This press release may not be published,

forwarded or distributed, directly or indirectly, in the United

States of America, Australia, Canada or Japan

This press release does not constitute or form

a part of any offer or solicitation to purchase or subscribe for

securities in the United States of America or any other

jurisdiction. The ORNANEs (and the underlying shares) may not be

offered or sold in the United States of America unless they are

registered under the U.S. Securities Act of 1933, as amended or

exempt from registration. Pierre & Vacances does not intend to

register the offer in whole or in part or to make a public offer of

its securities in the United States of America.

Regulatory News:

Pierre et Vacances (Paris:VAC) (the “Company” or

“Pierre et Vacances”) today announces that, following the

reverse bookbuilding process on net share settled bonds convertible

into new shares and/or exchangeable for existing shares due October

1st 2019 (the “2019 ORNANEs”) launched on November 30th,

2017 concurrently with the issuance through a private placement

(the “Issuance”) of net share settled bonds convertible into

new shares and/or exchangeable for existing shares due April 1st,

2023 (the “ORNANEs”), the unit repurchase price of the 2019

ORNANEs has been set at €46.53.

The unit repurchase price of the 2019 ORNANEs is equal to

arithmetical average of the daily volume-weighted average price of

the Pierre et Vacances share on the regulated market of Euronext in

Paris (“Euronext Paris”), being €46.08, during a period

starting on November 30th, 2017 (inclusive) and ending today

December 4th, 2017 (inclusive), increased by €0.45.

The 2019 ORNANEs tendered in the reverse bookbuilding will be

repurchased off the market, subject to the settlement of the

Issuance, after the close of Euronext Paris on December 7th,

2017.

As the number of 2019 ORNANEs collected via the reverse

bookbuilding process represents more than 20% of the aggregate

number of 2019 ORNANEs initially issued, the Company will launch,

in order to ensure that all the 2019 ORNANEs holders are treated

equally, an off-market repurchase offer centralised by BNP Paribas

Securities Services pursuant to which the Company will repurchase

the 2019 ORNANEs from all holders requesting such repurchase during

the 5-trading day period between December 8th, 2017 (inclusive) and

December 14th, 2017 (inclusive), at the same price determined

following the reverse bookbuilding procedure (the “Centralized

Repurchase Procedure”). Holders of 2019 ORNANEs wishing to

participate in the Centralized Repurchase Procedure will need to

contact their financial intermediary.

The settlement of the 2019 ORNANEs repurchase price by the

Company in the context of the Centralized Repurchase Procedure will

occur on December 18th, 2017.

The repurchased 2019 ORNANEs will be cancelled at the latest on

December 18th, 2017 in accordance with their terms and conditions

and the applicable law.

The Company reserves the right to repurchase 2019 ORNANEs on or

off the market after the close of the Centralized Repurchase

Procedure.

BNP Paribas, Crédit Agricole Corporate and Investment Bank and

Natixis acted as Joint Global Coordinators and Joint Bookrunners

for the Issuance and the repurchase of the 2019 ORNANEs (the

“Joint Global Coordinators”) and CM-CIC Market Solutions

acted as Co-Lead Manager (and together, the “Managers”).

This press release does not constitute or form part of any offer

or solicitation to purchase or subscribe for or to sell the ORNANEs

and the Offering is not an offer to the public in any jurisdiction,

including France.

About the Pierre & Vacances-Center Parcs group

Leader in holidays in Europe, the Pierre & Vacances-Center

Parcs group has been developing and managing innovative and

environmentally-friendly holiday and leisure concepts for 50 years

in seaside, mountain and countryside destinations as well as in

city centres.

Its business model is based on two complementary activities:

real estate and tourism.

With its well-known brands – Pierre & Vacances, Center

Parcs, Sunparks, Aparthotels Adagio®, maeva.com, Villages Nature®

Paris – the Group operates almost 280 locations and resorts in

Europe.

