B&G Foods Announces Public Offering of Senior Notes

November 08 2017 - 8:16AM

Business Wire

B&G Foods, Inc. (NYSE:BGS) announced today its intention to

offer, subject to market and other conditions, $350.0 million

aggregate principal amount of 5.25% senior notes due 2025 (the

“Notes”), pursuant to an effective shelf registration statement

previously filed with the Securities and Exchange Commission. The

Notes will be issued as additional notes under the same indenture

as B&G Foods’ 5.25% senior notes due 2025 that were originally

issued on April 3, 2017 and, as such, will form a single series and

trade interchangeably with such previously issued notes. The Notes

will be guaranteed on a senior unsecured basis by certain

subsidiaries of B&G Foods.

B&G Foods intends to use the proceeds of the offering to

repay all of the outstanding borrowings under B&G Foods’

revolving credit facility and to pay related fees and expenses.

B&G Foods intends to use the remaining net proceeds for

general corporate purposes, which could include, among other

things, repayment of other long term debt or possible acquisitions.

However, there can be no assurances that the offering of the Notes

will be completed as described herein or at all.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction. The offering is being made only by means of a

prospectus and the related prospectus supplement.

Interested persons may obtain copies of the prospectus and the

related prospectus supplement from the Securities and Exchange

Commission’s website at www.sec.gov or by contacting any of the

joint bookrunning managers, including: Barclays Capital Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, by emailing Barclaysprospectus@broadridge.com or calling

888-603-5847; BofA Merrill Lynch, NC1-004-03-43, 200 North College

Street, 3rd floor, Charlotte NC 28255-0001, Attn: Prospectus

Department, by emailing dg.prospectus_requests@baml.com; RBC

Capital Markets, LLC, RBC Capital Markets, LLC, 200 Vesey Street,

8th Floor, New York, NY 10281-8098, Attn: Attn: DCM Transaction

Management, by calling (866) 375-6829; BMO Capital Markets Corp., 3

Times Square, New York, NY 10036, Attn: High Yield Syndicate, by

calling (212) 702-1882; Credit Suisse Securities (USA) LLC, One

Madison Avenue, New York, NY 10010, Attn: Prospectus Department, by

emailing newyork.prospectus@credit-suisse.com or calling

1-800-221-1037; Deutsche Bank Securities Inc., 60 Wall Street, New

York, New York 10005-2836, Attention: Prospectus Group, by emailing

prospectus.cpdg@db.com or calling telephone (800) 503-4611; Goldman

Sachs & Co. LLC, Attn: Prospectus Department, 200 West Street,

New York, NY 10282, telephone:(866) 471-2526, facsimile:

212-902-9316, e-mail: prospectusgroup-ny@ny.email.gs.com; and J.P.

Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155

Long Island Avenue, Edgewood, NY 11717, toll-free: (866)

803-9204.

About B&G Foods, Inc.

Based in Parsippany, New Jersey, B&G Foods and its

subsidiaries manufacture, sell and distribute high-quality, branded

shelf-stable and frozen foods across the United States, Canada and

Puerto Rico. With B&G Foods’ diverse portfolio of more

than 50 brands you know and love, including Back to Nature,

B&G, B&M, Cream of Wheat, Green Giant, Las Palmas,

Le Sueur, Mama Mary’s, Maple Grove Farms,

Mrs. Dash, New York Style, Ortega,

Pirate’s Booty, Polaner, SnackWell’s, Spice Islands and

Victoria, there’s a little something for everyone.

Forward-Looking Statements

Statements in this press release that are not statements of

historical or current fact constitute “forward-looking statements.”

The forward-looking statements contained in this press release

include without limitation statements related to B&G Foods’

intention to offer senior notes and the use of proceeds of such

offering. Such forward-looking statements involve known and unknown

risks, uncertainties and other unknown factors that could cause the

actual results of B&G Foods to be materially different

from the historical results or from any future results expressed or

implied by such forward-looking statements. In addition to

statements that explicitly describe such risks and uncertainties

readers are urged to consider statements labeled with the terms

“believes,” “belief,” “expects,” “projects,” “intends,”

“anticipates” or “plans” to be uncertain and forward-looking. The

forward-looking statements contained herein are also subject

generally to other risks and uncertainties that are described from

time to time in B&G Foods’ filings with the Securities and

Exchange Commission, including under Item 1A, “Risk Factors” in the

Company’s most recent Annual Report on Form 10-K and in its

subsequent reports on Forms 10-Q and 8-K. Investors are cautioned

not to place undue reliance on any such forward-looking statements,

which speak only as of the date they are made. B&G Foods

undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171108005871/en/

Investor Relations:ICR, Inc.Dara Dierks, 866-211-8151orMedia

Relations:ICR, Inc.Matt Lindberg, 203-682-8214

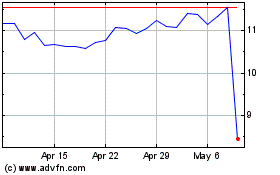

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

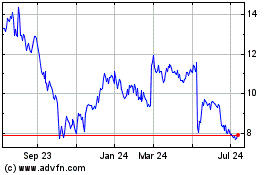

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024