Infinera Corporation (NASDAQ:INFN), provider of Intelligent

Transport Networks, today released financial results for its third

quarter ended September 30, 2017. The company also today announced

a plan to restructure its worldwide operations to reduce its

expenses and establish a more cost-efficient operating structure.

Third Quarter 2017 Financial Review

GAAP revenue for the quarter was $192.6 million compared to

$176.8 million in the second quarter of 2017 and $185.5 million in

the third quarter of 2016.

GAAP gross margin for the quarter was 35.2% compared to 36.7% in

the second quarter of 2017 and 45.6% in the third quarter of 2016.

GAAP operating margin for the quarter was (17.8)% compared to

(22.9)% in the second quarter of 2017 and (5.9)% in the third

quarter of 2016.

GAAP net loss for the quarter was $(37.2) million, or $(0.25)

per share, compared to a net loss of $(42.8) million, or $(0.29)

per share, in the second quarter of 2017, and net loss of $(11.2)

million, or $(0.08) per share, in the third quarter of 2016.

Non-GAAP gross margin for the quarter was 39.1% compared to

40.7% in the second quarter of 2017 and 49.2% in the third quarter

of 2016. Non-GAAP operating margin for the quarter was (7.8)%

compared to (12.2)% in the second quarter of 2017 and 3.6% in the

third quarter of 2016.

Non-GAAP net loss for the quarter was $(17.0) million, or

$(0.11) per share, compared to a net loss of $(22.8) million, or

$(0.15) per share, in the second quarter of 2017, and net income of

$7.4 million, or $0.05 per diluted share, in the third quarter of

2016.

A further explanation of the use of non-GAAP financial

information and a reconciliation of the non-GAAP financial measures

to the GAAP equivalents can be found at the end of this

release.

“In the third quarter we continued to bring new products to

market and delivered financial results that exceeded our guidance,”

said Tom Fallon, Infinera’s Chief Executive Officer. “Our ICE4

products are delivering the technology differentiation we expected

and are gaining traction across multiple customer verticals.

Despite a softening near-term market outlook, over time I am

confident we will return to outgrowing the market and delivering

strong financial results.”

Restructuring Initiative

Infinera also announced it is implementing a plan to restructure

its worldwide operations in order to reduce its expenses and

establish a more cost-efficient structure that better aligns its

operations with its long-term strategies. As part of this

restructuring plan, Infinera will reduce headcount, rationalize

certain products and programs, and close a remote R&D

facility.

Infinera anticipates annual savings from the restructuring to be

approximately $40.0 million, compared to what the projected

run-rate of expenses for fiscal 2018 would have been prior to the

restructuring. Infinera estimates total costs related to the

restructuring will be in the range of $21.0 million to $27.0

million. The company anticipates a majority of the restructuring

will be completed during the fourth quarter of 2017.

“In recent years we have made significant investments to become

a multi-market company, deliver a fully refreshed product portfolio

and establish a faster technology cadence. Reflecting on the

internal expansion associated with these investments, we have

identified areas where we can be more efficient going forward,”

stated Mr. Fallon. “While difficult, my expectation is taking

action at this time will result in a more cost-efficient structure

that enables us to focus on our strengths and return to

profitability as we grow. I believe these are the right steps for

our shareholders, our company and our customers.”

Conference Call Information

Infinera will host a conference call for analysts and investors

to discuss its third quarter 2017 results and its outlook for the

fourth quarter of 2017 today at 4:30 p.m. Eastern Time (1:30 p.m.

Pacific Time). Interested parties may join the conference call by

dialing 1-866-373-6878 (toll free) or 1-412-317-5101

(international). A live webcast of the conference call will also be

accessible from the Events & Webcasts section of Infinera’s

website at investors.infinera.com. Replay of the audio webcast will

be available at investors.infinera.com approximately two hours

after the end of the live call.

Contacts:

Media:Anna VueTel. +1 (916) 595-8157avue@infinera.com

Investors:Jeff HustisTel. +1 (408)

213-7150jhustis@infinera.com

About Infinera

Infinera provides Intelligent Transport Networks, enabling

carriers, cloud operators, governments and enterprises to scale

network bandwidth, accelerate service innovation and automate

optical network operations. Infinera’s end-to-end packet-optical

portfolio is designed for long-haul, subsea, data center

interconnect and metro applications. Infinera’s unique large scale

photonic integrated circuits enable innovative optical networking

solutions for the most demanding networks. To learn more about

Infinera visit www.infinera.com, follow us on Twitter @Infinera and

read our latest blog posts at www.infinera.com/blog.

