Marinus Pharmaceuticals Provides Business Update and Reports Third Quarter 2017 Financial Results

October 31 2017 - 7:30AM

Marinus Pharmaceuticals, Inc. (Nasdaq:MRNS) (the “Company”), a

biopharmaceutical company dedicated to the development of

innovative therapeutics to treat epilepsy and neuropsychiatric

disorders, today provided a business update and reported its

financial results for the quarter ended September 30, 2017.

“We achieved an important milestone this quarter

as we announced successful results from our clinical study in

children with CDKL5 deficiency disorder, a rare, genetic epilepsy

with no approved therapies,” said Christopher M. Cashman, Chief

Executive Officer of Marinus Pharmaceuticals. “On the heels

of this data, we raised capital to advance the development of

ganaxolone into CDKL5 patients and extend our cash runway.

With a strong balance sheet in place, we are focused on quality

execution of our clinical studies in postpartum depression, which

will inform our later stage clinical development plans for this

important underserved patient population.”

Clinical Programs Update

CDKL5 Deficiency Disorder (CDD)

- In September, the Company announced successful results from a

Phase 2 open-label study evaluating the safety and efficacy of

ganaxolone in children with CDD. The data showed that ganaxolone

provided substantial and durable anti-seizure efficacy in children

with CDD. Ganaxolone was generally safe and well-tolerated with no

serious adverse events. Four patients continue to receive

ganaxolone; three of which have entered the one-year extension of

the study and one of which is still receiving treatment within the

26-week treatment period. Based on the data, the Company is

planning to meet with regulatory agencies to discuss the clinical

development plan with the goal of commencing a clinical study in

2018.

- The Phase 2 data in patients with CDD was presented at the 2017

Child Neurology Society Annual Meeting in October. The Child

Neurology Society is the preeminent professional association of

pediatric neurologists worldwide devoted to fostering the

discipline of child neurology and promoting the optimal care and

welfare of children with neurological and neuro developmental

disorders.

Postpartum Depression (PPD)

- Enrollment is on-going in the Magnolia Study, a Phase 2

double-blind, placebo-controlled clinical trial to evaluate the

safety, efficacy and pharmacokinetics of intravenous (IV)

ganaxolone in women diagnosed with severe PPD. The study consists

of multiple cohorts of women with a Hamilton Depression Rating

Scale (HAMD17) score ≥ 26. Patients randomized in the initial

cohort(s) will undergo an infusion of either ganaxolone or placebo

and will be followed for 30 days, with data expected in early 2018.

Subsequent cohorts could include shorter- or higher-dose IV

regimens alone, or in sequential administration with ganaxolone

capsules.

- The Company is initiating its Amaryllis Study, a Phase 2

clinical trial to evaluate the safety, tolerability and efficacy of

oral ganaxolone in women with moderate PPD (HAMD17 score > 20

and < 26). The goal of this study is to determine the oral

dosing regimen for future studies. Oral ganaxolone has the

potential to provide the largest segment of the PPD patient

population with access to convenient, oral outpatient therapy. Data

from this study is expected in 2018.

Status Epilepticus (SE)

- The Company is initiating its Phase 2 feasibility study with

ganaxolone IV in patients with refractory status epilepticus (RSE).

The Phase 2 trial is designed to treat patients in the SE treatment

paradigm as second-line, when they have active brain function and

potential for better outcomes. Data from this feasibility study is

expected in 2018.

Financial Update

At September 30, 2017, the Company had cash,

cash equivalents and investment balances of $62.9 million.

The Company believes that its cash, cash equivalents and

investments as of September 30, 2017 are adequate to fund

operations into 2020.

Research and development expenses decreased to

$2.6 million and $9.0 million for the three and nine months ended

September 30, 2017, respectively, as compared to $4.8 million

and $17.6 million for the same periods in the prior year. The

decreases were primarily due to a decrease of $1.8 million and $9.3

million for the three- and nine-month periods ended September 30,

respectively, associated with our drug-resistant focal onset

seizures program, which discontinued in June 2016.

Additionally, we sold $0.4 million in state research and

development tax credits which we used to offset research and

development expenses. The decrease was partially offset by an

increase of $0.9 million for the nine-month period ended September

30, associated with our IV programs in PPD, for which a Phase 2

clinical trial was initiated in June 2017, and SE, for which we are

initiating a Phase 2 clinical trial.

General and administrative expenses were $1.6

million and $5.1 million for the three and nine months ended

September 30, 2017 as compared to similar expense amounts of

$1.5 million and $4.7 million for the same periods in the

prior year.

Cash used in operating activities decreased to

$14.3 million for the nine months ended September 30, 2017

compared to $18.7 million for the same period a year ago. The

decrease was driven primarily by a decrease in our net loss of $8.5

million, partially offset by a decrease in the change in operating

assets and liabilities of $4.1 million. The net decrease in

the change in operating assets and liabilities was primarily due to

upfront payments for planned clinical trials in our IV program,

payment of corporate insurance premiums and the timing of payment

obligations related to our drug supply in 2016.

Readers are referred to, and encouraged to read

in its entirety, the Company’s Quarterly Report on Form 10-Q for

the quarter ended September 30, 2017 to be filed with the

Securities and Exchange Commission, which includes further detail

on the Company’s business plans and operations, financial condition

and results of operations.

About Marinus

Pharmaceuticals

Marinus Pharmaceuticals, Inc. is a

biopharmaceutical company dedicated to the development of

ganaxolone, which offers a new mechanism of action, demonstrated

efficacy and safety, and convenient dosing to improve the lives of

patients suffering from epilepsy and neuropsychiatric disorders.

