Current Report Filing (8-k)

December 18 2017 - 4:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported):

December 15, 2017

iSign Solutions Inc.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-19301

|

|

94-2790442

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

2025

Gateway Place, Suite 485

San

Jose, CA 95110

(Address

of principal executive offices)

(650)

802-7888

Registrant’s

telephone number, including area code

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

o

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by

check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

o

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

|

|

Item 1.01

|

Entry into Material

Definitive Agreement

|

|

|

Item 3.02

|

Unregistered Sales

of Equity Securities

|

On December 15, 2017, iSign Solutions

Inc. (the “Company”) entered into a Note Purchase Agreement (the “Purchase Agreement”) with certain investors

(each an “Investor,” and, collectively, the “Investors”). Under the terms of the Purchase Agreement, the

Company received loans in the aggregate amount of $150,000 from the Investors in exchange for the Company’s issuance to

each of the Investors of a secured convertible promissory note equal to the principal amount of such Investor’s loan to

the Company (each a “Note,” and, collectively, the “Notes”). The Notes bear interest at the rate of 10%

per annum, and have a maturity date of December 31, 2018. Should the Notes remain outstanding past the maturity date, an additional,

one-time 30% will accrue on the principal of the Notes. The Notes may be converted by their terms at the option of Investors into

shares of the Company’s common stock.

The Company may use any funds received

from the Investors for working capital and general corporate purposes, in the ordinary course of business, and to pay fees and

expenses in connection with the Company’s entry into the Purchase Agreement.

Transactions

With Related Persons

SG Phoenix LLC

assisted the Company in negotiating with Investors the term sheet for the transaction described above, the terms of which were

approved by a Special Committee of the Board of Directors comprised of disinterested directors, as well as the entire Board of

Directors. SG Phoenix LLC is the management company of Phoenix Venture Fund LLC, the Company’s largest stockholder, which

has participated in several of the Company’s previous financing transactions. Philip Sassower and Andrea Goren are the co-managers

of SG Phoenix LLC, and are also the Company’s Chief Executive Officer and Chief Financial Officer, respectively. Mike Engmann,

Andrea Goren and/or entities affiliated to them participated as Investors in the above described financing. Messrs. Sassower and

Engmann are Co-Chairmen of the Board of Directors, Mr. Engmann is also the Company’s President and Chief Operating Officer,

and Mr. Goren is also a member of the Company’s Board of Directors and the Company’s Corporate Secretary.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

iSign Solutions Inc.

|

|

December 18, 2017

|

|

|

|

By:

|

/s/ Andrea Goren

|

|

|

|

|

Andrea Goren

|

|

|

|

Chief Financial Officer

|

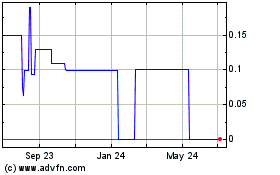

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

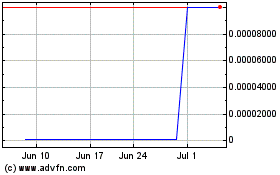

iSign Solutions (CE) (USOTC:ISGN)

Historical Stock Chart

From Apr 2023 to Apr 2024