Filed by Galena Biopharma, Inc.

pursuant to Rule 425 under

the

Securities Act of 1933, as amended,

and deemed filed pursuant to Rule

14a-6(b)

under

the Securities Exchange Act of 1934, as amended

Subject Company: SELLAS Life Sciences Group Ltd

File No. of Related Registration Statement:

333-220592

On December 8, 2017, Galena Biopharma, Inc. (“

Galena

”) made the following communications in connection with the proposed merger pursuant

to the terms of an Agreement and Plan of Merger and Reorganization, dated August 7, 2017 and amended as of November 5, 2017, by and among Galena, SELLAS Life Sciences Group Ltd, Sellas Intermediate Holdings I, Inc., Sellas Intermediate

Holdings II, Inc. and Galena Bermuda Merger Sub, Ltd.:

|

(i)

|

Press Release issued and dated December 8, 2017; and

|

|

(ii)

|

Proposed Merger Summary presentation, made publicly available on Galena’s website on December 8, 2017.

|

Galena issued the following press release on December 8, 2017:

Galena Biopharma Reminds Shareholders to Vote Ahead of Special

Meeting on December 15, 2017

San

Ramon, California, December

8, 2017

— Galena Biopharma, Inc. (NASDAQ: GALE), would like to remind stockholders to vote their respective shares and support the business combination transaction with SELLAS Life Sciences

Group Ltd. To assist stockholders, Galena has published a presentation on its website to provide an overview of the transaction and the proposals. The presentation can be accessed under Investors

g

Investor Resources, or by clicking

here

.

With the Friday, December 15, 2017 meeting fast

approaching, Galena reminds stockholders who have not already done so that they can still vote their shares and strongly encourages them to do so. Your vote is important, no matter how many or how few shares you may own.

Please Vote Your Galena Shares Today

by contacting Galena’s proxy solicitor, MacKenzie Partners, Inc., at (800)

322-2885

(toll-free)

or (212)

929-5500

(collect).

On November 30, 2017, Galena sent a letter to stockholders that, in pertinent part, stated as follows:

Dear Stockholders:

We previously

mailed you a proxy statement/prospectus/consent solicitation statement, dated November 6, 2017, regarding the special meeting of stockholders to be held on December 15, 2017 (“Special Meeting”). We are seeking your approval of a

business combination transaction in which the businesses of Galena Biopharma, Inc. and SELLAS Life Sciences Group Ltd (“SELLAS”) will be combined (the “Merger”).

As we have disclosed in the materials sent to you, if the Merger is not completed, Galena may elect to liquidate its remaining assets and there

can be no assurances as to whether any cash would be available to distribute to Galena’s stockholders after paying Galena’s debts and other obligations. We believe a liquidation of Galena would be the worst possible outcome for

Galena’s stockholders and, therefore, recommend that stockholders approve the proposals discussed below.

There are ten proposals for

consideration at the Special Meeting (the “Proposals”). We note the following regarding the Proposals:

|

|

•

|

|

Proposals 1, 2 and 3 must be approved by stockholders for the Merger to occur;

|

|

|

•

|

|

If approved, Proposal 4 would provide the continuing company with the ability to raise the necessary equity capital in the future, within certain parameters, without obtaining further stockholder approval;

|

|

|

•

|

|

Proposal 5 relates to a new equity incentive plan and Proposal 6 relates to a new employee stock purchase plan, both of which are expected to help the continuing company attract and retain employees, directors and

consultants;

|

|

|

•

|

|

Proposal 7 relates to the amendment of Galena’s bylaws so they are more in accordance with the standard bylaws among public companies; and

|

|

|

•

|

|

Proposal 8 relates to an amendment to Galena’s amended and restated certificate of incorporation to allow the board of directors to adopt, amend or repeal Galena’s bylaws, which is more in line with standard

bylaws of public companies;

|

|

|

•

|

|

Proposal 9 relates to a

non-binding,

advisory vote on the compensation that will be paid or may become payable to Galena’s named executive officers in connection with the

Merger;

|

|

|

•

|

|

Proposal 10 relates to adjourning the Special Meeting in the event there are not sufficient votes to approve the Proposals mentioned above. Please refer to the proxy statement/prospectus/consent solicitation statement

for a complete description of each of the Proposals.

|

The Galena board of directors believes that approval of each of the

Proposals is important to Galena and the ongoing business of the continuing company after the Merger. Accordingly, the Galena board of directors unanimously recommends that stockholders

vote “FOR ”

each of the Proposals.

