Williams Partners Responds to Temporary Administrative Stay of Atlantic Sunrise FERC Authorization

November 07 2017 - 11:08AM

Business Wire

- Williams Files Motion for Clarification

of the administrative stay to confirm no interruption of East Coast

natural gas supplies

- U.S. Court of Appeals Order: “The

purpose of this administrative stay is to give the court sufficient

opportunity to consider the emergency motion for stay and should

not be construed in any way as a ruling on the merits of that

motion.”

- Temporary stay a result of a lawsuit

against the FERC for not further extending a comprehensive

four-year permitting process

- Stay puts 8,000 jobs at risk in

Pennsylvania and could delay clean, affordable natural gas

deliveries to millions of U.S. families

Williams Partners L.P. (NYSE: WPZ) today filed a Motion for

Clarification of an administrative stay issued yesterday by the

U.S. Court of Appeals for the District of Columbia Circuit of the

Federal Energy Regulatory Commissions’ authorization of the

company’s Atlantic Sunrise natural gas pipeline project. The

purpose of the administrative stay is to give the court sufficient

opportunity to consider an emergency motion filed by project

opponents last week requesting FERC extend a comprehensive

four-year permitting process even further.

“Atlantic Sunrise has undergone a nearly four-year, extensive

review process and is operating and being constructed in compliance

with all state and federal permits,” said Micheal Dunn, Williams

Partners’ chief operating officer. “These current actions by

opponents of American energy are, this morning, idling thousands of

workers in Pennsylvania and could delay the benefits of low-cost

energy delivery to millions of American families.”

Dunn continued: “It is important to stress that this temporary

stay is administrative and not related to the project’s execution

or its compliance with applicable federal or state regulations or

permit conditions. It is merely intended to give the court

sufficient opportunity to consider the motion recently filed by

project opponents and is not a ruling on the merits of that motion.

Our expectation is that the court will expeditiously complete its

review.

“We have worked with countless elected officials, regulators,

environmental consultants and landowners to bring this vital U.S.

energy project to construction, and a vast majority of stakeholders

understand how critical these types of projects are to economic

growth, jobs and manufacturing expansion in addition to helping the

U.S. transition away from the use of higher carbon fuels.”

Atlantic Sunrise pipeline construction broke ground in

Pennsylvania on Sept. 15, 2017. While the company has ceased

construction activities until the temporary stay is lifted, the

company believes it is prudent and will continue to maintain

environmental controls related to construction to remain in

compliance with Federal and Pennsylvania permits, while protecting

the environment.

During peak construction periods, the project is anticipated to

directly employ approximately 2,300 people in 10 Pennsylvania

counties. In addition, the project could support an additional

6,000 jobs in related industries and generate up to $1.6 billion in

economic activity, according to researchers at Pennsylvania State

University.

The nearly $3 billion project, which is designed to increase

natural gas deliveries by 1.7 billion cubic feet per day, is

expected to be placed into full service in mid-2018.

Additional information about the Atlantic Sunrise project can be

found at www.williams.com/atlanticsunrise.

About Williams & Williams Partners

Williams (NYSE: WMB) is a premier provider of large-scale

infrastructure connecting U.S. natural gas and natural gas products

to growing demand for cleaner fuel and feedstocks. Headquartered in

Tulsa, Okla., Williams owns approximately 74 percent of Williams

Partners L.P. (NYSE: WPZ). Williams Partners is an

industry-leading, large-cap master limited partnership with

operations across the natural gas value chain including gathering,

processing and interstate transportation of natural gas and natural

gas liquids. With major positions in top U.S. supply basins,

Williams Partners owns and operates more than 33,000 miles of

pipelines system wide – including the nation’s largest volume and

fastest growing pipeline – providing natural gas for clean-power

generation, heating and industrial use. Williams Partners’

operations touch approximately 30 percent of U.S. natural gas.

www.williams.com

Portions of this document may constitute “forward-looking

statements” as defined by federal law. Although the company

believes any such statements are based on reasonable assumptions,

there is no assurance that actual outcomes will not be materially

different. Any such statements are made in reliance on the “safe

harbor” protections provided under the Private Securities Reform

Act of 1995. Additional information about issues that could lead to

material changes in performance is contained in the company’s

annual and quarterly reports filed with the Securities and Exchange

Commission.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171107006231/en/

Williams PartnersMedia Contact:Christopher Stockton,

713-215-2010orInvestor Contact:Brett Krieg, 918-573-4614

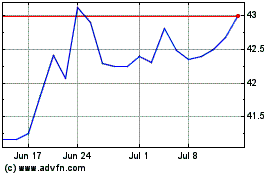

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

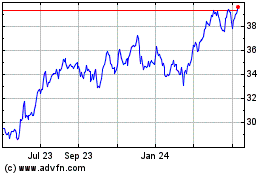

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Apr 2023 to Apr 2024