Thanks to the talent of its 12 200 employees, the Pierre

& Vacances-Center Parcs group achieved a revenue of €1,506.3

million and welcomed c.8 million customers in 2016/2017.

www.groupepvcp.com - @GroupePVCP

No communication and no information in respect of the offering

by the issuer of the ORNANEs may be distributed to the public in

any jurisdiction where a registration or approval is required. No

steps have been or will be taken in any jurisdiction where such

steps would be required. The offering or subscription of the

ORNANEs may be subject to specific legal or regulatory restrictions

in certain jurisdictions. The issuer takes no responsibility for

any violation of any such restrictions by any person.

This announcement is an advertisement and not a prospectus

within the meaning of the Prospectus Directive (as defined

below).

This announcement does not and shall not, in any circumstances

constitutes a public offering nor an invitation to the public in

connection with any offer in any jurisdiction other than

France.

European Economic Area

This announcement is only addressed to and directed, in member

states of the European Economic Area which have implemented the

Prospectus Directive (each, a “Relevant Member State”), at

persons who are “qualified investors” within the meaning of Article

2(1)(e) of the Prospectus Directive and pursuant to the relevant

implementing rules and regulations adopted by each relevant member

state (“Qualified Investors”). Such person who initially

acquires any ORNANEs or to whom any offer of the ORNANEs may be

made will be deemed to have represented, acknowledged and agreed

that it is a qualified investor as defined above.

With respect to each Relevant Member State, no action has been

undertaken or will be undertaken to make a public offering of

ORNANEs in that Relevant Member State other than to any legal

entity which is a Qualified Investor, excluding any offer made to

natural persons.

For the purposes of this provision, the expression (i) “an

offer of ORNANEs to the public” in relation to any ORNANEs in

any Relevant Member State means the communication in any form and

by any means of sufficient information on the terms of the offer

and the ORNANEs to be offered so as to enable an investor to decide

to purchase or subscribe the ORNANEs, as the same may be varied in

that member state by any measure implementing the Prospectus

Directive in that member state, (ii) the expression Prospectus

Directive means Directive 2003/71/EC (and amendments thereto,

including the 2010 Prospectus Directive Amending Directive, to the

extent implemented in the Relevant Member State), and includes any

relevant implementing measure in the Relevant Member State and

(iii) the expression "2010 Prospectus Directive Amending

Directive" means Directive 2010/73/EU.

This selling restriction is in addition to any other selling

restrictions applicable in the Relevant Member States having

implemented the Prospectus Directive.

You further represent and agree that, with effect from and

including the relevant implementation date, you are not making any

public offering of the securities in a Relevant Member State in

reliance on the exemption set out in Article 3.2(b) of the

Prospectus Directive.

In the case of any ORNANEs being offered to you as a financial

intermediary as that term is used in Article 3(2) of the Prospectus

Directive, you will also be deemed to have represented and agreed

that the ORNANEs acquired by you in the offering have not been

acquired on behalf of persons in the European Economic Area other

than Qualified Investors or persons in the United-Kingdom and other

member states (where equivalent legislation exists) for whom you

have authority to make decisions on a wholly discretionary basis,

nor have the ORNANEs been acquired with a view to their offer or

resale in the European Economic Area where this would result in a

requirement for publication by the issuer, the Managers or any

other manager of a prospectus pursuant to Article 3 of the

Prospectus Directive, or in which the prior consent of the Managers

has been obtained to such offer or resale.

Prohibition of sales to European Economic Area Retail Investors

- the ORNANEs are not and are not intended to be offered, sold or

otherwise made available to and, with effect from such date, should

not be offered, sold or otherwise made available to any Retail

Investor in the European Economic Area. For the purpose of this

paragraph, a “Retail Investor” means any person(s) who is

(are): (i) a retail client as defined in point (11) of Article 4(1)

of Directive 2014/65/EU (“MIFID II”); (ii) a customer within

the meaning of Directive 2002/92/EC (“IMD”), where that

customer would not qualify as a professional client as defined in

point (10) of Article 4(1) of MiFID II; or (iii) not a Qualified

Investor as defined in the Prospectus Directive. Consequently no

key information document required, from January 1st 2018, by

Regulation (EU) no 1286/2014 (the “PRIIPS Regulation”) for

offering or selling the ORNANEs or otherwise making them available

to Retail Investors in the European Economic Area has been and will

be prepared and therefore offering or selling the ORNANEs or

otherwise making them available to any Retail Investor in the

European Economic Area may be unlawful under the PRIIPS

Regulation.