Forward-Looking Statements

This press release contains certain forward-looking statements

based on current expectations, forecasts and assumptions that

involve risks and uncertainties. Such forward-looking statements

include, without limitation, Infinera’s ability to continue to gain

traction across multiple customer verticals; Infinera's ability to

outgrow the market and deliver strong financial results; Infinera's

ability to become a multi-market company, deliver a fully refreshed

product portfolio and establish a faster technology cadence;

Infinera’s expectations regarding its restructuring and the

expected cost and annual savings associated with the restructuring

plan. Forward-looking statements can also be identified by

forward-looking words such as "anticipate," "believe," "could,"

"estimate," "expect," "intend," "may," "should," "will," and

"would" or similar words. These statements are based on information

available to Infinera as of the date hereof and actual results

could differ materially from those stated or implied due to risks

and uncertainties. The risks and uncertainties that could cause

Infinera’s results to differ materially from those expressed or

implied by such forward-looking statements include, delays in the

development and introduction of new products or updates to existing

products and market acceptance of these products; the effects of

increased customer consolidation; fluctuations in demand, sales

cycles and prices for products and services, including discounts

given in response to competitive pricing pressures, as well as the

timing of purchases by our key customers; the effect that changes

in product pricing or mix, and/or increases in component costs

could have on Infinera’s gross margin; Infinera’s ability to

respond to rapid technological changes; aggressive business tactics

by Infinera’s competitors; Infinera's ability to adequately respond

to demand as a result of the restructuring plan; Infinera's

reliance on single and limited source suppliers; Infinera’s ability

to protect Infinera’s intellectual property; claims by others that

Infinera infringes their intellectual property; the effect of

global macroeconomic conditions on Infinera's business; war,

terrorism, public health issues, natural disasters and other

circumstances that could disrupt the supply, delivery or demand of

Infinera's products; and other risks and uncertainties detailed in

Infinera’s SEC filings from time to time. More information on

potential factors that may impact Infinera’s business are set forth

in its Quarterly Report on Form 10-Q for the quarter ended on July

1, 2017 as filed with the SEC on August 8, 2017, as well as

subsequent reports filed with or furnished to the SEC from time to

time. These reports are available on Infinera’s website at

www.infinera.com and the SEC’s website at www.sec.gov. Infinera

assumes no obligation to, and does not currently intend to, update

any such forward-looking statements.

Use of Non-GAAP Financial Information

In addition to disclosing financial measures prepared in

accordance with U.S. Generally Accepted Accounting Principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP measures that exclude non-cash stock-based

compensation expenses, amortization of debt discount on Infinera’s

convertible senior notes, amortization and impairment of acquired

intangible assets, acquisition-related costs, and certain purchase

accounting adjustments related to Infinera's acquisition of

Transmode AB, which closed during the third quarter of 2015, along

with related tax effects. Infinera believes these adjustments are

appropriate to enhance an overall understanding of its underlying

financial performance and also its prospects for the future and are

considered by management for the purpose of making operational

decisions. In addition, these results are the primary indicators

management uses as a basis for its planning and forecasting of

future periods. The presentation of this additional information is

not meant to be considered in isolation or as a substitute for net

income (loss), basic and diluted net income (loss) per share, gross

margin or operating margin prepared in accordance with GAAP.

Non-GAAP financial measures are not based on a comprehensive set of

accounting rules or principles and are subject to limitations. For

a description of these non-GAAP financial measures and a

reconciliation to the most directly comparable GAAP financial

measures, please see the section titled, “GAAP to Non-GAAP

Reconciliations.” Infinera anticipates disclosing forward-looking

non-GAAP information in its conference call to discuss its third

quarter 2017 results, including an estimate of certain non-GAAP

financial measures for the fourth quarter of 2017 that excludes

non-cash stock-based compensation expenses, amortization of

acquired intangible assets and related tax effects, and

amortization of debt discount on Infinera’s convertible senior

notes.

A copy of this press release can be found on the Investor

Relations page of Infinera’s website at www.infinera.com.

Infinera and the Infinera logo are trademarks or registered

trademarks of Infinera Corporation. All other trademarks used or

mentioned herein belong to their respective owners.

Infinera CorporationCondensed

Consolidated Statements of Operations(In

thousands, except per share

data)(Unaudited)

