Pilgrim’s Pride Corporation (NASDAQ:PPC) reports third quarter 2017

financial results.

Third Quarter Highlights

- Consolidated numbers reflect Moy Park for the entire quarter,

including historical data in accordance to U.S. GAAP.

- Net Sales of $2.79 billion (+37.4% versus same quarter last

year of $2.03 billion, excluding Moy Park).

- Net Income of $232.7 million.

- Adjusted Operating Income margins of 16.6% in U.S., 13.4% in

Mexico and 4.1% in Europe operations, respectively.

- Adjusted EBITDA of $463.6 million (or a 16.6% margin) and

Adjusted EPS of $0.98.

- Excluding Moy Park: Net Sales was $2.28 billion, Adjusted

Operating Income was $367.7 million, Adjusted EBITDA was $427.6

million (or an 18.8% margin).

- Acquisition of Moy Park positions us as the global leader in

chicken and prepared foods, and aligns with our strategic

priorities while providing a strong platform for future

growth.

- GNP integration is progressing well; operations and

profitability significantly improved with synergy captured ahead of

expectations.

| Unaudited

(2), In Millions, Except Per Share and Percentages |

| |

Thirteen Weeks Ended |

| |

Sep 24, 2017 |

|

Sep 25, 2016 |

|

Change |

| Net Sales |

$ |

2,793.9 |

|

|

$ |

2,495.3 |

|

|

+12.0 |

% |

| GAAP EPS |

$ |

0.93 |

|

|

$ |

0.39 |

|

|

+138.5 |

% |

| Operating Income |

$ |

372.2 |

|

|

$ |

176.8 |

|

|

+110.6 |

% |

| Adjusted EBITDA

(1) |

$ |

463.6 |

|

|

$ |

237.4 |

|

|

+95.3 |

% |

| Adjusted EBITDA Margin

(1) |

|

16.6 |

% |

|

|

9.5 |

% |

|

+7.1pts |

|

| |

|

|

|

|

|

(1) Reconciliations for non-GAAP measures are provided in

subsequent sections within this release.(2) Figures have been

adjusted to include full-quarter of Moy Park, in accordance to U.S.

GAAP.

“During Q3, our U.S. operations were robust across all business

units and Mexico performed even better than our expectations. The

results once again demonstrated the strength and diversity of our

portfolio of bird sizes, and is what fundamentally differentiates

us from the competition, giving us the potential to reduce

volatility and generate higher margins over time. Despite greater

availability of alternative protein, we saw strong demand for

chicken during grilling season and we expect a continuation of

chicken as a choice protein in domestic and international markets,”

stated Bill Lovette, Chief Executive Officer of Pilgrim's.

“We closed the acquisition of Moy Park last September and are

very excited about the potential opportunities in Europe because it

creates a stronger, more diverse and more stable global chicken and

prepared foods leader in Pilgrim’s. The new European operations

align with our strategic priorities as we continue expanding our

geographical and brands footprint, and extending our global poultry

leadership position into attractive new markets while providing us

a strong platform for future growth in the region.”

“We continue to increase GNP performance, and margins have

increased by 600 bps since we acquired the business in Q1. The

integration is tracking above expectations and we are well ahead in

delivering the previously announced $30 million synergy target.

Together with the success we had in improving the profitability of

the acquired assets in Mexico relative to the legacy operations, we

believe we have the method and the team to continue to grow the

profitability of our European business.”

Conference Call Information

A conference call to discuss Pilgrim’s quarterly results will be

held tomorrow, November 8, at 7:00 a.m. MT (9 a.m. ET).

Participants are encouraged to pre-register for the conference call

using the link below. Callers who pre-register will be given

a unique PIN to gain immediate access to the call and bypass the

live operator. Participants may pre-register at any time,

including up to and after the call start time.

To pre-register, go to:

https://services.choruscall.com/links/ppc3q2017.html

You may also reach the pre-registration link by logging in

through the investor section of our website at

www.pilgrims.com and clicking on the link under “Upcoming

Events.”

For those who would like to join the call but have not

pre-registered, access is available by dialing +1 (844) 883-3889

within the US, or +1 (412) 317-9245 internationally, and requesting

the “Pilgrim’s Pride Conference.” Please note that to submit a

question to management during the call, you must be logged in via

telephone.

