SBA Communications Corporation (Nasdaq:SBAC) ("SBA" or the

"Company") today reported results for the quarter ended September

30, 2017.

Highlights of the third quarter

include:

- Increased Full Year Outlook

- Net income of $49.2 million or $0.41 per

share

- AFFO per share growth of 14% over the year earlier

period

- Repurchased 3.5 million shares from July 1 through

October 30, 2017

“The third quarter was another solid one for

SBA,” commented Jeffrey A. Stoops, President and Chief Executive

Officer. “Our customers were active across all of our markets

and we executed well, once again posting industry-leading tower

cash flow and adjusted EBITDA margins. Growth in site leasing

revenue, tower cash flow, adjusted EBITDA and AFFO and a reduction

in shares outstanding produced material year-over-year growth in

AFFO per share. We continue to focus on steady balance sheet

management and opportunistic capital allocation, with a number of

successes in these areas since our last report. We remain solidly

on track to achieve our goal of producing at least $10 of AFFO per

share in 2020. With FirstNet, 600 Mhz, 2.5 Ghz, and other

deployments by our customers still ahead in the U.S. and material

network investment expected from our customers in our international

markets, we remain very optimistic about the future and our ability

to create additional shareholder value through consistent and

material growth in AFFO per share.”

Operating Results

The table below details select financial results

for the three months ended September 30, 2017 and comparisons to

the prior year period.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

|

Q3 2017 |

|

Q3 2016 |

|

$ Change |

|

% Change |

|

excluding FX (1) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated |

|

($ in millions, except per share

amounts) |

| Site leasing

revenue |

|

$ |

408.5 |

|

$ |

388.2 |

|

|

$ |

20.3 |

|

|

5.2 |

% |

|

|

4.9 |

% |

| Site development

revenue |

|

|

25.4 |

|

|

23.2 |

|

|

|

2.2 |

|

|

9.5 |

% |

|

|

9.5 |

% |

| Tower cash flow

(1) |

|

|

321.5 |

|

|

302.8 |

|

|

|

18.7 |

|

|

6.2 |

% |

|

|

5.9 |

% |

| Net income (loss) |

|

|

49.2 |

|

|

(15.4 |

) |

|

|

64.6 |

|

|

419.5 |

% |

|

|

298.5 |

% |

| Earnings per share -

diluted |

|

|

0.41 |

|

|

(0.12 |

) |

|

|

0.53 |

|

|

441.7 |

% |

|

|

308.3 |

% |

| Adjusted EBITDA

(1) |

|

|

303.1 |

|

|

283.2 |

|

|

|

19.9 |

|

|

7.0 |

% |

|

|

6.7 |

% |

| AFFO (1) |

|

|

211.3 |

|

|

191.5 |

|

|

|

19.8 |

|

|

10.3 |

% |

|

|

9.9 |

% |

| AFFO per share (1) |

|

|

1.75 |

|

|

1.53 |

|

|

|

0.22 |

|

|

14.4 |

% |

|

|

13.7 |

% |

(1) Non-GAAP metrics, please see the

reconciliations and other disclosures under “Non-GAAP Financial

Measures” later in this press release.

Total revenues in the third quarter of 2017 were

$433.9 million compared to $411.3 million in the year earlier

period, an increase of 5.5%. Site leasing revenue in the quarter of

$408.5 million was comprised of domestic site leasing revenue of

$328.4 million and international site leasing revenue of $80.1

million. Domestic cash site leasing revenue was $327.9 million in

the third quarter of 2017 compared to $316.8 million in the year

earlier period, an increase of 3.5%. International cash site

leasing revenue was $76.3 million in the third quarter of 2017

compared to $64.0 million in the year earlier period, an increase

of 19.2%.

Site leasing operating profit was $318.2

million, an increase of 5.4% over the year earlier period. Site

leasing contributed 98.7% of the Company’s total operating profit

in the third quarter of 2017. Domestic site leasing segment

operating profit was $263.2 million, an increase of 3.7% over the

year earlier period. International site leasing segment operating

profit was $55.0 million, an increase of 14.5% over the year

earlier period.

Tower Cash Flow for the third quarter of 2017 of

$321.5 million was comprised of Domestic Tower Cash Flow of $269.4

million and International Tower Cash Flow of $52.1 million.

