Fledgling Studio STX Secures Investment from Malone's Liberty Global -- Update

November 30 2017 - 9:38PM

Dow Jones News

By Wayne Ma

HONG KONG -- STX Entertainment, the young Hollywood studio

behind the "Bad Moms" franchise, said Thursday it will receive an

investment from John Malone's Liberty Global PLC.

A person familiar with the matter said Liberty would invest $35

million, valuing the studio at $1.37 billion. Spokespeople for STX

and Liberty said the amount of the investment was incorrect; they

declined to elaborate.

The investment in STX comes ahead of its planned initial public

offering in Hong Kong next year, where the studio is seeking to

raise about $500 million at a valuation of $3.5 billion, The Wall

Street Journal has reported.

Liberty Global, based in London, is a sprawling international

basket of cable operators that has scooped up assets across the

world as it looks to position itself as a media and

content-distribution giant.

Mr. Malone's companies have made other content investments over

the past few years, which include Liberty Media Corp.'s acquisition

of Formula One, and an interest in another Hollywood studio, Lions

Gate Entertainment Corp. That studio acquired premium cable channel

Starz last year. Mr. Malone was the largest voting shareholder in

Starz.

Earlier this year, Liberty Global partnered with an affiliate of

U.S. private-equity firm TPG to launch a global TV production and

distribution studio. TPG is one of STX's largest investors.

STX said in a news release early Friday, Hong Kong time, that

Bruce Mann, chief programming officer at Liberty, would join its

board of directors.

Last month, STX released its second "Bad Moms" film. The sequel

has grossed more than $90 million world-wide in its first month, on

a budget of around $30 million, according to Box Office Mojo. The

original film grossed more than $180 million over its three-month

run, on a budget of $20 million.

Founded in 2014 by producer Robert Simonds and Bill McGlashan, a

top executive at TPG, STX has focused mainly on mid-budget movies

and expanded into television, virtual reality, digital video, music

and live entertainment.

STX is projected to book an operating loss of about $85 million

on revenue of about $285 million this year, a second person

familiar with the matter said. The company's operating loss is

expected to widen to about $90 million on revenue of about $755

million next year, the second person said. By 2019, STX is expected

to roughly break even on revenue of more than $1.8 billion, the

second person said.

STX's potential listing in Hong Kong is part of efforts to stay

close to its investors and audience. The studio forged early

partnerships with Chinese investors, receiving a major investment

in 2014 from Hony Capital, a Chinese private-equity firm. TPG now

owns at least a third of the studio, while Hony owns at least a

quarter of it, the first person said.

Huayi Bros. Media Corp., China's leading film studio, committed

several hundred million dollars to help finance STX's movies for

three years starting in 2015.

In 2016, Chinese internet giant Tencent Holdings Ltd. and a unit

of Hong Kong-based telecom and media company PCCW Ltd. bought

stakes in STX for undisclosed sums. The size of those stakes are

each less than 5%, the first person added.

Write to Wayne Ma at wayne.ma@wsj.com

(END) Dow Jones Newswires

November 30, 2017 21:23 ET (02:23 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

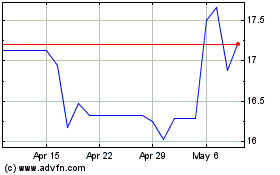

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

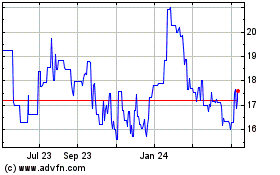

Liberty Global (NASDAQ:LBTYB)

Historical Stock Chart

From Apr 2023 to Apr 2024