Alcoa Corporation Announces Decisions on Smelting Assets

December 21 2017 - 4:27PM

Business Wire

Alcoa Corporation, a global leader in bauxite, alumina and

aluminum products, today announced decisions regarding smelting

assets in the United States and Italy. The actions support the

Company’s strategic priorities to reduce complexity and to

strengthen the balance sheet.

- In the United States, Alcoa intends to

permanently close its Rockdale Operations site in Texas, which has

been fully curtailed since the end of 2008. The site includes a

primary aluminum smelter and casthouse, an aluminum powder plant

and associated buildings and equipment. Alcoa’s strategic review of

these assets, announced earlier this year, concluded that these

operations have limited economic prospects. Separately, the Company

continues to market for sale more than 30,000 acres of land at the

Rockdale site.

- In Italy, Alcoa has reached an

agreement to divest the Portovesme primary aluminum smelter, fully

curtailed since 2012 and closed since 2014, to Invitalia, the

Italian government agency that manages economic development. As

part of the agreement, Alcoa and the Italian government have

settled matters related to past energy tariffs, including the

Italian Energy Authority Regulation 148/2004 matter, and a

groundwater remediation project.

“We continuously evaluate our portfolio of global assets against

many factors to optimize value,” said President and Chief Executive

Officer Roy Harvey. “Achieving a resolution on these two assets

further streamlines our Company as we continue to execute against

our strategic priorities.”

The Company will record an estimated charge of $55 million (pre-

and after-tax) in the fourth quarter of 2017 associated with the

permanent closure of Rockdale. In addition, the Company will record

an estimated $22 million (pre- and after-tax) reserve reduction in

the fourth quarter of 2017 associated with a reserve established at

the end of 2015 for the Italy matter.

The net earnings impact of the two actions is estimated to be a

negative $0.18 per share in the fourth quarter of 2017. The Company

anticipates annual adjusted EBITDA benefits of approximately $3

million upon completion of the Rockdale decommissioning in 2022,

and of approximately $4 million upon completion of the Portovesme

divestiture in 2018.

Cash outlays for the Rockdale closure are expected to be

approximately $53 million over the next five years, including

holding and demolition costs, with approximately $16 million in

2018. Cash outlays for the Italy settlement, including the

pre-existing 148/2004 matter and remediation reserves, are expected

to be between $40 million and $50 million over the next five years,

with approximately $10 million in 2018.

About Alcoa

Alcoa (NYSE: AA) is a global industry leader in bauxite, alumina

and aluminum products, with a strong portfolio of value-added cast

and rolled products and substantial energy assets. Alcoa is built

on a foundation of strong values and operating excellence dating

back nearly 130 years to the world-changing discovery that made

aluminum an affordable and vital part of modern life. Since

inventing the aluminum industry, and throughout our history, our

talented Alcoans have followed on with breakthrough innovations and

best practices that have led to efficiency, safety, sustainability

and stronger communities wherever we operate. Visit us online on

www.alcoa.com, follow @Alcoa on Twitter and on Facebook at

www.facebook.com/Alcoa.

The above website addresses are included only as inactive

textual references and are not intended to be active links to such

websites. Information contained on such websites or that can be

accessed through such websites do not constitute part of this press

release.

Dissemination of Company Information

Alcoa Corporation intends to make future announcements regarding

company developments and financial performance through its website

at www.alcoa.com.

Forward-Looking Statements

This press release contains statements that relate to future

events and expectations and as such constitute forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include those

containing such words as “anticipates,” “believes,” “could,”

“estimates,” “expects,” “forecasts,” “intends,” “may,” “outlook,”

“plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,”

“would,” or other words of similar meaning. All statements that

reflect the Company’s expectations, assumptions or projections

about the future, other than statements of historical fact, are

forward-looking statements. Forward-looking statements are not

guarantees of future performance and are subject to known and

unknown risks, uncertainties, and changes in circumstances that are

difficult to predict. Although the Company believes that the

expectations reflected in any forward-looking statements are based

on reasonable assumptions, it can give no assurance that these

expectations will be attained and it is possible that actual

results may differ materially from those indicated by these

forward-looking statements due to a variety of risks and

uncertainties. Additional information concerning factors that could

cause actual results to differ materially from those projected in

the forward-looking statements is contained in our filings with the

Securities and Exchange Commission. The Company disclaims any

obligation to update publicly any forward-looking statements,

whether in response to new information, future events or otherwise,

except as required by applicable law.

Adjusted EBITDA Definition

Alcoa Corporation’s definition of Adjusted EBITDA is net margin

plus an add-back for depreciation, depletion, and amortization. Net

margin is equivalent to Sales minus the following items: Cost of

goods sold; Selling, general administrative, and other expenses;

Research and development expenses; and Provision for depreciation,

depletion, and amortization. Adjusted EBITDA is a non-GAAP

financial measure. Management believes that this measure is

meaningful to investors because Adjusted EBITDA provides additional

information with respect to Alcoa Corporation’s operating

performance and the Company’s ability to meet its financial

obligations. The Adjusted EBITDA presented may not be comparable to

similarly titled measures of other companies. Alcoa Corporation has

not provided a reconciliation of the forward-looking Adjusted

EBITDA amounts included in this release to the most directly

comparable GAAP financial measures due primarily to the variability

and complexity in making accurate forecasts and projections, as not

all of the information for a quantitative reconciliation is

available to the company without unreasonable effort.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171221006038/en/

Alcoa CorporationInvestor ContactJames Dwyer,

412-992-5450James.Dwyer@alcoa.comorMedia ContactJim Beck,

412-315-2909Jim.Beck@alcoa.com

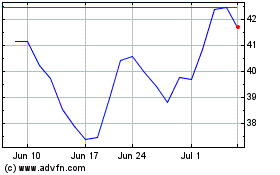

Alcoa (NYSE:AA)

Historical Stock Chart

From Mar 2024 to Apr 2024

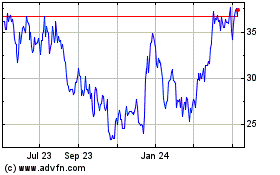

Alcoa (NYSE:AA)

Historical Stock Chart

From Apr 2023 to Apr 2024