Domestic Tower Cash Flow for the quarter increased 4.1% over the

prior year period and International Tower Cash Flow increased 18.6%

over the prior year period. Tower Cash Flow Margin was 79.5% for

the third quarter of 2017 and 2016.

Net Cash Interest Expense was $78.9 million in

the third quarter of 2017 compared to $80.3 million in the third

quarter of 2016.

Net income for the third quarter of 2017 was

$49.2 million, or $0.41 per share, and included a $18.4 million

gain on the currency related remeasurement of a U.S. dollar

denominated intercompany loan with a Brazilian subsidiary, while

net loss for the third quarter of 2016 was $15.4 million, or

$(0.12) per share, and included a $3.2 million loss on the currency

related remeasurement of a U.S. dollar denominated intercompany

loan with a Brazilian subsidiary.

Adjusted EBITDA for the quarter was $303.1

million, a 7.0% increase over the prior year period. Adjusted

EBITDA Margin was 70.6% in the third quarter of 2017 compared to

70.1% in the third quarter of 2016.

AFFO for the quarter was $211.3 million, a 10.3%

increase over the prior year period. AFFO per share for the third

quarter of 2017 was $1.75, a 14.4% increase over the third quarter

of 2016.

Investing Activities

During the third quarter of 2017, SBA purchased

118 communication sites and the rights to manage 2 additional

communication sites for total consideration of $47.9 million. SBA

also built 134 towers during the third quarter of 2017. As of

September 30, 2017, SBA owned or operated 26,764 communication

sites, 15,949 of which are located in the United States and its

territories, and 10,815 of which are located internationally. In

addition, the Company spent $14.8 million to purchase land and

easements and to extend lease terms. Total cash capital

expenditures for the third quarter of 2017 were $115.7 million,

consisting of $9.1 million of non-discretionary cash capital

expenditures (tower maintenance and general corporate) and $106.6

million of discretionary cash capital expenditures (new tower

builds, tower augmentations, acquisitions, and purchasing land and

easements).

Subsequent to the third quarter of 2017, the

Company acquired 35 communication sites for an aggregate

consideration of $24.4 million in cash. In addition, the Company

has agreed to purchase 1,275 communication sites, 1,228 of which

are located in international markets in which the Company currently

operates, for an aggregate amount of $332.2 million. The Company

anticipates that these acquisitions will be consummated by the end

of the first quarter of 2018.

Financing Activities and Liquidity

SBA ended the third quarter with $9.1 billion of

total debt, $7.2 billion of total secured debt, $170.1 million of

cash and cash equivalents, short-term restricted cash, and

short-term investments, and $8.9 billion of Net Debt. SBA’s

Net Debt and Net Secured Debt to Annualized Adjusted EBITDA

Leverage Ratios were 7.3x and 5.8x, respectively.

As of the date of this press release, SBA had no

amount outstanding under its $1.0 billion Revolving Credit

Facility.

During the third quarter of 2017, the Company

repurchased 2.7 million shares of its Class A common stock for

$383.9 million, at an average price per share of $141.17.

Subsequent to September 30, 2017, the Company repurchased 0.8

million shares of its Class A common stock for $111.1 million, at

an average price per share of $147.19. As of the date of this press

release, the Company had $350.0 million of authorization remaining

under its current stock repurchase plan.

On October 13, 2017, the Company issued $750.0

million of unsecured senior notes due October 1, 2022 (the “2017

Senior Notes”). The 2017 Senior Notes accrue interest at a rate of

4.0% per annum. Interest on the 2017 Senior Notes is due

semi-annually on April 1 and October 1 of each year, beginning on

April 1, 2018. Net proceeds from this offering were used to repay

$460.0 million outstanding under the Revolving Credit Facility and

for general corporate purposes.

Outlook

The Company is updating its full year 2017

Outlook for anticipated results. The Outlook provided is based on a

number of assumptions that the Company believes are reasonable at

the time of this press release. Information regarding

potential risks that could cause the actual results to differ from

these forward-looking statements is set forth below and in the

Company’s filings with the Securities and Exchange Commission.

The Company’s full year 2017 Outlook assumes the

acquisitions of only those communication sites under contract at

the time of this press release. The Company may spend

additional capital in 2017 on acquiring revenue producing assets

not yet identified or under contract, the impact of which is not

reflected in the 2017 guidance. The Outlook does not contemplate

any new financings or any additional repurchases of the Company’s

stock during 2017 other than those financings and repurchases

completed as of the date of this press release.