Replays of the conference call will be available on Pilgrim’s

website approximately two hours after the call concludes and can be

accessed through the “Investor” section of www.pilgrims.com. The

webcast will be available for replay through February 8, 2018.

About Pilgrim’s Pride

Pilgrim’s employs approximately 52,000 people and operates

chicken processing plants and prepared-foods facilities in 14

states, Puerto Rico, Mexico, the U.K, Ireland and continental

Europe. The Company’s primary distribution is through retailers and

foodservice distributors. For more information, please visit

www.pilgrims.com.

Forward-Looking Statements

Statements contained in this press release that state the

intentions, plans, hopes, beliefs, anticipations, expectations or

predictions of the future of Pilgrim’s Pride Corporation and its

management are considered forward-looking statements. It is

important to note that actual results could differ materially from

those projected in such forward-looking statements. Factors that

could cause actual results to differ materially from those

projected in such forward-looking statements include: matters

affecting the poultry industry generally; the ability to execute

the Company’s business plan to achieve desired cost savings and

profitability; future pricing for feed ingredients and the

Company’s products; outbreaks of avian influenza or other diseases,

either in Pilgrim’s Pride’s flocks or elsewhere, affecting its

ability to conduct its operations and/or demand for its poultry

products; contamination of Pilgrim’s Pride’s products, which has

previously and can in the future lead to product liability claims

and product recalls; exposure to risks related to product

liability, product recalls, property damage and injuries to

persons, for which insurance coverage is expensive, limited and

potentially inadequate; management of cash resources; restrictions

imposed by, and as a result of, Pilgrim’s Pride’s leverage; changes

in laws or regulations affecting Pilgrim’s Pride’s operations or

the application thereof; new immigration legislation or increased

enforcement efforts in connection with existing immigration

legislation that cause the costs of doing business to increase,

cause Pilgrim’s Pride to change the way in which it does business,

or otherwise disrupt its operations; competitive factors and

pricing pressures or the loss of one or more of Pilgrim’s Pride’s

largest customers; currency exchange rate fluctuations, trade

barriers, exchange controls, expropriation and other risks

associated with foreign operations; disruptions in international

markets and distribution channel, including anti-dumping

proceedings and countervailing duty proceedings; and the impact of

uncertainties of litigation as well as other risks described under

“Risk Factors” in the Company’s Annual Report on Form 10-K and

subsequent filings with the Securities and Exchange Commission.

Pilgrim’s Pride Corporation undertakes no obligation to update or

revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise.

| PILGRIM’S PRIDE CORPORATION |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| |

