Sphere 3D Reports Third Quarter Fiscal Year 2017 Financial Results

November 09 2017 - 4:05PM

Sphere 3D Corp. (NASDAQ:ANY), a containerization,

virtualization, and data management solutions provider, today

reported financial results for its third quarter ended September

30, 2017.

“This quarter we grew revenue by 17% year-over-year and 12%

sequentially from the previous quarter; both signs of the strategic

and financial progress we have made,” said Eric Kelly, chairman and

chief executive officer of Sphere3D. “In addition, I am proud

of the progress we have made toward the goal of achieving

profitability, evident by the improvement in our adjusted EBITDA of

84% year-over-year and 77% sequentially from the previous

quarter. These solid financial results are driven by our

improved business operations and the growing market recognition of

both our virtualization and storage products.”

Third Quarter 2017 Financial Results:

|

Financial Highlights |

Three Months Ended |

Three Months Ended |

Nine Months Ended |

Nine Months Ended |

|

(in millions) |

September 30, 2017 |

September 30, 2016 |

September 30, 2017 |

September 30, 2016 |

|

|

|

|

|

|

|

Net revenue |

$21.7 |

$18.5 |

$62.9 |

$57.7 |

|

Gross profit |

$6.7 |

$5.2 |

$19.0 |

$16.9 |

|

Gross margin (%) |

31.1% |

28.0% |

30.2% |

29.3% |

|

Adjusted EBITDA (1) |

$(0.6) |

$(4.0) |

$(4.2) |

$(11.7) |

|

Net loss |

$(3.5) |

$(43.3) |

$(18.8) |

$(61.0) |

| (1)

Non-GAAP financial measure as defined below. See the “Use of

GAAP and Non-GAAP Financial Measures” and “Non-GAAP

Reconciliations” sections of this announcement below. |

| |

|

|

|

|

- Net revenue for the third quarter of 2017 was $21.7 million,

compared to $18.5 million for the third quarter of 2016, which

represented a 17% year-over-year growth in revenue.

- Product revenue for the third quarter of 2017 was $19.6

million, compared to $16.5 million for the third quarter of 2016,

representing a 19% year-over-year growth. •

Disk systems revenue was $14.1 million, compared to $11.1

million for the third quarter of 2016. Disk systems is defined as

RDX, SnapServer family, virtual desktop infrastructure, and

Glassware derived products. • Tape archive

product revenue was $5.5 million, compared to $5.4 million for the

third quarter of 2016.

- Service revenue was $2.1 million, compared to $2.0 million in

the third quarter of 2016, representing a 5% year-over year

growth.

- Gross margin for the third quarter of 2017 was 31.1%, compared

to 28.0% for the third quarter of 2016. Non-GAAP gross margin

for the third quarter of 2017 was 33.7%, compared to 31.1% for the

third quarter of 2016. Our methodology for determining

non-GAAP gross margin, which excludes the effect of intangible

asset amortization from gross profit, is described in the Use of

GAAP and Non-GAAP Financial Measures section of this

announcement. See also, “Non-GAAP Reconciliations”

below.

- Operating expenses for the third quarter of 2017 were $11.2

million, compared to $47.8 million for the third quarter of

2016. Included in the operating expenses for the third

quarter of 2016 were $34.4 million in impairment of goodwill and

acquired intangible assets.

- Share-based compensation expense for the third quarter of 2017

was $2.0 million, compared to $2.7 million for the third quarter of

2016. Depreciation and amortization was $1.5 million in the third

quarter of 2017 and 2016.

- Net loss for the third quarter of 2017 was $3.5 million, or a

net loss of $0.59 per share, compared to a net loss of $43.3

million, or a net loss of $21.10 per share, in the third quarter of

2016.

- Adjusted EBITDA for the third quarter of 2017 was a net loss of

$0.6 million, or a net loss of $0.11 per share, based on 5.9

million weighted average shares outstanding, compared to adjusted

EBITDA net loss of $4.0 million, or net loss of $1.96 per share

based on 2.1 million weighted average shares outstanding for the

third quarter of 2016. For additional information regarding the

non-GAAP financial measures discussed in this release, please see

“Use of GAAP and Non-GAAP Financial Measures” and "Non-GAAP

Reconciliations" below.

- The preceding financial results for the third quarter of 2017

include contribution from our acquisition in January 2017.

