Key Highlights

- Transformation Plan on track with

$92 million in cost savings realized through September 30,

2017

- Initiating 2018 Adjusted EBITDA and

FCFbG guidance

- Repurchased $604 million1

of corporate debt, delivering approximately $47 million of

annualized interest savings, completing 2017 capital allocation

plan

- Closed drop down of a 38 MW

portfolio of solar assets to NRG Yield and formed a new partnership

with NRG Yield focused primarily on community solar

projects

NRG Energy, Inc. (NYSE: NRG) today reported third quarter income

from continuing operations of $190 million. Income from continuing

operations for the first nine months of 2017 of $120 million, or

$0.58 per diluted common share, compares to a loss from continuing

operations of $92 million, or $0.10 per diluted common share for

the first nine months of 2016. Adjusted EBITDA for the three and

nine months ended September 30, 2017, was $806 million and $1,876

million, respectively. Year-to-date cash from continuing operations

totaled $844 million.

“I am pleased with the progress we have made on our

Transformation Plan,” said Mauricio Gutierrez, NRG President and

Chief Executive Officer. “While we executed well in the third

quarter, our results were impacted by mild temperatures and

Hurricane Harvey. I am encouraged by the market recovery in Texas

and the multiple regulatory initiatives that highlight the urgent

need for power market reform.”

Consolidated Financial Results

Three Months Ended Nine Months Ended ($ in millions)

9/30/17 9/30/16 9/30/17

9/30/16 Income/(Loss) from Continuing Operations $ 190 $ 128

$ 120 $ (92 ) Cash From Continuing Operations $ 732 $ 794 $ 844 $

1,674 Adjusted EBITDA $ 806 $ 895 $ 1,876 $ 2,234 Free Cash Flow

Before Growth Investments (FCFbG) $ 599 $ 726

$ 807 $ 985

1 Comprised of $398 million of 2018 Senior Notes and $206

million of 2021 Senior Notes. Transaction completed in October 2017

at total cost of $615 million.

Segment Results

Table 1: Income/(Loss) from Continuing

Operations

($ in millions)

Three Months Ended Nine Months Ended

Segment

9/30/17 9/30/16 9/30/17

9/30/16 Generation $ 258 $ 372 $ 200 $ (49 ) Retail 69 (78 )

380 734 Renewables 1 (4 ) 2 (84 ) (107 ) NRG Yield 1 41 50 85 116

Corporate (174 ) (218 ) (461 ) (786 ) Income/(Loss) from Continuing

Operations 2 $ 190 $ 128 $ 120 $ (92 )

1. In accordance with GAAP, 2016 results

have been restated to include full impact of the assets in the NRG

Yield Drop Down transactions which closed onSeptember 1, 2016,

March 27, 2017, and August 1, 2017.2. Includes mark-to-market gains

and losses of economic hedges.

Table 2: Adjusted EBITDA

($ in millions)

Three Months Ended Nine Months Ended

Segment

9/30/17 9/30/16 9/30/17

9/30/16 Generation 1 $ 226 $ 268 $ 431 $ 750 Retail 276 304

612 677 Renewables 2 66 77 148 143 NRG Yield 2 265 252 719 707

Corporate (27 ) (6 ) (34 ) (43 ) Adjusted EBITDA 3 $ 806 $

895 $ 1,876 $ 2,234

1. Generation regional Reg G

reconciliations are included in Appendices A-1 through A-4.2. In

accordance with GAAP, 2016 results have been restated to include

full impact of the assets in the NRG Yield Drop Down transactions,

which closed onSeptember 1, 2016, March 27, 2017, and August 1,

2017.3. See Appendices A-1 through A-4 for Operating Segment Reg G

reconciliations.

Generation: Third quarter Adjusted EBITDA was $226

million, $42 million lower than third quarter 2016 primarily driven

by:

- Gulf Coast: $46 million decrease due to

lower realized energy prices and lower generation, partially offset

by lower operating expenses, net of outages due to flooding in the

region.

- East/West1: $4 million increase from

higher capacity revenues, partially offset by lower energy margins

and unfavorable trading results in BETM.

Retail: Third quarter Adjusted EBITDA was $276 million,

$28 million lower than third quarter 2016 due to mild weather,

impacts from Hurricane Harvey, and higher supply costs, partially

offset by customer growth and reduced operating costs.

Renewables: Third quarter Adjusted EBITDA was $66

million, $11 million lower than third quarter 2016 due to lower

solar generation at Ivanpah and higher operating expenses.

NRG Yield: Third quarter Adjusted EBITDA was $265

million, $13 million higher than third quarter 2016 due to the

acquisition of the Utah utility-scale solar portfolio and higher

conventional availability, partially offset by lower renewable

resources in the current quarter.

Corporate: Third quarter Adjusted EBITDA was $(27)

million, $21 million lower than the third quarter 2016 due to a

reduction in shared service income, partially offset by lower

corporate marketing expenses and the elimination of operating

losses at residential solar following its full wind down of

operations.

1 Includes International, BETM and generation eliminations.

Liquidity and Capital Resources

Table 3: Corporate Liquidity

($ in millions)

9/30/17 12/31/16 Cash at NRG-Level 1

$ 383 $ 570 Revolver Availability 1,604 989

NRG-Level

Liquidity $ 1,987 $ 1,559

Restricted Cash 537 446 Cash at Non-Guarantor Subsidiaries

225 368

Total Liquidity $ 2,749

$ 2,373

1. Composed of cash of $998 million as of

9/30/2017, including unrestricted cash held at Midwest Generation

(a non-guarantor subsidiary), which can bedistributed to NRG

without limitation, pro-forma for $615 million of corporate debt

repurchases completed in October 2017.

NRG-Level cash as of September 30, 2017, pro-forma for the debt

repurchases completed in October 2017, was $383 million, a decrease

of $187 million from December 31, 2016. As of September 30, 2017,

total liquidity was $2.7 billion, including $1,604 million of the

Company’s credit facilities, as well as $537 million restricted

cash and $225 million cash at non-guarantor subsidiaries (primarily

NRG Yield).

NRG Strategic Developments

Transformation Plan

As of the end of the third quarter of 2017, NRG has realized $92

million, or 142%, of its 2017 cost savings target as part the

previously announced Transformation Plan. With respect to the

targeted asset sales under the Transformation Plan, NRG continues

to expect up to $4 billion of net cash proceeds, with transactions

leading to a majority of those proceeds announced by year end 2017,

and the balance in 2018. NRG anticipates these sales to include

100% of its interest in NRG Yield and its Renewables platform.

