Current Report Filing (8-k)

December 27 2017 - 4:16PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 20, 2017

WIDEPOINT

CORPORATION

(Exact

Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-33035

|

|

52-2040275

|

|

(State or Other Jurisdiction of

Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

7926 Jones Branch Drive, Suite 520, McLean,

Virginia

(Address of Principal Executive Office)

|

|

22102

(Zip Code)

|

|

Registrant’s telephone number, including area code:

(703) 349-2577

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 5.02. Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

On December 20, 2017,

WidePoint Corporation (the “Company”) entered into employment agreements with each of Jin Kang, its Chief Executive

Officer, and Jason Holloway, its Executive Vice President, Chief Sales and Marketing Officer and Chief Executive Officer and President

of WidePoint Cybersecurity Solutions Corporation.

Mr. Kang entered into

a three year employment agreement, effective January 1, 2018, providing the following: (i) an annual base salary of $300,000 (increasing

$25,000 annually); (ii) an annual target bonus opportunity equal to 50% of the base salary (with a maximum of 100% of base salary)

based on the Company achieving performance goals determined by the Compensation Committee of the Board of Directors (payable one-half

in cash and one-half in common stock of the Company); (iii) a restricted stock grant of 100,000 shares of common stock effective

January 2, 2018 vesting only if certain performance goals are met, (iv) participation in the Company’s employee benefit plans

and (v) four (4) weeks of vacation. The employment agreement contains severance provisions which provide that upon the termination

of his employment without Cause (as described in the employment agreement) or his voluntary resignation for a Good Reason (as described

in the employment agreement), Mr. Kang will receive severance compensation payable in a lump-sum of cash equal six (6) month’s

base salary (increasing to twelve (12) months of base salary if terminated after the first year) and a pro rata bonus amount. The

employment agreement further provides that if within 90 days prior to or two years after a change in control of the Company there

occurs any termination of Mr. Kang for any reason other than for Cause or a voluntary resignation without a Good Reason, then the

Company will be required to pay to Mr. Kang a one-time severance payment equal twelve (12) months base salary and a pro rata bonus.

The employment agreement

for Mr. Holloway is the same as Mr. Kang’s, except that it provides for: (i) an annual base salary of $265,000; (ii) a restricted

stock grant of 50,000 shares of common stock effective January 2, 2018 vesting only if certain performance goals are met and (iii)

the severance compensation payable upon termination without Cause or For Good Reason is equal six (6) month’s base salary

(increasing to twelve (12) months of base salary if terminated after the first year).

A copy of each of the

employment agreements are filed herewith as Exhibits 10.1 and 10.2, respectively, and the foregoing descriptions are qualified

by reference to the full text thereof.

Item 9.01(d) Financial

Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

WIDEPOINT CORPORATION

|

|

|

|

|

|

/s/ Kito Mussa

|

|

Date: December 27, 2017

|

Kito Mussa

|

|

|

Interim Chief Financial Officer

|

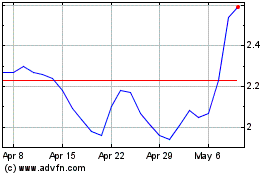

WidePoint (AMEX:WYY)

Historical Stock Chart

From Mar 2024 to Apr 2024

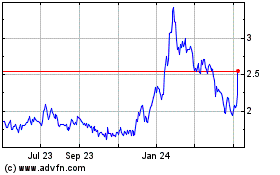

WidePoint (AMEX:WYY)

Historical Stock Chart

From Apr 2023 to Apr 2024