Nine Months Ended September 30, 2017 Financial

Results:

- Net revenue for the first nine months of 2017 was $62.9

million, compared to $57.7 million for the first nine months of

2016 which represented a 9% year-over-year growth in revenue.

- Product revenue for the first nine months of 2017 was $56.2

million, compared to $51.2 million for the first nine months of

2016, representing a 10% year-over-year growth. •

Disk systems revenue was $40.6 million, compared to $35.1

million for the first nine months of 2016. Disk systems is defined

as RDX, SnapServer family, virtual desktop infrastructure, and

Glassware derived products. • Tape archive

product revenue was $15.6 million compared to $16.1 million for the

first nine months of 2016.

- Service revenue for the first nine months was $6.7 million,

compared to $6.5 million in the first nine months of 2016,

representing a 3% year-over-year growth.

- Gross margin for the first nine months of 2017 was 30.2%,

compared to 29.3% for the first nine months of 2016. Non-GAAP

gross margin for the first nine months of 2017 was 32.9%, compared

to 32.4% for the first nine months of 2016.

- Operating expenses for the first nine months of 2017 were $34.3

million, compared to $75.4 million for the first nine months of

2016. Included in the operating expenses for the first nine months

of 2016 were $34.4 million in impairment of goodwill and acquired

intangible assets.

- Share-based compensation expense for the first nine months of

2017 was $5.6 million, compared to $7.4 million for the first nine

months of 2016. Depreciation and amortization was $4.6 million in

the first nine months of 2017, compared to $4.7 million in the

first nine months of 2016.

- Net loss for the first nine months of 2017 was $18.8 million,

or a net loss of $4.28 per share, compared to a net loss of $61.0

million, or a net loss of $31.22 per share, in the first nine

months of 2016.

- Adjusted EBITDA for the first nine months of 2017 was a net

loss of $4.2 million, or a net loss of $0.96 per share, based on

4.4 million weighted average shares outstanding, compared to

adjusted EBITDA net loss of $11.7 million, or net loss of $5.97 per

share based on 2.0 million weighted average shares outstanding for

the first nine months of 2016. For additional information regarding

the non-GAAP financial measures discussed in this release, please

see “Use of GAAP and Non-GAAP Financial Measures” and "Non-GAAP

Reconciliations" below.

- The preceding financial results for the first nine months of

2017 include contribution from our acquisition in January

2017.

Shares outstanding and per share numbers contained in this

release reflect our 1-for-25 reverse share split that was effected

in July 2017.

Use of GAAP and Non-GAAP Financial

Measures:

To supplement Sphere 3D’s consolidated financial statements

presented in accordance with GAAP, the Company uses Adjusted

EBITDA, a non-GAAP financial measure that excludes from the

statement of operations the effects of interest expense, income

taxes, impairment of goodwill and acquired intangible assets,

acquisition costs, depreciation and amortization, share-based

compensation, loss on revaluation of investment, and warrant

revaluation gain. The Company also uses Non-GAAP gross profit and

Non-GAAP gross-margin, non-GAAP financial measures that exclude the

effect of intangible asset amortization. Sphere 3D uses the above

non-GAAP financial measures internally to understand, manage and

evaluate the business. Management believes it is useful for itself

and investors to review, as applicable, both GAAP information and

the non-GAAP measures in order to assess the performance of

continuing operations and for planning and forecasting in future

periods. The presentation of these non-GAAP measures is intended to

provide investors with an understanding of the Company’s

operational results and trends that enables them to analyze the

base financial and operating performance and facilitate

period-to-period comparisons and analysis of operational trends.

Sphere 3D believes the presentation of these non-GAAP financial

measures is useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision-making.

Non-GAAP financial measures should be considered in addition

to results prepared in accordance with GAAP, but should not be

considered substitutes for or superior to GAAP results. In

addition, our non-GAAP financial measures may not be comparable to

similarly titled measures utilized by other companies since such

other companies may not calculate such measures in the same manner

as we do.

Investors are encouraged to review the reconciliation of these

non-GAAP financial measures to the most comparable GAAP measures,

which are provided in the attached table after the text of this

release.

Investor Conference Call:Sphere 3D will

host an investor conference call today at 2:00 p.m.