Your vote is very important. It is imperative that you vote your shares, as unvoted shares may prevent the approval of the Merger.

[In addition to calling Mackenzie at (800)

322-2885

(toll-free) or (212)

929-5500

(collect), t]here are three ways to vote your Galena shares without attending the Special Meeting in person – each only taking a few moments:

|

|

•

|

|

By Internet: If you have Internet access, you may submit your proxy by following the Internet voting instructions on the proxy card or voting instruction card sent to you.

|

|

|

•

|

|

By Telephone: You may submit your proxy by following the telephone voting instructions on the proxy card or voting instruction card sent to you.

|

|

|

•

|

|

By Mail: You may do this by marking, dating and signing your proxy card or, for shares held in street name, the voting instruction card provided to you by your broker or other nominee, and mailing it in the

self-addressed, postage prepaid envelope provided to you.

|

. . .

We thank you for your continued support of Galena Biopharma, Inc.

Sincerely,

Stephen F. Ghiglieri

Interim Chief Executive Officer and Chief Financial Officer

Additional Information about the Proposed Merger involving Galena Biopharma, Inc. and SELLAS Life Sciences Group Ltd and Where to Find It

In connection with the proposed merger, Galena and SELLAS have filed relevant materials with the Securities and Exchange Commission, or the SEC, including a

final proxy statement/prospectus/consent solicitation statement dated November 6, 2017 and filed with the SEC pursuant to Rule 424(b)(3) on November 8, 2017 (the “final proxy statement/prospectus/consent solicitation statement”).

Galena and SELLAS have mailed the

final proxy statement/prospectus/consent solicitation statement to their respective stockholders.

Investors and stockholders of Galena and SELLAS are urged to read the final proxy

statement/prospectus/consent solicitation statement because it contains important information about Galena, SELLAS and the proposed merger.

The final proxy statement/prospectus/consent solicitation statement, other relevant materials and any

other documents filed by Galena with the SEC (when they become available), may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, copies of the documents filed with the SEC by Galena will be available free of charge

on Galena’s website at www.galenabiopharma.com (under “Investors”—“Financials”) or by directing a written request to: Galena Biopharma, Inc., 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583, Attention: Investor

Relations or by email to: ir@galenabiopharma.com. Investors and stockholders are urged to read the final proxy statement/prospectus/consent solicitation statement and the other relevant materials when they become available before making any voting

or investment decision with respect to the proposed merger.

Contact:

Remy Bernarda

SVP, Investor Relations & Corporate

Communications

(925)

498-7709

ir@galenabiopharma.com

Source: Galena Biopharma, Inc.

The following is a Proposed Merger Summary presentation made publicly available on Galena’s website on

December 8, 2017:

PROPOSED MERGER SUMMARY December 8, 2017

FORWARD LOOKING STATEMENT Some of the information contained in this presentation may include forward-looking statements about strategy,

future operations, future financial position, prospects, plans and objectives of management of Galena Biopharma, Inc. (“Galena”), SELLAS Life Sciences Group Ltd (“SELLAS”) or the continuing company. Examples of such statements

include, but are not limited to, statements relating to the structure, timing and completion of the proposed merger; the continuing company’s ability to successfully initiate and complete clinical trials; anticipated milestones; the nature,

strategy and focus of the continuing company; the development and commercial potential of any product candidates of the continuing company; the executive and board structure of the continuing company; and expectations regarding voting by

Galena’s and SELLAS’ stockholders. The continuing company may not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in the forward-looking statements and you should not place undue

reliance on these forward-looking statements. Such statements are based on management’s current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking

statements as a result of many factors, including, without limitation, risks and uncertainties associated with stockholder approval of and the ability to consummate the proposed merger through the process being conducted by Galena and SELLAS, the

ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, the availability of sufficient resources of the continuing company to meet its business objectives and operational

requirements, the fact that the results of earlier studies and trials may not be predictive of future clinical trial results, the protection and market exclusivity provided by SELLAS’ intellectual property, risks related to the drug discovery

and the regulatory approval process and the impact of competitive products and technological changes. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those identified under “Risk

Factors” in the final proxy statement/prospectus/consent solicitation statement dated November 6, 2017 and filed with the SEC pursuant to Rule 424(b)(3) on November 8, 2017 (the “final proxy statement/prospectus/consent solicitation

statement”). Actual results may differ materially from those contemplated by these forward-looking statements. Galena and SELLAS each disclaim any intent or obligation to update these forward-looking statements to reflect events or

circumstances that exist after the date on which they were made, except as required by law. Additional Information about the Proposed Merger involving Galena Biopharma, Inc. and SELLAS Life Sciences Group Ltd and Where to Find It In connection with

the proposed merger, Galena and SELLAS have filed relevant materials with the Securities and Exchange Commission, or the SEC, including in the final proxy statement/prospectus/consent solicitation statement. Galena and SELLAS have mailed the final

proxy statement/prospectus/consent solicitation statement to their respective stockholders. Investors and stockholders of Galena and SELLAS are urged to read the final proxy statement/prospectus/consent solicitation statement because it contains

important information about Galena, SELLAS and the proposed merger. The final proxy statement/prospectus/consent solicitation statement, other relevant materials and any other documents filed by Galena with the SEC (when they become available), may

be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, copies of the documents filed with the SEC by Galena will be available free of charge on the Galena’s website at www.galenabiopharma.com (under

“Investors” - “Financials”) or by directing a written request to: Galena Biopharma, Inc., 2000 Crow Canyon Place, Suite 380, San Ramon, CA 94583, Attention: Investor Relations or by email to: ir@galenabiopharma.com. Investors and

stockholders are urged to read the final proxy statement/prospectus/consent solicitation statement and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed merger.

PROPOSED MERGER DETAILS Special Meeting of Stockholders: December 15, 2017 Time: 9:00 a.m. Eastern Standard Time Location: Paul Hastings

LLP, 200 Park Avenue, New York, NY All materials available on the SEC and the Galena websites: Galena CEO Letter to Stockholders Proxy statement/prospectus/consent solicitation statement Prospectus Supplement Your Vote is Very Important - VOTE YOUR

SHARES TODAY: Call (212) 929-5500 (Call Collect) or (800) 322-2885 (toll free in North America)

WHY VOTE FOR THE MERGER Synergistic clinical development programs create a cancer immunotherapy pipeline with multiple oncology targets

Galinpepimut-S (GPS) is targeting Wilm’s Tumor 1 (WT1) which is ranked as a leading antigen by the National Cancer Institute Multiple GPS clinical trials ongoing and planned Three ongoing, NeuVax™ (nelipepimut-S) investigator sponsored

trials New, experienced Board of Directors and leadership team to guide the continuing company If the Merger is not completed, Galena may elect to liquidate its remaining assets and there can be no assurances as to whether any cash would be

available to distribute to Galena’s stockholders after paying Galena’s debts and other obligations.

PROPOSAL SUMMARY Proposals 1, 2 and 3 must be approved by stockholders for the Merger to occur If approved, Proposal 4 would provide the

continuing company with the ability to raise necessary equity capital in the future, within certain parameters, without obtaining further stockholder approval Proposal 5 relates to a new equity incentive plan and Proposal 6 relates to a new employee

stock purchase plan, both of which are expected to help the continuing company attract and retain employees, directors and consultants Proposal 7 relates to the amendment of Galena’s bylaws so they are more in accordance with the standard

bylaws among public companies Proposal 8 relates to an amendment to Galena’s amended and restated certificate of incorporation to allow the board of directors to adopt, amend or repeal Galena’s bylaws, which is more in line with standard

bylaws of public companies Proposal 9 relates to a non-binding, advisory vote on the compensation that will be paid or may become payable to Galena’s named executive officers in connection with the Merger Proposal 10 relates to adjourning the

Special Meeting in the event there are not sufficient votes to approve the Proposals mentioned above. Please refer to the proxy statement/prospectus/consent solicitation statement for a complete description of each of the Proposals