NRG Yield

Closed the November 2017 Drop Down Transaction

On November 1, 2017, NRG sold a 38 MW solar portfolio to NRG

Yield primarily comprised of assets from NRG's Solar Power Partners

(SPP) funds, in addition to other projects developed by NRG for

cash consideration of $71 million, excluding working capital

adjustments.

Investment Partnership with NRG Yield

Pursuant to the ROFO Agreement on September 26, 2017, NRG formed

a new investment partnership in which NRG Yield would invest up to

$50 million in a portfolio of distributed solar assets, primarily

comprised of community solar projects, developed by NRG.

Drop Down Offer to NRG Yield

Pursuant to the ROFO Agreement, NRG offered NRG Yield the

opportunity to acquire Buckthorn Solar, a 154 MW solar facility

located near Fort Stockton, Texas with a 25-year PPA with the City

of Georgetown.

Outlook for 2017 and Initiation of 2018 Guidance

NRG has decreased and narrowed the range of its Adjusted EBITDA

and FCF before growth investments guidance for 2017 and is

initiating guidance for fiscal year 2018. The 2018 guidance does

not include the impact from targeted asset sales announced on July

12, 2017, as part of the Transformation Plan.

Table 4: 2017 and 2018 Adjusted EBITDA

and FCF before Growth Investments Guidance

2017 2017 2018 ($

in millions)

Prior Guidance Revised

Guidance Guidance Adjusted EBITDA1 $2,565 -

$2,765 $2,400 - $2,500 $2,800 - $3,000 Cash From Operations $1,760

- $1,960 $1,600 - $1,700 $2,015 - $2,215 Free Cash Flow Before

Growth Investments (FCFbG) $1,290 - $1,490 $1,175 -

$1,275 $1,550 - $1,750

1. Non-GAAP financial measure; see

Appendix Tables A-1 through A-5 for GAAP Reconciliation to Net

Income that excludes fair value adjustments related toderivatives.

The Company is unable to provide guidance for Net Income due to the

impact of such fair value adjustments related to derivatives in a

given year.

Capital Allocation Update

In October 2017, the Company redeemed $398 million of its 7.625%

2018 Senior Notes through a tender offer at an early redemption

percentage of 101.42%, and $206 million of its 7.875% 2021 Senior

Notes through a tender offer at an average early redemption

percentage of 102.625%. This generated approximately $47 million of

annualized interest savings and extended the Company's nearest

corporate bond maturity to July 2022.

On October 18, 2017, NRG declared a quarterly dividend on the

company's common stock of $0.03 per share, payable November 15,

2017, to stockholders of record as of November 1, 2017. This

represents $0.12 on an annualized basis.

The Company’s common stock dividend, debt reduction and share

repurchases are subject to available capital, market conditions and

compliance with associated laws and regulations.

Earnings Conference Call

On November 2, 2017, NRG will host a conference call at 8:00

a.m. Eastern to discuss these results. Investors, the news media

and others may access the live webcast of the conference call and

accompanying presentation materials by logging on to NRG’s website

at http://www.nrg.com and clicking on

“Investors.” The webcast will be archived on the site for those

unable to listen in real time.

About NRG

NRG is the leading integrated competitive power company in the

U.S., built on the strength of our diverse competitive electric

generation portfolio and leading retail electricity platform. A

Fortune 500 company, NRG creates value through best-in-class

operations, reliable and efficient electric generation, and a

retail platform serving residential and commercial businesses.

Working with electricity customers large and small, we implement

sustainable solutions for producing and managing energy, developing

smarter energy choices and delivering exceptional service as our

retail electricity providers serve almost three million residential

and commercial customers throughout the country. More information

is available at www.nrg.com. Connect with NRG Energy on Facebook

and follow us on Twitter @nrgenergy.

Safe Harbor Disclosure

In addition to historical information, the information presented

in this press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Exchange Act. These statements involve

estimates, expectations, projections, goals, assumptions, known and

unknown risks and uncertainties and can typically be identified by

terminology such as “may,” “should,” “could,” “objective,”

“projection,” “forecast,” “goal,” “guidance,” “outlook,” “expect,”

“intend,” “seek,” “plan,” “think,” “anticipate,” “estimate,”

“predict,” “target,” “potential” or “continue” or the negative of

these terms or other comparable terminology. Such forward-looking

statements include, but are not limited to, statements about the

Company’s future revenues, income, indebtedness, capital structure,

plans, expectations, objectives, projected financial performance

and/or business results and other future events, and views of

economic and market conditions.

Although NRG believes that its expectations are reasonable, it

can give no assurance that these expectations will prove to be

correct, and actual results may vary materially. Factors that could

cause actual results to differ materially from those contemplated

herein include, among others, general economic conditions, hazards

customary in the power industry, weather conditions, including wind

and solar performance, competition in wholesale power markets, the

volatility of energy and fuel prices, failure of customers to

perform under contracts, changes in the wholesale power markets,

changes in government regulations, the condition of capital markets

generally, our ability to access capital markets, unanticipated

outages at our generation facilities, adverse results in current

and future litigation, failure to identify, execute or successfully

implement acquisitions, repowerings or asset sales, our ability to

implement value enhancing improvements to plant operations and

companywide processes, our ability to implement and execute on our

publicly announced transformation plan, including any cost savings,

margin enhancement, asset sale, and net debt targets, our ability

to proceed with projects under development or the inability to

complete the construction of such projects on schedule or within

budget, risks related to project siting, financing, construction,

permitting, government approvals and the negotiation of project

development agreements, our ability to progress development

pipeline projects, the timing or completion of the GenOn

restructuring, the inability to maintain or create successful

partnering relationships, our ability to operate our businesses

efficiently, our ability to retain retail customers, our ability to

realize value through our commercial operations strategy and the

creation of NRG Yield, the ability to successfully integrate

businesses of acquired companies, our ability to realize

anticipated benefits of transactions (including expected cost

savings and other synergies) or the risk that anticipated benefits

may take longer to realize than expected, our ability to close the

Drop Down transactions with NRG Yield, and our ability to execute

our Capital Allocation Plan. Debt and share repurchases may be made

from time to time subject to market conditions and other factors,

including as permitted by United States securities laws.

Furthermore, any common stock dividend is subject to available

capital and market conditions.

