Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

December 06 2017 - 4:17PM

Edgar (US Regulatory)

|

Supplement

No. 2

|

Rule

424(b)(3) Registration

|

|

Dated

December 6, 2017

|

No.

333-220438

|

|

(To

Prospectus dated October 17, 2017)

|

|

MARATHON

PATENT GROUP, INC.

This

prospectus supplement (“Supplement”) modifies, supersedes and supplements information contained in, and should be

read in conjunction with, that certain prospectus, dated October 17, 2017 and as supplemented and amended to date (“Prospectus”),

of Marathon Patent Group, Inc. This Supplement is not complete without, and may not be delivered or used except in connection

with, the original Prospectus.

The

information included in this Supplement modifies and supersedes, in part, the information in the Prospectus. Any information that

is modified or superseded in the Prospectus shall not be deemed to constitute a part of the Prospectus, except as modified or

superseded by this Supplement.

We

may amend or supplement the Prospectus from time to time by filing amendments or supplements as required. You should read the

entire Prospectus and any amendments or supplements carefully before you make an investment decision.

See

“Risk Factors” beginning on page 6 of the prospectus dated October 17, 2017, for risk factors and information you

should consider before you purchase shares.

Recent

Developments

The Company registered an aggregate of 1,588,564

shares of Common Stock issuable upon conversion of 5% convertible promissory notes on behalf of Revere Investments LP. (“Revere”).

On October 30, 2017, the Company affected a 4-1 reverse stock split. All numbers in this Supplement reflect such reverse stock

split. On September 5, 2017, Deane A. Gilliam converted her promissory note to 175,000 shares of Common Stock. On October

31, 2017, Deane A. Gilliam transferred the Common Stock to the Deane A. Gilliam 2017 Irrevocable Family Trust. Accordingly,

the Selling Stockholders section in the Prospectus is amended to replace Deane A. Gilliam as the Selling Stockholder with the

Deane A. Gilliam 2017 Irrevocable Family Trust. Ari Raskas exercises sole voting and dispositive power over the Deane A. Gilliam

2017 Irrevocable Family Trust and thus is deemed to beneficially own such shares pursuant to Rule 13 d-3 under the Exchange Act.

The address for the Deane A. Gilliam 2017 Irrevocable Family Trust is 1325 Franklin Avenue, Suite 335, Garden City, New York 11530.

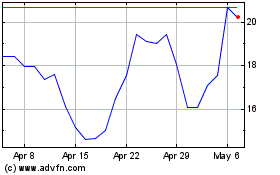

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024