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30,2017 |

|

September 24,2016 |

|

September 30,2017 |

|

September 24,2016 |

| Revenue: |

|

|

|

|

|

|

|

|

|

Product |

|

$ |

159,579 |

|

|

$ |

156,188 |

|

|

$ |

449,992 |

|

|

$ |

599,802 |

|

|

Services |

|

33,001 |

|

|

29,264 |

|

|

94,931 |

|

|

89,290 |

|

|

Total revenue |

|

192,580 |

|

|

185,452 |

|

|

544,923 |

|

|

689,092 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

| Cost of

product |

|

111,803 |

|

|

91,064 |

|

|

311,437 |

|

|

331,564 |

|

| Cost of

services |

|

12,951 |

|

|

9,786 |

|

|

36,772 |

|

|

32,842 |

|

|

Total cost of revenue |

|

124,754 |

|

|

100,850 |

|

|

348,209 |

|

|

364,406 |

|

| Gross profit |

|

67,826 |

|

|

84,602 |

|

|

196,714 |

|

|

324,686 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

| Research

and development |

|

56,616 |

|

|

50,855 |

|

|

169,076 |

|

|

164,541 |

|

| Sales and

marketing |

|

27,824 |

|

|

27,960 |

|

|

86,662 |

|

|

88,434 |

|

| General

and administrative |

|

17,634 |

|

|

16,646 |

|

|

53,556 |

|

|

51,617 |

|

|

Total operating expenses |

|

102,074 |

|

|

95,461 |

|

|

309,294 |

|

|

304,592 |

|

| Income (loss) from

operations |

|

(34,248 |

) |

|

(10,859 |

) |

|

(112,580 |

) |

|

20,094 |

|

| Other income (expense),

net: |

|

|

|

|

|

|

|

|

| Interest

income |

|

857 |

|

|

647 |

|

|

2,470 |

|

|

1,764 |

|

| Interest

expense |

|

(3,549 |

) |

|

(3,313 |

) |

|

(10,408 |

) |

|

(9,644 |

) |

| Other

gain (loss), net: |

|

(80 |

) |

|

(188 |

) |

|

(462 |

) |

|

(1,116 |

) |

|

Total other income (expense), net |

|

(2,772 |

) |

|

(2,854 |

) |

|

(8,400 |

) |

|

(8,996 |

) |

| Income (loss) before

income taxes |

|

(37,020 |

) |

|

(13,713 |

) |

|

(120,980 |

) |

|

11,098 |

|

| Provision for (benefit

from) income taxes |

|

211 |

|

|

(2,416 |

) |

|

(459 |

) |

|

(725 |

) |

| Net income (loss) |

|

(37,231 |

) |

|

(11,297 |

) |

|

(120,521 |

) |

|

11,823 |

|

| Less: Net

loss attributable to noncontrolling interest |

|

— |

|

|

(125 |

) |

|

— |

|

|

(503 |

) |

| Net income (loss)

attributable to Infinera Corporation |

|

$ |

(37,231 |

) |

|

$ |

(11,172 |

) |

|

$ |

(120,521 |

) |

|

$ |

12,326 |

|

| Net income (loss) per

common share attributable to Infinera Corporation: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.25 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.82 |

) |

|

$ |

0.09 |

|

|

Diluted |

|

$ |

(0.25 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.82 |

) |

|

$ |

0.08 |

|

| Weighted average shares

used in computing net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

Basic |

|

148,777 |

|

|

143,850 |

|

|

147,367 |

|

|

142,350 |

|

|

Diluted |

|

148,777 |

|

|

143,850 |

|

|

147,367 |

|

|

145,921 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Infinera CorporationGAAP to Non-GAAP

Reconciliations(In thousands, except percentages

and per share data)(Unaudited)

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30,2017 |

|

|

|

July 1,2017 |

|

|

|

September 24,2016 |

|

|

|

September 30,2017 |

|

|

|

September 24,2016 |

|

|

| Reconciliation

ofRevenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

192,580 |

|

|

|

|

$ |

176,821 |

|

|

|

|

$ |

185,452 |

|

|

|

|

$ |

544,923 |

|

|

|

|

$ |

689,092 |

|

|

|

|

Acquisition-relateddeferred revenueadjustment(1) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

400 |

|

|

|

| Non-GAAP as

adjusted |

$ |

192,580 |

|

|

|

|

$ |

176,821 |

|

|

|

|

$ |

185,452 |

|

|

|

|

$ |

544,923 |

|

|

|

|

$ |

689,492 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of Gross Profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

67,826 |

|

|

35.2 |

% |

|

$ |

64,832 |

|

|

36.7 |

% |

|

$ |

84,602 |

|

|

45.6 |

% |

|

$ |

196,714 |

|

|

36.1 |

% |

|

$ |

324,686 |

|

|

47.1 |

% |

|

Acquisition-relateddeferred revenueadjustment(1) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