The Company’s Outlook assumes an average foreign

currency exchange rate of 3.25 Brazilian Reais to 1.0 U.S. Dollar

and 1.28 Canadian Dollars to 1.0 U.S. Dollar for the fourth quarter

of 2017.

| |

|

|

|

|

|

| (in millions,

except per share amounts) |

Full Year 2017 |

|

|

|

|

|

|

|

| Site leasing revenue

(1) |

$ |

1,613.0 |

to |

$ |

1,623.0 |

| Site development

revenue |

$ |

95.0 |

to |

$ |

105.0 |

| Total revenues |

$ |

1,708.0 |

to |

$ |

1,728.0 |

| Tower Cash Flow

(2) |

$ |

1,271.0 |

to |

$ |

1,281.0 |

| Adjusted EBITDA

(2) |

$ |

1,195.0 |

to |

$ |

1,205.0 |

| Net cash interest

expense (3) |

$ |

310.0 |

to |

$ |

315.0 |

| Non-discretionary cash

capital expenditures (4) |

$ |

32.5 |

to |

$ |

37.5 |

| AFFO (2) |

$ |

825.5 |

to |

$ |

849.5 |

| AFFO per share

(2) (5) |

$ |

6.82 |

to |

$ |

7.01 |

| Discretionary cash

capital expenditures (6) |

$ |

395.0 |

to |

$ |

415.0 |

(1) The Company’s Outlook for site leasing

revenue includes revenue associated with pass through reimbursable

expenses.(2) See the reconciliation of this non-GAAP

financial measure presented below under “Non-GAAP Financial

Measures.”(3) Net cash interest expense is defined as

interest expense less interest income. Net cash interest expense

does not include amortization of deferred financing fees or

non-cash interest expense. (4) Consists of tower

maintenance and general corporate capital expenditures. Includes

$1.0 million of estimated capital expenditures associated with

hurricanes Harvey, Irma, and Maria.(5) Outlook for AFFO per

share is calculated by dividing the Company’s outlook for AFFO by

an assumed weighted average number of diluted common shares of

121.1 million. Our Outlook does not include the impact of any

additional repurchases of the Company’s stock during 2017 other

than those repurchases completed or agreed to as of the date of

this press release.(6) Consists of new tower builds, tower

augmentations, communication site acquisitions and ground lease

purchases. Does not include expenditures for acquisitions of

revenue producing assets not under contract at the date of this

press release.

Conference Call Information

SBA Communications Corporation will host a

conference call on Monday, October 30, 2017 at 5:00 PM (ET) to

discuss the quarterly results. The call may be accessed as

follows:

| When: |

|

|

Monday, October 30,

2017 at 5:00 PM (ET) |

| Dial-in Number: |

|

|

(800) 230-1951 |

| Conference Name: |

|

|

SBA third quarter

results |

| Replay Available: |

|

|

October 30, 2017 at

8:00 PM (ET) through November 13, 2017 at 11:59 PM (ET) |

| Replay Number: |

|

|

(800) 475-6701 |

| Access Code: |

|

|

431482 |

| Internet Access: |

|

|

www.sbasite.com |

| |

|

|

|

Information Concerning Forward-Looking

Statements

This press release includes forward-looking

statements, including statements regarding the Company’s

expectations or beliefs regarding (i) the Company’s long term goal

of producing AFFO of $10 or more per share in 2020 and its progress

toward achieving that goal, (ii) future domestic and international

customer demand and the timing and impact of spectrum deployments

and network investment, (iii) the Company’s intentions for future

capital allocation, (iv) the Company’s financial and operational

guidance for the full year 2017, (v) timing of closing for

currently pending acquisitions, (vi) the Company’s expectations

regarding additional capital spending in 2017, and (vii) the

Company’s expectations regarding foreign exchange rates and their

impact on the Company’s financial and operational guidance.

Furthermore, the Company’s 2017 outlook assumes that the Company’s

business is currently operated in a manner that complies with the

REIT rules and that the Company is able to qualify and to remain

qualified as a REIT and the timing of such qualification. These

forward-looking statements may be affected by the risks and

uncertainties in the Company’s business. This information is

qualified in its entirety by cautionary statements and risk factor

disclosures contained in the Company’s Securities and Exchange

Commission filings, including the Company’s annual report on Form

10-K filed with the Commission on March 1, 2017.

