October 2017 Purchase Agreement, a copy of which is incorporated by reference hereto as

Exhibit 10.1

; and (b) the

Certificate of Designation of Series C Preferred Stock (the “

Designation

”) incorporated by reference as

Exhibit

3.1

hereto, which are incorporated in this

Item 1.01

by reference in their entirety.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information

disclosed in

Item 1.01

of this Current Report on Form 8-K is incorporated by reference into this

Item

2.03

in its entirety.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The information disclosed

in

Item 1.01

of this Current Report on Form 8-K is incorporated by reference into this

Item 3.02

.

The sale and issuance of the securities described herein have been determined to be exempt from registration under the Securities

Act of 1933, as amended (the “

Securities Act

”) in reliance on Sections 3(a)(9) and 4(a)(2) of the Securities

Act, Rule 506 of Regulation D promulgated thereunder and Regulation S promulgated thereunder, as transactions by an issuer not

involving a public offering. The Investor has represented that it is an accredited investor, as that term is defined in Regulation

D. The Investor also has represented that it is acquiring the securities for investment purposes only and not with a view to or

for sale in connection with any distribution thereof.

As of the date of this

Report, the Series C Preferred Stock sold at the Initial Closing, Second Closing and Third Closing would convert into approximately

61,129,596 shares of our common stock if fully converted, which number includes 1,230,770 shares of common stock convertible upon

conversion of each share of outstanding Series C Preferred Stock at a conversion price of $3.25 per share (based on the $10,000

face amount of the Series C Preferred Stock) and approximately 59,898,826 shares of common stock for premium shares due thereunder

(based on the current dividend rate of 24.95% per annum), which number of premium shares may increase from time to time as the

trading price of our common stock decreases, upon the occurrence of any trigger event under the Designation of the Series C Preferred

Stock and upon the occurrence of certain other events, as described in greater detail in the Designation of the Series C Preferred

Stock.

The conversion of

the Series C Preferred Stock into common stock of the Company will create substantial dilution to existing stockholders.

|

Item 7.01.

|

Regulation FD Disclosure.

|

On

December 28, 2017, the Company will issue a press release announcing the Third Closing. A copy of the press release is

furnished herewith as

Exhibit 99.1

.

The information

contained in this

Item 7.01

and in

Exhibit 99.1

attached to this report is being furnished to

the Commission and shall not be deemed “

filed

” for purposes of Section 18 of the Securities Exchange Act of

1934, as amended (the “

Exchange Act

”), or otherwise subject to the liabilities of that Section, or incorporated

by reference in any filing under the Exchange Act or the Securities Act, except as shall be expressly set forth by specific reference

in such a filing.

Item 8.01. Other Events.

On November 29, 2017,

the Company filed its definitive Proxy Statement on Schedule 14A (the “

Proxy Statement

”) with the Securities

and Exchange Commission (the “

SEC

”), in connection with the Company’s 2018 Annual Meeting of Shareholders

to be held on Tuesday, January 9, 2018 (the “

Meeting

”), and shortly thereafter, it began mailing the Proxy Statement

to its shareholders of record as of November 24, 2017.

The

Company would like to remind all of its stockholders that it is critical for them to vote at the Meeting. The Board of Directors

and management team are strongly encouraging all of the Company’s stockholders to vote “

For

” all proposals

to come before the Meeting. These proposals include approval for the Board of Directors, without further stockholder approval,

to complete a reverse stock split of the Company’s outstanding common stock and to increase the number of shares of common

stock the Company is authorized to issue.

A

copy of the Proxy Statement can be obtained free of charge at

https://www.iproxydirect.com/CEI

or at the SEC’s website at www.sec.gov. Investors and stockholders also may obtain free copies of the proxy statement from

the Company by contacting the Company by telephone at (713) 528-1881 or by mail at Camber Energy, Inc., 4040 Broadway, Suite 425,

San Antonio, Texas 78209. Investors and stockholders of the Company are urged to read the Proxy Statement before making any voting

decision with respect to the proposals described in the Proxy Statement because it contains important information about the proposals.

The Company and

its respective directors, executive officers and other members of its management and employees, under SEC rules, may be deemed

to be participants in the solicitation of proxies of the Company in connection with the Proxy Statement. Investors and stockholders

may obtain more detailed information regarding the names, affiliations and interests of the Company’s executive officers

and directors in the solicitation by reading the Proxy Statement.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

Exhibit

Number

|

|

Description of Exhibit

|

|

3.1

|

|

Certificate of Designations of Preferences, Powers, Rights and Limitations of Series C Redeemable Convertible Preferred Stock as filed with the Secretary of State of Nevada on August 25, 2016 (Filed as Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed with the Commission on August 31, 2016, and incorporated herein by reference)(File No. 001-32508)

|

|

10.1

|

|

Form of Stock Purchase Agreement relating to the purchase of $16 million in shares of Series C Redeemable Convertible Preferred Stock dated October 5, 2017 (Filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on October 5, 2017, and incorporated herein by reference)(File No. 001-32508)

|

|

99.1**

|

|

Press Release of Camber Energy, Inc. dated December 28, 2017

|

** Furnished herewith.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

CAMBER ENERGY, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

/s/ Richard N. Azar II

|

|

|

|

|

Name:

|

Richard N. Azar II

|

|

|

|

|

Title:

|

Interim Chief Executive Officer

|

|

Date: December 27, 2017

EXHIBIT INDEX

Exhibit

Number

|

|

Description of Exhibit

|

|

3.1

|

|

Certificate of Designations of Preferences, Powers, Rights and Limitations of Series C Redeemable Convertible Preferred Stock as filed with the Secretary of State of Nevada on August 25, 2016 (Filed as Exhibit 3.2 to the Company’s Current Report on Form 8-K, filed with the Commission on August 31, 2016, and incorporated herein by reference)(File No. 001-32508)

|

|

10.1

|

|

Form of Stock Purchase Agreement relating to the purchase of $16 million in shares of Series C Redeemable Convertible Preferred Stock dated October 5, 2017 (Filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K, filed with the Commission on October 5, 2017, and incorporated herein by reference)(File No. 001-32508)

|

|

99.1**

|

|

Press Release of Camber Energy, Inc. dated December 28, 2017

|

** Furnished herewith.

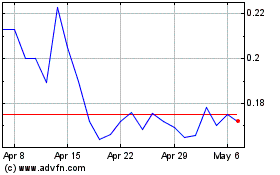

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Camber Energy (AMEX:CEI)

Historical Stock Chart

From Apr 2023 to Apr 2024