United Kingdom

This announcement is only being distributed to and is only

directed at persons in the United Kingdom who are (i) investment

professionals falling within Article 19(5) of the Financial

Services and Markets Act 2000 (financial promotion) Order 2005 (as

amended) or (ii) persons falling within Article 49(2) (a) to (d)

(high net worth companies, unincorporated associations, etc.) of

the Financial Services and Markets Act 2000 (financial promotion)

Order 2005 (as amended) and (iii) other persons to whom it can be

legally communicated (all such persons together being referred to

as (“Relevant Persons”). The ORNANEs and the shares to be

delivered upon conversion or exchange of the ORNANEs (the

“Subject Securities”) are directed only at Relevant Persons

and no invitation, offer or agreements to subscribe, purchase or

otherwise acquire the Subject Securities may be proposed or made

other than to Relevant Persons. Any person who is not a Relevant

Person should not rely on this announcement or any of its

contents.

This announcement is not a prospectus and has not been approved

by the Financial Conduct Authority or any other United Kingdom

regulatory authority for the purposes of section 85 of the

Financial Services and Markets Act 2000.

United States of America

This announcement may not be published, distributed or

transferred, directly or indirectly, in the United States

(including its territories and dependencies, any state of the

United States and the District of Columbia). This announcement does

not constitute or form a part of any offer or solicitation to

purchase or subscribe for securities in the United States. The

ORNANEs and the shares to be issued or granted upon conversion or

exchange of the ORNANEs have not been, and will not be, registered

under the United States Securities Act of 1933, as amended (the

“Securities Act”), or with any securities regulatory

authority of any state or other jurisdiction in the United States,

and may not be offered or sold, directly or indirectly, in the

United States, except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act. The ORNANEs will be offered or sold only outside of

the United States in offshore transactions in accordance with

regulation s of the Securities Act. The issuer does not intend to

register any portion of the proposed offering in the United States

or to conduct a public offering of securities in the United

States.

Canada, Australia, Japan

The ORNANEs have not been offered or sold and may not be

offered, sold or purchased in Canada, Australia or Japan.

The distribution of this announcement in some countries may

constitute a breach of applicable law.

This announcement does not constitute an invitation to sell

ORNANEs 2019 in any country where or to any person to which such

invitation is restricted by applicable laws or regulations. The

repurchase procedure of ORNANEs 2019 through a reverse bookbuilding

procedure and the centralized repurchase procedure are not and will

not be opened, directly or indirectly, to U.S. holders (as defined

under Rule 800(h) of the Securities Act) under any form and by any

means. Persons in such jurisdictions into which this announcement

is released, published or distributed must inform themselves about

and comply with such laws or regulations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171204005849/en/

Pierre et VacancesInvestor Relations and Strategic

OperationsEmeline Lauté, +33 (0) 1 58 21 54

76info.fin@groupepvcp.comorPress RelationsValérie Lauthier,

+33 (0) 1 58 21 54 61valerie.lauthier@groupepvcp.com

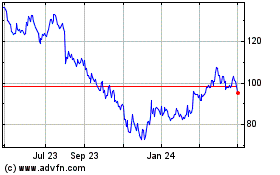

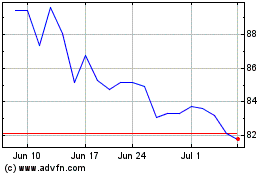

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Apr 2023 to Apr 2024