Snap Inc. (NYSE: SNAP) today announced financial results for the

quarter ended September 30, 2017.

Third Quarter 2017 Financial Highlights:

Three Months Ended Nine

Months Ended September 30, Percent September

30, Percent 2017 2016 Change

2017 2016 Change (dollars in

thousands) (dollars in thousands) (Unaudited)

(NM =

Not Meaningful) (NM = Not Meaningful) Revenue $

207,937 $ 128,204 62 % $ 539,256 $ 238,800 126 % Net loss(1) $

(443,159 ) $ (124,228 ) NM $ (3,095,089 ) $ (344,698 ) NM Adjusted

EBITDA(2) $ (178,901 ) $ (108,604 ) 65 % $ (561,134 ) $ (306,959 )

83 %

Other Financial Highlights Cash, cash

equivalents, and marketable securities $ 2,298,068 Cash used in

operating activities $ (194,013 ) $ (216,866 ) $ (558,584 ) $

(443,517 ) Free Cash Flow(3) $ (219,961 ) $ (234,058 ) $ (621,890 )

$ (489,582 ) Capital expenditures $ (25,948 ) $ (17,192 ) $ (63,306

) $ (46,065 ) (1) Net loss for the nine months ended

September 30, 2017 includes $2.5 billion of stock-based

compensation expense, primarily due to the recognition of expense

related to RSUs with a performance condition satisfied on the

effectiveness of the registration statement for our initial public

offering. (2) Adjusted EBITDA is defined as net income (loss),

excluding interest income; interest expense; other income (expense)

net; income tax benefit (expense); depreciation and amortization;

stock-based compensation expense and related payroll tax expense;

and certain other non-cash or non-recurring items impacting net

income (loss) from time to time, as described below. (3) Free Cash

Flow is defined as net cash used in operating activities, reduced

by purchases of property and equipment.

Note: For adjustments and additional information regarding the

non-GAAP financial measures discussed, please see “Non-GAAP

Financial Measures” and “Reconciliation of GAAP to Non-GAAP

Financial Measures” below.

Operational Highlights

- Daily active users (DAU)(1) – DAUs grew

from 153 million in Q3 2016 to 178 million in Q3 2017, an increase

of 25.2 million or 17% year-over-year. DAUs increased 4.5 million

or 3% quarter-over-quarter, from 173 million in Q2 2017.

- Average revenue per user (ARPU)(2) –

ARPU was $1.17 in Q3 2017, an increase of 39% over Q3 2016 when

ARPU was $0.84. ARPU increased 12% over Q2 2017 when ARPU was

$1.05.

- Hosting costs per DAU – Hosting costs

per DAU were $0.68 in Q3 2017, as compared to $0.64 in Q3 2016 and

$0.61 in Q2 2017.

- Capital expenditures – Capital

expenditures were $25.9 million in Q3 2017, as compared to $17.2

million in Q3 2016 and $19.4 million in Q2 2017.

- Excess inventory and related charges –

In Q3 2017, we recorded $39.9 million of charges related to

Spectacles inventory, primarily related to excess inventory

reserves and inventory purchase commitment cancellation

charges.

(1) We define a Daily Active User, or DAU, as a registered

Snapchat user who opens the Snapchat application at least once

during a defined 24-hour period. We measure average Daily Active

Users for a particular quarter by calculating the average Daily

Active Users for that quarter. (2) We define ARPU as quarterly

revenue divided by the average Daily Active Users.

CONFERENCE CALL INFORMATION

Snap Inc. will host a conference call to discuss the results at

2:00 p.m. Pacific / 5:00 p.m. Eastern today. The live audio webcast

along with supplemental information will be accessible at

investor.snap.com. A recording of the webcast will also be

available following the conference call.

Snap Inc. uses the investor.snap.com and snap.com/news websites

as means of disclosing material non-public information and for

complying with its disclosure obligation under Regulation FD.

