NetworkNewsWire

Coverage: For 17 years Canada has provided legal access to

medical cannabis to its citizens, and now the country is expected

to legalize recreational marijuana by July 2018. With sales of

Canadian medical cannabis projected to exceed $8 billion by 2024

(http://nnw.fm/bEi4r) and the recreational

market estimated to be worth over $18 billion annually (http://nnw.fm/x49Ay), investment capital has been

pouring into Canada’s licensed producers (LPs). Though the demand

for cannabis is projected to exceed 600,000 kilograms a year (about

1.3 million pounds), Canada’s LPs currently only cultivate about

20,000 pounds of dried marijuana annually. This immense impending

imbalance is a magnet for serious capital investment. It also

presents enormous domestic opportunities for one of Canada’s

premier producers, ABcann Global (TSX.V: ABCN) (OTCQB:

ABCCF) (ABCCF

Profile), which produces only organically grown,

pesticide-free, standardized product and produces among the highest

yields within the Canadian sector. Other publicly traded cannabis

companies vying for position include Cronos Group Inc.

(TSX-V: MJN) (OTC: PRMCF), Maricann Group Inc.

(CSE: MARI) (OTCQB: MRRCF), Emblem Corp., (TSX.V:

EMC) (OTC: EMMBF), with cannabis finance company,

Cannabis Wheaton Income Corp. (TSX.V: CBW) (OTCQB:

CBWTF), looking to profit by injecting capital into select

growers.

Canada’s initial objective in recreational legalization is to

eliminate criminal elements that made a fortune trafficking in

marijuana. By getting marijuana out of the black market and into a

regulated environment, Canada will generate significant tax

revenues and enable it become the first developed country in the

world to legalize recreational use. Managing the complexities of

integrating the programs will be a delicate balance, but despite

the challenges, suppliers are optimistic that legal recreational

sales will be a reality by summer. Once fully implemented, Canada

could be in the enviable position of being the only regulated

producer of marijuana products in the world. In the interim, money

keeps streaming into licensed suppliers; $685 million in investment

capital was infused into publically traded licensed producers last

year and this year looks to be even bigger. In November,

Constellation Brands, a major beer and wine distributor in the

United States, pumped $245 million into Canadian licensed medical

marijuana growers (http://nnw.fm/Dl3Ew).

To become a licensed producer is a marathon exercise in

bureaucracy that can take up to three years, with only 3% of

applications ultimately approved. Health Canada conducts thorough

reviews of applications, ensures compliance, conducts frequent

inspections, and enforces stringent standards. A pioneer in

Canadian medical cannabis, ABcann Global

(TSX.V: ABCN) (OTCQB: ABCCF), has been licensed in

good standing since 2014 with no history of product recalls, and

proprietary computer-controlled production systems that have

bolstered the company’s reputation for its consistent

pharmaceutical-grade cannabis. Recognizing early on that if the

plant was to be effectively utilized as medicine, production had to

be standardized from batch to batch, year-over-year, ABcann took an

unprecedented scientific approach to medical cannabis production

and established a $1.5 million research contract with the

University of Guelph, a world leader in controlled environmental

growth systems. The scientific collaboration led to ABcann’s

proprietary cultivation methods that produce the highest consistent

quality cannabis with yields that double the industry standards.

Precise computer control of every possible variable allows ABcann

to reliably homogenize the environmental experience so each plant

reacts and produces the exact same medical compounds each and every

grow cycle. The success of company’s proprietary technique is

reflected in its 94.7 percent customer retention rate, 30 percent

month-over-month customer growth and its current yield rate which

is nearly double the industry average (http://nnw.fm/w1vUW). ABcann’s scientific approach to

medicine has established the company as an industry leader for

quality and consistency and a reputation for pharmaceutical-grade

products, a crucial factor to capitalize on international market

opportunities. The company’s modular approach to systems technology

mitigates start up risks while ensuring consistency and product

quality anywhere in the world. ABcann is already tactically

targeting Western Europe.