| |

|

September 24, 2017 |

|

December 25, 2016 |

| |

|

(Unaudited) |

|

|

| |

|

(In thousands) |

| Cash and cash

equivalents |

|

$ |

401,789 |

|

|

$ |

292,544 |

|

| Restricted cash |

|

4,841 |

|

|

4,979 |

|

| Trade accounts and

other receivables, less allowance for doubtful accounts |

|

624,802 |

|

|

445,553 |

|

| Accounts receivable

from related parties |

|

970 |

|

|

4,010 |

|

| Inventories |

|

1,196,201 |

|

|

975,608 |

|

| Income taxes

receivable |

|

16,362 |

|

|

— |

|

| Prepaid expenses and

other current assets |

|

102,914 |

|

|

81,932 |

|

| Assets held for

sale |

|

2,777 |

|

|

5,259 |

|

| Total

current assets |

|

2,350,656 |

|

|

1,809,885 |

|

| Other long-lived

assets |

|

20,007 |

|

|

19,260 |

|

| Identified intangible

assets, net |

|

620,693 |

|

|

471,591 |

|

| Goodwill |

|

995,582 |

|

|

887,221 |

|

| Property, plant and

equipment, net |

|

2,076,347 |

|

|

1,833,985 |

|

| Total

assets |

|

$ |

6,063,285 |

|

|

$ |

5,021,942 |

|

| |

|

|

|

|

| Accounts payable |

|

$ |

743,528 |

|

|

$ |

790,378 |

|

| Accounts payable to

related parties |

|

7,091 |

|

|

4,468 |

|

| Accrued expenses and

other current liabilities |

|

416,476 |

|

|

347,021 |

|

| Income taxes

payable |

|

191,432 |

|

|

27,578 |

|

| Current maturities of

long-term debt |

|

61,811 |

|

|

15,712 |

|

| Total

current liabilities |

|

1,420,338 |

|

|

1,185,157 |

|

| Long-term debt, less

current maturities |

|

2,548,575 |

|

|

1,396,124 |

|

| Deferred tax

liabilities |

|

286,038 |

|

|

251,807 |

|

| Other long-term

liabilities |

|

98,098 |

|

|

102,722 |

|

| Total

liabilities |

|

4,353,049 |

|

|

2,935,810 |

|

| Common stock |

|

2,602 |

|

|

307,288 |

|

| Treasury stock |

|

(231,758 |

) |

|

(217,117 |

) |

| Additional paid-in

capital |

|

1,926,386 |

|

|

3,100,332 |

|

| Retained earnings

(accumulated deficit) |

|

39,606 |

|

|

(782,785 |

) |

| Accumulated other

comprehensive loss |

|

(36,517 |

) |

|

(329,858 |

) |

| Total

Pilgrim’s Pride Corporation stockholders’ equity |

|

1,700,319 |

|

|

2,077,860 |

|

| Noncontrolling

interest |

|

9,917 |

|

|

8,272 |

|

| Total

stockholders’ equity |

|

1,710,236 |

|

|

2,086,132 |

|

| Total

liabilities and stockholders’ equity |

|

$ |

6,063,285 |

|

|

$ |

5,021,942 |

|

| PILGRIM’S PRIDE CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

|

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

| |

|

(In thousands, except per share

data) |

| Net sales |

|

$ |

2,793,885 |

|

|

$ |

2,495,281 |

|

|

$ |

8,025,511 |

|

|

$ |

7,507,681 |

|

| Cost of sales |

|

2,315,301 |

|

|

2,242,221 |

|

|

6,815,701 |

|

|

6,632,568 |

|

| Gross

profit |

|

478,584 |

|

|

253,060 |

|

|

1,209,810 |

|

|

875,113 |

|

| Selling, general and

administrative expense |

|

102,191 |

|

|

75,933 |

|

|

284,009 |

|

|

229,786 |

|

| Administrative

restructuring charges |

|

4,147 |

|

|

279 |

|

|

8,496 |

|

|

279 |

|

| Operating

income |

|

372,246 |

|

|

176,848 |

|

|

917,305 |

|

|

645,048 |

|

| Interest expense, net

of capitalized interest |

|

24,636 |

|

|

19,119 |

|

|

66,315 |

|

|

58,480 |

|

| Interest income |

|

(2,128 |

) |

|

(253 |

) |

|

(3,600 |

) |

|

(2,000 |

) |

| Foreign currency

transaction gain |

|

(888 |

) |

|

4,569 |

|

|

(2,500 |

) |

|

(1,769 |

) |

| Miscellaneous, net |

|

(1,083 |

) |

|

(2,371 |

) |

|

(5,198 |

) |

|

(7,327 |

) |

| Nonrecurring items |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Income

before income taxes |

|

351,709 |

|

|

155,784 |

|

|

862,288 |

|

|

597,664 |

|

| Income tax expense |

|

113,396 |

|

|

53,819 |

|

|

278,046 |

|

|

202,979 |

|

| Net

income |

|

238,313 |

|

|

101,965 |

|

|

584,242 |

|

|

394,685 |

|

| Less: Net income from

Granite Holdings Sàrl prior to acquisition by Pilgrim's

Pride Corporation |

|

6,093 |

|

|

3,438 |

|

|

23,486 |

|

|

25,105 |

|

| Less: Net income (loss)

attributable to noncontrolling interests |

|

(460 |

) |

|

(130 |

) |

|

514 |

|

|

(334 |

) |

| Net

income attributable to Pilgrim’s Pride Corporation |

|

$ |

232,680 |

|

|

$ |

98,657 |

|

|

$ |

560,242 |

|

|

$ |

369,914 |

|

| |

|

|

|

|

|

|

|

|

| Weighted

average shares of common stock outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

