Peugeot Steers Opel Into Electric Cars -- WSJ

November 10 2017 - 3:02AM

Dow Jones News

By William Boston

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 10, 2017).

RÜSSELSHEIM, Germany -- The maker of Peugeot on Thursday

unveiled a sweeping restructuring plan for its Opel and Vauxhall

units aimed at pushing into electric cars and finally turning a

profit at the recently acquired brands within two years.

The overhaul marks the next step in the turnaround for PSA

Group, which also manufactures the Citroën brand. The French car

maker was rescued from near bankruptcy in 2013 through a bailout

from the French government and Chinese state-owned Dongfeng

Motors.

Over the past three years, PSA has become one of Europe's most

profitable companies as Chief Executive Carlos Tavares has tried to

build Peugeot into a global competitor to Volkswagen AG, General

Motors Co. and Toyota Motors Co.

Peugeot acquired Opel and its British unit Vauxhall from GM in

August for $2.2 billion, after GM threw in the towel following

years of losses and failed attempts to wean them back to

health.

"Over the past 15 years this company has lost more than $10

billion. This company has cut more than 30,000 jobs. This is a

fact. We face a dramatic situation," Mr. Tavares told reporters at

Opel's headquarters in Rüsselsheim.

If Mr. Tavares succeeds where GM failed, the restructuring could

become a watershed for the European auto industry, which still

suffers from low profits and overcapacity as growth in European

new-car sales slows, and transform Peugeot into a potent rival to

Volkswagen.

The restructuring plan, thrashed out in over three months of

tense meetings, targets annual savings of EUR1.1 billion ($1.3

billion) and a profit margin of 2% by 2020. By 2026, those targets

are forecast to increase to EUR1.7 billion in savings and a 6%

profit margin.

Opel's management doesn't plan to achieve the savings through

plant closures or mass layoffs, said Opel Chief Executive Michael

Lohscheller. He said labor costs needed to come down, but that

could be achieved through early retirement and other measures,

declining to elaborate on any details.

Mr. Tavares is aiming to nurse Opel and Vauxhall back to profit

by accelerating plans to shift production to the French car maker's

technology, allowing the larger car group to cut costs by building

Peugeot, Citroen, Opel and Vauxhall models with the same equipment

and parts.

Mr. Lohscheller said savings would be achieved through

long-overdue streamlining "just like PSA did" that includes

reducing the number of engine groups to four from 10 and cutting

the model technology platforms to two from nine.

Opel is targeting substantial savings in manufacturing,

purchasing, and management, aiming to reduce costs per car by

EUR700 by 2020 with the aim of reducing the break-even point to the

sale of 800,000 cars. The executives didn't say where break-even is

now.

Producing Opel and Vauxhall models on Peugeot technology will

help cut the number of components used by half. Opel isn't planning

to shut any plants, but it will reduce the size of their

manufacturing operations by 25% and will boost capacity usage in

Germany by moving production from South Korea.

Until now, Opel has only had one electric vehicle, the Ampera-E.

Without additional electric-car models, Opel has been on a

trajectory to exceed European greenhouse-gas emission targets in

2020. Under the new plan, Opel will begin churning out electric and

hybrid versions of its models. Every model the company makes will

have an electric version by 2024.

"They were able to rebuild the product planning in a short

period of time to put the CO2 strategy back on track," Mr. Tavares

said.

Under GM's leadership, Opel neither exported its products nor

expanded into other markets where GM was present. That will also

change under Peugeot's tutelage. Mr. Lohscheller said Opel has

identified up to 20 markets that the company plans to enter in the

coming years. He declined to elaborate much, but cited Argentina,

Saudi Arabia and Taiwan.

Mr. Tavares's best argument for the potential success of his

plans for Opel is his record at Peugeot. When he began in 2014,

Peugeot's factories were working well below capacity and bleeding

cash. Last month, he said, Peugeot's factories worked at 130%

capacity.

Opel is the next steppingstone for Mr. Tavares to achieve his

global ambition.

"Being a strong champion in Europe gives us a very strong basis

from which we can leverage more profitable growth overseas," he

said. "You cannot be a strong global leader if you are not strong

in your home market."

--Max Bernhard contributed to this article.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

November 10, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

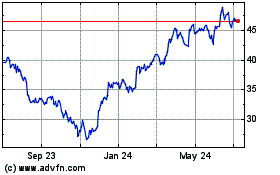

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

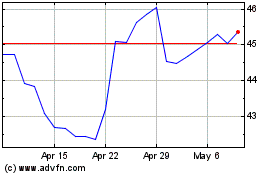

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024