Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

November 29 2017 - 6:08AM

Edgar (US Regulatory)

|

Supplement

No. 1

|

Rule

424(b)(3) Registration

|

|

Dated

November 29, 2017

|

No.

333-220438

|

|

(To

Prospectus dated October 17, 2017)

|

|

MARATHON

PATENT GROUP, INC.

This

prospectus supplement (“Supplement”) modifies, supersedes and supplements information contained in, and should be

read in conjunction with, that certain prospectus, dated October 17, 2017 and as supplemented and amended to date (“Prospectus”),

of Marathon Patent Group, Inc. This Supplement is not complete without, and may not be delivered or used except in connection

with, the original Prospectus.

The

information included in this Supplement modifies and supersedes, in part, the information in the Prospectus. Any information that

is modified or superseded in the Prospectus shall not be deemed to constitute a part of the Prospectus, except as modified or

superseded by this Supplement.

We

may amend or supplement the Prospectus from time to time by filing amendments or supplements as required. You should read the

entire Prospectus and any amendments or supplements carefully before you make an investment decision.

See

“Risk Factors” beginning on page 6 of the prospectus dated October 17, 2017, for risk factors and information you

should consider before you purchase shares.

Recent

Developments

The Company registered an aggregate of 1,588,564

shares of Common Stock issuable upon conversion of 5% convertible promissory notes on behalf of Revere Investments LP. (“Revere”).

On October 30, 2017, the company affected a 4-1 reverse stock split. All numbers in this Supplement reflect such reverse

stock split. On November 27, 2017, Revere sold $224,284 of its promissory notes to Hudson Bay Master Fund Ltd. Accordingly,

the Selling Stockholders section in the Prospectus is amended to include the shares issuable upon conversion of the promissory

note that was sold and should read as follows:

SELLING

STOCKHOLDERS

This prospectus relates

to the resale of up to 1,848,500 shares of Common Stock by the selling stockholders, of which (i) 1,649,000 shares are issuable

upon conversion of certain 5% convertible promissory notes issued by the Company in the Private Placement of up to $5,500,000

in 5% convertible promissory notes and five-year warrants to purchase shares of Common Stock and (ii) 199,500 shares were issued

in exchange for the Exchange Warrants which were exercisable to purchase an aggregate of 190,000 shares of Common

stock, pursuant to the Exchange Agreements dated July 17, 2017, by and among the Company and the Investor in the Company’s

Offering.

The issuance of the Exchange Shares was approved by the Company’s shareholders

at a special meeting of the shareholders held by the Company on September 29, 2017.

The

following table sets forth, based on information provided to us by the selling stockholders or known to us, the names of the selling

stockholders, the nature of any position, office or other material relationship, if any, which the selling stockholder has had,

within the past three years, with us or with any of our predecessors or affiliates, and the number of shares of our common stock

beneficially owned by the selling stockholders before this offering. The number of shares owned are those beneficially owned,

as determined under the rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other

purpose. Under these rules, beneficial ownership includes any shares of common stock as to which a person has sole or shared voting

power or investment power and any shares of common stock which the person has the right to acquire within 60 days through the

exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power

of attorney or revocation of a trust, discretionary account or similar arrangement. Except as set forth below, none of the selling

stockholders is a broker-dealer or an affiliate of a broker-dealer. As of November 27, 2017, there were 10,102,485 shares

of our common stock issued and outstanding and 195,501 shares of our Series B Preferred Stock issued and outstanding.

We

have assumed all shares of common stock reflected on the table will be sold from time to time in the offering covered by this

prospectus. Because the selling stockholders may offer all or any portions of the shares of common stock listed in the table below,

no estimate can be given as to the amount of those shares of common stock covered by this prospectus that will be held by the

selling stockholders upon the termination of the offering.

|

Name of Selling Stockholder

|

|

Number of

Shares of

Common Stock

Beneficially

Owned Before

Offering

|

|

|

Number of

Shares of

Common

Stock

Offered

|

|

|

Number of

Shares of

Common

Stock

Owned After

Offering

|

|

|

Percentage

of Common

Stock

Beneficially

Owned After

Offering *

|

|

|

Peter Benz

(3)

|

|

|

88,000

|

(1)

|

|

|

12,143

|

|

|

|

75,857

|

|

|

|

**

|

|

|

CVI Investments, Inc.