Forward-Looking Statements

This press release contains “forward-looking” statements that

are based on our management’s beliefs and assumptions and on

information currently available to management. Forward-looking

statements include statements about expected financial metrics,

such as revenue, non-GAAP Adjusted EBITDA, capital expenditures,

and stock-based compensation, as well as non-financial metrics,

such as DAU and video views. They also include statements about our

possible or assumed business strategies, potential growth

opportunities, new products, and potential market

opportunities.

Forward-looking statements include all statements that are not

historical facts and can be identified by terms such as “believes,”

“continue,” “could,” “potential,” “remain,” “will,” “would” or

similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks,

uncertainties and other factors that may cause our actual results,

performance or achievements to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. These risks include, but are not

limited to, risks and uncertainties related to: our limited

operating history, our lack of significant revenue to date, our

ability to monetize our products, the highly competitive and

rapidly changing market for internet and advertising companies,

infrastructure costs, our ability to create new and innovative

products, our ability to manage any future user growth, and our

international expansion strategies. Additional risks and

uncertainties that could affect our financial results are included

in the section titled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in

the final prospectus for our initial public offering, dated March

1, 2017, which is available on the SEC’s website at www.sec.gov.

Additional information will be made available in Snap Inc.’s

quarterly report on Form 10-Q and other filings that we make from

time to time with the SEC. In addition, any forward-looking

statements contained in this press release are based on assumptions

that we believe to be reasonable as of this date. Except as

required by law, we assume no obligation to update these

forward-looking statements, or to update the reasons if actual

results differ materially from those anticipated in the

forward-looking statements.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we use certain

non-GAAP financial measures, as described below, to understand and

evaluate our core operating performance. These non-GAAP financial

measures, which may be different than similarly titled measures

used by other companies, are presented to enhance investors’

overall understanding of our financial performance and should not

be considered a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

We use the non-GAAP financial measure of Adjusted EBITDA, which

is defined as net income (loss); excluding interest income;

interest expense; other income (expense), net; income tax benefit

(expense); depreciation and amortization; stock-based compensation

expense and related payroll tax expense; and certain other non-cash

or non-recurring items impacting net income (loss) from time to

time, as described below. We believe that Adjusted EBITDA helps

identify underlying trends in our business that could otherwise be

masked by the effect of the expenses that we exclude in Adjusted

EBITDA.

We use the non-GAAP financial measure of Free Cash Flow, which

is defined as net cash used in operating activities, reduced by

purchases of property and equipment. We believe Free Cash Flow is

an important liquidity measure of the cash that is available, after

capital expenditures, for operational expenses and investment in

our business and is a key financial indicator used by management.

Additionally, we believe that Free Cash Flow is an important

measure since we use third-party infrastructure partners to host

our services and therefore we do not incur significant capital

expenditures to support revenue generating activities. Free Cash

Flow is useful to investors as a liquidity measure because it

measures our ability to generate or use cash. Once our business

needs and obligations are met, cash can be used to maintain a

strong balance sheet and invest in future growth.

We use the non-GAAP financial measure of Non-GAAP Net Loss,

which is defined as net income (loss); excluding amortization of

intangible assets; stock-based compensation expense and related

payroll tax expense; certain other non-cash or non-recurring items

impacting net income (loss) from time to time; and related income

tax adjustments. Non-GAAP Net Loss and weighted average diluted

shares are then used to calculate Non-GAAP diluted net loss per

share. Similar to Adjusted EBITDA, we believe these measures help

identify underlying trends in our business that could otherwise be

masked by the effect of the expenses we exclude in the measure.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and future prospects, and

allow for greater transparency with respect to key metrics used by

our management for financial and operational decision-making. We

are presenting these non-GAAP measures to assist investors in

seeing our financial performance through the eyes of management,

and because we believe that these measures provide an additional

tool for investors to use in comparing our core financial

performance over multiple periods with other companies in our

industry.

For a reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measure, please see

“Reconciliation of GAAP to Non-GAAP Financial Measures” below.

