DHT Holdings, Inc. Third Quarter 2017 Results

November 13 2017 - 4:36PM

HAMILTON, BERMUDA, November 13, 2017 - DHT Holdings, Inc.

(NYSE:DHT) ("DHT" or the "Company") today announced:

FINANCIAL AND OPERATIONAL HIGHLIGHTS:

|

USD mill. (except per share) |

Q3 2017 |

Q2 2017 |

Q1 2017 |

Q4 2016 |

Q3 2016 |

2016 |

2015 |

|

Adjusted Net Revenue1 |

54.8 |

59.6 |

70.7 |

67.0 |

50.3 |

290.7 |

296.3 |

|

Adjusted EBITDA |

31.4 |

36.7 |

50.6 |

46.7 |

29.5 |

209.4 |

214.8 |

|

Net Income/(Loss) |

(5.1) |

4.8 |

14.32 |

17.8 |

(75.7)2 |

9.32 |

105.42 |

|

EPS - basic |

(0.04) |

0.04 |

0.15 |

0.19 |

(0.81) |

0.10 |

1.13 |

|

EPS - diluted3 |

(0.04) |

0.04 |

0.15 |

0.18 |

(0.81) |

0.10 |

1.04 |

|

Interest Bearing Debt |

826.0 |

841.1 |

674.6 |

701.5 |

684.9 |

701.5 |

662.5 |

|

Cash |

86.5 |

104.0 |

72.2 |

109.34 |

71.5 |

109.34 |

166.84 |

|

Dividend5 |

0.02 |

0.02 |

0.08 |

0.08 |

0.02 |

0.58 |

0.69 |

|

Spot Exposure6 |

67.9% |

63.5% |

58.1% |

57.3% |

59.9% |

57.8% |

50.5% |

|

Unscheduled off hire6 |

0.3% |

0.2% |

0.2% |

5.5% |

0.8% |

1.8% |

0.2% |

|

Scheduled off hire6 |

2.7% |

2.8% |

2.4% |

0.9% |

5.1% |

1.7% |

0.5% |

HIGHLIGHTS OF THE QUARTER:

- Adjusted EBITDA for the quarter of $31.4 million. Net loss for

the quarter of $5.1 million or loss of $0.04 per basic share.

- The Company's VLCCs achieved time charter equivalent earnings

of $22,500 per day in the third quarter of 2017 of which the

Company's VLCCs on time-charter earned $35,600 per day and the

Company's VLCCs operating in the spot market achieved $17,500 per

day. For the first nine months of 2017 the Company's VLCCs achieved

time charter equivalent earnings of $29,100 per day of which the

Company's VLCCs on time-charter earned $37,100 per day and the

Company's VLCCs operating in the spot market achieved $25,600 per

day.

- For the third quarter of 2017, the Company will return $2.8

million to shareholders in the form of a cash dividend of $0.02 per

share, payable on December 6, 2017 for shareholders of record as of

November 28, 2017.

- During the quarter the Company extended time-charters for three

of its VLCCs to oil majors. The vessels DHT Amazon, DHT Europe and

BW Peony have been extended for one year commencing during the

October 2017 to January 2018 period. The time-charters have

been extended with fixed base rates that are above DHT's cash break

even levels. Additional earnings are based on market index

above these fixed base rates and divided into two tranches with the

first fully paid to DHT and the second shared 50/50 between the

customer and DHT.

- DHT has a fleet of 30 VLCCs, 26 in the water and four under

construction scheduled for delivery in 2018, as well as two

Aframaxes. The total dwt of the fleet is 9,502,995. The

average age of the VLCC fleet is 7.1 years. Seven of the VLCCs and

the two Aframaxes are on fixed rate time charters. For more details

on the fleet, please refer to our web site:

http://dhtankers.com/index.php?name=About_DHT%2FFleet.html.