NRG undertakes no obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law. The adjusted

EBITDA and free cash flow guidance are estimates as of November 2,

2017. These estimates are based on assumptions the company believed

to be reasonable as of that date. NRG disclaims any current

intention to update such guidance, except as required by law. The

foregoing review of factors that could cause NRG’s actual results

to differ materially from those contemplated in the forward-looking

statements included in this press release should be considered in

connection with information regarding risks and uncertainties that

may affect NRG's future results included in NRG's filings with the

Securities and Exchange Commission at www.sec.gov.

NRG ENERGY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(Unaudited)

Three months endedSeptember

30,

Nine months endedSeptember

30,

(In millions,

except for per share amounts)

2017 2016 2017 2016

Operating Revenues Total operating revenues $ 3,049 $

3,421 $ 8,132 $ 8,328

Operating Costs and

Expenses Cost of operations 2,156 2,440 5,852 5,711

Depreciation and amortization 272 298 789 826 Impairment losses 14

9 77 65 Selling, general and administrative 213 277 697 801

Reorganization 18 — 18 — Development activity expenses 14 21

49 65 Total operating costs and expenses 2,687

3,045 7,482 7,468 Other income - affiliate 14 48 104 144

Gain/(loss) on sale of assets — 4 4 (79 )

Operating Income 376 428 758 925

Other Income/(Expense) Equity in earnings of unconsolidated

affiliates 27 16 29 13 Impairment loss on investment — (8 ) — (147

) Other income, net 15 7 33 29 Loss on debt extinguishment, net (1

) (50 ) (3 ) (119 ) Interest expense (221 ) (237 ) (692 ) (718 )

Total other expense (180 ) (272 ) (633 ) (942 )

Income/(Loss)

from Continuing Operations Before Income Taxes 196 156 125 (17

) Income tax expense 6 28 5 75

Income/(Loss) from Continuing Operations 190 128 120 (92 )

(Loss)/Income from discontinued operations, net of income tax (27 )

265 (802 ) 256

Net Income/(Loss) 163

393 (682 ) 164

Less: Net loss attributable to

noncontrolling interest and redeemablenoncontrolling interests

(8 ) (9 ) (63 ) (49 )

Net Income/(Loss) Attributable to NRG

Energy, Inc. 171 402 (619 ) 213 Dividends for preferred shares

— — — 5 Gain on redemption of preferred shares — — —

(78 )

Net Income/(Loss) Available for Common

Stockholders $ 171 $ 402 $ (619 ) $ 286

Income/(Loss) per Share Attributable to

NRG Energy, Inc. CommonStockholders

Weighted average number of common shares outstanding — basic 317

316 317 315

Income from continuing operations per

weighted average common share— basic

$ 0.63 $ 0.43 $ 0.58 $ 0.10

(Loss)/Income from discontinued operations

per weighted average commonshare — basic

$ (0.09 ) $ 0.84 $ (2.53 ) $ 0.81

Income/(Loss)

per Weighted Average Common Share — Basic $ 0.54 $ 1.27

$ (1.95 ) $ 0.91 Weighted average number of common

shares outstanding — diluted 322 317 317 316

Income from continuing operations per

weighted average common share —diluted

$ 0.61 $ 0.43 $ 0.58 $ 0.10

(Loss)/Income from discontinued operations

per weighted average commonshare — diluted

$ (0.08 ) $ 0.84 $ (2.53 ) $ 0.81

Income/(Loss) per Weighted

Average Common Share — Diluted $ 0.53 $ 1.27 $

(1.95 ) $ 0.91

Dividends Per Common Share $ 0.03

$ 0.03 $ 0.09 $ 0.21

NRG ENERGY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF

COMPREHENSIVE INCOME/(LOSS)(Unaudited)

Three months endedSeptember

30,

Nine months endedSeptember

30,

2016 2015 2017 2016

(In millions) Net income/(loss) $ 163 $ 393 $ (682 )

$ 164

Other comprehensive income/(loss), net of tax

Unrealized gain/(loss) on derivatives, net

of income tax(benefit)/expense of $0, $(1), $1, and $1

7 27 6 (8 )

Foreign currency translation adjustments,

net of income taxexpense of $0, $0, $0, and $0

2 3 10 6

Available-for-sale securities, net of

income tax expense of$0, $0, $0, and $0

1 — 2 1

Defined benefit plans, net of income tax

expense of $0, $0,$0, and $0

(1 ) 31 26 32 Other comprehensive income 9

61 44 31

Comprehensive

income/(loss) 172 454 (638 ) 195

Less: Comprehensive loss attributable to

noncontrollinginterest and redeemable noncontrolling interests

(5 ) (2 ) (61 ) (70 )

Comprehensive income/(loss)

attributable to NRG Energy,Inc.

177 456 (577 ) 265 Dividends for preferred shares — — — 5 Gain on

redemption of preferred shares — — — (78 )

Comprehensive income/(loss) available

for commonstockholders

$ 177 $ 456 $ (577 ) $ 338

NRG ENERGY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE SHEETS

September 30,2017

December 31, 2016

(In millions,

except shares)

