Today's Top Supply Chain and Logistics News From WSJ

December 06 2017 - 7:25AM

Dow Jones News

By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The strong surge in online sales this season is starting to slow

down delivery of the goods to homes. United Parcel Service Inc.

says big seasonal volumes that are running ahead of expectations

are backing up its U.S. distribution system, the WSJ's Paul Ziobro

reports, pushing the country's biggest private carrier to warn

customers of delays in delivery and to call on drivers to work

extra hours. The delays show delivery operations critical to

e-commerce are still struggling with the busiest shopping periods

despite heavy investment to build out and automate operations. The

carriers are facing a flood of goods: Adobe estimates that Cyber

Monday sales rose 17% from last year, and that online sales this

season will clear $100 billion. The U.S. Postal Service is

responding by expanding delivery hours, and UPS has tried to get

retailers to spread volume more evenly through the period. But with

the company's holiday-season volume up more than 22% in just two

years, the plans are being buried by the flood of boxes.

The rebound in truck manufacturing is running at high throttle.

Fleet operators ordered 32,900 Class 8 trucks in November, a 70%

boost over a year ago that ACT Research says gives truck makers

their strongest two-month stretch for orders since the start of

2015. Trucking companies are adding capacity as strong economic

growth fuels surging freight volume, WSJ Logistics Report's Erica

E. Phillips writes, and bolsters shipping prices and carrier

confidence heading into 2018. That's providing a boost for truck

makers like Navistar International Corp. that were laying off

workers in 2016 as orders fell to multi-year lows. Factories will

be operating in high gear in the coming months, and ACT expects

orders to remain high next year as operators replace trucks and add

capacity. The only brake on the fleet owners' expansion plans, in

fact, may be finding enough drivers to run the big rigs.

Ford Motor Co. is trying to restart its sales engine in China as

it builds up its supply chain in the world's biggest car market.

The auto manufacturer will launch 50 new vehicles in China by 2025,

including 15 electric models, the WSJ's Trefor Moss writes, as it

seeks to reverse this year's 14% slide in passenger-car sales. Ford

plans to make automobiles that cater more to Chinese buyers, and to

follow a shift in the country toward vehicles that are more

autonomous, connected and electric. The company depends less on

China than some auto makers, but its commitment is growing. It

plans to start production at its first Lincoln plant in China in

2019, and plans to shift production of the Focus from the U.S. to

China. Along with a new $103 million testing facility in Nanjing,

the moves will give Ford a bigger stake in the network of suppliers

that is growing in the expanding car market.

E-COMMERCE

Jack Ma doesn't have any patience with complaints from foreign

companies about doing business in China. The Alibaba Group Holding

Ltd. founder told an internet forum that companies that struggle in

China simply may not be taking the right approach, the WSJ's Liza

Lin writes, a tough message that comes as retailers and e-commerce

companies are looking to expand across borders. Alibaba itself is

pushing plans to compete in the U.S. even as American online rival

Amazon.com Inc. tries to scale up its own operations in Alibaba's

back yard. Transport and logistics operators are among those that

have struggled to build up business in China while meeting strict

regulatory requirements. Mr. Ma says foreign companies shouldn't

expect to succeed quickly or easily. "When you determine to come,

prepare for it," he said. "Follow the rules and laws and spend 10

years."

QUOTABLE

IN OTHER NEWS

U.S. imports expanded 1.6% in October on rising consumer goods

and oil trade while exports remained flat. (WSJ)

Canada's merchandise trade deficit narrowed sharply in October

as exports surged 2.7% while imports fell. (WSJ)

A measure of U.S. service-sector activity slipped slightly last

month but remained in strong growth territory. (WSJ)

China and Canada stopped short of announcing new trade talks

during meetings between the countries' top leaders. (WSJ)

Listed companies are at their most profitable level on record

after a bumper year of earnings growth. (WSJ)

Nissan Motor Co. says it will start testing robo-taxis on

Japanese streets in March. (WSJ)

Japan Airlines Co. invested in a U.S. startup seeking to build a

supersonic airliner capable of flying trans-Pacific routes in five

hours. (WSJ)

Copper prices fell to two-month lows on reports of growing

inventories. (WSJ)

Vietnam will eliminate tariffs on many auto parts starting in

January. (Nikkei Asian Review)

Amazon had a quiet start to the launch of its online marketplace

in Australia. (New York Times)

Fitch Ratings says the outlook for the shipping industry remains

negative for next year due to lingering overcapacity in most

sectors. (Lloyd's List)

Employers at U.S. East and Gulf Coast ports and unionized

dockworkers began negotiations aimed at long-term contract

extension. (Journal of Commerce)

CMA CGM SA signed a 10-year pact with Total SA to provide

liquefied natural gas to fuel its ships. (Splash 14/7)

The main airline trade group forecasts industry profits will

grow 11% next year to $38.4 million. (STAT Times)

U.S. transport regulators withdrew a proposed rule requiring

special brakes on freight trains carrying hazardous commodities.

(Railway Age)

An administrative law judge rules New Jersey-based Intermodal

Bridge Transport wrongly classified its port truck drivers as

independent contractors. (American Shipper)

Daimler Trucks North America will start delivering parts built

using 3D printing technology. (Commercial Carrier Journal)

Lineage Logistics LLC acquired eight refrigerated facilities in

Southern California from U.S. Growers Cold Storage Inc. (Modern

Materials Handling)

Airlines in Germany have canceled more than 200 flights this

year because flight crews refused to take part in deportations of

asylum seekers to Afghanistan. (The Independent)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

December 06, 2017 07:10 ET (12:10 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

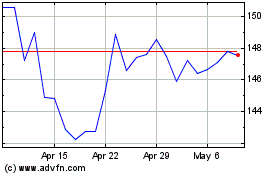

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

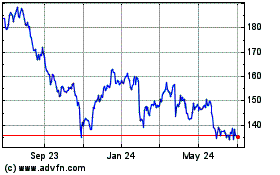

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024