Today's Top Supply Chain and Logistics News From WSJ

November 15 2017 - 7:29AM

Dow Jones News

By Brian Baskin

Sign up: With one click, get this newsletter delivered to your

inbox.

More products bear the "Made in the USA" label in the year since

Donald Trump's election, but economists say the new

administration's policies aren't behind the trend. A rebound in

global energy and commodity prices and steady worldwide economic

growth are fueling a steady rise in U.S. manufacturing jobs and

spending on new equipment and plants, the WSJ's Andrew Tangel and

Josh Zumbrun write. The gains have come without the tariffs and

penalties for outsourcing jobs that Mr. Trump has at times

threatened to implement, with manufacturers crediting improved

automation technology in addition to strong global demand. This

year's recovery hasn't changed some fundamental trends in how

companies structure their global supply chains. While manufacturers

like Caterpillar Inc. that serve commodity industries are

benefiting from booming U.S. harvests, clothing makers continue to

move production offshore. And some of the gains seen this year

could be quickly reversed if the economy slows or countries put up

new barriers to trade.

Some real-estate investors think brick-and-mortar retail isn't

dead yet. In the wake of Brookfield Property Partners LP's $14.8

billion bid for mall operator GGP Inc., other top-tier malls are

expected to become takeover targets, the WSJ's Esther Fung reports.

Malls have been bottom of the barrel in the real-estate market in

recent years, with buyers spooked by a steady parade of retail

bankruptcies. Owners counter that plenty of malls still attract

crowds, particularly locations targeting affluent shoppers. And as

traditional retailers exit, malls are finding other ways to fill

empty storefronts, including restaurants and attractions. Some are

trying to lure trendy brands that do most of their business online,

offering favorable leases to brands like Untuckit and Warby Parker

that appeal to younger shoppers. The budding revival in mall

operators' fortunes is a reminder that for all of the growth in

e-commerce over the last decade, the vast majority of shopping

still takes place in stores - and Brookfield is betting that's not

going to change anytime soon.

U.S. trade negotiators are doubling down on their "take it or

leave it" approach to re-negotiating the North American Free Trade

Agreement. Commerce Secretary Wilbur Ross told The Wall Street

Journal CEO Council that Mexico and Canada have more to lose from

the pact's demise, giving the U.S. an upper hand in trade talks.

Mr. Ross's statements are a sign that the Trump administration is

sticking to its guns on trade, with Nafta negotiations deadlocked

and U.S. participation in the Trans-Pacific Partnership off the

table. It's true that as the world's largest economy, the U.S. is

in pole position in most trade negotiations. But that doesn't mean

potential partners don't have other options if they feel they've

been pushed too far. A group of 11 nations is reviving TPP talks

that exclude the U.S., and Mexico has courted Chinese investment as

a lifeline should its U.S. trade ties fray. Many U.S. business

leaders agree, worrying American auto makers and farmers could be

among the losers if Nafta is dismantled.

AIRFREIGHT

Airbus SE is in a tug-of-war with one of its biggest customers

over a significant part of its production line. Emirates Airline is

stepping up pressure on the plane maker to keep producing its A380

super jumbo for at least another decade before it places any more

orders, the WSJ's Robert Wall reports, even though the jet is

losing money for Airbus and faces foundering support in the rest of

the aviation world. The demand is an aggressive negotiating ploy

and highlights how the Airbus's troubled plane now depends on

backing from just one airline. The stance from Emirates pushes

Airbus into a corner while the manufacturer is trying to reset its

supply chain and pull away from a $20 billion program that hasn't

produced profits after a decade of production. With 100 of the jets

in its fleet, 42 on order and another 30 under negotiation,

Emirates seems to be saying that the real control of the production

rests with the customer.

QUOTABLE

IN OTHER NEWS

The Wall Street Journal ranks top contenders for Amazon's new

headquarters. (WSJ)

Canada plans to escalate its legal fight against the U.S.

Commerce Department's decision to slap tariffs of roughly 20% or

more on Canadian lumber imports. (WSJ)

White House economic adviser Gary Cohn says the Trump

administration could begin discussions with lawmakers about an

ambitious infrastructure package in the coming weeks. (WSJ)

U.S. household debt hit a record of nearly $13 trillion last

quarter. (WSJ)

Foxconn Technology Group's profits plunged amid iPhone

production problems. (WSJ)

The operator of TJ Maxx, Marshalls and HomeGoods reported no

sales growth for the first time since 2009. (WSJ)

Indonesia's apparel manufacturing sector is booming as retailers

look for alternatives to China's rising labor costs. (Business of

Fashion)

Ceva Logistics cut its third-quarter loss nearly in half to $22

million on double-digit gains in air and ocean freight volumes.

(Air Cargo News)

Taiwan's Yang Ming Transport Ltd. is considering ordering 20

container ships, including a mix of mega-ships and feeder vessels.

(Splash 24/7)

The Georgia Ports Authority approved the Mason Mega Rail

Terminal project to double on-dock rail capacity. (Business in

Savannah)

E-commerce is driving up demand for air freight outside the peak

season. (Journal of Commerce)

U.S. ports say they face a shortage of customs inspectors. (The

Loadstar)

Australia Post is testing a "mobile parcel locker" to deliver

packages to homes. (The Guardian)

Ethiopian Airlines agreed to buy four Boeing Co. 777 freighters

in a deal worth $1.3 billion. (Associated Press)

ABOUT US

Brian Baskin is editor of WSJ Logistics Report. Follow him at

@brianjbaskin, and follow the entire WSJ Logistics Report team:

@PaulPage , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Brian Baskin at brian.baskin@wsj.com

(END) Dow Jones Newswires

November 15, 2017 07:14 ET (12:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

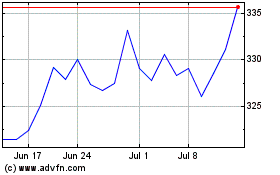

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

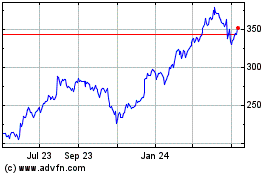

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024