SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2017

(Commission File No. 001-33356),

Gafisa S.A.

(Translation of Registrant's name into English)

Av. Nações Unidas No. 8501, 19th floor

São Paulo, SP, 05425-070

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ______ No ___X___

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ______ No ___X___

Indicate by check mark whether by furnishing the information contained in this Form,

the Registrant is also thereby furnishing the information to the Commission pursuant

to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ______ No ___X___

If “Yes” is marked, indicate below the file number assigned

to the registrant in connection with Rule 12g3-2(b):

N/A

GAFISA S.A.

CNPJ/MF No. 01.545.826/0001-07

NIRE 35.300.147.952

Publicly-Held Company

NOTICE TO SHAREHOLDERS

GAFISA S.A. (B3: GFSA3) (“

Company

”) hereby informs its Shareholders that an Extraordinary Shareholders’ Meeting held on this date approved the Company’s capital increase, for private subscription, on the following conditions (“

Capital Increase

”):

1. Number of Shares to be Issued and Guaranteed Rights.

The Capital Increase will be accomplished by the issue, for private subscription, of a minimum of thirteen million, three hundred thirty-three thousand, three hundred and thirty-four (13,333,334) (“

Minimum Subscription

”) and a maximum of twenty million (20,000,000) (“

Maximum Subscription

”) new non-par, book-entry, registered common shares.

The shares to be issued shall confer on their holders all the same rights, advantages and restrictions conferred on the other shareholders of the Company, as provided for in its articles of incorporation, including the receipt of dividends and/or interest on equity which may be declared by the Company on or after the issue date.

2. Increase of Capital Stock.

If the Minimum Subscription is reached, the total issue price shall be two hundred million and ten reais (R$200,000,010.00), of which the sum of one hundred and ninety-nine million eight hundred and sixty-six thousand six hundred and seventy-six reais and sixty-six cents (R$199,866,676.66) shall be allocated to capital reserve, pursuant to Article 182, para. 1 “a” of Law No. 6.404/76, and the sum of one hundred and thirty-three thousand three hundred and thirty-three reais and thirty-four cents (R$133,333.34) shall be allocated to capital stock, so that the capital stock shall increase from the current value of two billion five hundred and twenty-one million one hundred and fifty-one thousand one hundred and eighty-seven reais and seventy-four cents (R$2,521,151,187.74), divided into twenty-eight million forty thousand one hundred and sixty two (28,040,162) registered, book-entry common shares, of no par value, to two billion five hundred and twenty-one million two hundred and eight-four thousand five hundred and twenty-one reais and eight cents (R$2,521,284,521.08), divided into forty-one million three hundred and seventy-three thousand four hundred and ninety-six (41,373,496) registered, book-entry common shares, of no par value.

On the other hand, if the Maximum Subscription is reached, the total issue price shall be three hundred million reais (R$300,000,000.00), of which the sum of two hundred

and ninety-nine million eight hundred thousand reais (R$299,800,000.00) shall be allocated to capital reserve, pursuant to Article 182, para. 1 “a” of Law No. 6.404/76, and the sum of two hundred thousand reais (R$200,000.00) to capital stock, so that the capital stock shall increase to two billion five hundred and twenty-one million three hundred and fifty-one thousand one hundred and eighty-seven reais and seventy-four cents (R$2,521,351,187.74), divided into forty-eight million forty thousand one hundred and sixty-two (48,040,162) registered, book-entry common shares, of no par value.

The new wording of the main section of Article 5 of the Company Articles of Incorporation, reflecting the new amount of capital stock and the new number of shares into which the capital is divided, as a result of the Capital Increase, shall be defined in due course, when the Capital Increase has been approved by the Company Board of Directors and the final figures are known.

3. Issue Price per Share.

The issue price shall be fifteen reais (R$15.00) per share, fixed on the basis of Article 170, para. 1, section III, of Law No. 6.404/76. Of this amount, one centavo (R$0.01) shall be allocated to capital stock and fourteen reais and ninety-nine centavos (R$14.99) to capital reserve, pursuant to Article 182, paragraph 1 “a”, of Law No. 6.404/76.

4. Method of Paying In.

The shares issued under the Capital Increase shall be paid in, in full, in local currency, at the time of subscription.

5. Preemptive Rights.

The Company shareholders shall be assured the preemptive right to subscribe for the new shares, pursuant to Article 171 of Law No. 6.404/76, based on their holdings at the close of trading on B3 on today’s date.