Ganaxolone is a positive allosteric modulator of GABAA that acts on

a well-characterized target in the brain known to have both

anti-seizure and anti-anxiety effects. Ganaxolone is being

developed in three different dose forms (IV, capsule and liquid)

intended to maximize therapeutic reach to adult and pediatric

patient populations in both acute and chronic care settings.

Marinus is currently evaluating ganaxolone in women with postpartum

depression and preparing to initiate studies in children with CDKL5

deficiency disorder and patients with status epilepticus, both of

which are orphan indications. For more information visit

www.marinuspharma.com. Please follow us on Twitter:

@MarinusPharma.

Forward-Looking Statements

To the extent that statements contained in this

press release are not descriptions of historical facts regarding

Marinus, they are forward-looking statements reflecting the current

beliefs and expectations of management made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. Words such as “may”, “will”, “expect”, “anticipate”,

“estimate”, “intend”, “believe”, and similar expressions (as well

as other words or expressions referencing future events, conditions

or circumstances) are intended to identify forward-looking

statements. Examples of forward-looking statements contained

in this press release include, among others, statements regarding

our interpretation of preclinical studies, development plans for

our product candidate, including the development of dose forms, the

clinical trial testing schedule and milestones, the ability to

complete enrollment in our clinical trials, interpretation of

scientific basis for ganaxolone use, timing for availability and

release of data, the safety, potential efficacy and therapeutic

potential of our product candidate and our expectation regarding

the sufficiency of our working capital. Forward-looking statements

in this release involve substantial risks and uncertainties that

could cause our clinical development programs, future results,

performance or achievements to differ significantly from those

expressed or implied by the forward-looking statements. Such

risks and uncertainties include, among others, the uncertainties

inherent in the conduct of future clinical trials, the timing of

the clinical trials, enrollment in clinical trials, availability of

data from ongoing clinical trials, expectations for regulatory

approvals, the attainment of clinical trial results that will be

supportive of regulatory approvals, and other matters, including

the development of formulations of ganaxolone, and the availability

or potential availability of alternative products or treatments for

conditions targeted by the Company that could affect the

availability or commercial potential of our drug candidates.

Marinus undertakes no obligation to update or revise any

forward-looking statements. For a further description of the

risks and uncertainties that could cause actual results to differ

from those expressed in these forward-looking statements, as well

as risks relating to the business of the Company in general, see

filings Marinus has made with the Securities and Exchange

Commission.

CONTACT: Lisa M. Caperelli

Executive Director, Investor & Strategic Relations

Marinus Pharmaceuticals, Inc. 484-801-4674

lcaperelli@marinuspharma.com

| Marinus Pharmaceuticals,

Inc.Selected Financial Data (in thousands, except

share and per share amounts)

(unaudited) |

|

|

|

|

|

|

|

September 30,2017 |

|

December 31,2016 |

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

| Cash and cash

equivalents |

$ |

37,530 |

$ |

26,178 |

| Investments |

|

25,373 |

|

3,922 |

| Other assets |

|

1,754 |

|

1,347 |

| Total

assets |

$ |

64,657 |

$ |

31,447 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

| Total current

liabilities |

$ |

2,430 |

$ |

8,084 |

| Notes payable,

long-term portion |

|

— |

|

1,743 |

| Other long term

liabilities |

|

127 |

|

141 |

| Total

liabilities |

|

2,557 |

|

9,968 |

| Total

stockholders’ equity |

|

62,100 |

|

21,479 |

| Total

liabilities and stockholders’ equity |

$ |

64,657 |

$ |

31,447 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research

and development |

|

$ |

2,642 |

|

|

$ |

4,840 |

|

|

$ |

9,032 |

|

|

$ |

17,593 |

|

|

| General

and administrative |

|

|

1,571 |

|

|

|

1,529 |

|

|

|

5,074 |

|

|

|

4,719 |

|

|

| Loss from

operations |

|

|

(4,213 |

) |

|

|

(6,369 |

) |

|

|

(14,106 |

) |

|

|

(22,312 |

) |

|

| Interest income |

|

|

45 |

|

|

|

36 |

|

|

|

116 |

|

|

|

93 |

|

|

| Interest expense |

|

|

(3 |

) |

|

|

(118 |

) |

|

|

(159 |

) |

|

|

(365 |

) |

|

| Other income

(expense) |

|

|

1 |

|

|

|

(13 |

) |

|

|

(11 |

) |

|

|

(44 |

) |

|

| Net loss |

|

$ |

(4,170 |

) |

|

$ |

(6,464 |

) |

|

$ |

(14,160 |

) |

|

$ |

(22,628 |

) |

|

| Per share

information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss

per share of common stock—basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.33 |

) |

|

$ |

(0.60 |

) |

|

$ |

(1.16 |

) |

|

| Basic and

diluted weighted average shares outstanding |

|

|

28,666,656 |

|

|

|

19,509,220 |

|

|

|

23,531,745 |

|

|

|

19,494,424 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

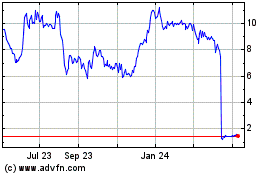

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Mar 2024 to Apr 2024

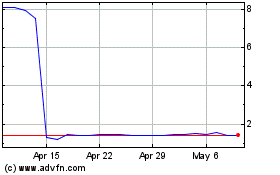

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Apr 2023 to Apr 2024