Snap Inc., “Snapchat,” and our other registered and common law

trade names, trademarks, and service marks are the property of Snap

Inc. or our subsidiaries.

SNAP INC. CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share amounts,

unaudited)

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Revenue $ 207,937

$ 128,204 $ 539,256 $ 238,800 Costs and expenses: Cost of revenue

210,710 127,780 526,216 298,310 Research and development 239,442

54,562 1,301,025 118,712 Sales and marketing 101,511 34,658 412,147

73,982 General and administrative 118,101

42,172 1,424,480 98,444 Total

costs and expenses 669,764 259,172

3,663,868 589,448 Loss from operations

(461,827 ) (130,968 ) (3,124,612 ) (350,648 ) Interest income 6,253

1,938 15,026 3,168 Interest expense (887 ) (648 ) (2,580 ) (648 )

Other income (expense), net 1,002 (1,421 )

1,975 (3,353 ) Loss before income taxes

(455,459 ) (131,099 ) (3,110,191 ) (351,481 ) Income tax benefit

(expense) 12,300 6,871 15,102

6,783 Net loss $ (443,159 ) $ (124,228 ) $

(3,095,089 ) $ (344,698 ) Net loss per share attributable to Class

A, Class B, and Class C common stockholders: Basic $ (0.36 ) $

(0.15 ) $ (2.71 ) $ (0.43 ) Diluted $ (0.36 ) $ (0.15 ) $ (2.71 ) $

(0.43 )

SNAP INC. CONSOLIDATED BALANCE

SHEETS

(In thousands, except per share

amounts)

September 30, December 31,

2017 2016 (Unaudited) Assets Current

assets Cash and cash equivalents $ 317,554 $ 150,121 Marketable

securities 1,980,514 837,247 Accounts receivable, net of allowance

194,971 162,659 Prepaid expenses and other current assets

54,692 29,958 Total current assets 2,547,731

1,179,985 Property and equipment, net 143,112 100,585 Intangible

assets, net 164,612 75,982 Goodwill 612,823 319,137 Other assets

74,102 47,103 Total assets $ 3,542,380

$ 1,722,792

Liabilities and Stockholders’

Equity Current liabilities Accounts payable $ 15,207 $ 8,419

Accrued expenses and other current liabilities 280,957

148,325 Total current liabilities 296,164

156,744 Other liabilities 70,946 47,134

Total liabilities 367,110 203,878

Commitments and contingencies Stockholders’ equity Convertible

voting preferred stock, Series A, A-1, and B, $0.00001 par value.

No shares and 146,962 shares authorized, issued, and outstanding at

September 30, 2017 and December 31, 2016, respectively. Liquidation

preference of $95,175 at December 31, 2016. — 1 Convertible

non-voting preferred stock, Series C, $0.00001 par value. No shares

and 16,000 shares authorized, issued, and outstanding at September

30, 2017 and December 31, 2016, respectively. Liquidation

preference of $54,543 at December 31, 2016. — — Convertible

non-voting preferred stock, Series D, E, and F, $0.00001 par value.

No shares and 83,851 shares authorized, issued, and outstanding at

September 30, 2017 and December 31, 2016, respectively. — 2 Series

FP convertible voting preferred stock, $0.00001 par value. No

shares and 260,888 shares authorized at September 30, 2017 and

December 31, 2016, respectively. No shares and 215,888 shares

issued and outstanding at September 30, 2017 and December 31, 2016,

respectively. — 2 Class A non-voting common stock, $0.00001 par

value. 3,000,000 shares authorized, 858,546 shares issued and

outstanding at September 30, 2017, and 1,500,000 shares authorized,

504,902 shares issued and outstanding at December 31, 2016. 9 5

Class B voting common stock, $0.00001 par value. 700,000 shares

authorized, 127,302 shares issued and outstanding at September 30,

2017, and 1,500,000 shares authorized, 31,469 shares issued and

outstanding at December 31, 2016. 1 — Class C voting common stock,

$0.00001 par value. 260,888 shares authorized, 215,888 shares

issued and outstanding at September 30, 2017, and 260,888 shares

authorized and no shares issued and outstanding at December 31,

2016. 2 — Additional paid-in capital 7,470,272 2,728,823

Accumulated other comprehensive income (loss) 11,682 (2,057 )