400 |

|

|

|

|

Stock-basedcompensation(2) |

2,063 |

|

|

|

|

2,071 |

|

|

|

|

1,424 |

|

|

|

|

5,965 |

|

|

|

|

4,614 |

|

|

|

| Amortization of

acquiredintangible assets(3) |

5,390 |

|

|

|

|

5,035 |

|

|

|

|

5,102 |

|

|

|

|

15,305 |

|

|

|

|

14,970 |

|

|

|

| Acquisition-related

costs(4) |

— |

|

|

|

|

6 |

|

|

|

|

38 |

|

|

|

|

46 |

|

|

|

|

117 |

|

|

|

| Non-GAAP as

adjusted |

$ |

75,279 |

|

|

39.1 |

% |

|

$ |

71,944 |

|

|

40.7 |

% |

|

$ |

91,166 |

|

|

49.2 |

% |

|

$ |

218,030 |

|

|

40.0 |

% |

|

$ |

344,787 |

|

|

50.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

102,074 |

|

|

|

|

$ |

105,337 |

|

|

|

|

$ |

95,461 |

|

|

|

|

$ |

309,294 |

|

|

|

|

$ |

304,592 |

|

|

|

|

Stock-basedcompensation(2) |

10,103 |

|

|

|

|

10,309 |

|

|

|

|

8,787 |

|

|

|

|

29,458 |

|

|

|

|

24,577 |

|

|

|

| Amortization of

acquiredintangible assets(3) |

1,622 |

|

|

|

|

1,515 |

|

|

|

|

1,537 |

|

|

|

|

4,605 |

|

|

|

|

4,753 |

|

|

|

| Acquisition-related

costs(4) |

— |

|

|

|

|

16 |

|

|

|

|

563 |

|

|

|

|

322 |

|

|

|

|

1,453 |

|

|

|

| Intangible

assetimpairment(5) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

252 |

|

|

|

|

— |

|

|

|

| Non-GAAP as

adjusted |

$ |

90,349 |

|

|

|

|

$ |

93,497 |

|

|

|

|

$ |

84,574 |

|

|

|

|

$ |

274,657 |

|

|

|

|

$ |

273,809 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of Income(Loss) from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

(34,248 |

) |

|

(17.8 |

)% |

|

$ |

(40,505 |

) |

|

(22.9 |

)% |

|

$ |

(10,859 |

) |

|

(5.9 |

)% |

|

$ |

(112,580 |

) |

|

(20.7 |

)% |

|

$ |

20,094 |

|

|

2.9 |

% |

|

Acquisition-relateddeferred revenueadjustment(1) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

400 |

|

|

|

| Stock-based

compensation(2) |

12,166 |

|

|

|

|

12,380 |

|

|

|

|

10,211 |

|

|

|

|

35,423 |

|

|

|

|

29,191 |

|

|

|

| Amortization of

acquiredintangible assets(3) |

7,012 |

|

|

|

|

6,550 |

|

|

|

|

6,639 |

|

|

|

|

19,910 |

|

|

|

|

19,723 |

|

|

|

| Acquisition-related

costs(4) |

— |

|

|

|

|

22 |

|

|

|

|

601 |

|

|

|

|

368 |

|

|

|

|

1,570 |

|

|

|

| Intangible

assetimpairment(5) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

252 |

|

|

|

|

— |

|

|

|

| Non-GAAP as

adjusted |

$ |

(15,070 |

) |

|

(7.8 |

)% |

|

$ |

(21,553 |

) |

|

(12.2 |

)% |

|

$ |

6,592 |

|

|

3.6 |

% |

|

$ |

(56,627 |

) |

|

(10.4 |

)% |

|

$ |

70,978 |

|

|

10.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of NetIncome (Loss)Attributable to

InfineraCorporation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

(37,231 |

) |

|

|

|

$ |

(42,839 |

) |

|

|

|

$ |

(11,172 |

) |

|

|

|

$ |

(120,521 |

) |

|

|

|

$ |

12,326 |

|

|

|

|

Acquisition-relateddeferred revenueadjustment(1) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