248,753 |

|

|

254,460 |

|

|

248,732 |

|

|

254,607 |

|

| Effect of

dilutive common stock equivalents |

|

235 |

|

|

460 |

|

|

230 |

|

|

430 |

|

|

Diluted |

|

248,988 |

|

|

254,920 |

|

|

248,962 |

|

|

255,037 |

|

| |

|

|

|

|

|

|

|

|

| Net income

attributable to Pilgrim's Pride Corporation per share

of common stock outstanding: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.94 |

|

|

$ |

0.39 |

|

|

$ |

2.25 |

|

|

$ |

1.45 |

|

|

Diluted |

|

$ |

0.93 |

|

|

$ |

0.39 |

|

|

$ |

2.25 |

|

|

$ |

1.45 |

|

| PILGRIM’S PRIDE CORPORATION AND

SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

| (Unaudited) |

| |

| |

|

Thirty-Nine Weeks Ended |

| |

|

September 24, 2017 |

|

September 25, 2016 |

| |

|

(In thousands) |

| Cash flows from

operating activities: |

|

|

|

|

| Net

income |

|

$ |

584,242 |

|

|

$ |

394,685 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

|

|

Depreciation and amortization |

|

204,625 |

|

|

174,128 |

|

| Foreign

currency transaction loss related to borrowing arrangements |

|

6,830 |

|

|

— |

|

|

Impairment expense |

|

4,947 |

|

|

— |

|

| Gain on

property disposals |

|

(540 |

) |

|

(7,315 |

) |

| Loss

(gain) on equity method investments |

|

(44 |

) |

|

194 |

|

|

Share-based compensation |

|

2,454 |

|

|

5,404 |

|

| Deferred

income tax expense (benefit) |

|

25,768 |

|

|

(6 |

) |

| Changes

in operating assets and liabilities: |

|

|

|

|

| Trade

accounts and other receivables |

|

(146,477 |

) |

|

(65,649 |

) |

|

Inventories |

|

(149,806 |

) |

|

(18,099 |

) |

| Prepaid

expenses and other current assets |

|

(15,377 |

) |

|

1,990 |

|

| Accounts

payable, accrued expenses and other current liabilities |

|

(36,105 |

) |

|

35,346 |

|

| Income

taxes |

|

149,063 |

|

|

45,789 |

|

| Long-term

pension and other postretirement obligations |

|

(9,660 |

) |

|

(8,294 |

) |

| Other

operating assets and liabilities |

|

(1,429 |

) |

|

(6,190 |

) |

| Cash provided by

operating activities |

|

618,491 |

|

|

551,983 |

|

| Cash flows from

investing activities: |

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

(258,364 |

) |

|

(221,035 |

) |

| Business

acquisition |

|

(658,520 |

) |

|

— |

|

| Proceeds

from property disposals |

|

2,585 |

|

|

12,977 |

|

| Cash used in investing

activities |

|

(914,299 |

) |

|

(208,058 |

) |

| Cash flows from

financing activities: |

|

|

|

|

| Proceeds

from note payable to bank |

|

— |

|

|

36,838 |

|

| Payments

on note payable to bank |

|

— |

|

|

(65,564 |

) |

| Proceeds

from revolving line of credit and long-term borrowings |

|

1,013,662 |

|

|

515,292 |

|

| Payments

on revolving line of credit, long-term borrowings and capital lease

obligations |

|

(609,678 |

) |

|

(504,078 |

) |

| Proceeds

from equity contribution under Tax Sharing Agreement between JBS

USA Food Company Holdings and Pilgrim's Pride Corporation |

|

5,038 |

|

|

3,691 |

|

| Payment

of capitalized loan costs |

|

(4,550 |

) |

|

(693 |

) |

| Purchase

of common stock under share repurchase program |

|

(14,641 |

) |

|

(20,333 |

) |

| Cash

dividends |

|

— |

|

|

(715,711 |

) |

| Cash provided by (used

in) financing activities |

|

389,831 |

|

|

(743,379 |

) |

| Increase (decrease) in

cash, cash equivalents and restricted cash |

|

109,107 |

|

|

(428,391 |

) |

| Cash, cash equivalents

and restricted cash, beginning of period |

|

297,523 |

|

|

696,553 |

|

| Cash, cash equivalents

and restricted cash, end of period |

|

$ |

406,630 |

|

|

$ |

268,162 |

|

PILGRIM’S PRIDE

CORPORATIONSelected Financial

Information(Unaudited)

“EBITDA” is defined as the sum of net income

(loss) plus interest, taxes, depreciation and amortization.

