Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 08 2017 - 4:37PM

Edgar (US Regulatory)

Final Term Sheet

Filed Pursuant to Rule 433

Registration Statement

No. 333-214056

November 8, 2017

United Parcel Service, Inc.

FINAL TERM SHEET

|

|

|

|

|

Security Offered:

|

|

0.375% Senior Notes due 2023 (the “2023 Notes”)

|

|

|

|

|

Issuer:

|

|

United Parcel Service, Inc. (the “Company”)

|

|

|

|

|

Expected Ratings:

|

|

A1/A+

|

|

|

|

|

Principal Amount:

|

|

€700,000,000

|

|

|

|

|

Trade Date:

|

|

November 8, 2017

|

|

|

|

|

Settlement Date:

|

|

It is expected that delivery of the 2023 Notes will be made against payment therefor on or about November 13, 2017, which will be the third business day following the date of pricing of the Notes (such settlement cycle being

referred to herein as ‘‘T+3’’). Under Rule

15c6-1

pursuant to the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two

business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the 2023 Notes on the date of pricing will be required, by virtue of the fact that the 2023 Notes initially will settle in T+3,

to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the 2023 Notes who wish to trade those 2023 Notes on the date of pricing should consult their own advisor.

|

|

|

|

|

Maturity Date:

|

|

November 15, 2023

|

|

|

|

|

Price to Public:

|

|

99.698%

|

|

|

|

|

Net Proceeds to Company (before expenses):

|

|

€695,261,000

|

|

|

|

|

Benchmark Security:

|

|

DBR 2.000% due August 15, 2023

|

|

|

|

|

Benchmark Security Price and Yield:

|

|

113.19;

-0.268%

|

|

|

|

|

Spread to Benchmark Security:

|

|

+69.4 basis points

|

|

|

|

|

Mid-Swap

Yield:

|

|

0.306%

|

|

|

|

|

Spread to

Mid-Swap

Yield:

|

|

+12 basis points

|

|

|

|

|

Re-offer

Yield:

|

|

0.426%

|

|

|

|

|

Coupon (Interest Rate):

|

|

0.375%

|

|

|

|

|

Record Dates:

|

|

November 1, beginning November 1, 2018 or, if the notes are represented by one or more global notes, the close of business on the business day immediately preceding the related Interest Payment Date.

|

|

|

|

|

Interest Payment Dates:

|

|

Annually on November 15, beginning November 15, 2018 (long first coupon)

|

|

|

|

|

Minimum Denominations:

|

|

The 2023 Notes will be issued in denominations of €100,000 and in integral multiples of €1,000 in excess thereof.

|

1

|

|

|

|

|

|

|

|

Optional Redemption:

|

|

The 2023 Notes will be redeemable at the Company’s option at any time prior to August 15, 2023 (three months prior to their

maturity), as a whole or in part, at the greater of (i) 100% of the principal amount of such 2023 Notes and (ii) the sum of the present values of remaining scheduled payments of principal and interest (exclusive of interest accrued to the date

of redemption) on such 2023 Notes discounted to the redemption date on an annual basis (ACTUAL/ACTUAL (ICMA)) at the Comparable Government Bond Rate plus 0.10% (10 basis points), plus accrued interest to the redemption date.

The 2023 Notes will be redeemable at the Company’s option at any time on or after August 15, 2023 (three months prior to their maturity), at a

redemption price equal to 100% of the principal amount of such 2023 Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date.

|

|

|

|

|

Original Issue Discount:

|

|

Because the 2023 Notes provide for an initial interest period that is longer than one year, the stated interest on the 2023 Notes will not qualify as “qualified stated interest” under the applicable U.S. Treasury

regulations. As a result, the 2023 Notes would be treated as having original issue discount (or OID) for U.S. federal income tax purposes. As a result, among other things, holders (including holders that are cash-basis taxpayers) will be

required to include stated interest on the 2023 Notes in income as it accrues in accordance with the OID rules (generally a constant yield method) in advance of the actual receipt of cash payments attributable to such income. Holders should

consult their tax advisors regarding the application of the OID rules to the 2023 Notes.

|

|

|

|

|

CUSIP:

|

|

911312 BF2

|

|

|

|

|

ISIN:

|

|

XS1718480327

|

|

|

|

|

Common Code:

|

|

171848032

|

|

|

|

|

Listing:

|

|

The Company intends to apply to list the 2023 Notes on the New York Stock Exchange.

|

|

|

|

|

Day Count Convention:

|

|

ACTUAL/ACTUAL (ICMA)

|

|

|

|

|

Form:

|

|

Clearstream/Euroclear, Book-Entry

|

|

|

|

|

Law:

|

|

New York

|

|

|

|

|

Joint Book-Running Managers:

|

|

BNP Paribas

Citigroup Global Markets

Limited

Merrill Lynch International

UBS Limited

|

To the extent any Underwriter that is not a U.S. registered broker-dealer intends to effect sales of notes in the United

States, it will do so through one or more U.S. registered broker-dealers in accordance with the applicable U.S. securities laws and regulations.

Note:

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The Issuer

has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed

with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov.

Alternatively, the Issuer, any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by

contacting BNP Paribas toll-free at

1-800-854-5674;

Citigroup Global Markets Limited toll-free at

1-800-831-9146;

Merrill Lynch International toll-free at

1-800-294-1322;

or UBS Limited toll-free at

1-888-827-7275.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES

WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

2

Registration Statement

No. 333-214056

November 8, 2017

United

Parcel Service, Inc.

