Amended Statement of Beneficial Ownership (sc 13d/a)

November 28 2017 - 3:46PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934 (Amendment No. 3)

Ladder Capital Corp

(Name of Issuer)

Class A Common Stock, par value $0.001 per

share

(Title of Class of Securities)

505743 10 4

(CUSIP Number)

Andrew Prodanyk, 900-100 Adelaide St W, Toronto, ON M5H 0E2

Canada,

Tel: 416.864.3227

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

November 27, 2017

(Date of Event which

Requires Filing of this Statement)

If the filing person has previously filed a statement on

Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of 240.13d -1(e), 240.13d -1(f) or 240.13d

-1(g), check the following box [ ].

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See 240.13d

-7(b) for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class

of securities, and for any subsequent amendment containing information which

would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities

of that section of the Act but shall be subject to all other provisions of the

Act (however, see the Notes).

SCHEDULE 13D

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

OCP LCF Holdings Inc.

|

|

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE

PERSONS (ENTITIES ONLY)

|

|

|

EIN: 98-0591884

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER

OF A GROUP*

|

|

|

(a) [ ]

|

|

|

(b) [ ]

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

|

|

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL

PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

Ontario, Canada

|

|

NUMBER OF

|

7

|

SOLE VOTING POWER

|

|

|

|

|

|

SHARES

|

|

3,683,087

|

|

|

|

|

|

BENEFICIALLY

|

8

|

SHARED VOTING POWER

|

|

|

|

|

|

OWNED BY

|

|

0

|

|

|

|

|

|

EACH

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

REPORTING

|

|

3,683,087

|

|

|

|

|

|

PERSON

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

WITH

|

|

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

|

|

|

|

|

3,683,087

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

4.1%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

|

|

|

|

CO

|

Page 2

SCHEDULE 13D

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

OMERS Administration Corporation

|

|

|

|

|

|

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS

(ENTITIES ONLY)

|

|

|

EIN: 98-0510778

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

|

(a) [ ]

|

|

|

(b) [ ]

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

|

|

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS

REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

Ontario, Canada

|

|

NUMBER OF

|

7

|

SOLE VOTING POWER

|

|

|

|

|

|

SHARES

|

|

3,683,087

|

|

|

|

|

|

BENEFICIALLY

|

8

|

SHARED VOTING POWER

|

|

|

|

|

|

OWNED BY

|

|

0

|

|

|

|

|

|

EACH

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

REPORTING

|

|

3,683,087

|

|

|

|

|

|

PERSON

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

WITH

|

|

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

|

|

|

|

|

|

3,683,087

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

4.1%*

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

|

|

|

|

CO

|

Page 3

This Amendment No. 3 (“Amendment No. 3”) amends and supplements

the statements on Schedule 13D filed with the Securities and Exchange Commission

(“SEC”) on February 21, 2014 (the “Original Schedule 13D”) as amended by

Schedule 13D filed with the SEC on March 7, 2017 (“Amendment No. 1”) and

Schedule 13D filed with the SEC on August 23, 2017 (“Amendment No. 2”) relating

to the Class A Common Stock, par value $0.001 per share (“Class A Common

Stock”), of Ladder Capital Corp (the “Company”). The Original Schedule 13D is

hereby amended further as follows:

Item 4. Purpose of Transaction

Item 4 of the Original Schedule 13D is hereby amended, with

effect from the date of the event giving rise to this Amendment No. 3, by adding

the following at the end thereof:

The Reporting Persons hold their securities of the Issuer for

investment purposes. A business decision was made by the Reporting Persons to

divest a portion of these securities based on a review of numerous factors,

including, among other things, the price levels of the securities, general

market and economic conditions, ongoing evaluation of the Issuer's business,

financial condition, operations and prospects; and the relative attractiveness

of alternative business and investment opportunities. Accordingly, 1,578,466

Class A shares of the Issuer were sold on November 27, 2017.

Item 5. Interest in Securities of the Issuer

Item 5 of the Amendment No. 1and Amendment No. 2 is hereby

amended and restated, with effect from the date of the event giving rise to this

Amendment No. 3:

*The ownership percentages set forth below are based on

88,925,736 shares of the Issuer’s Class A Common Stock and 21,822,238 shares of

the Issuer’s Class B Common Stock outstanding as set forth in Form 10-Q filed by

the Issuer with the SEC on November 3, 2017.

|

|

(a)

|

OCP LCF Holdings Inc. beneficially owns 3,683,087 shares

of Class A Common Stock, which represent 4.1% of the outstanding Class A

shares (3.3% on a fully diluted basis).

|

|

|

|

|

|

|

|

OMERS Administration Corporation, as the parent company

of OCP LCF Holdings Inc., beneficially owns 3,683,087 shares of Class A

Common Stock, which represent 4.1% of the outstanding Class A shares (3.3%

on a fully diluted basis).

|

|

|

|

|

|

|

(b)

|

The number of shares of Class A Common Stock as to which

each of the Reporting Persons share voting and dispositive power is

5,261,553.

|

|

|

|

|

|

|

(e)

|

OCP LCF Holdings Inc. and OMERS Administration

Corporation will cease to be a beneficial owner of more than five percent

of the class of securities upon settlement of the trade on November 29,

2017.

|

Page 4

Signature

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true,

complete and correct.

|

November 28, 2017

|

|

Dated

|

|

|

|

[signed] “Andrew

Prodanyk”

|

|

Signature

|

|

|

|

|

|

Andrew Prodanyk,

Assistant Secretary and Director, OCP LCF Holdings Inc.

|

|

Name/Title

|

|

|

|

|

|

|

|

November 28, 2017

|

|

Dated

|

|

|

|

[signed]

“Christine Sharp”

|

|

Signature

|

|

|

|

|

|

Christine Sharp, Senior Vice President & Associate

General Counsel, Legal,

|

|

OMERS

Administration Corporation

|

|

Name/Title

|

The original statement shall be signed by each person on whose

behalf the statement is filed or his authorized representative. If the statement

is signed on behalf of a person by his authorized representative (other than an

executive officer or general partner of this filing person), evidence of the

representative’s authority to sign on behalf of such person shall be filed with

the statement, provided, however, that a power of attorney for this purpose

which is already on file with the Commission may be incorporated by reference.

The name and any title of each person who signs the statement shall be typed or

printed beneath his signature.

Attention: Intentional misstatements or omissions of fact

constitute Federal criminal violations (See 18 U.S.C. 1001).

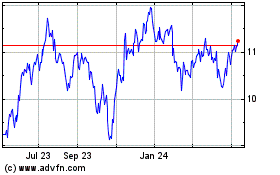

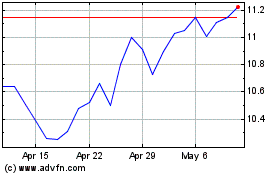

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ladder Capital (NYSE:LADR)

Historical Stock Chart

From Apr 2023 to Apr 2024