400 |

|

|

|

|

Stock-basedcompensation(2) |

12,166 |

|

|

|

|

12,380 |

|

|

|

|

10,211 |

|

|

|

|

35,423 |

|

|

|

|

29,191 |

|

|

|

| Amortization of

acquiredintangible assets(3) |

7,012 |

|

|

|

|

6,550 |

|

|

|

|

6,639 |

|

|

|

|

19,910 |

|

|

|

|

19,723 |

|

|

|

| Acquisition-related

costs(4) |

— |

|

|

|

|

(4 |

) |

|

|

|

874 |

|

|

|

|

257 |

|

|

|

|

2,263 |

|

|

|

| Intangible

assetimpairment(5) |

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

|

|

252 |

|

|

|

|

— |

|

|

|

| Amortization of

debtdiscount(6) |

2,643 |

|

|

|

|

2,577 |

|

|

|

|

2,391 |

|

|

|

|

7,734 |

|

|

|

|

6,996 |

|

|

|

| Income tax

effects(7) |

(1,543 |

) |

|

|

|

(1,450 |

) |

|

|

|

(1,519 |

) |

|

|

|

(4,467 |

) |

|

|

|

(4,531 |

) |

|

|

| Non-GAAP as

adjusted |

$ |

(16,953 |

) |

|

|

|

$ |

(22,786 |

) |

|

|

|

$ |

7,424 |

|

|

|

|

$ |

(61,412 |

) |

|

|

|

$ |

66,368 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Income

(Loss) perCommon ShareAttributable to InfineraCorporation -

Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

(0.25 |

) |

|

|

|

$ |

(0.29 |

) |

|

|

|

$ |

(0.08 |

) |

|

|

|

$ |

(0.82 |

) |

|

|

|

$ |

0.09 |

|

|

|

| Non-GAAP as

adjusted |

$ |

(0.11 |

) |

|

|

|

$ |

(0.15 |

) |

|

|

|

$ |

0.05 |

|

|

|

|

$ |

(0.42 |

) |

|

|

|

$ |

0.47 |

|

|

|

| Net Income

(Loss) perCommon ShareAttributable to InfineraCorporation -

Diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. GAAP as

reported |

$ |

(0.25 |

) |

|

|

|

$ |

(0.29 |

) |

|

|

|

$ |

(0.08 |

) |

|

|

|

$ |

(0.82 |

) |

|

|

|

$ |

0.08 |

|

|

|

| Non-GAAP as

adjusted |

$ |

(0.11 |

) |

|

|

|

$ |

(0.15 |

) |

|

|

|

$ |

0.05 |

|

|

|

|

$ |

(0.42 |

) |

|

|

|

$ |

0.45 |

|

|

|

| Weighted

AverageShares Used inComputing Net Income(Loss) per

CommonShare: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

148,777 |

|

|

|

|

147,538 |

|

|

|

|

143,850 |

|

|

|

|

147,367 |

|

|

|

|

142,350 |

|

|

|

| Diluted |

148,777 |

|

|

|

|

147,538 |

|

|

|

|

144,993 |

|

|

|

|

147,367 |

|

|

|

|

145,921 |

|

|

|

____________________________

| (1) |

|

Business

combination accounting principles require Infinera to write down to

fair value its maintenance support contracts assumed in the

Transmode acquisition. The revenue for these support contracts is

deferred and typically recognized over a one year period, so

Infinera's GAAP revenue for the one year period after the

acquisition will not reflect the full amount of revenue that would

have been reported if the acquired deferred revenue was not written

down to fair value. The non-GAAP adjustment eliminates the effect

of the deferred revenue write-down. Management believes these

adjustments to the revenue from these support contracts are useful

to investors as an additional means to reflect revenue trends of

Infinera's business. |

| |

|

|

| (2) |

|

Stock-based

compensation expense is calculated in accordance with the fair

value recognition provisions of Financial Accounting Standards

Board Accounting Standards Codification Topic 718, Compensation –

Stock Compensation effective January 1, 2006. The following

table summarizes the effects of non-cash stock-based compensation

related to employees and non-employees (in thousands): |

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30,2017 |

|

July 1,2017 |

|

September 24,2016 |

|

September 30,2017 |

|

September 24,2016 |

| Cost of revenue |

|

$ |

779 |

|

|

$ |

834 |

|

|

$ |

756 |

|

|

$ |

2,337 |

|

|

$ |

2,175 |

|

| Research and

development |

|

4,040 |

|

|

4,184 |

|

|

3,496 |

|

|

12,004 |

|

|

9,721 |

|

| Sales and

marketing |

|

3,025 |

|

|

3,273 |

|

|

2,826 |

|

|

9,024 |

|

|

8,006 |

|

| General and

administration |

|

3,039 |

|

|

2,852 |

|

|

2,465 |

|

|

8,431 |

|

|

6,850 |

|

| |

|

10,883 |

|

|

11,143 |

|

|

9,543 |

|

|

31,796 |

|

|

26,752 |

|

| Cost of revenue -

amortization from balance sheet* |

|

1,284 |

|

|

1,237 |

|

|

668 |

|

|

3,628 |

|

|

2,439 |

|

| Total stock-based

compensation expense |

|

$ |

12,167 |

|

|

$ |

12,380 |

|

|

$ |

10,211 |

|

|

$ |

35,424 |

|

|

$ |

29,191 |

|

_____________________________

| * |

|

Stock-based

compensation expense deferred to inventory and deferred inventory

costs in prior periods and recognized in the current

period. |

| |

|

|

| (3) |

|

Amortization of acquisition-related intangible assets consists of

amortization of developed technology, trade names, and customer

relationships acquired in connection with the Transmode

acquisition. U.S. GAAP accounting requires that acquired intangible

assets are recorded at fair value and amortized over their useful

lives. As this amortization is non-cash, Infinera has excluded it

from its non-GAAP operating expenses, gross margin and net income

measures. Management believes the amortization of acquired

intangible assets is not indicative of ongoing operating

performance and its exclusion provides a better indication of

Infinera's underlying business performance. |

| |

|

|

| (4) |

|