Taking into account the current shareholding structure of the Company, each common share shall confer on its holder the right to subscribe for 0.73794970562

1

of a common share issued in the Capital Increase.

Since the subscription rights will not be able to be exercised by holders of American Depositary Shares (“

ADSs

”), Citibank N.A., as the depositary bank for the Company’s ADS program, will make reasonable efforts to sell the Preemptive Rights attributable to such holders, and shall distribute the proceeds of sale among the holders of ADSs as provided for in the ADS Deposit Agreement.

6. Potential for Dilution.

Since the shareholders of the Company are assured preemptive rights in subscribing for the new shares, if they exercise such rights in full, the Capital Increase will not lead to any dilution of current shareholders.

1

Based on shareholders’ position of 12.13.2017.

If the shareholders decide not to exercise their preemptive rights, the potential dilution arising from the Capital Increase, in the event of subscription of the minimum and maximum amounts, will be 32.2% and 41.6% respectively.

7. Procedures for the Exercise of Preemptive Rights.

The holders of Company shares shall have preemptive rights to the subscription of new shares, and may subscribe, or assign such rights for a third party to subscribe, for a number of shares in proportion to the percentage they hold of the total number of shares in the Company.

The deadline for the exercise of preemptive rights shall be thirty calendar days from December 21, 2017 (inclusive), i.e. January 19, 2018 (inclusive) (“

Initial Preemptive Rights Period

”). The exercise of preemptive rights for shares held in custody by B3 should comply with B3's deadlines and operational procedures.

Company shares acquired after December 21, 2017, shall not be entitled to preemptive rights, and shall be traded “ex” subscription rights.

In accordance with the procedures established by Itaú Unibanco S.A. (“

Itaú

”), the bank responsible for the bookkeeping of the Company shares, and of B3 S.A. – Brasil, Bolsa e Balcão (“

B3

”), the subscription rights may be exercised as from the start of the Initial Preemptive Rights Period by shareholders, or by assignees of preemptive rights, in the case of shares held in custody by B3 by the corresponding custody agent, observing the deadlines and operational procedures stipulated by B3, and in the case of shares held by Itaú, by means of (i) signing the applicable documents at any specialist branch of Itaú listed in item 9 below (“

Specialist Branches

”); (ii) submitting the documentation listed in item 10 below; and (iii) completing the corresponding subscription form and paying the subscription price.

Since the subscription rights will not be able to be exercised by holders of ADSs, Citibank N.A., as the depositary bank for the Company’s ADS program, will make reasonable efforts to sell the Preemptive Rights attributable to such holders, and shall distribute the proceeds of sale among the holders of ADSs as provided for in the ADS Deposit Agreement.

Wishbone Management, LP, a shareholder of the Company, jointly with Conifer Capital Management, LLC and investment funds managed by their affiliates (“

Investors

”), undertake to subscribe for shares and any unsubscribed shares under the Capital Increase by exercising their respective preemptive rights, so as to guarantee the subscription of the minimum amount of R$200,000,000.00 (two hundred million Reais). The sum to be actually contributed will depend on the preemptive rights exercised and the subscription for unsubscribed shares by the other shareholders of the Company. This subscription commitment by the Investors is also conditional on the absence of material adverse effects.

8. Procedure for the Subscription of Unsubscribed Shares.

After the end of the Initial Preemptive Rights Period, if any shares remain unsubscribed, the shareholders or assignees of preemptive rights who have indicated an interest in the reservation of unsubscribed shares in their subscription forms shall have a period of time, to be determined in a notice to shareholders relating to the unsubscribed shares after the Initial Preemptive Rights Period, to subscribe for such unsubscribed shares by signing an additional subscription form (“

First Period for Subscription of Unsubscribed Shares

”).

After the end of the First Period for Subscription of Unsubscribed Shares, if any shares still remain unsubscribed, the shareholders or assignees of preemptive rights who have indicated an interest in the reservation of unsubscribed shares in their subscription forms shall have a further period of time, to be determined in a notice to shareholders relating to the unsubscribed shares after the First Period for Subscription of Unsubscribed Shares, to subscribe for such unsubscribed shares by signing another subscription form (“

Second Period for Subscription of Unsubscribed Shares

” and, jointly with the First Period for Subscription of Unsubscribed Shares, the “

Period for Subscription of Unsubscribed Shares

”).

