Navios Maritime Holdings Inc. Announces Expiration of Early Tender Deadline in Tender Offer for Its 8 1/8% Senior Notes Due 2...

November 21 2017 - 4:02PM

Navios Maritime Holdings Inc. (“Navios Holdings”) (NYSE:NM)

announced today that the early tender deadline expired on November

20, 2017 under the previously announced cash tender offer (the

“Tender Offer”) of Navios Holdings and its wholly-owned subsidiary,

Navios Maritime Finance II (US) Inc. (“Navios Finance,” and

together with Navios Holdings, the “Co-Issuers”) for any and all of

their outstanding 8 1/8% Senior Notes due 2019 (the “2019 Notes”)

issued pursuant to the indenture dated as of January 28, 2011, as

amended, among the Co-Issuers, each of the guarantors party thereto

and Wells Fargo Bank, National Association, as trustee (the

“Trustee”).

On November 21, 2017, the Co-Issuers accepted for payment, and

paid for, all 2019 Notes validly tendered and not validly withdrawn

prior to the early tender deadline, comprising $266,261,000 in

aggregate principal amount (representing approximately 91.47%) of

outstanding 2019 Notes. After the purchase by the Co-Issuers of all

2019 Notes validly tendered and not validly withdrawn prior to the

early tender deadline, $24,833,000 in aggregate principal amount of

2019 Notes remains outstanding.

Any 2019 Notes validly tendered after the early tender deadline

but before the expiration of the Tender Offer will be eligible to

receive the tender offer consideration of $973.75 per $1,000

principal amount of 2019 Notes, plus accrued and unpaid interest

to, but not including, the final payment date for the tendered 2019

Notes, but not the early tender premium. The Tender Offer remains

open and is scheduled to expire at 12:00 midnight, New York City

time, on December 5, 2017, unless extended by the Co-Issuers (the

“Expiration Time”). Other than as required by applicable law,

tendered 2019 Notes may not be withdrawn. The Co-Issuers currently

expect to have a final payment date promptly following the

Expiration Time for any 2019 Notes tendered after the early tender

deadline.

The terms of the Tender Offer are described in the Co-Issuers’

Offer to Purchase dated November 6, 2017 (the “Offer to

Purchase”).

The Co-Issuers also announced that they will redeem for cash, on

December 21, 2017, all 2019 Notes that remain outstanding after

completion of the Tender Offer, at a redemption price of $1,000 per

$1,000 principal amount of 2019 Notes, plus accrued and unpaid

interest to, but not including, that redemption date. The

Co-Issuers issued a notice of redemption on November 21, 2017 to

redeem the remaining outstanding 2019 Notes pursuant to the

redemption and satisfaction and discharge provisions of the

Indenture. This press release does not constitute a notice of

redemption.

The Co-Issuers have engaged Morgan Stanley & Co. LLC to act

as dealer manager in connection with the Tender Offer. The

Co-Issuers have engaged D. F. King & Co., Inc. to act as

information agent and tender agent in connection with the Tender

Offer. Questions regarding the Tender Offer may be directed to

Morgan Stanley & Co. LLC, at (800) 624-1808 (toll-free) or

(212) 761-1057 (collect). Requests for documentation relating to

the Tender Offer may be directed to D. F. King & Co., Inc., at

(800) 669-5550 (toll-free) or (212) 269-5550 (collect).

None of the Co-Issuers, D. F. King & Co., Inc., the dealer

manager or the Trustee is making any recommendation as to whether

holders should tender the 2019 Notes in response to the Tender

Offer.

This press release is for informational purposes only and does

not constitute a notice of redemption, nor does it constitute an

offer to sell or the solicitation of an offer to buy any securities

of the Co-Issuers. The Tender Offer is being made solely pursuant

to the Offer to Purchase which sets forth the complete terms of the

Tender Offer. The Tender Offer is not being made to holders of 2019

Notes in any jurisdiction in which the making of, or acceptance of,

the Tender Offer would not be in compliance with the laws of such

jurisdiction.

About Navios Maritime Holdings Inc.

Navios Maritime Holdings Inc. (NYSE:NM) is a global, vertically

integrated seaborne shipping and logistics company focused on the

transport and transshipment of dry bulk commodities including iron

ore, coal and grain. For more information about Navios Holdings

please visit our website: www.navios.com.

Forward-Looking Statements

This press release contains forward-looking statements (as

defined in Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended)

concerning future events and Navios Holdings’ subsidiaries. Words

such as “expects,” “intends,” “plans,” “believes,” “anticipates,”

“hopes,” “estimates,” and variations of such words and similar

expressions are intended to identify forward-looking statements.

Such statements include statements related to the Tender Offer,

including the Expiration Time and possible completion of the Tender

Offer and the redemption of the 2019 Notes. Although Navios

Holdings believes that the expectations reflected in such

forward-looking statements are reasonable, no assurance can be

given that such expectations will prove to have been correct. These

statements involve known and unknown risks and are based upon a

number of assumptions and estimates which are inherently subject to

significant uncertainties and contingencies, many of which are

beyond the control of Navios Holdings. Actual results may differ

materially from those expressed or implied by such forward-looking

statements. Navios Holdings expressly disclaims any obligations or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in Navios Holdings’ expectations with respect thereto or any change

in events, conditions or circumstances on which any statement is

based.

Contact:

Navios Maritime Holdings Inc. +1.212.906.8643

investors@navios.com

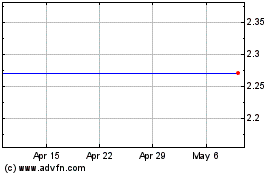

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Mar 2024 to Apr 2024

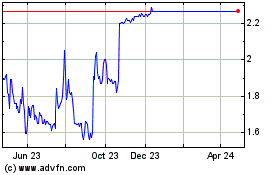

Navios Maritime (NYSE:NM)

Historical Stock Chart

From Apr 2023 to Apr 2024