By Paul Page

Sign up: With one click, get this newsletter delivered to your

inbox.

The world's big grain processing companies are having a hard

time digesting the global glut in agriculture commodities. Grain

trading and processing giants Archer Daniels Midland Co. and Bunge

Ltd. are slashing hundreds of millions of dollars in spending and

restructuring their operations, the WSJ's Jacob Bunge and Jesse

Newman write, as they navigate a world awash in corn, soybeans and

wheat. Several years of bumper crops in markets across the globe

have kept grain prices low, upended traditional farm-sector

dynamics and roiled supply chains. Farmers are storing grain rather

than sell it to grain companies at low prices, and some food

companies are placing fewer long-term orders since prices are

expected to stay cheap. That's squeezing financial returns at

trading companies like ADM, Bunge and Cargill Inc., and hitting

agriculture suppliers. Fertilizer giant Mosaic Co. is idling a

Florida plant as it grapples with an oversupply of crop nutrients,

and farm cooperative CHS Inc. recently agreed to sell its Canadian

retail locations.

Truckers are getting more confident than ever in the U.S.

freight economy. Fleet owners ramped up orders for new heavy-duty

trucks to the highest level in nearly three years, WSJ Logistics

Reports Jennifer Smith writes, ordering 36,200 Class 8 trucks in a

bullish start to the busiest part of the ordering season. ACT

Research says the busiest month for big-rig orders since December

2014 likely signals even stronger orders in coming months. Truckers

are glowing over robust demand and stronger prices for shipping

services to go along with it. Truckload operator Werner Enterprises

Inc. recently reported a 19% increase in third-quarter profit that

was helped by a 3.4% gain in average revenue per mile -- the sort

of increase many truckers now are trying to build into higher

contract rates. The orders also provide a long-awaited boost to

truck and engine makers that will pump up factory operations that

were pulling back just a few months ago.

Growing use of consumer data is helping drive bigger gains in

online sales at Alibaba Group Holding Ltd. The Chinese e-commerce

giant more than doubled its net profit to $2.7 billion in a

blockbuster second quarter, the WSJ's Liza Lin at and Maria

Armental report, on a 61% gain in overall revenue and 63% more

revenue from core online commerce. The gains suggest the

integration of retail technologies is bringing more information

that helps Alibaba tailor its buyer home pages to spur sales. The

rising sales volume should be a boon to its logistics operation as

Alibaba works with that business, Cainiao, after increasing its

stake to a majority holding this fall. The Cainiao losses rose last

quarter to $41 million, a slim amount given Alibaba's $8.3 billion

in overall revenue. Like U.S. competitor Amazon.com Inc., the

company also is investing in physical stores, and those are likely

to figure more prominently in its development of logistics and data

in the coming year.

ECONOMY & TRADE

Tensions over ongoing trade between the U.S. and Canada are

growing just as the countries are trying to reset the map for the

movement of goods across North America. The U.S. is launching big

tariffs on imports of softwood lumber from Canada, the WSJ's

William Mauldin and Paul Vieira report, bringing back to the

forefront one of several targeted disputes buffeting relations

between the countries while they renegotiate Nafta. The lumber

dispute, a similar tariff fight over Bombardier Inc. jets made in

Canada, and a disagreement over milk products have dominated

business headlines in Canada this year, raising concerns that the

trade friction could spill over into broader bilateral ties. The

lumber tariffs, if they are permanently imposed, will a duty of

around 20% or more on shipments from Canada, depending on the

Canadian mill. That's lower than expected, however, and futures

prices for lumber fell after the announcement from a more than

two-decade high.