Additional information about the First Period for Subscription of Unsubscribed Shares and the Second Period for Subscription of Unsubscribed Shares will be issued by the Company, in a notice to shareholders, after the end of the Initial Preemptive Rights Period and the First Period for Subscription of Unsubscribed Shares, respectively.

9. Specialist Branches of Itaú.

The holders of subscription rights for shares registered with Itaú may exercise the rights mentioned in this notice at any of the following Specialist Branches. Doubts related to Itaú can be answered on business days, from 9:00 am to 6:00 pm, through the Investors Exclusive Service, at (11) 3003-9285 (capitals and metropolitan areas) or 0800 7209285 (other locations).

Specialist Branch in Rio de Janeiro

Av. Almirante Barroso, 52 – 2

nd

floor, Centro – Rio de Janeiro/RJ

Specialist Branch in São Paulo

R. Boa Vista, 176 – 1

st

Basement, Centro - São Paulo/SP

10. Documentation for Share Subscription and Assignment of Subscription Rights.

Holders of subscription rights for shares held in custody by Itaú who wish to exercise or to assign their preemptive rights, directly through Itaú, must submit the following documents:

Individuals

: (i) identity document, (ii) tax registration document (CPF), and (iii) proof of residence.

Legal Entities:

(i) original and copy of the articles and minutes of the election of the current officers, or authenticated copy of the consolidated articles of incorporation or statutes, (ii) tax registration document (CNPJ), (iii) authenticated

copy of the corporate documents confirming the powers of the signatory to the subscription form, and (iv) authenticated copy of the identity document, CPF and proof of residence of the signatory(ies). Additional documents may be required of investors resident abroad.

Powers of Attorney

: in the event of signature under a power of attorney, a public instrument conferring specific powers must be submitted, together with the above-mentioned documents, as appropriate, for the grantor and the proxy.

The holders of subscription rights for shares held in the B3 Central Depository must exercise their preemptive rights through their custody agents, within the periods stipulated by B3 and in accordance with the terms of this notice.

The signing of a subscription form shall imply an irrevocable wish to purchase the new shares subscribed for, and the signatory shall be irrevocably bound to make payment for the shares at the time of subscription.

11. Approval of the Capital Increase.

If the Capital Increase is not fully subscribed by the end of the Period for Subscription of Unsubscribed Shares, and provided that the Minimum Subscription has been attained, the Board of Directors may partially approve the Capital Increase. In such case, the shares not subscribed for after the close of the Period for Subscription of Unsubscribed Shares shall be cancelled and the Board of Directors shall give its definite approval for the Capital Increase, subject to the conditions and procedures detailed below.

No additional period shall be allowed for reconsideration of the decision to subscribe, in the event of a partial approval of the Capital Increase. However, under these circumstances, subscribers shall have the right to a conditional subscription to the Capital Increase. In order to exercise this right, subscribers must indicate, at the time of subscription, whether, if the condition is fulfilled, they wish to receive (i) all the shares subscribed for or (ii) a number of shares which is in the proportion that the total number of shares actually subscribed for bears to the maximum number of shares originally approved for issuance in the Capital Increase. If no such indication is made, it will be assumed that the subscriber wishes to receive the full amount of shares subscribed for.

Subscribers whose conditions for subscribing indicated in the subscription form are not fulfilled shall be repaid the amount paid in, without adjustment for inflation, in full or in part, according to the option indicated in the said form.

12. Credit of shares.

The shares issued shall be credited on the business day immediately following the date of approval of the Capital Increase by the Company Board of Directors, and shall be shown in shareholders’ statements no later than the 5th business day after the date of approval.

São Paulo, December 20, 2017.

GAFISA S.A.

Carlos Calheiros

Chief Financial and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 20, 2017

|

Gafisa S.A.

|

|

|

|

|

|

By:

|

|

|

|

Name: Sandro Gamba

Title: Chief Executive Officer

|

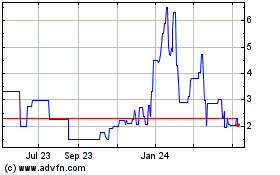

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Mar 2024 to Apr 2024

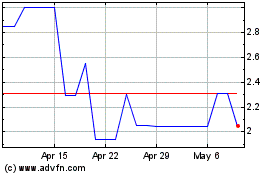

Gafisa (PK) (USOTC:GFASY)

Historical Stock Chart

From Apr 2023 to Apr 2024