The Company wishes to caution readers that

certain important factors may have affected and could in the future

affect the Company’s actual results and could cause the Company’s

actual results for subsequent periods to differ materially from

those expressed in any forward-looking statement made by or on

behalf of the Company. With respect to the Company’s expectations

regarding all of these statements, including its financial and

operational guidance, such risk factors include, but are not

limited to: (1) the ability and willingness of wireless service

providers to maintain or increase their capital expenditures; (2)

the Company’s ability to identify and acquire sites at prices and

upon terms that will allow the portfolio growth to be accretive;

(3) the Company’s ability to accurately identify any risks

associated with its acquired sites, to effectively integrate such

sites into its business and to achieve the anticipated financial

results; (4) the Company’s ability to secure and retain as many

site leasing tenants as planned at anticipated lease rates; (5) the

impact of continued consolidation among wireless service providers

on the Company’s leasing revenue; (6) the Company’s ability to

successfully manage the risks associated with international

operations, including risks associated with foreign currency

exchange rates; (7) the Company’s ability to secure and deliver

anticipated services business at contemplated margins; (8) the

Company’s ability to maintain expenses and cash capital

expenditures at appropriate levels for its business while seeking

to attain its investment goals; (9) the Company’s ability to

acquire land underneath towers on terms that are accretive; (10)

the Company’s ability to realize economies of scale from its tower

portfolio; (11) the economic climate for the wireless

communications industry in general and the wireless communications

infrastructure providers in particular in the United States,

Brazil, and internationally; (12) the continued dependence on

towers and outsourced site development services by the wireless

carriers; (13) the Company’s ability to protect its rights to land

under its towers; (14) the Company’s ability to obtain future

financing at commercially reasonable rates or at all; and (15) the

Company’s ability to qualify for treatment as a REIT for U.S.

federal income tax purposes and to comply with and conduct its

business in accordance with such rules. With respect to the

Company’s plan for new builds, these factors also include zoning

and regulatory approvals, weather, availability of labor and

supplies and other factors beyond the Company’s control that could

affect the Company’s ability to build additional towers in 2017.

With respect to its expectations regarding the ability to close

pending acquisitions, these factors also include satisfactorily

completing due diligence, the amount and quality of due diligence

that the Company is able to complete prior to closing of any

acquisition and its ability to accurately anticipate the future

performance of the acquired towers, the ability to receive required

regulatory approval, the ability and willingness of each party to

fulfill their respective closing conditions and their contractual

obligations and the availability of cash on hand or borrowing

capacity under the Revolving Credit Facility to fund the

consideration. With respect to repurchases under the Company’s

stock repurchase program, the amount of shares repurchased, if any,

and the timing of such repurchases will depend on, among other

things, the trading price of the Company’s common stock, which may

be positively or negatively impacted by the repurchase program,

market and business conditions, the availability of stock, the

Company’s financial performance or determinations following the

date of this announcement in order to use the Company’s funds for

other purposes.

This press release contains non-GAAP financial

measures. Reconciliation of each of these non-GAAP financial

measures and the other Regulation G information is presented below

under “Non-GAAP Financial Measures.”

This press release will be available on our

website at www.sbasite.com.

About SBA Communications Corporation

SBA Communications Corporation is a first choice

provider and leading owner and operator of wireless communications

infrastructure in North, Central, and South America. By “Building

Better Wireless,” SBA generates revenue from two primary businesses

– site leasing and site development services. The primary focus of

the Company is the leasing of antenna space on its multi-tenant

communication sites to a variety of wireless service providers

under long-term lease contracts. For more information please visit:

www.sbasite.com.