The full report can be found on the link below

Footnotes:1Net of voyage expenses.2Q1 2017

includes an impairment charge of $7.5 million related to the sale

of DHT Ann and DHT Phoenix. Q3 2016 includes an impairment charge

of $76.6 million. 2016 includes total impairment charges of $84.7

million. 2015 includes a loss of $0.8 million related to the sale

of the DHT Trader.3Diluted shares include the dilutive effect of

the convertible senior notes and restricted shares granted to

management and members of the board of directors.4The cash balance

as of December 31, 2016 includes $48.7 million relating to the

financing for DHT Tiger which was drawn in 2016 in advance of the

delivery of the DHT Tiger on January 16, 2017. The cash balance as

of December 31, 2015 includes $50.0 million relating to the

financing for DHT Leopard which was drawn on December 29, 2015 in

advance of the delivery of the DHT Leopard on January 4, 2016.5Per

common share.6As % of total operating days in period.

EARNINGS CONFERENCE CALL AND WEBCAST INFORMATION The

Company will host a conference call and webcast which will include

a slide presentation at 8:00 a.m. EDT/14:00 CET on Tuesday November

14, 2017 to discuss the results for the

quarter.

All shareholders and other interested parties are invited to

join the conference call, which may be accessed by calling

1 718 354 1359 within the United States, 23500486 within

Norway and +44 203 427 1917 for international callers.

The passcode is "DHT" or "5865866".

The webcast which will include a slide presentation will be

available on the following

link:https://edge.media-server.com/m6/p/yqs4ceq7 and can also be

accessed in the Investor Relations section on DHT's website at

http://www.dhtankers.com. An audio replay of the conference call

will be available through November 20, 2017. To access the

replay, dial 1 888 203 1112 within the United States,

80019672 within Norway or +44 808 101 1153 for

international callers and enter 5865866 as the pass code.

ABOUT DHT HOLDINGS, INC.DHT is an independent crude oil

tanker company. Our fleet trades internationally and consists of

crude oil tankers in the VLCC and Aframax segments. We operate

through our integrated management companies in Oslo, Norway and

Singapore. You shall recognize us by our business approach with an

experienced organization with focus on first rate operations and

customer service, quality ships built at quality shipyards, prudent

capital structure with robust cash break even levels to accommodate

staying power through the business cycles, a combination of market

exposure and fixed income contracts for our fleet and a transparent

corporate structure maintaining a high level of integrity and good

governance. For further information: www.dhtankers.com.

FORWARD LOOKING STATEMENTS This press release contains

certain forward-looking statements and information relating to the

Company that are based on beliefs of the Company's management as

well as assumptions, expectations, projections, intentions and

beliefs about future events, in particular regarding dividends

(including our dividend plans, timing and the amount and growth of

any dividends), daily charter rates, vessel utilization, the future

number of newbuilding deliveries, oil prices and seasonal

fluctuations in vessel supply and demand. When used in this

document, words such as "believe," "intend," "anticipate,"

"estimate," "project," "forecast," "plan," "potential," "will,"

"may," "should" and "expect" and similar expressions are intended

to identify forward-looking statements but are not the exclusive

means of identifying such statements. These statements

reflect the Company's current views with respect to future events

and are based on assumptions and subject to risks and

uncertainties. Given these uncertainties, you should not

place undue reliance on these forward-looking statements.

These forward-looking statements represent the Company's

estimates and assumptions only as of the date of this press release

and are not intended to give any assurance as to future results.

For a detailed discussion of the risk factors that might

cause future results to differ, please refer to the Company's

Annual Report on Form 20-F, filed with the Securities and Exchange

Commission on March 23, 2017. The Company undertakes no obligation

to publicly update or revise any forward-looking statements

contained in this press release, whether as a result of new

information, future events or otherwise, except as required by law.

In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this press release might not

occur, and the Company's actual results could differ materially

from those anticipated in these forward-looking statements.

CONTACT: Eirik Uboe, CFO Phone: +1 441 299 4912 and +47 412

92 712 E-mail: eu@dhtankers.com

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/9dccd9e2-956d-4bf7-b9f0-183d7493a0bd

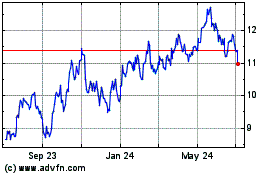

DHT (NYSE:DHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

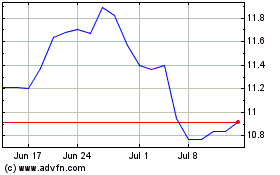

DHT (NYSE:DHT)

Historical Stock Chart

From Apr 2023 to Apr 2024