WPP Cuts Forecasts Again on Lower Ad Spending -- Update

October 31 2017 - 8:46AM

Dow Jones News

By Nick Kostov

WPP PLC cut its annual sales forecast for the third time this

year, as the world's largest advertising company struggles to boost

revenue at a time when previously big-spending consumer-goods firms

are ratcheting down marketing spend.

The London-listed company on Tuesday said it now expects sales

growth excluding currency swings and acquisitions to come in

"broadly flat" for the year and also lowered its profit-margin

guidance. After achieving 3.1% comparable net sales growth last

year, WPP initially targeted 2% growth for 2017 before cutting its

forecast to 0-1% two months ago in a move that sent shock waves

through the marketing industry.

Like other ad giants, WPP is grappling with the slowest revenue

growth since the financial crisis as some of its largest clients

like Procter & Gamble Co. and Unilever NV cut their advertising

budgets. That slowdown in growth has led some investor to question

the broader health of the agency business, with the emergence of

new competitors and fast-changing technology also putting pressure

on share prices.

WPP's closest competitors face similar headwinds. Omnicom Group

Inc. reported a fall in its third-quarter revenue earlier this

month, although its numbers beat estimates, while rival Publicis

Groupe SA reported revenue below expectations after being hit by a

slowdown in Europe, sending its shares sharply lower.

WPP Chief Executive Martin Sorrell -- known for giving colorful

economic predictions -- said the low growth environment has led

consumer-good companies to keep a tight lid on costs.

He added that low interest rates were driving capital into

activist investing, which was putting pressure on companies to

focus on short-term returns.

"The traditional view that innovation and branding is critically

important is coming under focus from the zero-based budgeters and

activists," Mr. Sorrell said.

Mr. Sorrell added that Facebook and Google weren't a threat to

WPP's business, and were forecast to be WPP's top two destinations

for investing its clients' money this year.

WPP said the weakest performance in the third-quarter came from

the group's North America operations, where the company last year

lost accounts with AT&T Inc. and Volkswagen AG. Comparable net

sales fell 4.9% in the region, driven by weakness across all

divisions. The U.K. was WPP's strongest region in the quarter, with

comparable net sales up 2%.

Overall, comparable net sales -- a key measure used to judge the

company's underlying performance -- fell 1.1% in the three months

to Sept. 30, compared with a fall of 0.5% in the first half. The

company reported a 1.1% rise in turnover for the period to GBP3.65

billion, as the Brexit-weakened pound meant its earnings overseas

were boosted when converted into sterling.

WPP didn't break out profit figures for its third quarter. Its

shares, which have fallen almost 30% this year, rose 1.5% on

Tuesday.

Write to Nick Kostov at Nick.Kostov@wsj.com

(END) Dow Jones Newswires

October 31, 2017 08:31 ET (12:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

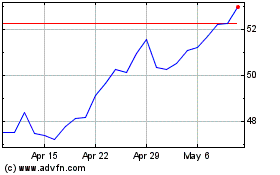

WPP (NYSE:WPP)

Historical Stock Chart

From Mar 2024 to Apr 2024

WPP (NYSE:WPP)

Historical Stock Chart

From Apr 2023 to Apr 2024