Accumulated deficit

(4,306,696

)

(1,207,862 ) Total stockholders’ equity 3,175,270

1,518,914 Total liabilities and stockholders’

equity $ 3,542,380 $ 1,722,792

SNAP

INC. CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands, unaudited)

Nine Months Ended September 30,

2017 2016 Cash flows from operating

activities Net loss $ (3,095,089 ) $ (344,698 ) Adjustments to

reconcile net loss to net cash used in operating activities:

Depreciation and amortization 42,502 18,482 Stock-based

compensation 2,458,851 25,075 Deferred income taxes (14,397 )

(7,231 ) Excess inventory reserve and related asset impairment

21,997 — Other (3,714 ) (360 ) Change in operating assets and

liabilities, net of effect of acquisitions: Accounts receivable,

net of allowance (24,513 ) (78,488 ) Prepaid expenses and other

current assets (48,965 ) (14,926 ) Other assets (8,545 ) 450

Accounts payable 4,103 1,656 Accrued expenses and other current

liabilities 103,449 (45,475 ) Other liabilities 5,737

1,998 Net cash used in operating activities

(558,584 ) (443,517 )

Cash flows from investing

activities Purchases of property and equipment (63,306 )

(46,065 ) Purchases of intangible assets (8,025 ) (572 )

Non-marketable investments (7,530 ) (5,703 ) Cash paid for

acquisitions, net of cash acquired (352,407 ) (68,096 ) Issuance of

notes receivable from officers/stockholders — (15,000 ) Repayment

of notes receivables from officers/stockholders — 15,000 Purchases

of marketable securities (3,412,776 ) (1,358,295 ) Sales of

marketable securities 441,089 164,003 Maturities of marketable

securities 1,831,327 180,805 Change in restricted cash 9,899

(7,048 ) Net cash used in investing activities

(1,561,729 ) (1,140,971 )

Cash flows from financing

activities Proceeds from the exercise of stock options 6,855

576 Stock repurchases from employees for tax withholdings (367,234

) — Proceeds from issuance of Class A common stock in initial

public offering, net of underwriting commissions 2,657,797 —

Repurchase of Class B voting common stock and Series FP voting

preferred stock — (10,593 ) Proceeds from issuances of preferred

stock, net of issuance costs — 1,157,147 Borrowings from revolving

credit facility — 5,000 Principal payments on revolving credit

facility — (5,000 ) Payments of initial public offering issuance

costs (9,672 ) — Net cash provided by

financing activities 2,287,746 1,147,130

Change in cash and cash equivalents 167,433 (437,358 ) Cash

and cash equivalents, beginning of period 150,121

640,810 Cash and cash equivalents, end of period $

317,554 $ 203,452

Supplemental disclosures

Cash paid for income taxes $ 5,437 $ 4

Supplemental disclosures

of non-cash activities Issuance of Class B common stock related

to acquisitions $ — $ 96,145 Assumed equity awards in acquisitions

$ 3,911 $ — Purchase consideration liabilities related to

acquisitions $ 11,772 $ 17,042 Repurchase of Class B voting common

stock and Series FP voting preferred stock in exchange for notes

receivable from officers/stockholders $ — $ 13,500 Construction in

progress related to financing lease obligations $ 1,107 $ 1,024 Net

change in accounts payable and accrued expenses and other current

liabilities related to property and equipment additions $ (4,155 )

$ 2,395

SNAP INC. RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(In thousands, unaudited)

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Adjusted

EBITDA reconciliation: Net loss $ (443,159 ) $ (124,228 ) $

(3,095,089 ) $ (344,698 ) Add (deduct): Interest income (6,253 )