CONTINUING COMPANY PIPELINE PROGRAM PRECLINICAL PHASE 1 PHASE 2 PHASE 3 SELLAS ASSET: Galinpepimut-S (GPS) Acute Myeloid Leukemia Phase

3 Planned (pending funding availability) Mesothelioma Phase 3 Planned (pending funding availability) Multiple Myeloma – Single Arm Ovarian Cancer (combo with nivolumab) Immune Combination (PD1 blockade; pembrolizumab) Trial (Five indicaitons)

Phase 2 Planned Chronic Myelogenous Leukemia (CML) Phase 2 Planned AML (w/ Hypomethylating Agent) Phase 2 Planned Multiple Myeloma – Randomized Phase 2 Planned GALENA ASSETS: NeuVax™ (nelipepimut-S) – Breast Cancer Development

Programs Combination w/ trastuzumab (Node-positive or node-negative/triple negative, HER2 IHC 1+/2+) Phase 2b Combination w/ trastuzumab (Node-positive or negative, HER2 IHC 3+) Ductal Carcinoma in Situ (DCIS) VADIS Anagrelide Controlled Release

(CR) Essential Thrombocythemia NeuVax is a trademark of Galena Biopharma, Inc.

RECENT ANNOUNCEMENTS SELLAS presents GPS data from the ongoing Phase 2 trial in multiple myeloma patients at the Annual Meeting of the

Society of Hematologic Oncology (SOHO) SELLAS entered into a Clinical Trial Collaboration and Supply Agreement with Merck & Co., Inc., Kenilworth, N.J., USA Initiation of a Phase 1/2 combination clinical trial with GPS and KEYTRUDA®

(pembrolizumab) across various indications expected in 1H, 2018 Enrollment completed in two NeuVax clinical trials in combination with trastuzumab Phase 2b Clinical Trial in HER2 1+/2+ Patients Phase 2 Clinical Trial in HER2 3+ Patients

CONTINUING COMPANY LEADERSHIP TEAM Name POSITION PRIOR EXPERIENCE Angelos M. Stergiou, M.D., Sc.D. h.c. Chief Executive Officer Paion

AG, Biovest International, Accentia, Analytica, Avanex Life Sciences Nicholas J. Sarlis, M.D., Ph.D., FACP Chief Medical Officer NIH, MD Anderson, Sanofi, Incyte Aleksey N. Krylov Interim Chief Financial Officer CHR Capital, Inc., Ftera Advisors,

LLC, SG Cowen Gregory M. Torre, Ph.D., JD Chief Regulatory Officer, & SVP Technical Operations Pfizer, Accentia, Bristol-Meyers, Sanofi Laura M. Katz, MPH VP, Clinical Operations & Biostatistics Novo Nordisk, Accentia Biopharmaceuticals

David Moser, JD VP, Corporate Legal Affairs Accentia, Biovest International

CONTINUING COMPANY BOARD OF DIRECTORS Jane Wasman Ms. Wasman has been President, International & General Counsel and

Corporate Secretary of Acorda Therapeutics, Inc., or Acorda, a publicly traded biopharmaceutical company, since October 2012, managing its International, Legal, Quality, IP and Compliance functions. From January 2012 until October 2012, she was

Acorda’s Chief, Strategic Development, General Counsel and Corporate Secretary, and from May 2004 until January 2012, she was Acorda’s Executive Vice President, General Counsel and Corporate Secretary. Before joining Acorda, Ms. Wasman was

with Schering-Plough Corporation, a global pharmaceutical company, for over eight years, holding various U.S. and international leadership positions, including Staff Vice President and Associate General Counsel. Ms. Wasman earned a J.D. from Harvard

Law School and her undergraduate degree magna cum laude from Princeton University. She has been a member of the board of directors and of the executive committee of the board of the New York Biotechnology Association since 2007. Stephen F. Ghiglieri

Mr. Ghiglieri is currently serving as Galena’s Interim Chief Executive Officer and Chief Financial Officer. Mr. Ghiglieri joined Galena in November 2016 as Chief Financial Officer. In February 2017, his responsibilities increased as he was

appointed Interim Chief Executive Officer. Prior to Galena, Mr. Ghiglieri served as Chief Financial Officer of MedData Inc., a private equity backed healthcare services company that was sold to Mednax, a publicly traded national medical group from

