Current Report Filing (8-k)

December 07 2017 - 5:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):

December 4, 2017

GLOBAL

EQUITY INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

|

000-54557

|

|

27-3986073

|

|

(State

or other jurisdiction of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer

Identification Number)

|

X3

Jumeirah Bay, Office 3305,

Jumeirah

Lake Towers

Dubai,

UAE

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code:

+ (971) 42767576 / + (1) 321 200 0142

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2., below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.133-4(c))

|

Item

1.01 Entry into a Material Definitive Agreement.

As previously reported

in our Form 10-Q Quarterly Report for the period ended September 30, 2017, Global Equity International, Inc. (“Company”)

has previously entered in funding transactions with Mammoth Corporation (“Mammoth”). In exchange for Mammoth’s

funding, the Company has issued a number of convertible debt instruments (“Instruments”) to Mammoth, the terms of

which allow Mammoth to convert the principal and interest due under the Instruments into shares of the company’s common

stock.

As of December 4,

2017, there were three Instruments outstanding. On December 7, 2017, Mammoth converted one of those Instruments (specifically,

the remaining balance of Note 3 to Mammoth) into common stock. As of December 7, 2017, there are two Instruments Notes

4 and 5 to Mammoth) outstanding for an aggregate of $325,015.

Pursuant to a Rider

to the Instruments, Mammoth and the Company agreed to suspend Mammoth’s conversion rights under the two currently outstanding

Instruments beginning December 8, 2017 until June 15, 2018, in order to allow the Company to pay the two currently outstanding

Instruments in cash, payable in six equal monthly payments of $54,168, beginning January 15, 2018 and ending on June 15,

2018.

Assuming that the Company

makes the above payments in a timely manner, there will be no further dilution in the Company’s common stock as a result

of conversion of debts due to Mammoth.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

– See “Exhibit Index” set forth below.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned hereunto duly authorized.

Dated:

December 7, 2017

|

|

GLOBAL

EQUITY INTERNATIONAL, INC.

|

|

|

|

|

|

|

By:

|

/s/

Enzo Taddei

|

|

|

|

Enzo

Taddei

|

|

|

|

Chief

Financial Officer

|

EXHIBIT

INDEX

List

of Exhibits attached or incorporated by reference pursuant to Item 601 of Regulation S-B

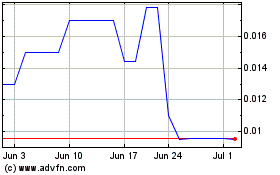

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

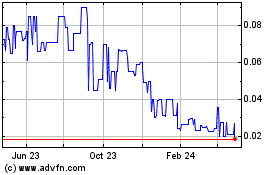

Argentum 47 (PK) (USOTC:ARGQ)

Historical Stock Chart

From Apr 2023 to Apr 2024