FINAL TERM SHEET

|

|

|

|

|

Security Offered:

|

|

1.500% Senior Notes due 2032 (the “2032 Notes”)

|

|

|

|

|

Issuer:

|

|

United Parcel Service, Inc. (the “Company”)

|

|

|

|

|

Expected Ratings:

|

|

A1/A+

|

|

|

|

|

Principal Amount:

|

|

€500,000,000

|

|

|

|

|

Trade Date:

|

|

November 8, 2017

|

|

|

|

|

Settlement Date:

|

|

It is expected that delivery of the 2032 Notes will be made against payment therefor on or about November 13, 2017, which will be the third business day following the date of pricing of the 2032 Notes (such settlement cycle

being referred to herein as ‘‘T+3’’). Under Rule

15c6-1

pursuant to the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two

business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the 2032 Notes on the date of pricing will be required, by virtue of the fact that the 2032 Notes initially will settle in T+3,

to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of the 2032 Notes who wish to trade those 2032 Notes on the date of pricing should consult their own advisor.

|

|

|

|

|

Maturity Date:

|

|

November 15, 2032

|

|

|

|

|

Price to Public:

|

|

99.880%

|

|

|

|

|

Net Proceeds to Company (before expenses):

|

|

€496,650,000

|

|

|

|

|

Benchmark Security:

|

|

DBR 0.500% due August 15, 2027

|

|

|

|

|

Benchmark Security Price and Yield:

|

|

101.75; 0.318%

|

|

|

|

|

Spread to Benchmark Security:

|

|

+119.10 basis points

|

|

|

|

|

Mid-Swap

Yield:

|

|

1.209%

|

|

|

|

|

Spread to

Mid-Swap

Yield:

|

|

+30 basis points

|

|

|

|

|

Re-offer

Yield:

|

|

1.509%

|

|

|

|

|

Coupon (Interest Rate):

|

|

1.500%

|

|

|

|

|

Record Dates:

|

|

November 1, beginning November 1, 2018 or, if the notes are represented by one or more global notes, the close of business on the business day immediately preceding the related Interest Payment Date.

|

|

|

|

|

Interest Payment Dates:

|

|

Annually on November 15, beginning November 15, 2018 (long first coupon)

|

|

|

|

|

Minimum Denominations:

|

|

The 2032 Notes will be issued in denominations of €100,000 and in integral multiples of €1,000 in excess thereof.

|

1

|

|

|

|

|

|

|

|

Optional Redemption:

|

|

The 2032 Notes will be redeemable at the Company’s option at any time prior to August 15, 2032 (three months prior to their

maturity), as a whole or in part, at the greater of (i) 100% of the principal amount of such 2032 Notes and (ii) the sum of the present values of remaining scheduled payments of principal and interest (exclusive of interest accrued to the date

of redemption) on such 2032 Notes discounted to the redemption date on an annual basis (ACTUAL/ACTUAL (ICMA)) at the Comparable Government Bond Rate plus 0.20% (20 basis points), plus accrued interest to the redemption date.

The 2032 Notes will be redeemable at the Company’s option at any time on or after August 15, 2032 (three months prior to their maturity), at a

redemption price equal to 100% of the principal amount of such 2032 Notes to be redeemed, plus accrued and unpaid interest, if any, to, but excluding, the redemption date.

|

|

|

|

|

Original Issue Discount:

|

|

Because the 2032 Notes provide for an initial interest period that is longer than one year, the stated interest on the 2032 Notes will not qualify as “qualified stated interest” under the applicable U.S. Treasury

regulations. As a result, the 2032 Notes would be treated as having original issue discount (or OID) for U.S. federal income tax purposes. As a result, among other things, holders (including holders that are cash-basis taxpayers) will be

required to include stated interest on the 2032 Notes in income as it accrues in accordance with the OID rules (generally a constant yield method) in advance of the actual receipt of cash payments attributable to such income. Holders should

consult their tax advisors regarding the application of the OID rules to the 2032 Notes.

|

|

|

|

|

CUSIP:

|

|

911312 BE5

|

|

|

|

|

ISIN:

|

|

XS1717441726

|

|

|

|

|

Common Code:

|

|

171744172

|

|

|

|

|

Listing:

|

|

The Company intends to apply to list the 2032 Notes on the New York Stock Exchange.

|

|

|

|

|

Day Count Convention:

|

|

ACTUAL/ACTUAL (ICMA)

|

|

|

|

|

Form:

|

|

Clearstream/Euroclear, Book-Entry

|

|

|

|

|

Law:

|

|

New York

|

|

|

|

|

Joint Book-Running Managers:

|

|

BNP Paribas

Citigroup Global Markets

Limited

Merrill Lynch International

UBS Limited

|

To the extent any Underwriter that is not a U.S. registered broker-dealer intends to effect sales of notes in the United

States, it will do so through one or more U.S. registered broker-dealers in accordance with the applicable U.S. securities laws and regulations.

Note:

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The Issuer

has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Issuer has filed

with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov.

Alternatively, the Issuer, any Underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by

contacting BNP Paribas toll-free at

1-800-854-5674;

Citigroup Global Markets Limited toll-free at

1-800-831-9146;

Merrill Lynch International toll-free at

1-800-294-1322;

or UBS Limited toll-free at

1-888-827-7275.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES

WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

2

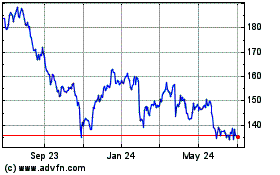

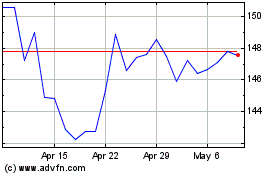

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024