Acquisition-related costs associated with the Transmode acquisition

include legal, financial, employee retention costs and other

professional fees incurred in connection with the transaction,

including squeeze-out proceedings. These amounts have been adjusted

in arriving at Infinera's non-GAAP results because management

believes that these expenses are non-recurring, not indicative of

ongoing operating performance and their exclusion provides a better

indication of Infinera's underlying business performance. |

| |

|

|

| (5) |

|

Intangible

asset impairment is associated with previously acquired

intangibles, which Infinera has determined that the carrying value

will not be recoverable. Management has excluded the impact of this

charge in arriving at Infinera's non-GAAP results because it is

non-recurring and management believes that these expenses are not

indicative of ongoing operating performance. |

| |

|

|

| (6) |

|

Under GAAP,

certain convertible debt instruments that may be settled in cash on

conversion are required to be separately accounted for as liability

(debt) and equity (conversion option) components of the instrument

in a manner that reflects the issuer's non-convertible debt

borrowing rate. Accordingly, for GAAP purposes, Infinera is

required to amortize as debt discount an amount equal to the fair

value of the conversion option that was recorded in equity as

interest expense on its $150 million in aggregate principal amount

of 1.75% convertible debt issuance in May 2013 over the term of the

notes. Interest expense has been excluded from Infinera's non-GAAP

results because management believes that this non-cash expense is

not indicative of ongoing operating performance and provides a

better indication of Infinera's underlying business

performance. |

| |

|

|

| (7) |

|

The

difference between the GAAP and non-GAAP tax is due to the net tax

effects of the purchase accounting adjustments, acquisition-related

costs and amortization of acquired intangible assets. |

| |

|

|

Infinera CorporationCondensed

Consolidated Balance Sheets(In thousands, except

par values)(Unaudited)

| |

|

September 30,2017 |

|

December 31,2016 |

|

ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

122,042 |

|

|

$ |

162,641 |

|

|

Short-term investments |

|

134,319 |

|

|

141,697 |

|

|

Short-term restricted cash |

|

740 |

|

|

8,490 |

|

| Accounts

receivable, net of allowance for doubtful accounts of $885 in 2017

and $772 in 2016 |

|

137,133 |

|

|

150,370 |

|

|

Inventory |

|

242,848 |

|

|

232,955 |

|

| Prepaid

expenses and other current assets |

|

50,320 |

|

|

34,270 |

|

|

Total current assets |

|

687,402 |

|

|

730,423 |

|

| Property, plant and

equipment, net |

|

143,217 |

|

|

124,800 |

|

| Intangible assets |

|

99,953 |

|

|

108,475 |

|

| Goodwill |

|

197,325 |

|

|

176,760 |

|

| Long-term

investments |

|

47,575 |

|

|

40,779 |

|

| Cost-method

investment |

|

7,000 |

|

|

7,000 |

|

| Long-term restricted

cash |

|

4,299 |

|

|

6,449 |

|

| Other non-current

assets |

|

4,328 |

|

|

3,897 |

|

|

Total assets |

|

$ |

1,191,099 |

|

|

$ |

1,198,583 |

|

| LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current

liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

89,310 |

|

|

$ |

62,486 |

|

| Accrued

expenses |

|

30,080 |

|

|

31,580 |

|

| Accrued

compensation and related benefits |

|

40,571 |

|

|

46,637 |

|

|

Short-term debt, net |

|

141,985 |

|

|

— |

|

| Accrued

warranty |

|

14,245 |

|

|

16,930 |

|

| Deferred

revenue |

|

65,328 |

|

|

58,900 |

|

|

Total current liabilities |

|

381,519 |

|

|

216,533 |

|

| Long-term

debt, net |

|

— |

|

|

133,586 |

|

| Accrued

warranty, non-current |

|

17,917 |

|

|

23,412 |

|

| Deferred

revenue, non-current |

|

21,794 |

|

|

19,362 |

|

| Deferred

tax liability |

|

23,384 |

|

|

25,327 |

|

| Other

long-term liabilities |

|

14,547 |

|

|

18,035 |

|

| Commitments and

contingencies |

|

|

|

|

| Stockholders’

equity: |

|

|

|

|

| Preferred

stock, $0.001 par value |

|

|

|

|

|

Authorized shares - 25,000 and no shares issued and

outstanding |

|

— |

|

|

— |

|

| Common

stock, $0.001 par value |

|

|

|

|

|

Authorized shares - 500,000 as of September 30, 2017

and December 31, 2016 |

|

|

|

|

|

Issued and outstanding shares - 149,305 as of

September 30, 2017 and 145,021 as of December 31, 2016 |

|

149 |

|

|

145 |

|

|

Additional paid-in capital |

|

1,406,936 |

|

|

1,354,082 |

|

|

Accumulated other comprehensive income (loss) |

|

8,949 |

|

|

(28,324 |

) |

|

Accumulated deficit |

|

(684,096 |

) |

|

(563,575 |

) |

| Total

stockholders’ equity |

|

731,938 |

|

|

762,328 |

|

|

Total liabilities and

stockholders’ equity |

|

$ |

1,191,099 |

|

|

$ |

1,198,583 |

|

|

|

|

|

|

|

|

|

|

|

Infinera CorporationCondensed

Consolidated Statements of Cash Flows(In

thousands)(Unaudited)

| |

|

Nine Months Ended |

| |

|

September 30,2017 |

|

September 24,2016 |

| Cash Flows from

Operating Activities: |

|

|

|

|

| Net income (loss) |

|

$ |

(120,521 |

) |

|

$ |

11,823 |

|

| Adjustments to

reconcile net income (loss) to net cash provided by (used in)

operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

49,391 |

|

|

45,764 |

|

|

Amortization of debt discount and issuance costs |

|

8,399 |

|

|

7,598 |

|

|

Amortization of premium on investments |

|

359 |

|

|

925 |

|

|

Impairment of intangible assets |

|

252 |

|

|

— |

|

|

Stock-based compensation expense |

|

35,424 |

|

|

29,191 |

|

| Other

loss |

|

11 |

|

|

261 |

|

| Changes

in assets and liabilities: |

|

|

|

|

|

Accounts receivable |

|

15,078 |

|

|

33,044 |

|

|

Inventory |

|

(9,601 |

) |

|

(61,078 |

) |

|

Prepaid expenses and other assets |

|

(15,366 |

) |

|

(1,625 |

) |

|

Accounts payable |

|

25,840 |

|

|

(13,935 |

) |

|

Accrued liabilities and other expenses |

|

(10,310 |

) |

|

(7,580 |

) |

|

Deferred revenue |

|

8,575 |

|

|

(805 |

) |

|

Accrued warranty |

|

(8,447 |

) |

|

(179 |

) |

|

Net cash provided by (used in) operating

activities |

|

(20,916 |

) |

|

43,404 |

|

| Cash Flows from

Investing Activities: |

|

|

|

|

| Purchase

of available-for-sale investments |

|

(122,249 |

) |

|

(118,017 |

) |

| Proceeds

from sales of available-for-sale investments |

|

10,531 |

|

|

— |

|

| Proceeds

from maturities of investments |

|

111,970 |

|

|

110,554 |

|

| Purchase

of cost-method investment |

|

— |

|

|

(5,000 |

) |

| Purchase

of property and equipment |

|

(50,247 |

) |

|

(32,878 |

) |

| Change in

restricted cash |

|

4,389 |

|

|

(4,950 |

) |

|

Net cash used in investing

activities |

|

(45,606 |

) |

|

(50,291 |

) |

| Cash Flows from

Financing Activities: |

|

|

|

|

| Security

pledge to acquire noncontrolling interest |

|

5,596 |

|

|

(5,921 |

) |

|

Acquisition of noncontrolling interest |

|

(471 |

) |

|

(16,771 |

) |

| Proceeds

from issuance of common stock |

|

17,991 |

|

|

16,486 |

|

| Minimum

tax withholding paid on behalf of employees for net share

settlement |

|

(963 |

) |

|

(3,592 |

) |

|

Net cash provided by (used in) financing

activities |

|

22,153 |

|

|

(9,798 |

) |

| Effect of exchange rate

changes on cash |

|

3,770 |

|

|

(1,420 |

) |

| Net change in cash and

cash equivalents |

|

(40,599 |

) |

|

(18,105 |

) |

| Cash and cash

equivalents at beginning of period |

|

162,641 |

|

|

149,101 |

|

| Cash and cash

equivalents at end of period |

|

$ |

122,042 |

|

|

$ |

130,996 |

|

| Supplemental

disclosures of cash flow information: |

|

|

|

|

| Cash paid

for income taxes, net of refunds |

|

$ |

4,159 |

|

|

$ |

5,557 |

|

| Cash paid

for interest |

|

$ |

1,317 |

|

|

$ |

1,445 |

|

| Supplemental

schedule of non-cash investing activities: |

|

|

|

|

| Transfer

of inventory to fixed assets |

|

$ |

3,110 |

|

|

$ |

5,211 |

|

|

|

|

|

|

|

|

|

|

|

Infinera CorporationSupplemental

Financial Information(Unaudited)

| |

|

Q4'15 |

|

Q1'16 |

|

Q2'16 |

|

Q3'16 |

|

Q4'16 |

|

Q1'17 |

|

Q2'17 |

|

Q3'17 |

| GAAP Revenue ($

Mil) |

|

$ |

260.0 |

|

|

$ |

244.8 |

|

|

$ |

258.8 |

|

|

$ |

185.5 |

|

|

$ |

181.0 |

|

|

$ |

175.5 |

|

|

$ |

176.8 |

|

|

$ |

192.6 |

|

| GAAP Gross Margin

% |

|

|

44.5 |

% |

|

|

47.5 |

% |

|

|

47.8 |

% |

|

|

45.6 |

% |

|

|

38.1 |

% |

|

|

36.5 |

% |

|

|

36.7 |

% |

|

|

35.2 |

% |

| Non-GAAP Gross Margin

%(1) |

|

|

48.3 |

% |

|

|

50.2 |

% |

|

|

50.4 |

% |

|

|

49.2 |

% |

|

|

41.8 |

% |

|

|

40.3 |

% |

|

|

40.7 |

% |

|

|

39.1 |

% |

| Revenue

Composition: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Domestic % |

|

|

62 |

% |

|

|

71 |

% |

|

|

64 |

% |

|

|

56 |

% |

|

|

53 |

% |

|

|

57 |

% |

|

|

63 |

% |

|

|

59 |

% |

| International % |

|

|

38 |

% |

|

|

29 |

% |

|

|

36 |

% |

|

|

44 |

% |

|

|

47 |

% |

|

|

43 |

% |

|

|

37 |

% |

|

|

41 |

% |

| Customers >10% of

Revenue |

|

|

2 |

|

|

|

3 |

|

|

|

2 |

|

|

|

2 |

|

|

|

2 |

|

|

|

1 |

|

|

|

3 |

|

|

|

2 |

|

| Cash Related

Information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash from Operations ($