(4)

|

|

|

433,167

|

|

|

|

199,500

|

(2)

|

|

|

233,667

|

|

|

|

2.26

|

%

|

|

Deane Gilliam

(5)

|

|

|

350,000

|

(1)

|

|

|

48,294

|

|

|

|

301,707

|

|

|

|

2.90

|

%

|

|

Revere Investments LP

(6)

|

|

|

8,343,394

|

(1)

|

|

|

1,310,708

|

|

|

|

7,032,686

|

|

|

|

41.04

|

%

(6)

|

|

Hudson Bay Master Fund Ltd.

(7)

|

|

|

277,855

|

(1)

|

|

|

277,855

|

|

|

|

0

|

|

|

|

0

|

%

|

|

Total

|

|

|

9,492,416

|

|

|

|

1,848,500

|

|

|

|

7,643,917

|

|

|

|

46.20

|

%

|

* Gives effect to the 4-1

Reverse Stock Split effected on October 30, 2017, and is based on 10,102,485 shares of Common Stock outstanding as of November

27, 2017.

** Less than 1%.

(1)

Represents the maximum number of shares of Common Stock issuable upon conversion of 5% convertible promissory notes (the “Convertible

Note”) sold in the Company’s Private Placement in August 2017, at a conversion price equal to the lesser of (i) $0.20

per share, or (ii) the closing bid price of the Common Stock on the day prior to conversion of the Convertible Notes; provided

that such conversion price may not be less than $0.10 per share.

(2)

Represents the number of shares of Common Stock issued in exchange for the Exchange Warrants to purchase 760,000 shares of Common

Stock, pursuant to the Exchange Agreements dated July 17, 2017, by and among the Company and the purchaser of securities in the

Company’s April 2017 Offering.

(3)

The address for Mr. Benz is 1705 Floribunda Avenue, Hillsborough, California 94010.

(4)

Mr. Martin Kobinger holds voting and dispositive power over shares held by CVI Investments, Inc. The business address for CVI

Investments, Inc., is 101 California Street, Suite 3250, San Francisco, CA 94111.

(5)

The address for Deane Gilliam is 700 Park Avenue, New York, New York 10021.

(6) Mr. John O’Rourke exercises sole

voting and investment authority over all of our securities owned by Revere Investments, LP, and thus is deemed to beneficially

own such shares pursuant to Rule 13d-3 under the Exchange Act. The address for Mr. O’Rourke and Revere Investments, LP,

is Revere Investments, LP, 808 Solar Isle Dr., Fort Lauderdale, Florida 33301. The percentage of Common Stock is calculated based

on the full exercise of Revere’s warrants and conversion of all of its promissory notes, but each of the

promissory notes and warrants contain a 2.49% beneficial ownership limitation.

(7)

Hudson Bay Capital Management, L.P., the investment manager of Hudson Bay Master Fund Ltd., has voting and investment power over

these securities. Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay

Capital Management, L.P. Each of Hudson Bay Master Fund Ltd. and Sander Gerber disclaims beneficial ownership over these securities.

The business address for Hudson Bay Master Fund Ltd. is 777 Third Avenue, 35

th

Floor, New York, NY 10017.

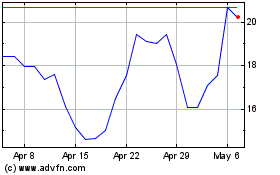

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marathon Digital (NASDAQ:MARA)

Historical Stock Chart

From Apr 2023 to Apr 2024