Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 09 2017 - 5:20PM

Edgar (US Regulatory)

Final Term Sheet

Filed Pursuant to Rule 433

Registration Statement

No.

333-214056

November 9, 2017

United Parcel Service, Inc.

Floating Rate Notes

FINAL TERM

SHEET

|

|

|

|

|

|

|

|

Security Offered:

|

|

Floating Rate Notes (the “Notes”)

|

|

|

|

|

Issuer:

|

|

United Parcel Service, Inc. (the “Company”)

|

|

|

|

|

Ratings:

|

|

A1/A+

|

|

|

|

|

Principal Amount:

|

|

$63,893,000

|

|

|

|

|

Trade Date:

|

|

November 9, 2017

|

|

|

|

|

Settlement Date:

|

|

November 14, 2017 (T+3)

|

|

|

|

|

Maturity:

|

|

November 15, 2067

|

|

|

|

|

Price to Public:

|

|

100.00%

|

|

|

|

|

Gross Spread:

|

|

1.00%

|

|

|

|

|

Price to Company:

|

|

99.00%

|

|

|

|

|

Net Proceeds to Company:

|

|

$63,254,070

|

|

|

|

|

Base Rate:

|

|

LIBOR (Reuters Page LIBOR01)

|

|

|

|

|

Index Maturity:

|

|

3 month

|

|

|

|

|

Designated LIBOR Currency:

|

|

U.S. Dollars

|

|

|

|

|

Spread:

|

|

-0.35%

|

|

|

|

|

Initial Interest Rate:

|

|

3 month U.S. Dollar LIBOR as of two London Banking Days prior to the

Settlement Date minus 0.35%

|

|

|

|

|

Interest Reset Dates:

|

|

March 15, June 15, September 15 and December 15 of each year,

commencing on December 15, 2017

|

|

|

|

|

Interest Determination Dates:

|

|

Quarterly, two London Banking Days prior to each Interest Reset Date

|

|

|

|

|

Interest Rate Reset Period:

|

|

Quarterly

|

|

|

|

|

Record Dates:

|

|

March 1, June 1, September 1 and December 1 of each year,

commencing on December 1, 2017

|

|

|

|

|

|

|

|

|

Interest Payment Dates:

|

|

March 15, June 15, September 15 and December 15 of each year,

commencing on December 15, 2017

|

|

|

|

|

Maximum Interest Rate:

|

|

N/A

|

|

|

|

|

Minimum Interest Rate:

|

|

0.00%

|

|

|

|

|

Minimum Denominations:

|

|

The Notes will be issued in denominations of $1,000

and in integral multiples of $1,000

|

|

|

|

|

CUSIP/ISIN:

|

|

911312 BG0 / US911312BG02

|

|

|

|

|

Put Provision:

|

|

The Notes will be repayable at the option of the holder on at least

30 days’ notice on the following days and at the following prices:

Repayment Date Price

November 15,

2018 98.00%

May 15, 2019 98.00%

November 15,

2019 98.00%

May 15, 2020 98.00%

November 15,

2020 98.00%

May 15, 2021 98.00%

November 15,

2021 98.00%

May 15, 2022 98.00%

November 15,

2022 98.00%

May 15, 2023 98.00%

November 15,

2023 99.00%

May 15, 2024 99.00%

November 15,

2024 99.00%

May 15, 2025 99.00%

November 15,

2025 99.00%

May 15, 2026 99.00%

November 15,

2026 99.00%

May 15, 2027 99.00%

November 15,

2027 99.00%

May 15, 2028 99.00%

|

|

|

|

|

|

|

November 15, 2028 and each 100.00%

two-year anniversary thereafter to

|

|

|

|

|

|

|

November 15, 2064

|

|

|

|

|

|

Call Provision:

|

|

The Notes may be redeemed at any time, at the option of the Company, in whole or in part, in amounts of $1,000 or any multiple of $1,000 at the following redemption prices, if redeemed during the 6 month periods beginning on

