Current Report Filing (8-k)

December 08 2017 - 1:19PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event

reported): December 1, 2017

VIVA

ENTERTAINMENT GROUP INC.

(F/K/A Black River Petroleum Corp.)

|

NEVADA

|

|

000-54704

|

|

98-0642409

|

|

(State

or Other Jurisdiction of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

143-41 84

th

Drive, Briarwood,

New York 11435

(Address of principal executive office, including zip code)

(347) 681-1668

(Registrant’s telephone number,

including area code)

(Former name, former address and former

fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether

the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

In

order to provide a possible source of funding for the Company, the Company, on December 1, 2017, entered into an Investor Agreement

(the "Agreement") with Ignition Capital, LLC ("Ignition").

Pursuant to the

Agreement, Ignition has agreed to provide the Company with up to $5,000,000 of funding through the purchase of shares of the Company's

common stock. During the term of the Agreement, the Company may deliver a Put Notice to Ignition, which will specify the number

of shares which the Company will sell to Ignition. The minimum amount the Company can draw down at any one time is $25,000, and

the maximum amount the Company can draw down at any one time is $250,000, as determined by the formula contained in the Agreement.

A closing will occur

on the date which is no earlier than five trading days following and no later than seven trading days following the applicable

Put Notice. On each Closing Date, the Company will sell, and Ignition will purchase, the shares of the Company's common stock specified

in the Put Notice.

The amount to be

paid by Ignition on a particular Closing Date will be determined by multiplying the Purchase Price by the number of shares specified

in the Put Notice. The Purchase Price will be 75% of the lowest trading price of the Company's common stock during the Pricing

Period applicable to the Put Notice. The Pricing Period, with respect to a particular Put Notice, is five consecutive trading days

including, and immediately following, the delivery of a Put Notice to Ignition.

The Company may

submit a Put Notice once every fifteen trading days provided the closing of the previous transaction has taken place. The Company

is under no obligation to submit any Put Notices.

The Agreement has

a term of 24 months, which will begin on the effective date of the registration statement which the Company has agreed to file

with the Securities and Exchange Commission so that the shares of common stock to be sold to Ignition may be sold in the public

market.

The Company issued

a promissory note to Ignition for the principal sum of $25,000 as a commitment fee for the equity line. The note bears interest

at 15% per year, is unsecured, and is due and payable on December 1, 2018. At the option of Ignition, all or any part of the note

may be converted into shares of the Company's common stock. Any amount so converted will be converted into common stock of the

Company at a price of 50% of the lowest trading price on the primary trading market on which the Company’s Common Stock is

quoted for the ten (10) trading days immediately prior to but not including the Conversion Date.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: December 8, 2017

|

Viva Entertainment Group, Inc.

|

|

|

|

|

|

By:

|

/s/Johnny Falcones

|

|

|

|

Johnny Falcones

|

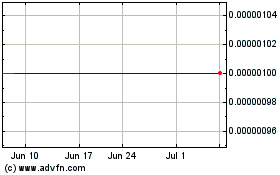

Viva Entertainment (CE) (USOTC:OTTV)

Historical Stock Chart

From Mar 2024 to Apr 2024

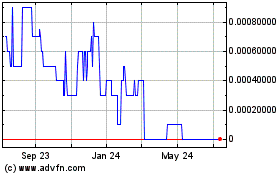

Viva Entertainment (CE) (USOTC:OTTV)

Historical Stock Chart

From Apr 2023 to Apr 2024