(unaudited) ASSETS Current Assets Cash

and cash equivalents $ 1,223 $ 938 Funds deposited by

counterparties 31 2 Restricted cash 537 446 Accounts receivable,

net 1,274 1,058 Inventory 630 721 Derivative instruments 475 1,067

Cash collateral posted in support of energy risk management

activities 203 150 Current assets - held for sale 33 9 Prepayments

and other current assets 354 404 Current assets - discontinued

operations — 1,919 Total current assets 4,760

6,714

Property, plant and equipment, net 15,332

15,369

Other Assets Equity investments in

affiliates 1,138 1,120 Notes receivable, less current portion 5 16

Goodwill 662 662 Intangible assets, net 1,838 1,973 Nuclear

decommissioning trust fund 670 610 Derivative instruments 206 181

Deferred income taxes 205 225 Non-current assets held-for-sale 10

10 Other non-current assets 644 841 Non-current assets -

discontinued operations — 2,961 Total other assets

5,378 8,599

Total Assets $ 25,470 $

30,682

LIABILITIES AND STOCKHOLDERS’ EQUITY

Current Liabilities Current portion of long-term debt and

capital leases $ 1,247 $ 516 Accounts payable 911 813 Derivative

instruments 522 1,092 Cash collateral received in support of energy

risk management activities 31 81 Accrued expenses and other current

liabilities 830 990 Accrued expenses and other current liabilities

- affiliate 164 — Current liabilities - discontinued operations —

1,210 Total current liabilities 3,705 4,702

Other Liabilities Long-term debt and capital leases

15,658 15,957 Nuclear decommissioning reserve 265 287 Nuclear

decommissioning trust liability 397 339 Deferred income taxes 21 20

Derivative instruments 307 284 Out-of-market contracts, net 213 230

Non-current liabilities held-for-sale 13 11 Other non-current

liabilities 1,116 1,176 Non-current liabilities - discontinued

operations — 3,184 Total non-current liabilities

17,990 21,488

Total Liabilities 21,695

26,190

Redeemable noncontrolling interest in

subsidiaries 85 46

Commitments and Contingencies

Stockholders’ Equity Common stock 4 4 Additional paid-in

capital 8,369 8,358 Retained deficit (4,713 ) (3,787 ) Less

treasury stock, at cost — 101,580,045 and 102,140,814 shares,

respectively (2,386 ) (2,399 ) Accumulated other comprehensive loss

(91 ) (135 ) Noncontrolling interest 2,507 2,405

Total Stockholders’ Equity 3,690 4,446

Total Liabilities and Stockholders’ Equity $ 25,470 $

30,682

NRG ENERGY, INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(Unaudited)

Nine months ended September 30, 2017

2016 (In millions) Cash Flows from Operating

Activities Net (loss)/income (682 ) 164 (Loss)/Income from

discontinued operations, net of income tax (802 ) 256

Income/(loss) from continuing operations $ 120 $ (92 ) Adjustments

to reconcile net (loss)/income to net cash provided by operating

activities: Distributions and equity in earnings of unconsolidated

affiliates 24 44 Depreciation and amortization 789 826 Provision

for bad debts 57 36 Amortization of nuclear fuel 37 39 Amortization

of financing costs and debt discount/premiums 44 42 Adjustment for

debt extinguishment 3 119 Amortization of intangibles and

out-of-market contracts 79 131 Amortization of unearned equity

compensation 27 23 Impairment losses 77 211 Changes in deferred

income taxes and liability for uncertain tax benefits 26 29 Changes

in nuclear decommissioning trust liability 20 24 Changes in

derivative instruments 25 30 Changes in collateral posted in

support of risk management activities (103 ) 261 Proceeds from sale

of emission allowances 21 11 (Gain)/loss on sale of assets (22 ) 70

Changes in other working capital (380 ) (130 )

Cash provided by

continuing operations 844 1,674

Cash (used)/provided by

discontinued operations (38 ) 67

Net Cash

Provided by Operating Activities 806 1,741

Cash Flows from Investing Activities Acquisitions of

businesses, net of cash acquired (36 ) (18 ) Capital expenditures

(760 ) (659 ) Decrease in notes receivable 11 2 Purchases of

emission allowances (47 ) (32 ) Proceeds from sale of emission

allowances 105 47 Investments in nuclear decommissioning trust fund

securities (402 ) (378 ) Proceeds from the sale of nuclear

decommissioning trust fund securities 382 354 Proceeds from

renewable energy grants and state rebates 8 11 Proceeds from sale

of assets, net of cash disposed of 36 84 Investments in

unconsolidated affiliates (31 ) (23 ) Other 22 31

Cash used by continuing operations (712 ) (581 )

Cash

(used)/provided by discontinued operations (53 ) 326

Net Cash Used by Investing Activities (765 ) (255 )

Cash

Flows from Financing Activities Payment of dividends to common

and preferred stockholders (28 ) (66 ) Payment for preferred shares

— (226 ) Net receipts from settlement of acquired derivatives that

include financing elements 2 6 Proceeds from issuance of long-term

debt 1,134 5,237 Payments for short and long-term debt (712 )

(5,353 ) Receivable from affiliate (125 ) — Payments for debt

extinguishment costs — (98 ) Contributions from, net of

distributions to, noncontrolling interest in subsidiaries 65 (127 )

Proceeds from issuance of stock — 1 Payment of debt issuance costs

(43 ) (70 ) Other - contingent consideration (10 ) (10 )

Cash

provided/(used) by continuing operations 283 (706 )

Cash

(used)/provided by discontinued operations (224 ) 119

Net Cash provided/(used) by Financing Activities 59

(587 ) Effect of exchange rate changes on cash and cash equivalents

(10 ) (6 )

Change in Cash from discontinued operations (315

) 512

Net Increase in Cash and Cash

Equivalents, Funds Deposited by Counterparties and

RestrictedCash

405 381

Cash and Cash Equivalents, Funds

Deposited by Counterparties and Restricted Cash at

Beginningof Period

1,386 1,322

Cash and Cash Equivalents, Funds

Deposited by Counterparties and Restricted Cash at End

ofPeriod

$ 1,791 $ 1,703

Appendix Table A-1: Third Quarter 2017

Adjusted EBITDA Reconciliation by Operating SegmentThe

following table summarizes the calculation of Adj. EBITDA and

provides a reconciliation to income/(loss) fromcontinuing

operations:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables

NRGYield

Corp/Elim

Total

Income/(Loss) fromContinuing

Operations

166

92 258

69 (4 ) 41

(174 ) 190 Plus: —

Interest expense, net 0 5 5 1 24 75 112 217 Income tax (2 ) 2 — —

(3 ) 8 1 6 Depreciation and amortization 69 27 96 29 51 88 8 272

ARO Expense 4 3 7 — 1 1 — 9 Contract amortization 2 1 3 (1 ) 1 18

(1 ) 20 Lease amortization 0 (2 )

(2 ) — — —

— (2 )

EBITDA 239 128 367

98 70 231 (54 ) 712

Adjustment to reflect NRGshare of adjusted

EBITDA inunconsolidated affiliates

(6 ) 7 1 (3 ) (12 ) 32 10 28

Acquisition-related transaction&

integration costs

— — — — — — 3 3 Reorganization costs 3 — 3 5 — — 10 18 Deactivation

costs — 2 2 — — — 5 7 Other non recurring charges 1 (4 ) (3 ) 2 2

(1 ) — Impairments — 1 1 — 13 — — 14

Mark to market (MtM)(gains)/losses on

economichedges

(135 ) (10 ) (145 ) 174

(5 ) — — 24

Adjusted EBITDA 102 124 226 276

66 265 (27 ) 806

(a) Includes International, BETM and

generation eliminations.

