Aconex Agrees to $1.2 Takeover Offer From Oracle

December 17 2017 - 5:33PM

Dow Jones News

By Robb M. Stewart

MELBOURNE, Australia--Oracle Corp. (ORCL) has struck a US$1.2

billion deal to buy Australian project-management software provider

Aconex Ltd. (ACX.AU) in a further effort to shift its computing

services to the cloud.

The two companies on Monday said they had entered a binding

takeover agreement after the California-based company offered 7.80

Australian dollars (US$5.96) cash a share, valuing Aconex at A$1.6

billion.

Aconex offers an online collaboration platform for contruction

and engineering projects, allowing contractors, project managers

and builders to share documents and work together on projects.

With the addition of Aconex, Oracle said it could offer a

comprehensive cloud-based project management solution for a US$14

trillion industry.

"Delivering projects on time and on budget are the highest

strategic imperatives for any engineering and construction

organization," Mike Sicilia, senior vice president and general

manager of Oracle's global construction and engineering business

unit, said.

The bid price marks a 47% premium to Friday's closing price for

Aconex, and a more than fourfold jump on the 2014 initial public

offering price for Aconex's shares.

Aconex's board said it would unanimously recommend the offer to

shareholders and intends to vote a collective 14% stake in favor of

the bid. The deal is expected to close in the first half of next

year, subject to certain regulatory approvals.

"The Aconex and Oracle businesses are a great, natural fit and

highly complementary in terms of vision, product, people and

geography," Leigh Jasper, Aconex cofounder and chief executive,

said.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

December 17, 2017 17:18 ET (22:18 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

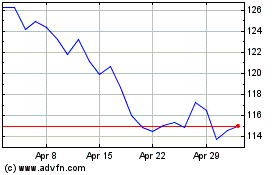

Oracle (NYSE:ORCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

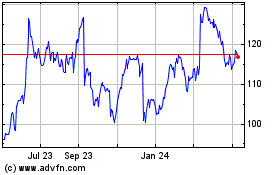

Oracle (NYSE:ORCL)

Historical Stock Chart

From Apr 2023 to Apr 2024