Blue Apron Holdings Inc. is having trouble fulfilling customer

orders and investor expectations. The meal-kit delivery company

more than doubled its net loss in the third quarter to $87.2

million, the WSJ's Heather Haddon reports, amid signs that the

fulfillment operations at the heart of its business are growing

costlier and slower. The company that made a splash with its

initial public offering this summer is facing growing competition

in the burgeoning food-delivery field, including service expansion

at grocery stores that have bigger scale and are closer to

consumers. Blue Apron is trying to offer more products and

flexibility to its subscription service, but a shift to a new

facility drove its costs up by 86% last quarter even as the

company's number of customers shrank. The company and competitors

like HelloFresh and Plated have drawn consumer interest to a new

business, but the results suggest they're still working on a

profitable logistics recipe.

QUOTABLE

IN OTHER NEWS

The Bank of England raised its benchmark interest rate for the

first time in a decade. (WSJ)

U.S. worker productivity improved in the third quarter at the

best rate in three years. (WSJ)

Rising iPhone demand and double-digit growth in iPad and Mac

shipments pushed Apple Inc.'s quarterly net profit up 19% to $10.71

billion. (WSJ)

Online-furniture retailer Wayfair Inc. reported a

steeper-than-expected $76.4 million quarterly loss on rising

marketing and operations costs. (WSJ)

Bombardier Inc.'s third-quarter net loss expanded as it prepared

for its new partnership with Airbus SE. (WSJ)

Etihad Airways pared its U.S. services after American Airlines

Group Inc. ended a passenger cooperation agreement with the

airline. (WSJ)

Tesla Inc. Chief Executive Elon Musk says its car production

will start in China in 2019 at the earliest. (WSJ)

Driverless-car business Waymo LLC signed AutoNation Inc. to

service robovans being tested in Arizona and California. (WSJ)

Starbucks Corp. is selling its Tazo tea business to Unilever

PLC. (WSJ)

Personal-computer maker Lenovo Group Ltd. agreed to buy a

controlling stake in a unit of Japan's Fujitsu Ltd. (WSJ)

DowDuPont Inc. will reduce its global workforce and shut assets

to help reach a $3 billion cost-savings goal. (WSJ)

Commissioners at the ports of Los Angeles and Long Beach

approved a plan to slash air pollution by phasing out diesel

trucks. (Los Angeles Times)

U.S. midwest grocer Hy-Vee Inc. is resetting its supply chain

expansion to focus on fulfillment operations for online shopping.

(Des Moines Register)

CSX Corp. dropped plans to expand a tunnel to improve cargo

transport connected to the Port of Baltimore. (Baltimore Sun)

Amazon is in advanced talks to cooperate on deliveries with

Australia Post. (Daily Mail)

India is considering rules that would allow deliveries by drone.

(Economic Times)

France's Marseille port will build a 750,000-square-foot

logistics center near its container terminals. (Lloyd's Loading

List)

Container ship owner Danaos Corp. does not expect "material

improvement" in the charter shipping market next year. (The

Loadstar)

The vessel-owning arm of Japanese shipyard Imabari Shipbuilding

will double the size of its container ship fleet. (Splash 24/7)

Agriculture suppliers began the first avocado exports from

Colombia to the U.S. (Fresh Plaza)

DistributionNow's third-quarter sales jumped 34% on stronger

demand in energy markets. (Industrial Distribution)

Nevada is investigating allegations that a transportation

employee who tests workers for substance abuse was selling

moonshine on the job. (Las Vegas Review-Journal)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Paul Page at paul.page@wsj.com

(END) Dow Jones Newswires

November 03, 2017 06:40 ET (10:40 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

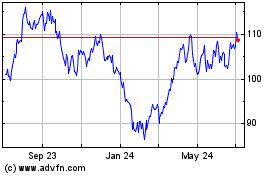

Bunge Global (NYSE:BG)

Historical Stock Chart

From Mar 2024 to Apr 2024

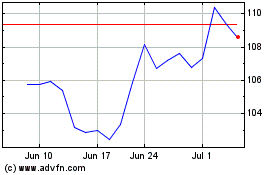

Bunge Global (NYSE:BG)

Historical Stock Chart

From Apr 2023 to Apr 2024