Third Quarter 2017 condensed financial

information by Operating Segment:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables NRG Yield

Corp/Elim

Total Operating revenues 655 431 1,086 1,936 140 282 (409 )

3,035 Cost of sales 394 202

596 1,458 4 15

(394 ) 1,679

Economic gross

margin 261 229 490 478 136

267 (15 ) 1,356

Operations &maintenance and othercost

of operations (b)

143 101 244 87 34 62 (15 ) 412

Selling, marketing,general

andadministrative(c)

26 13 39 107 14 4 31 195 Other expense/(income)(d)

(10 ) (9 ) (19 ) 8 22

(64 ) (4 ) (57 )

Adjusted EBITDA

102 124 226

276 66

265 (27 ) 806

(a) Includes International, BETM and

generation eliminations.(b) Excludes deactivation costs of $7

million.(c) Excludes reorganization costs of $18 million.(d)

Excludes impairments of $14 million, and acquisition and

integration costs of $3 million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions)

Condensedfinancialinformation

Interest, tax,depr., amort.

MtM Deactivation Other adj. Adjusted

EBITDA Operating revenues 3,049 12 (26 ) — — 3,035 Cost of

operations 1,737 (8 ) (50 )

— — 1,679

Gross

margin 1,312 20 24 — —

1,356

Operations & maintenanceand other cost

of operations

419 — (7 ) — 412

Selling, marketing, general&

administrative (a)

213 — — — (18 ) 195 Other expense/(income)(b) 490

(272 ) — — (275 )

(57 )

Income/(Loss) fromContinuing

Operations

190 292

24 7 293

806

(a) Other adj. includes reorganization

costs of $18 million.(b) Other adj, includes impairments of $14

million, and acquisition and integration costs of $3 million.

Appendix Table A-2: Third Quarter 2016

Adjusted EBITDA Reconciliation by Operating Segment

The following table summarizes the

calculation of Adjusted EBITDA and provides a reconciliation to

income/(loss) fromcontinuing operations:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables

NRGYield

Corp/Elim

Total

Income/(Loss) fromContinuing

Operations

224 148

372 (78 ) 2

50

(218

)

128 Plus: Interest expense, net — 7 7 (1 ) 34

70 124 234 Income tax — (2 ) (2 ) — (3 ) 13 20 28

Loss on debtextinguishment

— — — — — — 50 50

Depreciation andamortization

108 26 134 26 48 75 15 298 ARO Expense 3 (6 ) (3 ) — — 1 — (2 )

Contract amortization 5 0 5 1 1 17 (1 ) 23 Lease amortization

— (2 ) (2 ) —

— — — (2 )

EBITDA 340 171 511 (52 )

82 226 (10 ) 757

Adjustment to reflect NRGshare of adjusted

EBITDAin unconsolidated affiliates

(1 ) 8 7 — (4 ) 26 (2 ) 27

Acquisition-relatedtransaction &

integrationcosts

— — — — — — 1 1 Reorganization costs — — — — — — 6 6 Deactivation

costs — 1 1 — — — 1 2 Gain on sale of assets — — — — — — (4 ) (4 )

Other non recurring charges 15 (5 ) 10 (2 ) — 2 10 Impairments — 9

9 — — — — 9

Mark to market (MtM)(gains)/losses on

economichedges

(206 ) (64 ) (270 ) 358

(1 ) — — 87

Adjusted EBITDA 148

120 268 304

77 252 (6

) 895

(a) Includes International, BETM and

generation eliminations.

Third Quarter 2016 condensed financial

information by Operating Segment:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables

NRGYield

Corp/Elim

Total Operating revenues 773 523 1,296 2,009 139 289 (362 )

3,371 Cost of sales 431 273

704 1,485 3 18

(363 ) 1,847

Economic gross

margin 342 250 592 524 136

271 1 1,524

Operations & maintenanceand other cost

ofoperations (b)

162 106 268 81 25 58 (1 ) 431

Selling, marketing, general&

administrative (c)

35 29 64 137 12 4 54 271 Other expense/(income) (d)

(3 ) (5 ) (8 ) 2 22

(43 ) (46 ) (73 )

Adjusted EBITDA

148 120

268 304 77

252 (6 )

895

(a) Includes International, BETM and

generation eliminations.(b) Excludes deactivation costs of $2

million.(c) Excludes reorganization costs of $6 million.(d)

Excludes loss on debt extinguishment of $50 million, impairments of

$9 million, gain on sale of assets of $4 million, and acquisition

and integrationcosts of $1 million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions)

Condensedfinancialinformation

Interest, tax,depr., amort.

MtM Deactivation Other adj.

AdjustedEBITDA

Operating revenues 3,421 12 (62 ) — — 3,371 Cost of operations

2,007 (11 ) (149 ) —

— 1,847

Gross margin

1,414 23 87 — — 1,524

Operations & maintenanceand other cost

of operations

433 — (2 ) — 431

Selling, marketing, general

&administrative (a)

277 — — — (6 ) 271 Other expense/(income) (b) 576

(587 ) — — (65 )

(73 )

Income/(Loss) fromContinuing

Operations

128 610

87 2 71

895

(a) Other adj. includes reorganization

costs of $6 million.(b) Other adj. includes loss on debt

extinguishment of $50 million, impairments of $9 million, gain on

sale of assets of $4 million, and acquisition andintegration costs

of $1 million.

Appendix Table A-3: YTD Third Quarter

2017 Adjusted EBITDA Reconciliation by Operating SegmentThe

following table summarizes the calculation of Adj. EBITDA and

provides a reconciliation to income/(loss) fromcontinuing

operations:

($ in millions)

GulfCoast

East/West(a)

Generation

Retail Renewables

NRGYield

Corp/Elim

Total

Income/(Loss) from

ContinuingOperations

59 141

200 380 (84

) 85 (461 )

120 Plus: Interest expense, net — 22 22 3 74 235 350

684 Income tax — 2 2 (9 ) (13 ) 15 10 5 Loss on debt extinguishment

— — — — 3 — — 3 Depreciation and amortization 207 80 287 87 150 241

24 789 ARO Expense 11 9 20 — 2 3 (1 ) 24 Contract Amortization 10 3

13 — 1 52 (1 ) 65 Lease amortization —

(6 ) (6 ) — — —

— (6 )

EBITDA 287 251

538 461 133 631 (79 )

1,684

Adjustment to reflect NRG share ofadjusted

EBITDA inunconsolidated affiliates

15 19 34 (10 ) (21 ) 79 11 93

Acquisition-related transaction

&integration costs

(10 ) — (10 ) — — 2 3 (5 ) Reorganization costs 3 — 3 5 — — 28 36

Deactivation costs — 3 3 — — — 9 12 Other non recurring charges (14

) (2 ) (16 ) 2 9 7 (6 ) (4 ) Impairments 42 — 42 — 35 — — 77

Mark to market (MtM)(gains)/losses on

economic hedges

(152 ) (11 ) (163 ) 154

(8 ) — — (17 )

Adjusted EBITDA 171

260 431 612

148 719 (34

) 1,876

(a) Includes International, BETM and

generation eliminations.