Contacts

Mark DeRussy, CFACapital Markets561-226-9531

Lynne HopkinsMedia Relations561-226-9431

| CONSOLIDATED STATEMENTS OF OPERATIONS

|

| (unaudited) (in thousands, except per share

amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months |

|

For the nine months |

| |

|

ended September 30, |

|

ended September 30, |

| |

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

| Site

leasing |

|

$ |

408,538 |

|

|

$ |

388,168 |

|

|

$ |

1,209,089 |

|

|

$ |

1,144,461 |

|

| Site

development |

|

|

25,407 |

|

|

|

23,151 |

|

|

|

75,513 |

|

|

|

72,159 |

|

| Total

revenues |

|

|

433,945 |

|

|

|

411,319 |

|

|

|

1,284,602 |

|

|

|

1,216,620 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenues (exclusive of depreciation, accretion, |

|

|

|

|

|

|

|

|

|

|

|

|

| and

amortization shown below): |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

site leasing |

|

|

90,351 |

|

|

|

86,354 |

|

|

|

269,070 |

|

|

|

255,609 |

|

| Cost of

site development |

|

|

21,117 |

|

|

|

19,114 |

|

|

|

62,713 |

|

|

|

59,021 |

|

| Selling, general, and

administrative (1)(2) |

|

|

32,559 |

|

|

|

32,255 |

|

|

|

100,177 |

|

|

|

110,326 |

|

| Acquisition related

adjustments and expenses |

|

|

1,583 |

|

|

|

2,970 |

|

|

|

6,857 |

|

|

|

8,974 |

|

| Asset impairment and

decommission costs |

|

|

9,417 |

|

|

|

2,305 |

|

|

|

25,908 |

|

|

|

23,180 |

|

| Depreciation,

accretion, and amortization |

|

|

161,907 |

|

|

|

160,111 |

|

|

|

480,457 |

|

|

|

479,635 |

|

| Total

operating expenses |

|

|

316,934 |

|

|

|

303,109 |

|

|

|

945,182 |

|

|

|

936,745 |

|

| Operating

income |

|

|

117,011 |

|

|

|

108,210 |

|

|

|

339,420 |

|

|

|

279,875 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest

income |

|

|

2,505 |

|

|

|

3,101 |

|

|

|

8,648 |

|

|

|

7,704 |

|

| Interest

expense |

|

|

(81,357 |

) |

|

|

(83,426 |

) |

|

|

(237,415 |

) |

|

|

(250,913 |

) |

| Non-cash

interest expense |

|

|

(725 |

) |

|

|

(585 |

) |

|

|

(2,146 |

) |

|

|

(1,500 |

) |

|

Amortization of deferred financing fees |

|

|

(4,957 |

) |

|

|

(5,445 |

) |

|

|

(16,603 |

) |

|

|

(16,035 |

) |

| Loss from

extinguishment of debt, net |

|

|

— |

|

|

|

(34,512 |

) |

|

|

(1,961 |

) |

|

|

(34,512 |

) |

| Other

income (expense), net |

|

|

20,062 |

|

|

|

(1,139 |

) |

|

|

16,218 |

|

|

|

92,137 |

|

| Total

other expense |

|

|

(64,472 |

) |

|

|

(122,006 |

) |

|

|

(233,259 |

) |

|

|

(203,119 |

) |

| Income

(loss) before provision for income taxes |

|

|

52,539 |

|

|

|

(13,796 |

) |

|

|

106,161 |

|

|

|

76,756 |

|

| Provision for income

taxes |

|

|

(3,378 |

) |

|

|

(1,574 |

) |

|

|

(10,167 |

) |

|

|

(5,780 |

) |

| Net income (loss) |

|

$ |

49,161 |

|

|

$ |

(15,370 |

) |

|

$ |

95,994 |

|

|

$ |

70,976 |

|

| Net income (loss) per

common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.41 |

|

|

$ |

(0.12 |

) |

|

$ |

0.80 |

|

|

$ |

0.57 |

|

|

Diluted |

|

$ |

0.41 |

|

|

$ |

(0.12 |

) |

|

$ |

0.79 |

|

|

$ |

0.56 |

|

| Weighted average number

of common shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

119,746 |

|

|

|

124,604 |

|

|

|

120,745 |

|

|

|

125,041 |

|

|

Diluted |

|

|

121,026 |

|

|

|

124,604 |

|

|

|

121,727 |

|

|

|

125,761 |

|

(1) Includes non-cash compensation of

$9,213 and $7,970 for the three months ended September 30, 2017 and

2016, respectively, and $28,069 and $24,440 for the nine months

ended September 30, 2017 and 2016, respectively.(2) Includes

the impact of the $16,498 Oi reserve for the nine months ended

September 30, 2016.