ABcann’s success didn’t go unnoticed. The company went public in

May 2017, raising nearly $12 million in a private placement and

another $25 million in debentures. Shortly after, PI Financial

pegged a one-year share price target of $2.25 (USD). ABcann

recently announced the receipt of $11.9 million in proceeds from

the exercise of warrants, and with a significant investment from

Cannabis Wheaton Income Corp. (TSX.V: CBW) (OTCQB:

CBWTF), brings ABcann’s current cash position to about $45

million today. Priced significantly above market, ABcann announced

on in August (http://nnw.fm/aVAL7) the close of an initial $15

million investment by Cannabis Wheaton, which has raised over $85

million in the last six months, funds licensed or nearly licensed

cannabis producers with smart money, brings in experts to evaluate

budgets, and injects capital at important development phases.

Once facilities are producing, Cannabis Wheaton gets a royalty

on the sale of one-third of the output, which it negotiates to

purchase at direct cost. Chuck Rifici, Cannabis Wheaton’s CEO,

commented on the investment, "This now adds a sixth license to the

Cannabis Wheaton portfolio, and our first publicly traded producer

with a sales license. Over the past three years, I've watched

ABcann's involvement and evolution in the Canadian cannabis

industry. They are widely recognized for their proprietary

cultivation methods that produce high quality cannabis with

industry leading yields.”

This initial investment is only part of a larger $30 million

phased investment for construction of an additional 50,000 square

feet of pure cultivation space next to ABcann's current

14,000-square-foot cannabis cultivation facility in Ontario,

Canada. ABcann’s second production facility, its 65-acre Kimmett

property, has construction plans for a 100,000-square-foot

purpose-built facility taking production capacity to 20,000

kilograms per year and positioning ABcann for hyperbolic expansion

in the Canadian cannabis industry.

Others vying for market position include Maricann Group

(CSE: MARI) (OTCQB: MRRCF), which is expanding its

cultivation, extraction and production facilities, has raised in

excess of $60 million over the last year, some of which was at a

$250 million pre-money valuation. However, the company reported

that Q2 sales declined by 27% from previous year levels and down

42% compared to Q1. Underscoring the importance of environmental

controls, Maricann attributed the shortfall to a March windstorm

that allowed sand to enter its greenhouses and ultimately caused

destruction of all impacted plants. Since going public less than a

year ago, Emblem (TSX.V: EMC) (OTC: EMMBF) has

attracted nearly $27 million in fresh capital and has the same size

growing facility as ABcann’s current facility. Cronos Group

(TSX-V: MJN) (OTC: PRMCF), which operates two wholly-owned

licensed producers collectively situated on more than 125 acres of

agricultural, licensed land, has garnered over $80 million in debt

and equity financing in just the last three months.

Smart money continues to pour into Canadian LPs at an

unprecedented rate, and appears to be on the upswing. Obvious

initial indications would be for the forthcoming legalization of

recreational use. There’s certain to be a bonanza of opportunity

upon implementation, but smart money capitalizes on not only the

impending obvious but also on strategic longer-term considerations.

Select Canadian medical cannabis companies will be uniquely

positioned to capitalize on gigantic global growth opportunities.

Investors seeking substantial capital appreciation should strongly

consider following the smart money.

For more information on ABcann Global please

visit: ABcann Global

(TSX.V: ABCN) (OTCQB: ABCCF)

About NetworkNewsWire

NetworkNewsWire (NNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

NetworkNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, NNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. NNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, NNW brings

its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW are a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertake no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

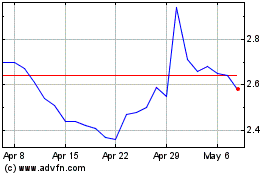

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Mar 2024 to Apr 2024

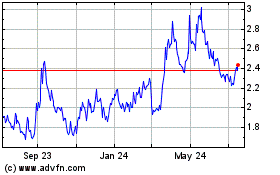

Cronos (NASDAQ:CRON)

Historical Stock Chart

From Apr 2023 to Apr 2024