(1,938 ) (15,026 ) (3,168 ) Interest expense 887 648 2,580 648

Other (income) expense, net (1,002 ) 1,421 (1,975 ) 3,353 Income

tax (benefit) expense (12,300 ) (6,871 ) (15,102 ) (6,783 )

Depreciation and amortization(1) 17,467 7,437 42,502 18,482

Stock-based compensation expense(2) 221,702 14,795 2,458,851 25,075

Payroll tax expense related to stock-based compensation 3,890 132

22,258 132 Spectacles inventory-related charges(3) 39,867

— 39,867 —

Adjusted EBITDA $ (178,901 ) $ (108,604 ) $ (561,134 ) $ (306,959 )

(1) Total depreciation and amortization expense by function:

Three Months Ended Nine Months Ended

September 30, September 30, 2017

2016 2017 2016 Depreciation and

amortization expense: Cost of revenue $ 5,404 $ 778 $ 10,043 $ 947

Research and development 6,401 4,623 18,139 12,398 Sales and

marketing 2,820 394 7,009 780 General and administrative

2,842 1,642 7,311 4,357 Total $ 17,467 $ 7,437

$ 42,502 $ 18,482

(2) Total stock-based compensation and related payroll tax

expense by function:

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Stock-based

compensation and related payroll tax expense: Cost of revenue $

2,039 $ 128 $ 24,288 $ 410 Research and development 146,531 12,143

1,032,508 17,491 Sales and marketing 27,968 1,262 209,468 2,590

General and administrative 49,054 1,394

1,214,845 4,716 Total $ 225,592 $ 14,927 $ 2,481,109 $

25,207

(3) Spectacles inventory-related charges were primarily related

to excess inventory reserves and inventory purchase commitment

cancellation charges. These charges are non-recurring and not

reflective of underlying trends in our business.

SNAP INC. RECONCILIATION OF GAAP TO NON-GAAP

FINANCIAL MEASURES (continued)

(In thousands, except per share amounts,

unaudited)

Three Months Ended Nine Months

Ended September 30, September 30, 2017

2016 2017 2016 Free Cash Flow

reconciliation: Net cash used in operating activities $

(194,013 ) $ (216,866 ) $ (558,584 ) $ (443,517 ) Less: Purchases

of property and equipment (25,948 ) (17,192 )

(63,306 ) (46,065 ) Free Cash Flow $ (219,961 ) $ (234,058 )

$ (621,890 ) $ (489,582 )

Three Months

Ended Nine Months Ended September 30,

September 30, 2017 2016 2017

2016 Non-GAAP Net Loss reconciliation: Net

loss $ (443,159 ) $ (124,228 ) $ (3,095,089 ) $ (344,698 )

Amortization of intangible assets 9,743 4,467 20,947 11,379

Stock-based compensation expense 221,702 14,795 2,458,851 25,075

Payroll tax expense related to stock-based compensation 3,890 132

22,258 132 Spectacles inventory-related charges 39,867 — 39,867 —

Income tax adjustments (123 ) — (2,313

) — Non-GAAP net loss $ (168,080 ) (104,834 )

(555,479 ) (308,112 ) Weighted-average common

shares - Diluted 1,232,993 832,401 1,140,004 798,660

Non-GAAP Diluted Net Loss Per Share reconciliation: Diluted

net loss per share $ (0.36 ) $ (0.15 ) $ (2.71 ) $ (0.43 ) Non-GAAP

adjustment to net loss 0.22 0.02

2.22 0.04 Non-GAAP diluted net loss per share

$ (0.14 ) $ (0.13 ) $ (0.49 ) $ (0.39 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171107006708/en/

Snap Inc.Investors and

Analysts:ir@snap.comorPress:press@snap.com

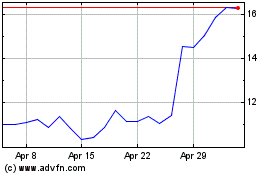

Snap (NYSE:SNAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Snap (NYSE:SNAP)

Historical Stock Chart

From Apr 2023 to Apr 2024