Report of Foreign Issuer (6-k)

October 31 2017 - 6:15AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

Report of

Foreign Private Issuer

Pursuant to Rule

13a-16

or

15d-16

under

the Securities Exchange Act of 1934

For the month of October 2017

Commission File

No. 000-54189

MITSUBISHI UFJ FINANCIAL GROUP, INC.

(Translation of registrant’s name into English)

7-1,

Marunouchi

2-chome,

Chiyoda-ku

Tokyo

100-8330,

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant files or

will file annual reports under cover of Form

20-F

or Form

40-F.

Form

20-F

X

Form

40-F

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7):

THIS REPORT ON FORM

6-K

SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE

IN THE REGISTRATION STATEMENT ON FORM

F-3

(NO.

333-209455)

OF MITSUBISHI UFJ FINANCIAL GROUP, INC. AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS

FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED WITH OR FURNISHED TO THE U.S. SECURITIES AND EXCHANGE COMMISSION.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: October 31, 2017

|

|

|

|

|

Mitsubishi UFJ Financial Group, Inc.

|

|

|

|

|

By:

|

|

/s/ Zenta Morokawa

|

|

Name:

|

|

Zenta Morokawa

|

|

Title:

|

|

Chief Manager, Documentation &

Corporate Secretary Department,

|

|

|

|

Corporate Administration Division

|

Mitsubishi UFJ Financial Group, Inc.

The Bank of Tokyo-Mitsubishi UFJ, Ltd.

Mitsubishi UFJ Trust and Banking Corporation

Corporate Split and Business Transfers under

“Functional Realignment” of Group Subsidiaries

Tokyo, October

31, 2017

— Mitsubishi UFJ Financial Group, Inc. (MUFG) announced the “functional realignment” of its

group subsidiaries in its press release titled “‘Functional Realignment’ of Group Subsidiaries” issued on May 15, 2017 (the “May 15 Press Release”).

To implement the “functional realignment,” Mitsubishi UFJ Trust and Banking Corporation (the Trust Bank) and The Bank of Tokyo-Mitsubishi UFJ, Ltd.

(the Commercial Bank) today entered into an absorption-type corporate split agreement to transfer the Trust Bank’s domestic corporate loan-related businesses(*) to the Commercial Bank (the absorption-type corporate split pursuant to such

agreement, the “Corporate Split”).

In addition, the Trust Bank and the Commercial Bank today entered into business transfer agreements to

transfer the corporate loan-related businesses carried on by the Trust Bank’s overseas locations to the Commercial Bank (the business transfers pursuant to such agreements, the “Business Transfers,” and the Corporate Split and the

Business Transfers are collectively referred to as the “Corporate Restructuring”).

|

(*)

|

These businesses include the corporate loan business, project finance, real estate finance, any related foreign exchange and remittance services, and all positions as bond administrator fiscal agents and issuing and

paying agents regarding bonds, specified bonds and foreign bonds entrusted to the Trust Bank, but do not include pension-related services, the corporate agency business, or real estate related businesses.

|

|

1.

|

Purposes of the Corporate Restructuring

|

As announced in the May 15 Press Release,

MUFG has determined to conduct the “functional realignment” with the dual aims of expeditiously adapting to the domestic and global structural changes in the business environment surrounding MUFG, and of providing outperforming value to

customers’ diversified and sophisticated needs. MUFG, the Commercial Bank and the Trust Bank initially planned to transfer the Trust Bank’s corporate loan-related businesses to the Commercial Bank through a corporate split as the method to

realize the “functional realignment.” However, taking into account the laws and regulations of relevant jurisdictions and other various considerations, they have determined to transfer the domestic corporate loan-related businesses through

the Corporate Split and to transfer the foreign corporate loan-related businesses through the Business Transfers.

1

Through the Corporate Restructuring, the corporate loan-related business within MUFG will be integrated in the

Commercial Bank. The Trust Bank will then focus on its domestic and global asset management and administration business, which is one of the important growth segments of MUFG, and strengthen its real estate business, pension service, shareholder

service and estate administration service, thereby integrating its high level of expertise with MUFG’s wide customer base and developing a “trust-oriented consulting and solution business.”

|

2.

|

Overview of the Corporate Split

|

|

(1)

|

Timeline of the Corporate Split

|

|

|

|

|

|

|

|

(i)

|

|

Resolutions by the Boards of Directors (of both companies)

|

|

October 30, 2017

|

|

(ii)

|

|

Execution of the absorption-type corporate split agreement

|

|

October 31, 2017

|

|

(iii)

|

|

Extraordinary general meeting of shareholders (of the Trust Bank) for approval of the absorption-type corporate split agreement

|

|

November 30, 2017(planned)

|

|

(iv)

|

|

Effective date of the Corporate Split

|

|

April 16, 2018 (planned)

|

|

(*)

|

The Commercial Bank will not obtain shareholder’s approval for concluding the Corporate Split, because the Corporate Split will constitute a simplified absorption-type corporate split (

kan’i kyushu

bunkatsu

) under Article 796, Paragraph 2 of the Companies Act.

|

|

(2)

|

Method of the Corporate Split

|

The Corporate Split is an absorption-type corporate split with

the Trust Bank as the splitting company and the Commercial Bank as the successor company.

|

3.

|

Overview of the Business Transfers

|

|

(1)

|

Timeline of the Business Transfers

|

|

|

|

|

|

|

|

(i)

|

|

Resolutions by the Boards of Directors (of both companies)

|

|

October 30, 2017

|

|

(ii)

|

|

Execution of the business transfer agreements

|

|

October 31, 2017

|

|

(iii)

|

|

Effective Date of the Business Transfers

|

|

April 16, 2018 (planned)

|

|

(*)

|

The Trust Bank will not obtain shareholder’s approval for concluding the Business Transfers, because each of the Business Transfers will constitute a simplified business transfer (

kan’i jigyou joto

)

under Article 467, Paragraph 1, Item 2 of the Companies Act.

|

|

(2)

|

Method of the Business Transfers

|

The Commercial Bank and the Trust Bank have entered into

respective business transfer agreement regarding the corporate loan-related businesses carried on by each of the Trust Bank’s overseas branches located in New York, London, Hong Kong and Singapore.

2

As the Corporate Restructuring consists of an absorption-type corporate split and

business transfers between two wholly-owned subsidiaries of MUFG, its impact on the consolidated financial status of MUFG is immaterial.

* *

*

Contacts:

|

|

|

|

|

|

|

Mitsubishi UFJ Financial Group

|

|

Public Relations Division

|

|

81-3-3240-7651

|

|

|

|

|

|

The Bank of Tokyo-Mitsubishi UFJ

|

|

Public Relations Division

|

|

81-3-3240-2950

|

|

|

|

|

|

Mitsubishi UFJ Trust and Banking

|

|

Public Relations Section Corporate Planning Division

|

|

81-3-6214-6044

|

3

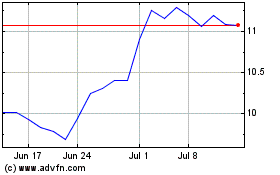

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Mar 2024 to Apr 2024

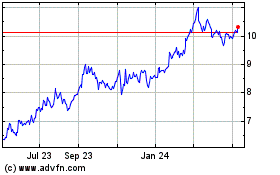

Mitsubishi UFJ Financial (NYSE:MUFG)

Historical Stock Chart

From Apr 2023 to Apr 2024