PST (5:00 p.m. EST) to discuss the Company’s 2017 third

quarter financial results. To access the call, dial (844)

268-1747 (Toll Free) or (918) 559-5655 (International) and give the

participant pass code 7799158. Participants are asked to call the

assigned number approximately 10 minutes before the conference call

begins. In addition, a live and archived webcast of the conference

call will be available at www.sphere3d.com in the

Investor Relations section. A replay of the conference call

will also be available via telephone by dialing (855) 859-2056

(Toll Free U.S. and Canada) or +1 (404) 537-3406

(International) and entering replay access code 7799158. The replay

will be available beginning approximately two hours after the call

and will remain available for one week.

About Sphere 3DSphere 3D

Corp. (NASDAQ:ANY) delivers containerization, virtualization,

and data management solutions via hybrid cloud, cloud and

on-premise implementations through its global reseller network and

professional services organization. Sphere 3D, along

with its wholly owned subsidiaries Overland Storage,

and Tandberg Data, has a strong portfolio of brands,

including Overland-Tandberg, HVE ConneXions and UCX

ConneXions, dedicated to helping customers achieve their IT goals.

For more information, visit www.sphere3d.com. Follow us on

Twitter @Sphere3D, @HVEconneXions and @ovltb

Safe Harbor Statement This

press release contains forward-looking statements that involve

risks, uncertainties, and assumptions that are difficult to

predict. Actual results and the timing of events could differ

materially from those anticipated in such forward-looking

statements as a result of risks and uncertainties including,

without limitation, our inability to obtain additional debt or

equity financing or to refinance our debt; any increase in our cash

needs; the Company’s ability to maintain listing with the NASDAQ

Capital Market; our ability to successfully integrate the UCX and

HVE ConneXions business with Sphere 3D’s other businesses;

unforeseen changes in the course of our business or the business of

our wholly-owned subsidiaries, including, without limitation,

Overland Storage and Tandberg Data; market adoption and performance

of our products; the level of success of our collaborations and

business partnerships; possible actions by customers, partners,

suppliers, competitors or regulatory authorities; and other risks

detailed from time to time in our periodic reports contained in our

Annual Information Form and other filings with Canadian securities

regulators (www.sedar.com) and in prior periodic reports filed with

the United States Securities and Exchange Commission (www.sec.gov).

Sphere 3D undertakes no obligation to update any forward-looking

statement, whether written or oral, that may be made from time to

time, whether as a result of new information, future developments

or otherwise, except as required by law.

| |

| SPHERE 3D

CORP. |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (In thousands, except