YTD Third Quarter 2017 condensed financial

information by Operating Segment:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables

NRGYield

Corp/Elim

Total Operating revenues 1,758 1,125 2,883 4,875 357 819

(946 ) 7,988 Cost of sales 1,049 496

1,545 3,669 11

45 (908 ) 4,362

Economic

gross margin 709 629 1,338 1,206

346 774 (38 ) 3,626

Operations & maintenance andother cost

of operations (b)

440 329 769 246 107 193 (29 ) 1,286

Selling, marketing, general

&administrative (c)

32 120 152 332 43 16 118 661 Other expense/(income) (d)

66 (80 ) (14 ) 16

48 (154 ) (93 ) (197 )

Adjusted

EBITDA 171 260

431 612 148

719 (34 )

1,876

(a) Includes International, BETM and

generation eliminations.(b) Excludes deactivation costs of $12

million.(c) Excludes reorganization costs of $36 million.(d)

Excludes impairments of $77 million, acquisition-related

transaction & integration costs of $5 million, and loss on debt

extinguishment of $3 million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions)

Condensedfinancialinformation

Interest, tax,depr., amort.

MtM Deactivation

Other adj.

AdjustedEBITDA

Operating revenues 8,132 41 (185 ) — — 7,988 Cost of operations

4,554 (24 ) (168 ) —

— 4,362

Gross margin

3,578 65 (17 ) — —

3,626

Operations & maintenance andother cost

of operations

1,298 — (12 ) — 1,286

Selling, marketing, general

&administrative(a)

697 (36 ) 661 Other expense/(income) (b) 1,463

(1,561 ) — — (197 )

(197 )

Income/(Loss) from

ContinuingOperations

120 1,626

(17 ) 12 233

1,876

(a) Other adj. includes reorganization

costs of $36 million.(b) Other adj. includes impairments of $77

million, acquisition-related transaction & integration costs of

$5 million, and loss on debtextinguishment of $3 million.

Appendix Table A-4: YTD Third Quarter

2016 Adjusted EBITDA Reconciliation by Operating SegmentThe

following table summarizes the calculation of Adjusted EBITDA and

provides a reconciliation to income/(loss)from continuing

operations:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables

NRGYield

Corp/Elim

Total

(Loss)/Income from

ContinuingOperations

(247 ) 198

(49 ) 734 (107

) 116 (786 )

(92 ) Plus: Interest expense, net 1 23 24 (1 )

84 212 391 710 Income tax — (2 ) (2 ) 1 (14 ) 25 65 75 Loss on debt

extinguishment — — — — — — 119 119 Depreciation and amortization

251 80 331 83 143 224 45 826 ARO Expense 8 2 10 — 1 2 0 13 Contract

Amortization 11 4 15 5 1 57 (3 ) 75 Lease amortization

— (6 ) (6 ) — —

— — (6 )

EBITDA

24 299 323 822 108 636

(169 ) 1,720

Adjustment to reflect NRG shareof adjusted

EBITDA inunconsolidated affiliates

5 18 23 — (2 ) 68 3 92

Acquisition-related transaction

&integration costs

— 1 1 — — 6 7 Reorganization costs — — — 5 3 — 17 25 Deactivation

costs — 13 13 — — — 1 14 Loss on sale of assets — — — — — — 79 79

Other non recurring charges 19 (6 ) 13 — 8 3 2 26 Impairments — 26

26 — 27 — 12 65 Impairment loss on investment 137 5 142 — (1 ) — 6

147

MtM (gains)/losses on economichedges

208 1 209

(150 ) — — — 59

Adjusted EBITDA 393

357 750 677

143 707

(43 ) 2,234

(a) Includes International, BETM and

generation eliminations.

YTD Third Quarter 2016 condensed financial

information by Operating Segment:

($ in millions)

GulfCoast

East/West(a)

Generation Retail Renewables

NRGYield

Corp/Elim

Total Operating revenues 2,002 1,439 3,441 4,918 337 840

(807 ) 8,729 Cost of sales 1,027 616

1,643 3,633 12

48 (810 ) 4,526

Economic

gross margin 975 823 1,798 1,285

325 792 3 4,203

Operations & maintenanceand other cost

of operations (b)

467 434 901 249 107 184 (3 ) 1,438

Selling, marketing, general

&administrative (c)

32 163 195 357 40 10 174 776 Other expense/(income) (d)

83 (131 ) (48 ) 2

35 (109 ) (125 ) (245 )

Adjusted

EBITDA 393 357

750 677 143

707 (43 )

2,234

(a) Includes International, BETM and

generation eliminations.(b) Excludes deactivation costs of $14

million.(c) Excludes reorganization costs of $25 million.(d)

Excludes loss on sale of assets of $79 million, loss on debt

extinguishment of $119 million, impairments of $65 million, and

acquisition-related transaction & integration costs of $7

million.

The following table reconciles the

condensed financial information to Adjusted EBITDA:

($ in millions)

Condensedfinancialinformation

Interest, tax,depr., amort.

MtM Deactivation Other adj.

AdjustedEBITDA

Operating revenues 8,328 41 360 — — 8,729 Cost of operations

4,259 (34 ) 301 —

— 4,526

Gross margin

4,069 75 59 — —

4,203

Operations & maintenance andother cost

of operations

1,452 — — (14 ) — 1,438

Selling, marketing, general

&administrative (a)

801 (25 ) 776 Other expense/(income) (b) 1,908

(1,938 ) — — (215 )

(245 )

(Loss)/Income from Continuing Operations

(92 ) 2,013

59 14 240

2,234

(a) Other adj. includes reorganization

costs of $25 million.(b) Other adj. includes loss on debt

extinguishment of $119 million, loss on sale of assets of $79

million, impairments of $65 million, and acquisition-related

transaction & integration costs of $7 million.