2013 until April 2016. Previously, he spent nearly 10 years at NeurogesX from October 2003 until June 2013, ending his tenure as its Executive Vice President, Chief Operating Officer and Chief Financial Officer. Prior to that, he served as the Chief

Financial Officer of Hansen Medical, Inc., a medical device company. He also held senior level finance positions at two other healthcare companies: Oacis Healthcare Systems, Inc., and Oclassen Pharmaceuticals, Inc. Additionally, Mr. Ghiglieri was

also the Chief Financial Officer and Corporate Secretary for two technology software companies: Avolent, Inc., and Andromedia, Inc. Mr. Ghiglieri began his career as an audit manager of PricewaterhouseCoopers, LLP. He received a B.S. in Business

Administration from California State University, Hayward where he graduated Magna Cum Laude. Mr. Ghiglieri is also a Certified Public Accountant (inactive). Fabio Lolpez Mr. Lolpez is a co-founder and the Chief Executive Officer of Equilibria

Capital Management Limited, positions he has held since its founding in 2011. Mr. Lolpez also serves on the investment committee and as a senior advisor to Stoneweg Spanish Real Estate funds based in Geneva, Switzerland, and on the board of a

private investment holding company. Mr. Lolpez holds a B.S. in Business Administration from Universidad PontificiaComillas ICADE in Madrid, Spain. David A. Scheinberg, M.D., Ph.D. Dr. Scheinberg is currently Vincent Astor Chair, and Chairman,

Molecular Pharmacology, Sloan Kettering Institute. He also founded and chairs the Center for Experimental Therapeutics at MSK, where he spearheaded the discovery and early clinical development of GPS, and founded and was chair of the Nanotechnology

Center from 2010 to 2014. He is additionally Professor of Medicine and Pharmacology and co-chair of the Pharmacology graduate program at the Weill-Cornell University Medical College and Professor in the Gerstner-Sloan Kettering Graduate School at

MSK. Dr. Scheinberg is also an attending physician in the Department of Medicine, Leukemia Service and Hematology Laboratory Service/Department of Clinical Laboratories at Memorial Hospital. Dr. Scheinberg is an advisor to charitable foundations and

cancer centers and sits on the board of directors of Progenics Pharmaceuticals, Inc. (NASDAQ: PGNX), a biotechnology company. Dr. Scheinberg has also served on SELLAS’ Scientific Advisory Board since 2015. From 2010-2016 he served on the board

of directors of Contrafect Corporation, a publicly traded clinical-stage biotechnology company. Dr. Scheinberg holds an M.D. and a Ph.D. in Pharmacology and Experimental Therapeutics from the Johns Hopkins University School of Medicine. Dr.

Scheinberg earned his undergraduate degree in Biology from Cornell University. All directors will be appointed to the continuing company’s board of directors effective as of the closing of the Merger.

CONTINUING COMPANY BOARD OF DIRECTORS Robert L. Van Nostrand Mr. Van Nostrand will be appointed to the continuing company’s board

of directors effective as of the closing of the Merger. Mr. Van Nostrand is currently on the Board of Directors of Achillion Pharmaceuticals, Inc. (NASDAQ: ACHN), a biotechnology company, Enumeral Biomedical Corporation (OTCMKTS: ENUM), a

biotechnology company, Intra-Cellular Therapies, Inc. (NASDAQ: ITCI), a biopharmaceutical company, Yield10 Bioscience, Inc. (NASDAQ: YTEN), formerly Metabolix, Inc., a bio agricultural company, and the Biomedical Research Alliance of New York, a

private company providing clinical trial services. Mr. Van Nostrand was Executive Vice President and Chief Financial Officer of Aureon Laboratories, Inc., a pathology life science company, from January 2010 to July 2010. Prior to joining Aureon