per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months

Ended |

|

Nine Months

Ended |

| |

|

|

September 30, |

|

September 30, |

| |

|

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

| Net

revenue |

|

$ |

21,679 |

|

|

$ |

18,459 |

|

|

$ |

62,855 |

|

|

$ |

57,670 |

|

| Cost

of revenue |

|

|

14,946 |

|

|

|

13,289 |

|

|

|

43,904 |

|

|

|

40,746 |

|

| Gross

profit |

|

|

6,733 |

|

|

|

5,170 |

|

|

|

18,951 |

|

|

|

16,924 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

| |

Sales and

marketing |

|

|

4,586 |

|

|

|

5,259 |

|

|

|

14,090 |

|

|

|

17,582 |

|

| |

Research and

development |

|

|

1,793 |

|

|

|

2,222 |

|

|

|

5,460 |

|

|

|

6,930 |

|

| |

General and

administrative |

|

|

4,840 |

|

|

|

5,874 |

|

|

|

14,743 |

|

|

|

16,474 |

|

| |

Impairment of

goodwill and acquired intangible assets |

|

|

- |

|

|

|

34,398 |

|

|

|

- |

|

|

|

34,398 |

|

| |

|

|

|

11,219 |

|

|

|

47,753 |

|

|

|

34,293 |

|

|

|

75,384 |

|

| Loss

from operations |

|

|

(4,486 |

) |

|

|

(42,583 |

) |

|

|

(15,342 |

) |

|

|

(58,460 |

) |

| |

Interest

expense |

|

|

(519 |

) |

|

|

(322 |

) |

|

|

(2,770 |

) |

|

|

(770 |

) |

| |

Interest expense

- related party |

|

|

(614 |

) |

|

|

(572 |

) |

|

|

(1,912 |

) |

|

|

(2,425 |

) |

| |

Other income

(expense), net |

|

|

2,642 |

|

|

|

(104 |

) |

|

|

2,223 |

|

|

|

626 |

|

| Loss

before income taxes |

|

|

(2,977 |

) |

|

|

(43,581 |

) |

|

|

(17,801 |

) |

|

|

(61,029 |

) |

|

Provision for (benefit from) income taxes |

|

|

504 |

|

|

|

(289 |

) |

|

|

1,002 |

|

|

|

(53 |

) |

| Net

loss |

|

$ |

(3,481 |

) |

|

$ |

(43,292 |

) |

|

$ |

(18,803 |

) |

|

$ |

(60,976 |

) |

| |

|

|

|

|

|

|

|

|

|

| Net

loss per share: |

|

|

|

|

|

|

|

|

| |

Basic and

diluted |

|

$ |

(0.59 |

) |

|

$ |

(21.10 |

) |

|

$ |

(4.28 |

) |

|

$ |

(31.22 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Shares used in computing |