Appendix Table A-5: 2017 and 2016 QTD

and YTD Third Quarter Adjusted Cash Flow from

OperationsReconciliationsThe following table summarizes

the calculation of adjusted cash flow operating activities

providing a reconciliationto net cash provided by operating

activities:

Three Months Ended ($ in millions)

September 30, 2017 September 30, 2016 Net

Cash Provided by Operating Activities 732

794

Reclassifying of net receipts for

settlement of acquired derivatives thatinclude financing

elements

— 2 Sale of Land — — Merger, integration, and cost-to-achieve

expenses (1) 14 22 Cash contribution to GenOn pension plan (2) 13 —

Return of capital from equity investments 4 (5 ) Adjustment for

change in collateral (3) (86 ) 62

Adjusted Cash Flow from Operating Activities

677 875 Maintenance CapEx, net

(4) (41 ) (79 ) Environmental CapEx, net — (36 ) Preferred

dividends — — Distributions to non-controlling interests

(37 ) (34 )

Free Cash Flow Before Growth

Investments (FCFbG) 599

726

(1) 2017 includes cost-to-achieve expenses

associated with the Transformation Plan announced on July 2017

call; 2016 includes cost-to-achieveexpenses associated with the

$150 million savings announced on September 2015 call.(2) Reflects

cash contribution related to Legacy GenOn pension liability

retained by NRG(3) Reflects change in NRG’s cash collateral balance

as of 3Q2017 including $79 million of collateral postings from our

deconsolidated affiliate(GenOn)(4) Includes insurance proceeds of

$4 million and $2 million in 2017 and 2016, respectively

Nine Months Ended ($ in millions)

September 30, 2017 September 30, 2016

Net Cash Provided by Operating Activities 844

1,674

Reclassifying of net receipts for

settlement of acquired derivatives thatinclude financing

elements

2 6 Sale of Land 8 — Merger, integration, and cost-to-achieve

expenses (1) 14 47 Cash contribution to GenOn pension plan (2) 13 —

Return of capital from equity investments 22 6 Adjustment for

change in collateral (3) 182 (261 )

Adjusted Cash Flow from Operating Activities

1,085 1,472 Maintenance CapEx,

net (4) (125 ) (171 ) Environmental CapEx, net (25 ) (198 )

Preferred dividends — (2 ) Distributions to non-controlling

interests (128 ) (116 )

Free Cash Flow

Before Growth Investments (FCFbG) 807

985

(1) 2017 includes cost-to-achieve expenses

associated with the Transformation Plan announced on July 2017

call; 2016 includes cost-to-achieveexpenses associated with the

$150 million savings announced on September 2015 call.(2) Reflects

cash contribution related to Legacy GenOn pension liability

retained by NRG(3) Reflects change in NRG’s cash collateral balance

as of 3Q2017 including $79 million of collateral postings from our

deconsolidated affiliate(GenOn)(4) Includes insurance proceeds of

$22 million and $33 million in 2017 and 2016, respectively

Appendix Table A-6: Third Quarter YTD

2017 Sources and Uses of LiquidityThe following table

summarizes the sources and uses of liquidity through third quarter

of 2017:

($ in millions)

Nine Months EndedSeptember 30,

2017

Sources: Adjusted cash flow from operations 1,085 Increase

in credit facility 615 Issuance of Agua Caliente HoldCo debt 130

Growth investments and acquisitions, net 132 Asset sales 28 NYLD

Equity Issuance 34

Uses: Debt Repayments, net

of proceeds (528) Collateral (1) (182) Maintenance and

environmental capex, net (2) (150) Distributions to non-controlling

interests (128) Common Stock Dividends (28) Other Investing and

Financing (17)

Change in Total Liquidity

991

(1) Reflects change in NRG’s cash

collateral balance as of 3Q2017 including $79MM of collateral

postings from our deconsolidated affiliate(GenOn)(2) Includes

insurance proceeds of $22 million.

Appendix Table A-7: 2017 and 2018

Adjusted EBITDA Guidance ReconciliationThe following table

summarizes the calculation of Adjusted EBITDA providing

reconciliation to net income:

2017 Adjusted EBITDA Prior Guidance ($ in millions)

Low High GAAP Net Income 1 360

560 Income Tax 80 80 Interest Expense 825 825 Depreciation,

Amortization, Contract Amortization and ARO Expense 1,150 1,150

Adjustment to reflect NRG share of adjusted EBITDA inunconsolidated

affiliates 110 110 Other Costs 2 40

40

Adjusted EBITDA 2,565

2,765 2017 Adjusted

EBITDA Revised Guidance ($ in millions)

Low High GAAP Net Income 1 55

155 Income Tax 10 10 Interest Expense 835 835 Depreciation,

Amortization, Contract Amortization and ARO Expense 1,170 1,170

Adjustment to reflect NRG share of adjusted EBITDA inunconsolidated

affiliates 130 130 Other Costs 2 200

200

Adjusted EBITDA 2,400

2,500 2018 Adjusted EBITDA

Guidance ($ in millions)

Low

High GAAP Net Income 1 410 610 Income Tax 20 20 Interest

Expense 785 785 Depreciation, Amortization, Contract Amortization

and ARO Expense 1,180 1,180 Adjustment to reflect NRG share of

adjusted EBITDA inunconsolidated affiliates 135 135 Other Costs 2

270 270

Adjusted EBITDA

2,800 3,000

(1) For purposes of guidance, discontinued

operations are excluded and fair value adjustments related to

derivatives are assumed to bezero.

(2) Includes deactivation costs, gain on

sale of businesses, asset write-offs, impairments and other

non-recurring charges.

Appendix Table A-8: 2017 and 2018 FCFbG

Guidance ReconciliationThe following table summarizes the

calculation of Free Cash Flow before Growth providing

reconciliation to Cashfrom Operations:

2017 2017 2018 ($

in millions)

PriorGuidance

RevisedGuidance

Guidance Adjusted EBITDA $2,565 - $2,765 $2,400 -

$2,500 $2,800 - $3,000 Cash Interest payments (825 ) (835 ) (785 )

Cash Income tax (40 ) (25 ) (40 ) Collateral / working capital /

other 60 60 40

Cash From Operations $1,760 - $1,960 $1,600 - $1,700 $2,015 -

$2,215

Adjustments: Acquired Derivatives,

Cost-to-Achieve, Return ofCapital Dividends, Collateral and

Other

—

—

—

Adjusted Cash flow from operations $1,760 - $1,960 $1,600 - $1,700

$2,015 - $2,215 Maintenance capital expenditures, net (210) - (240)

(200) - (220) (210) - (240) Environmental capital expenditures, net

(25) - (45) (25) - (35) (0) - (5) Distributions to non-controlling

interests (185) - (205) (180) - (190)

(220) - (250) Free Cash Flow - before Growth Investments

$1,290 - $1,490 $1,175 - $1,275 $1,550 -

$1,750

EBITDA and Adjusted EBITDA are non-GAAP financial measures.