November 15 and May 15 of any of the following years:

|

|

|

|

|

|

|

Redemption Date

Price

November 15, 2047 105.00%

May 15, 2048

105.00%

November 15, 2048 104.50%

May 15, 2049

104.50%

November 15, 2049 104.00%

May 15, 2050

104.00%

November 15, 2050 103.50%

May 15, 2051

103.50%

|

|

|

|

November 15, 2051 103.00%

May 15, 2052

103.00%

November 15, 2052 102.50%

May 15, 2053

102.50%

November 15, 2053 102.00%

May 15, 2054

102.00%

November 15, 2054 101.50%

May 15, 2055

101.50%

November 15, 2055 101.00%

May 15, 2056

101.00%

November 15, 2056 100.50%

May 15, 2057

100.50%

|

|

|

|

|

|

|

November 15, 2057 and 100.00%

thereafter to maturity

|

|

|

|

|

Day Count Convention:

|

|

Actual/360

|

|

|

|

|

Form:

|

|

DTC, Book-Entry

|

|

|

|

|

Underwriters:

|

|

UBS Securities LLC

Citigroup Global Markets Inc.

J.P. Morgan Securities LLC

Merrill Lynch, Pierce, Fenner & Smith

Incorporated

Morgan Stanley & Co. LLC

RBC Capital Markets, LLC

Wells Fargo Securities, LLC

|

Certain United States Federal Income Tax Considerations:

Notes Used as Qualified Replacement Property

Prospective investors seeking to treat the Notes as “qualified replacement property” for purposes of Section 1042 of the Internal

Revenue Code of 1986, as amended (the “Code”), should be aware that Section 1042 requires the issuer to meet certain requirements in order for the Notes to constitute qualified replacement property. In general, qualified replacement

property is a security issued by a domestic operating corporation that did not, for the taxable year preceding the taxable year in which such security was purchased, have “passive investment income” in excess of 25 percent of the gross

receipts of such corporation for such preceding taxable year (the “passive income test”). For purposes of the passive income test, where the issuing corporation is in control of one or more corporations or such issuing corporation is

controlled by one or more other corporations, all such corporations are treated as one corporation (the “affiliated group”) when computing the amount of passive investment income for purposes of Section 1042.

The Company believes that it qualifies as a domestic operating corporation and that less than 25 percent of its affiliated group’s gross

receipts is passive investment income for the taxable year ended December 31, 2016. In making this determination, the Company has made certain assumptions and used procedures which it believes are reasonable. The Company cannot give any assurance as

to whether it will continue to qualify as a domestic operating corporation or meet the passive income test. It is, in addition, possible that the Internal Revenue Service may disagree with the manner in which the Company has calculated the

affiliated group’s gross receipts (including the characterization thereof) and passive investment income and the conclusions reached in this discussion. Prospective purchasers of the Notes should consult with their own tax advisors with respect

to these and other tax matters relating to the Notes.

The Notes are securities with no established trading market. No assurance can be

given as to whether a trading market for the Notes will develop or as to the liquidity of a trading market for the Notes. The availability and liquidity of a trading market for the Notes will also be affected by the degree to which purchasers treat

the Notes as qualified replacement property.

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to

revision or withdrawal at any time.

The Issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which

this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these

documents for free by visiting EDGAR on the SEC Website at www.sec.gov.

Alternatively, the Issuer, any underwriter or any dealer participating in

the offering will arrange to send you the prospectus if you request it by contacting UBS Securities LLC toll free at 1 888 827 7275; or Citigroup Global Markets Inc. toll-free at 800-831-9146; or J.P. Morgan Securities LLC collect at (212) 834-4533;

or Merrill Lynch, Pierce, Fenner & Smith Incorporated toll-free at 800-294-1322; or Morgan Stanley & Co. LLC toll-free at 1-866-718-1649; or RBC Capital Markets, LLC toll-free at (866) 375-6829; or Wells Fargo Securities, LLC toll-free at

(800) 645-3751.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH

DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

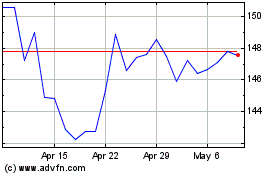

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

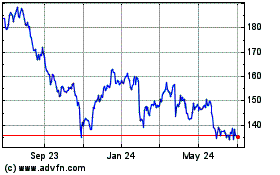

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024