“Adjusted EBITDA” is calculated by adding to EBITDA certain items

of expense and deducting from EBITDA certain items of income that

we believe are not indicative of our ongoing operating performance

consisting of: (i) income (loss) attributable to non-controlling

interests, (ii) restructuring charges, (iii) reorganization items,

(iv) losses on early extinguishment of debt and (v) foreign

currency transaction losses (gains). EBITDA is presented because it

is used by management and we believe it is frequently used by

securities analysts, investors and other interested parties, in

addition to and not in lieu of results prepared in conformity with

accounting principles generally accepted in the US (“GAAP”), to

compare the performance of companies. We believe investors

would be interested in our Adjusted EBITDA because this is how our

management analyzes EBITDA. The Company also believes that

Adjusted EBITDA, in combination with the Company’s financial

results calculated in accordance with GAAP, provides investors with

additional perspective regarding the impact of certain significant

items on EBITDA and facilitates a more direct comparison of its

performance with its competitors. EBITDA and Adjusted EBITDA

are not measurements of financial performance under GAAP.

They should not be considered as an alternative to cash flow from

operating activities or as a measure of liquidity or an alternative

to net income as indicators of our operating performance or any

other measures of performance derived in accordance with GAAP.

| PILGRIM'S PRIDE CORPORATION |

| Reconciliation of Adjusted

EBITDA |

| |

|

|

|

|

|

|

|

|

(Unaudited) |

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

| |

(In thousands) |

| Net income |

$ |

238,313 |

|

|

$ |

101,965 |

|

|

$ |

584,242 |

|

|

$ |

394,685 |

|

| Add: |

|

|

|

|

|

|

|

| Interest expense,

net |

22,508 |

|

|

18,866 |

|

|

62,715 |

|

|

56,480 |

|

| Income tax expense |

113,396 |

|

|

53,819 |

|

|

278,046 |

|

|

202,979 |

|

| Depreciation and

amortization |

71,763 |

|

|

58,718 |

|

|

204,625 |

|

|

174,128 |

|

| Minus: |

|

|

|

|

|

|

|

| Amortization of

capitalized financing costs |

1,181 |

|

|

970 |

|

|

3,129 |

|

|

2,859 |

|

| EBITDA |

444,799 |

|

|

232,398 |

|

|

1,126,499 |

|

|

825,413 |

|

| Add: |

|

|

|

|

|

|

|

| Foreign currency

transaction loss (gains) |

(888 |

) |

|

4,569 |

|

|

(2,500 |

) |

|

(1,769 |

) |

| Acquisition

charges |

15,039 |

|

|

— |

|

|

15,039 |

|

|

— |

|

| Restructuring

charges |

4,147 |

|

|

279 |

|

|

8,496 |

|

|

279 |

|

| Minus: |

|

|

|

|

|

|

|

| Net income

(loss) attributable to noncontrolling interest |

(460 |

) |

|

(130 |

) |

|

514 |

|

|

(334 |

) |

| Adjusted EBITDA |

$ |

463,557 |

|

|

$ |

237,376 |

|

|

$ |

1,147,020 |

|

|

$ |

824,257 |

|

EBITDA margins have been calculated by taking the relevant

unaudited EBITDA figures, then dividing by Net Revenue for the

applicable period.

| PILGRIM'S PRIDE CORPORATION |

| Reconciliation of EBITDA Margin |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

