Over 80% of wealthy investors plan to leave

their collection to their heirs, but 65% of heirs have no interest

in keeping the collection

Key findings:

- 57% of wealthy collectors are driven by

passion rather than profit

- 81% of investors prefer to pass on

their valuables to their heirs rather than sell them, but 65% of

heirs have no interest in keeping the collection

- Over half (51%) of investors have never

had their collections appraised and 44% have not insured their

collections

- 47% of wealthier investors (those with

over $5 million in investable assets) collect fine art, while only

33% of investors with less than $5 million in assets do the

same

UBS Wealth Management Americas revealed today that 57% of

wealthy collectors are driven by passion rather than profit in its

latest Investor Watch report entitled “For love not money,” which

looks at investors’ behavior toward acquiring collections and

passing them on to their heirs. The quarterly survey, in its

twenty-first edition, polled over 2,000 affluent and high net worth

investors.

Investor passions cloud judgment, often resulting in

overpayment or regret

Most collectors have spent over 20 years accumulating their

collections, which represent on average 10% of their overall

wealth. Of these valuables, gold and precious metals (49%), fine

art (36%), precious jewelry (26%), stamps (22%), antiques (16%),

automobiles (15%) and wine (12%) are the most collected items.

Despite spending a significant amount of time and money amassing

their collections, many investors (39%) do not know their

collections’ full value. More than half (51%) of collectors

revealed they have never had their collections appraised, and 44%

have not insured their collections.

Passion for collecting can also cloud judgment, with nearly half

of collectors admitting that they have overpaid for pieces, or

bought or sold an object they later regretted. Four out of five

collectors also confessed that if they needed money in an

emergency, they would rather sell assets in their portfolio than

part with a piece from their collection.

“Investors assign a substantial amount of sentimental value to

their collections, but do not always realize their financial

value,” said Paula Polito, Client Strategy Officer of UBS Wealth

Management Americas. “There is an opportunity for investors to

manage collections far more effectively, by assessing

their true worth, and ensuring that they are protected.”

Most heirs have no interest in the collections they

inherit

Eight out of ten collectors (81%) intend to leave their

collections to heirs. Nearly all investors who inherited a

collection felt honored to receive it, but only 35% were interested

in the collection and kept it as a result. Thirty-nine percent had

no interest in the collection and only kept it out of obligation

and guilt; and 26% were not interested and sold or intend to sell

the collection. Of collectibles inherited, heirs were most likely

to keep fine art, automobiles, antiques and wine. They were most

likely to sell gold, precious metals, coins and stamps.

“The data clearly show that most investors have not properly

prepared their heirs to manage, appraise or sell their collection,”

said Sameer Aurora, Head of Client Strategy for UBS Wealth

Management Americas. “This lack of education leaves many investors

fearful that their heirs will be taken advantage of and unable to

realize the full monetary value should they sell collectibles.”

Wealthier investors are more drawn to fine art

Wealthier investors (those with $5 million or more in investable

assets) are usually serious collectors and feel they are getting

more in return, both financially and sentimentally, from their

hobby. Nearly half (48%) of wealthier investors spend more on their

collection over time, compared to 40% of investors with less than

$5 million in assets. Twenty-two percent of wealthier investors

spend more on their collection than they save for retirement,

compared to only 10% of less affluent investors who do the

same.

These wealthy investors are also more likely to be enamored with

fine art. Almost half (47%) of wealthier investors, compared to 33%

of less affluent investors, collect fine art, and 56% of these

investors are affiliated with a local museum. They are also more

likely to support specific artists (21%) than their less affluent

peers (13%). A third (32%) plan to leave their collections to a

museum or charitable organization.

“Very often, heirs are more interested in pursuing their own

personal passions than following the passions and hobbies of the

prior generation,” said Mike Ryan, Chief Investment Officer

Americas, UBS Wealth Management. “Family collections can therefore

be very fleeting. It is why proper planning is essential to

maintaining and growing your legacy as a wealthy investor.”

Notes to Editors:

About UBS Investor Watch

UBS Wealth Management Americas surveys U.S. investors on a

quarterly basis to keep a pulse on their needs, goals and concerns.

After identifying several emerging trends in the survey data, UBS

decided in 2012 to create the UBS Investor Watch to track, analyze

and report the sentiment of affluent and high net worth investors.

For more information on Investor Watch, visit

ubs.com/investorwatch.

Methodology

For this twenty-first edition of UBS Investor Watch, we surveyed

2,475 high net worth investors (with at least $1 million in

investable assets) from September 15 – 25, 2017, including 608 with

at least $5 million. With 90 survey respondents, we conducted

qualitative follow-up interviews.

About UBS Wealth Management Americas

Wealth Management Americas is one of the leading wealth managers

in the Americas in terms of Financial Advisor productivity and

invested assets. Its business includes UBS’s domestic U.S. and

Canadian wealth management businesses, as well as international

business booked in the U.S. It provides a fully integrated set of

wealth management solutions designed to address the needs of ultra

high net worth and high net worth clients.

About UBS

UBS provides financial advice and solutions to wealthy,

institutional and corporate clients worldwide, as well as private

clients in Switzerland. The operational structure of the Group is

comprised of our Corporate Center and five business divisions:

Wealth Management, Wealth Management Americas, Personal &

Corporate Banking, Asset Management and the Investment Bank. UBS’s

strategy builds on the strengths of all of its businesses and

focuses its efforts on areas in which it excels, while seeking to

capitalize on the compelling growth prospects in the businesses and

regions in which it operates, in order to generate attractive and

sustainable returns for its shareholders. All of its businesses are

capital-efficient and benefit from a strong competitive position in

their targeted markets.

UBS is present in all major financial centers worldwide. It has

offices in 54 countries, with about 34% of its employees working in

the Americas, 35% in Switzerland, 18% in the rest of Europe, the

Middle East and Africa and 13% in Asia Pacific. UBS Group AG

employs approximately 60,000 people around the world. Its shares

are listed on the SIX Swiss Exchange and the New York Stock

Exchange (NYSE).

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171109005234/en/

For UBS Wealth Management Americas:Maya Dillon,

212-713-3130Mobile: 917-615-7094Maya.dillon@ubs.com

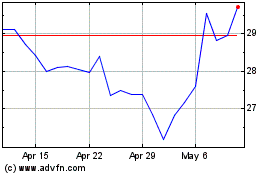

UBS (NYSE:UBS)

Historical Stock Chart

From Mar 2024 to Apr 2024

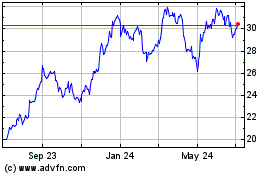

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2023 to Apr 2024