These measurements are not recognized in accordance with GAAP and

should not be viewed as an alternative to GAAP measures of

performance. The presentation of Adjusted EBITDA should not be

construed as an inference that NRG’s future results will be

unaffected by unusual or non-recurring items.

EBITDA represents net income before interest (including loss on

debt extinguishment), taxes, depreciation and amortization. EBITDA

is presented because NRG considers it an important supplemental

measure of its performance and believes debt-holders frequently use

EBITDA to analyze operating performance and debt service capacity.

EBITDA has limitations as an analytical tool, and you should not

consider it in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are:

- EBITDA does not reflect cash

expenditures, or future requirements for capital expenditures, or

contractual commitments;

- EBITDA does not reflect changes in, or

cash requirements for, working capital needs;

- EBITDA does not reflect the significant

interest expense, or the cash requirements necessary to service

interest or principal payments, on debt or cash income tax

payments;

- Although depreciation and amortization

are non-cash charges, the assets being depreciated and amortized

will often have to be replaced in the future, and EBITDA does not

reflect any cash requirements for such replacements; and

- Other companies in this industry may

calculate EBITDA differently than NRG does, limiting its usefulness

as a comparative measure.

Because of these limitations, EBITDA should not be considered as

a measure of discretionary cash available to use to invest in the

growth of NRG’s business. NRG compensates for these limitations by

relying primarily on our GAAP results and using EBITDA and Adjusted

EBITDA only supplementally. See the statements of cash flow

included in the financial statements that are a part of this news

release.

Adjusted EBITDA is presented as a further supplemental measure

of operating performance. As NRG defines it, Adjusted EBITDA

represents EBITDA excluding impairment losses, gains or losses on

sales, dispositions or retirements of assets, any mark-to-market

gains or losses from accounting for derivatives, adjustments to

exclude the Adjusted EBITDA related to the non-controlling

interest, gains or losses on the repurchase, modification or

extinguishment of debt, the impact of restructuring and any

extraordinary, unusual or non-recurring items plus adjustments to

reflect the Adjusted EBITDA from our unconsolidated investments.

The reader is encouraged to evaluate each adjustment and the

reasons NRG considers it appropriate for supplemental analysis. As

an analytical tool, Adjusted EBITDA is subject to all of the

limitations applicable to EBITDA. In addition, in evaluating

Adjusted EBITDA, the reader should be aware that in the future NRG

may incur expenses similar to the adjustments in this news

release.

Management believes Adjusted EBITDA is useful to investors and

other users of NRG's financial statements in evaluating its

operating performance because it provides an additional tool to

compare business performance across companies and across periods

and adjusts for items that we do not consider indicative of NRG’s

future operating performance. This measure is widely used by

debt-holders to analyze operating performance and debt service

capacity and by equity investors to measure our operating

performance without regard to items such as interest expense,

taxes, depreciation and amortization, which can vary substantially

from company to company depending upon accounting methods and book

value of assets, capital structure and the method by which assets

were acquired. Management uses Adjusted EBITDA as a measure of

operating performance to assist in comparing performance from

period to period on a consistent basis and to readily view

operating trends, as a measure for planning and forecasting overall

expectations, and for evaluating actual results against such

expectations, and in communications with NRG's Board of Directors,

shareholders, creditors, analysts and investors concerning its

financial performance.

Adjusted cash flow from operating activities is a non-GAAP

measure NRG provides to show cash from operations with the

reclassification of net payments of derivative contracts acquired

in business combinations from financing to operating cash flow, as

well as the add back of merger, integration and related

restructuring costs. The Company provides the reader with this

alternative view of operating cash flow because the cash settlement

of these derivative contracts materially impact operating revenues

and cost of sales, while GAAP requires NRG to treat them as if

there was a financing activity associated with the contracts as of

the acquisition dates. The Company adds back merger, integration

related restructuring costs as they are one time and unique in

nature and do not reflect ongoing cash from operations and they are

fully disclosed to investors.

Free cash flow (before Growth Investments) is adjusted cash flow

from operations less maintenance and environmental capital

expenditures, net of funding, preferred stock dividends and

distributions to non-controlling interests and is used by NRG

predominantly as a forecasting tool to estimate cash available for

debt reduction and other capital allocation alternatives. The

reader is encouraged to evaluate each of these adjustments and the

reasons NRG considers them appropriate for supplemental analysis.

Because we have mandatory debt service requirements (and other

non-discretionary expenditures) investors should not rely on Free

Cash Flow before Growth Investments as a measure of cash available

for discretionary expenditures.

Free Cash Flow before Growth Investments is utilized by

Management in making decisions regarding the allocation of capital.

Free Cash Flow before Growth Investment is presented because the

Company believes it is a useful tool for assessing the financial

performance in the current period. In addition, NRG’s peers

evaluate cash available for allocation in a similar manner and

accordingly, it is a meaningful indicator for investors to

benchmark NRG's performance against its peers. Free Cash Flow

before Growth Investment is a performance measure and is not

intended to represent net income (loss), cash from operations (the

most directly comparable U.S. GAAP measure), or liquidity and is

not necessarily comparable to similarly titled measures reported by

other companies.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171102005712/en/

NRG Energy, Inc.Media:Sheri Woodruff, 609-524-4608Marijke

Shugrue, 609-524-5262orInvestors:Kevin L. Cole, CFA,

609-524-4526Lindsey Puchyr, 609-524-4527

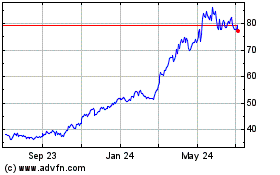

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

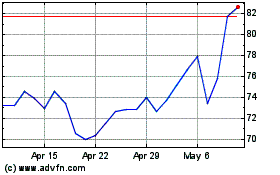

NRG Energy (NYSE:NRG)

Historical Stock Chart

From Apr 2023 to Apr 2024