|

|

|

|

|

|

|

|

| net

loss per share: |

|

|

|

|

|

|

|

|

| |

Basic and

diluted |

|

|

5,901 |

|

|

|

2,052 |

|

|

|

4,396 |

|

|

|

1,953 |

|

| |

|

|

|

|

|

|

|

|

|

| SPHERE 3D

CORP. |

| CONDENSED CONSOLIDATED

BALANCE SHEETS |

| (In

thousands) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

September 30, |

|

December 31, |

| |

|

|

2017 |

|

2016 |

| |

|

|

(Unaudited) |

|

(Unaudited) |

|

ASSETS |

|

|

|

|

| Cash

and cash equivalents |

|

$ |

3,866 |

|

$ |

5,056 |

|

Accounts receivable |

|

|

13,063 |

|

|

11,591 |

|

Inventories |

|

|

8,605 |

|

|

10,002 |

| Other

current assets |

|

|

1,707 |

|

|

3,621 |

| |

Total current

assets |

|

|

27,241 |

|

|

30,270 |

|

Property and equipment, net |

|

|

2,854 |

|

|

3,058 |

|

Intangible assets, net |

|

|

45,340 |

|

|

47,728 |

|

Goodwill |

|

|

11,590 |

|

|

11,068 |

| Other

assets |

|

|

807 |

|

|

432 |

| |

Total assets |

|

$ |

87,832 |

|

$ |

92,556 |

| |

|

|

|

|

|

| |

|

|

|

|

|

|

LIABILITIES AND

EQUITY |

|

|

|

|

|

Current liabilities |

|

$ |

67,452 |

|

$ |

42,854 |

|

Long-term debt — related party, net |

|

|

- |

|

|

24,401 |

|

Long-term deferred tax liabilities |

|

|

3,188 |

|

|

3,100 |

| Other

long-term liabilities |

|

|

3,519 |

|

|

1,755 |

|

Shareholders' equity |

|

|

13,673 |

|

|

20,446 |

| |

Total liabilities

and equity |

|

$ |

87,832 |

|

$ |

92,556 |

| |

|

|

|

|

|

| SPHERE 3D

CORP. |

|

| NON-GAAP

RECONCILIATIONS |

|

| (In thousands, except

per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months

Ended |

|

Nine Months

Ended |

|

| |

|

September 30, |

|

September 30, |

|

| |

|

|

2017 |

|

|

|

2016 |

|

|

|

2017 |

|

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Unaudited) |

|

(Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

21,679 |

|

|

$ |

18,459 |

|

|

$ |

62,855 |

|

|

$ |

57,670 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Gross Profit -

GAAP |

|

$ |

6,733 |

|

|

$ |

5,170 |

|

|

$ |

18,951 |

|

|

$ |

16,924 |

|

|

| Intangible asset

amortization |

|

|

570 |

|

|

|

577 |

|

|

|

1,700 |

|

|

|

1,753 |

|

|

| Gross Profit -

Non -GAAP |

|

$ |

7,303 |

|

|

$ |

5,747 |

|

|

$ |

20,651 |

|

|

$ |

18,677 |

|

|

| |

|

|

|

|

|

|

|

|

|

| Gross Margin

Percentages |

|

|

|

|

|

|

|

|

|

| GAAP |

|

|

31.1 |

% |

|

|

28.0 |

% |

|

|

30.2 |

% |

|

|

29.3 |

% |

|

| Non-GAAP |

|

|

33.7 |

% |

|

|

31.1 |

% |

|

|

32.9 |

% |

|

|

32.4 |

% |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,481 |

) |

|

$ |

(43,292 |

) |

|

$ |

(18,803 |

) |

|

$ |

(60,976 |

) |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

Interest |

|

|

1,133 |

|

|

|

894 |

|

|

|

4,682 |

|

|

|

3,195 |

|

|

|

Provision for (benefit from) income taxes |

|

|

504 |

|

|

|

(289 |

) |

|

|

1,002 |

|

|

|

(53 |

) |

|

|

Impairment of goodwill and acquired intangible assets |

|

|

- |

|

|

|

34,398 |

|

|

|

- |

|

|

|

34,398 |

|

|

|

Acquisition costs |

|

|

- |

|

|

|

- |

|

|

|

34 |

|

|

|

- |

|

|

|

Depreciation and amortization |

|

|

1,517 |

|

|

|

1,540 |

|

|

|

4,574 |

|

|

|

4,694 |

|

|

|

Share-based compensation |

|

|

1,981 |

|

|

|

2,733 |

|

|

|

5,647 |

|

|

|

7,436 |

|

|

|

Loss on revaluation of investment |

|

|

- |

|

|

|

- |

|

|

|

1,145 |

|

|

|

- |

|

|

|

Warrant revaluation gain |

|

|

(2,283 |

) |

|

|

- |

|

|

|

(2,518 |

) |

|

|

(348 |

) |

|

| Adjusted

EBITDA |

|

$ |

(629 |

) |

|

$ |

(4,016 |

) |

|

$ |

(4,237 |

) |

|

$ |

(11,654 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Net loss per

share: |

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

$ |

(0.59 |

) |

|

$ |

(21.10 |

) |

|

$ |

(4.28 |

) |

|

$ |

(31.22 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Adjusted net loss

per share: |

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

$ |

(0.11 |

) |

|

$ |

(1.96 |

) |

|

$ |

(0.96 |

) |

|

$ |

(5.97 |

) |

|

| |

|

|

|

|

|

|

|

|

|

| Shares used in

computing |

|

|

|

|

|

|

|

|

|

| net loss and

adjusted EBITDA per share: |

|

|

|

|

|

|

|

|

|

| Basic and

diluted |

|

|

5,901 |

|

|

|

2,052 |

|

|

|

4,396 |

|

|

|

1,953 |

|

|

| |

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures:To supplement

Sphere 3D’s consolidated financial statements presented in

accordance with GAAP, the Company uses non-GAAP financial measures

that exclude from the statement of operations the effects of

interest expense, income taxes, impairment of goodwill and acquired

intangible assets, acquisition costs, depreciation and

amortization, share-based compensation, loss on revaluation of

investment, and warrant revaluation gain. These non-GAAP financial

measures are non-GAAP gross margin and adjusted EBITDA. Sphere 3D

uses the above non-GAAP financial measures internally to

understand, manage and evaluate the business. Management believes

it is useful for itself and investors to review, as applicable,

both GAAP information and the non-GAAP measures in order to assess

the performance of continuing operations and for planning and

forecasting in future periods. The presentation of these non-GAAP

measures is intended to provide investors with an understanding of

the Company’s operational results and trends that enables them to

analyze the base financial and operating performance and facilitate

period-to-period comparisons and analysis of operational trends.

Sphere 3D believes the presentation of these non-GAAP financial

measures is useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision-making.

Non-GAAP financial measures should be considered in addition to

results prepared in accordance with GAAP, but should not be

considered substitutes for or superior to GAAP results. In

addition, our non-GAAP financial measures may not be comparable to

similarly titled measures utilized by other companies since such

other companies may not calculate such measures in the same manner

as we do.

Investor Contact:The Blueshirt

GroupLauren SloaneTel: +1 415-217-2632Lauren@blueshirtgroup.com

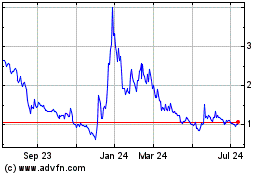

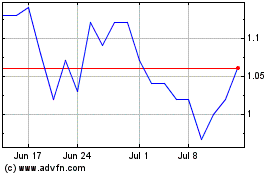

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sphere 3D (NASDAQ:ANY)

Historical Stock Chart

From Apr 2023 to Apr 2024