|

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

| |

|

(In thousands) |

| Net income from

continuing operations |

|

$ |

238,313 |

|

|

$ |

101,965 |

|

|

$ |

584,242 |

|

|

$ |

394,685 |

|

|

8.53 |

% |

|

4.09 |

% |

|

7.28 |

% |

|

5.26 |

% |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense,

net |

|

22,508 |

|

|

18,866 |

|

|

62,715 |

|

|

56,480 |

|

|

0.81 |

% |

|

0.76 |

% |

|

0.78 |

% |

|

0.75 |

% |

| Income tax expense |

|

113,396 |

|

|

53,819 |

|

|

278,046 |

|

|

202,979 |

|

|

4.06 |

% |

|

2.16 |

% |

|

3.46 |

% |

|

2.70 |

% |

| Depreciation and

amortization |

|

71,763 |

|

|

58,718 |

|

|

204,625 |

|

|

174,128 |

|

|

2.57 |

% |

|

2.35 |

% |

|

2.55 |

% |

|

2.32 |

% |

| Minus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of

capitalized financing costs |

|

1,181 |

|

|

970 |

|

|

3,129 |

|

|

2,859 |

|

|

0.04 |

% |

|

0.04 |

% |

|

0.04 |

% |

|

0.04 |

% |

| EBITDA |

|

444,799 |

|

|

232,398 |

|

|

1,126,499 |

|

|

825,413 |

|

|

15.92 |

% |

|

9.32 |

% |

|

14.03 |

% |

|

10.99 |

% |

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency

transaction gains |

|

(888 |

) |

|

4,569 |

|

|

(2,500 |

) |

|

(1,769 |

) |

|

(0.03 |

)% |

|

0.18 |

% |

|

(0.03 |

)% |

|

(0.02 |

)% |

| Acquisition

charges |

|

15,039 |

|

|

— |

|

|

15,039 |

|

|

— |

|

|

0.54 |

% |

|

— |

% |

|

0.19 |

% |

|

— |

% |

| Restructuring

charges |

|

4,147 |

|

|

279 |

|

|

8,496 |

|

|

279 |

|

|

0.15 |

% |

|

0.01 |

% |

|

0.11 |

% |

|

— |

% |

| Minus: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) attributable to noncontrolling interest |

|

(460 |

) |

|

(130 |

) |

|

514 |

|

|

(334 |

) |

|

(0.02 |

)% |

|

(0.01 |

)% |

|

0.01 |

% |

|

— |

% |

| Adjusted EBITDA |

|

$ |

463,557 |

|

|

$ |

237,376 |

|

|

$ |

1,147,020 |

|

|

$ |

824,257 |

|

|

16.59 |

% |

|

9.52 |

% |

|

14.28 |

% |

|

10.98 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Revenue: |

|

$ |

2,793,885 |

|

|

$ |

2,495,281 |

|

|

$ |

8,025,511 |

|

|

$ |

7,507,681 |

|

|

$ |

2,793,885 |

|

|

$ |

2,495,281 |

|

|

$ |

8,025,511 |

|

|

$ |

7,507,681 |

|

A reconciliation of net income (loss)

attributable to Pilgrim's Pride Corporation per common diluted

share to adjusted net income (loss) attributable to Pilgrim's Pride

Corporation per common diluted share is as follows:

| PILGRIM'S PRIDE CORPORATION |

| Reconciliation of Adjusted

Earnings |

| (Unaudited) |

| |

| |

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

|

September 24, 2017 |

|

September 25,

2016 |

|

September 24,

2017 |

|

September 25,

2016 |

| |

|

(In thousands, except per share

data) |

| Net income attributable

to Pilgrim's Pride Corporation |

|

$ |

232,680 |

|

|

$ |

98,657 |

|

|

$ |

560,242 |

|

|

$ |

369,914 |

|

| Loss on early

extinguishment of debt |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Acquisition and

restructuring charges, net of taxes |

|

12,988 |

|

|

— |

|

|

15,980 |

|

|

— |

|

| Foreign currency

transaction gains |

|

(888 |

) |

|

4,569 |

|

|

(2,500 |

) |

|

(1,769 |

) |

| Income before loss on

early extinguishment of debt and foreign currency transaction

gains |

|

244,780 |

|

|

103,226 |

|

|

573,722 |

|

|

368,145 |

|

| Weighted average

diluted shares of common stock outstanding |

|

248,988 |

|

|

254,920 |

|

|

248,962 |

|

|

255,037 |

|

| Income before loss on

early extinguishment of debt and foreign currency transaction

gains per common diluted share |

|

$ |

0.98 |

|

|

$ |

0.41 |

|

|

$ |

2.30 |

|

|

$ |

1.44 |

|

A reconciliation of GAAP earnings per share

(EPS) to adjusted earnings per share (EPS) is as follows:

| PILGRIM'S PRIDE CORPORATION |

| Reconciliation of GAAP EPS to Adjusted

EPS |

| (Unaudited) |

| |

|

|

|

|

|

|

|

| |

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

| |

(In thousands, except per share

data) |

| GAAP EPS |

$ |

0.93 |

|

|

$ |

0.39 |

|

|

$ |

2.25 |

|

|

$ |

1.45 |

|

| Loss on early

extinguishment of debt |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Acquisition and