Mil) |

|

$ |

25.8 |

|

|

$ |

10.0 |

|

|

$ |

28.2 |

|

|

$ |

5.2 |

|

|

($ |

5.0 |

) |

|

$ |

3.0 |

|

|

($ |

3.0 |

) |

|

($ |

20.9 |

) |

| Capital Expenditures ($

Mil) |

|

$ |

15.3 |

|

|

$ |

10.8 |

|

|

$ |

12.5 |

|

|

$ |

9.6 |

|

|

$ |

10.4 |

|

|

$ |

14.7 |

|

|

$ |

24.5 |

|

|

$ |

11.0 |

|

| Depreciation &

Amortization ($ Mil) |

|

$ |

13.7 |

|

|

$ |

14.7 |

|

|

$ |

15.2 |

|

|

$ |

15.9 |

|

|

$ |

15.7 |

|

|

$ |

16.0 |

|

|

$ |

16.6 |

|

|

$ |

16.8 |

|

| DSOs |

|

|

65 |

|

|

|

69 |

|

|

|

68 |

|

|

|

75 |

|

|

|

81 |

|

|

|

64 |

|

|

|

64 |

|

|

|

65 |

|

| Inventory

Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Raw Materials ($

Mil) |

|

$ |

27.9 |

|

|

$ |

33.1 |

|

|

$ |

39.1 |

|

|

$ |

37.2 |

|

|

$ |

33.2 |

|

|

$ |

34.8 |

|

|

$ |

36.7 |

|

|

$ |

35.8 |

|

| Work in Process ($

Mil) |

|

$ |

52.6 |

|

|

$ |

59.4 |

|

|

$ |

61.0 |

|

|

$ |

65.5 |

|

|

$ |

74.5 |

|

|

$ |

81.1 |

|

|

$ |

91.6 |

|

|

$ |

84.3 |

|

| Finished Goods ($

Mil) |

|

$ |

94.2 |

|

|

$ |

97.2 |

|

|

$ |

102.2 |

|

|

$ |

128.8 |

|

|

$ |

125.3 |

|

|

$ |

118.0 |

|

|

$ |

117.7 |

|

|

$ |

122.7 |

|

| Total Inventory

($ Mil) |

|

$ |

174.7 |

|

|

$ |

189.7 |

|

|

$ |

202.3 |

|

|

$ |

231.5 |

|

|

$ |

233.0 |

|

|

$ |

233.9 |

|

|

$ |

246.0 |

|

|

$ |

242.8 |

|

| Inventory Turns(2) |

|

|

3.1 |

|

|

|

2.6 |

|

|

|

2.5 |

|

|

|

1.6 |

|

|

|

1.8 |

|

|

|

1.8 |

|

|

|

1.7 |

|

|

|

1.9 |

|

| Worldwide

Headcount |

|

|

2,056 |

|

|

|

2,128 |

|

|

|

2,218 |

|

|

|

2,262 |

|

|

|

2,240 |

|

|

|

2,245 |

|

|

|

2,272 |

|

|

|

2,296 |

|

| Weighted

Average Shares Outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

140,015 |

|

|

|

140,805 |

|

|

|

142,396 |

|

|

|

143,850 |

|

|

|

144,770 |

|

|

|

145,786 |

|

|

|

147,538 |

|

|

|

148,777 |

|

| Diluted |

|

|

149,439 |

|

|

|

146,880 |

|

|

|

145,891 |

|

|

|

144,993 |

|

|

|

145,497 |

|

|

|

147,017 |

|

|

|

148,662 |

|

|

|

149,714 |

|

_____________________________

| (1) |

|

Non-GAAP

adjustments include non-cash stock-based compensation expense,

certain purchase accounting adjustments related to Infinera's

acquisition of Transmode and amortization of acquired intangible

assets. For a description of this non-GAAP financial measure,

please see the section titled, “GAAP to Non-GAAP Reconciliations”

of this press release for a reconciliation to the most directly

comparable GAAP financial measures. |

| |

|

|

| (2) |

|

Infinera

calculates non-GAAP inventory turns as annualized non-GAAP cost of

revenue before adjustments for non-cash stock-based compensation

expense and certain purchase accounting adjustments, divided by the

average inventory for the quarter. |

| |

|

|

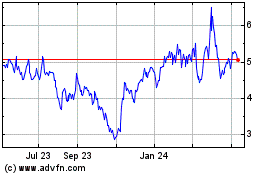

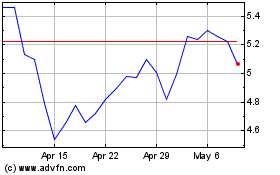

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024