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| (in thousands, except par values) |

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

2017 |

|

|

2016 |

|

|

ASSETS |

|

(unaudited) |

|

|

|

| Current assets: |

|

|

|

|

|

|

| Cash and

cash equivalents |

|

$ |

139,711 |

|

|

$ |

146,109 |

|

|

Restricted cash |

|

|

30,168 |

|

|

|

36,786 |

|

| Accounts

receivable, net |

|

|

87,417 |

|

|

|

78,344 |

|

| Costs and

estimated earnings in excess of billings on uncompleted

contracts |

|

|

12,508 |

|

|

|

11,127 |

|

| Prepaid

and other current assets |

|

|

54,262 |

|

|

|

52,205 |

|

| Total

current assets |

|

|

324,066 |

|

|

|

324,571 |

|

| Property and equipment,

net |

|

|

2,777,339 |

|

|

|

2,792,076 |

|

| Intangible assets,

net |

|

|

3,550,710 |

|

|

|

3,656,924 |

|

| Other assets |

|

|

648,355 |

|

|

|

587,374 |

|

| Total

assets |

|

$ |

7,300,470 |

|

|

$ |

7,360,945 |

|

| LIABILITIES AND

SHAREHOLDERS' DEFICIT |

|

|

|

|

|

|

| Current

Liabilities: |

|

|

|

|

|

|

| Accounts

payable |

|

$ |

32,429 |

|

|

$ |

28,320 |

|

| Accrued

expenses |

|

|

85,052 |

|

|

|

61,129 |

|

| Current

maturities of long-term debt |

|

|

773,289 |

|

|

|

627,157 |

|

| Deferred

revenue |

|

|

101,168 |

|

|

|

101,098 |

|

| Accrued

interest |

|

|

19,668 |

|

|

|

44,503 |

|

| Other

current liabilities |

|

|

11,109 |

|

|

|

11,240 |

|

| Total

current liabilities |

|

|

1,022,715 |

|

|

|

873,447 |

|

| Long-term

liabilities: |

|

|

|

|

|

|

| Long-term

debt, net |

|

|

8,185,512 |

|

|

|

8,148,426 |

|

| Other

long-term liabilities |

|

|

350,041 |

|

|

|

334,993 |

|

| Total

long-term liabilities |

|

|

8,535,553 |

|

|

|

8,483,419 |

|

| Shareholders'

deficit: |

|

|

|

|

|

|

| Prefer.

stock-par value $.01, 30,000 shares authorized, no shares issued or

outst. |

|

|

— |

|

|

|

— |

|

| Common

stock - Class A, par value $.01, 400,000 shares authorized,

118,428 |

|

|

|

|

|

|

| and

121,004 shares issued and outstanding at September 30, 2017 |

|

|

|

|

|

|

| and

December 31, 2016, respectively |

|

|

1,184 |

|

|

|

1,210 |

|

|

Additional paid-in capital |

|

|

2,148,273 |

|

|

|

2,010,520 |

|

|

Accumulated deficit |

|

|

(4,064,805 |

) |

|

|

(3,637,467 |

) |

|

Accumulated other comprehensive loss |

|

|

(342,450 |

) |

|

|

(370,184 |

) |

| Total

shareholders' deficit |

|

|

(2,257,798 |

) |

|

|

(1,995,921 |

) |

| Total

liabilities and shareholders' deficit |

|

$ |

7,300,470 |

|

|

$ |

7,360,945 |

|

| CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS |

| (unaudited) (in thousands) |

|

|

|

|

|

|

|

|

| |

|

For the three months |

| |

|

ended September 30, |

| |

|

2017 |

|

|

2016 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

| Net

income (loss) |

|

$ |

49,161 |

|

|

$ |

(15,370 |

) |

| Adjust.

to reconcile net income (loss) to net cash provided by operating

activities: |

|

|

|

|

|

|

|

Depreciation, accretion, and amortization |

|

|

161,907 |

|

|

|

160,111 |

|

| Non-cash

asset impairment and decommission costs |

|

|

8,597 |

|

|

|

1,298 |

|

| Non-cash

compensation expense |

|

|

9,423 |

|

|

|

8,076 |

|

|

Amortization of deferred financing fees |

|

|

4,957 |

|

|

|

5,445 |

|

| (Gain)