restructuring charges, net of taxes |

0.05 |

|

|

— |

|

|

0.06 |

|

|

— |

|

| Foreign currency

transaction gains |

— |

|

|

0.02 |

|

|

(0.01 |

) |

|

(0.01 |

) |

| Adjusted EPS |

$ |

0.98 |

|

|

$ |

0.41 |

|

|

$ |

2.30 |

|

|

$ |

1.44 |

|

| |

|

|

|

|

|

|

|

| Weighted average

diluted shares of common stock outstanding |

248,988 |

|

|

254,920 |

|

|

248,962 |

|

|

255,037 |

|

| PILGRIM'S PRIDE CORPORATION |

| Supplementary Selected Segment and Geographic

Data |

| |

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Thirty-Nine Weeks Ended |

| |

|

September 24, 2017 |

|

September 25, 2016 |

|

September 24, 2017 |

|

September 25, 2016 |

| |

|

(Unaudited) |

|

|

|

|

|

|

| |

|

(In thousands) |

| Sources of net sales by

country of origin: |

|

|

|

|

|

|

|

|

| US: |

|

$ |

1,938,542 |

|

|

$ |

1,724,625 |

|

|

$ |

5,557,089 |

|

|

$ |

5,072,351 |

|

| Mexico: |

|

341,018 |

|

|

307,096 |

|

|

994,568 |

|

|

950,622 |

|

| Europe: |

|

514,325 |

|

|

463,560 |

|

|

1,473,854 |

|

|

1,484,708 |

|

| Total net sales: |

|

$ |

2,793,885 |

|

|

$ |

2,495,281 |

|

|

$ |

8,025,511 |

|

|

$ |

7,507,681 |

|

| |

|

|

|

|

|

|

|

|

| Sources of cost of

sales by country of origin: |

|

|

|

|

|

|

|

|

| US: |

|

$ |

1,561,333 |

|

|

$ |

1,545,289 |

|

|

$ |

4,656,825 |

|

|

$ |

4,470,648 |

|

| Mexico: |

|

286,617 |

|

|

276,366 |

|

|

822,822 |

|

|

818,749 |

|

| Europe: |

|

467,374 |

|

|

420,590 |

|

|

1,336,123 |

|

|

1,343,242 |

|

| Elimination: |

|

(23 |

) |

|

(24 |

) |

|

(69 |

) |

|

(71 |

) |

| Total cost of

sales: |

|

$ |

2,315,301 |

|

|

$ |

2,242,221 |

|

|

$ |

6,815,701 |

|

|

$ |

6,632,568 |

|

| |

|

|

|

|

|

|

|

|

| Sources of gross profit

by country of origin: |

|

|

|

|

|

|

|

|

| US: |

|

$ |

377,209 |

|

|

$ |

179,336 |

|

|

$ |

900,262 |

|

|

$ |

601,703 |

|

| Mexico: |

|

54,401 |

|

|

30,730 |

|

|

171,745 |

|

|

131,874 |

|

| Europe: |

|

46,951 |

|

|

42,970 |

|

|

137,734 |

|

|

141,466 |

|

| Elimination: |

|

23 |

|

|

24 |

|

|

69 |

|

|

70 |

|

| Total gross

profit: |

|

$ |

478,584 |

|

|

$ |

253,060 |

|

|

$ |

1,209,810 |

|

|

$ |

875,113 |

|

| |

|

|

|

|

|

|

|

|

| Sources of operating

income by country of origin: |

|

|

|

|

|

|

|

|

| US: |

|

$ |

307,962 |

|

|

$ |

141,195 |

|

|

$ |

719,121 |

|

|

$ |

480,280 |

|

| Mexico: |

|

45,692 |

|

|

22,603 |

|

|

146,241 |

|

|

108,856 |

|

| Europe: |

|

18,569 |

|

|

13,027 |

|

|

51,874 |

|

|

55,841 |

|

| Elimination: |

|

23 |

|

|

23 |

|

|

69 |

|

|

71 |

|

| Total operating

income: |

|

$ |

372,246 |

|

|

$ |

176,848 |

|

|

$ |

917,305 |

|

|

$ |

645,048 |

|

Contact:

Dunham WinotoDirector, Investor

RelationsIRPPC@pilgrims.com (970)

506-8192www.pilgrims.com

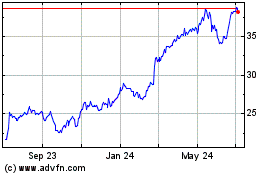

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pilgrims Pride (NASDAQ:PPC)

Historical Stock Chart

From Apr 2023 to Apr 2024