Laboratories, Mr. Van Nostrand served as Executive Vice President and Chief Financial Officer of AGI Dermatics, a private biotechnology company, from July 2007 to September 2008 when the company was acquired. Between 1986 and 2007, Mr. Van Nostrand

held various executive and other management positions, including Chief Compliance Officer and Chief Financial Officer, at OSI Therapeutics, Inc., or OSI. Prior to joining OSI, Mr. Van Nostrand served in a managerial position with the accounting

firm, Touche Ross & Co., currently Deloitte. Mr. Van Nostrand is also on the board of New York Biotechnology Association and was the former chairman, and is on the Foundation Board of Farmingdale University. Mr. Van Nostrand holds a B.S. in

Accounting from Long Island University, New York and completed advanced management studies at the Wharton School of the University of Pennsylvania. He is a Certified Public Accountant. John Varian Mr. Varian will be appointed to the continuing

company’s board of directors effective as of the closing of the Merger. Mr. Varian served as Chief Executive Officer of XOMA Corporation, or XOMA, from August 2011 through December 2016 and served as a member of the Board of Directors of XOMA

from December 2008 through May 2017. Mr. Varian currently serves as a member of Versartis, Inc.’s (NASDAQ: VSAR) Board of Directors, a position he has held since March 2014. Mr. Varian previously served as Chief Operating Officer of ARYx

Therapeutics, Inc. from December 2003 through August 2011. Beginning in May 2000, Mr. Varian was Chief Financial Officer of Genset S.A. in Paris France, where he was a key member of the team negotiating Genset’s sale to Serono S.A. in 2002.

From 1998 to 2000, Mr. Varian served as Senior Vice President, Finance and Administration of Elan Pharmaceuticals, Inc., joining the company as part of its acquisition of Neurex Corporation. Prior to the acquisition, he served as Neurex

Corporation’s Chief Financial Officer from 1997 until 1998. From 1991 until 1997, Mr. Varian served as the VP Finance and Chief Financial Officer of Anergen Inc. Mr. Varian was an Audit Principal / Senior Manager at Ernst & Young LLP from

1987 until 1991 where he focused on life sciences. Mr. Varian was also a founding committee member of Bay Bio and a former chairman of the Association of Bioscience Financial Officers International Conference. Mr. Varian holds a B.B.A. from Western

Michigan University. Angelos M. Stergiou, M.D., Sc.D. h.c. Dr. Stergiou has served as SELLAS’ Chief Executive Officer since founding SELLAS in 2012 and has served as a director since that time, both as Chairman from 2012 to July 2016, and as

Vice Chairman since July 2016. Dr. Stergiou also co-founded Genesis Life Sciences, Ltd. (now Genesis Research), a boutique health economics and pricing-reimbursement and health access company. Dr. Stergiou served on the joint steering and oversight

committee of PAION AG with Forest Labs in 2003-2004 as it relates to the desmoteplase technology and its clinical development program, had a senior management role, Vice President and Head of Drug Development at Accentia Biopharmaceuticals, Inc.

from 2004 to 2008 and also served in the same capacity as well as Chief Medical Officer at its subsidiary Biovest International, Inc. during the same time. While at Biovest International, Inc., Dr. Stergiou led the Phase 3 development of a

therapeutic cancer vaccine, BiovaxID, which was presented at the American Society of Clinical Oncology plenary session in 2009. Dr. Stergiou holds an M.D. from the U.S. American Institute of Medicine and a Sc.D. h.c. from Kentucky Wesleyan College

and received his undergraduate degree in pre-medicine, biology and chemistry from Kentucky Wesleyan College. Dr. Stergiou is a member of the Board of Trustees at Kentucky Wesleyan College, a Fellow of the Royal Society of Medicine, an active member

of the World Medical Association, and a member of the American Academy of Physicians in Clinical Research and the Association of Clinical Research Professionals. All directors will be appointed to the continuing company’s board of directors

effective as of the closing of the Merger.

VOTE YOUR SHARES TODAY Call (212) 929-5500 (Collect) Call (800) 322-2885 (toll free in North America)

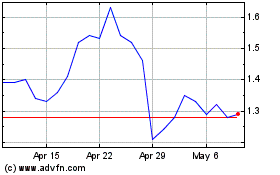

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

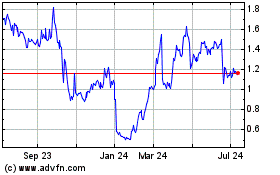

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024