loss on remeasurement of U.S. denominated intercompany loan |

|

|

(18,407 |

) |

|

|

3,168 |

|

| Provision

for doubtful accounts |

|

|

486 |

|

|

|

3,012 |

|

| Loss from

extinguishment of debt, net |

|

|

— |

|

|

|

34,512 |

|

| Other

non-cash items reflected in the Statements of Operations |

|

|

(1,017 |

) |

|

|

(2,770 |

) |

| Changes

in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

| Accounts

receivable and costs and estimated earnings in excess of

billings |

|

|

|

|

|

|

| on

uncompleted contracts, net |

|

|

(10,871 |

) |

|

|

(12,413 |

) |

| Prepaid

expenses and other assets |

|

|

(7,093 |

) |

|

|

(5,132 |

) |

| Accounts

payable and accrued expenses |

|

|

4,265 |

|

|

|

1,047 |

|

| Accrued

interest |

|

|

(22,375 |

) |

|

|

(16,901 |

) |

| Other

liabilities |

|

|

8,240 |

|

|

|

8,413 |

|

| Net cash

provided by operating activities |

|

|

187,273 |

|

|

|

172,496 |

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

Acquisitions |

|

|

(78,826 |

) |

|

|

(42,698 |

) |

| Capital

expenditures |

|

|

(36,875 |

) |

|

|

(33,659 |

) |

| Other

investing activities |

|

|

(6,573 |

) |

|

|

5,571 |

|

| Net cash

used in investing activities |

|

|

(122,274 |

) |

|

|

(70,786 |

) |

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

| Net

borrowings (repayments) under Revolving Credit Facility |

|

|

280,000 |

|

|

|

120,000 |

|

| Repayment

of Tower Securities |

|

|

— |

|

|

|

(550,000 |

) |

| Proceeds

from issuance of Tower Securities, net of fees |

|

|

— |

|

|

|

690,584 |

|

|

Repurchase and retirement of common stock, inclusive of fees |

|

|

(378,932 |

) |

|

|

(52,320 |

) |

| Proceeds

from 2016 Senior Notes, net of fees and original issue

discount |

|

|

— |

|

|

|

1,078,387 |

|

| Payment

for the redemption of 5.75% Senior Notes |

|

|

— |

|

|

|

(825,795 |

) |

| Other

financing activities |

|

|

5,440 |

|

|

|

(3,022 |

) |

| Net cash

(used in) provided by financing activities |

|

|

(93,492 |

) |

|

|

457,834 |

|

| Effect of

exchange rate changes on cash, cash equivalents, and restricted

cash |

|

|

3,762 |

|

|

|

(1,249 |

) |

| NET CHANGE IN CASH,

CASH EQUIVALENTS, AND RESTRICTED CASH |

|

|

(24,731 |

) |

|

|

558,295 |

|

| CASH, CASH EQUIVALENTS,

AND RESTRICTED CASH: |

|

|

|

|

|

|

| Beginning

of period |

|

|

197,193 |

|

|

|

162,636 |

|

| End of

period |

|

$ |

172,462 |

|

|

$ |

720,931 |

|

| |

|

|

|

|

|

|

|

|

Selected Capital Expenditure Detail

| |

|

|

|

|

|

|

| |

|

For the three |

|

For the nine |

| |

|

months ended |

|

months ended |

| |

|

September 30, 2017 |

|

September 30, 2017 |

| |

|

|

|

|

|

|

| |

|

(in thousands) |

| Construction and

related costs on new builds |

|

$ |

16,851 |

|

$ |

49,650 |

| Augmentation and tower

upgrades |

|

|

10,942 |

|

|

31,704 |

| Non-discretionary

capital expenditures: |

|

|

|

|

|

|

| Tower

maintenance |

|

|

8,056 |

|

|

21,752 |

| General

corporate |

|

|

1,026 |

|

|

3,204 |

| Total

non-discretionary capital expenditures |

|

|

9,082 |

|

|

24,956 |

| Total

capital expenditures |

|

$ |

36,875 |

|

$ |

106,310 |

| |

|

|

|

|

|

|

Communication Site Portfolio Summary

| |

|

|

|

|

|

|

| |

|

Domestic |

|

International |

|

Total |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Sites owned at June 30,

2017 |

|

15,947 |

|

|

10,615 |

|

|

26,562 |

|

| Sites acquired during

the third quarter |

|

35 |

|

|

83 |

|

|

118 |

|

| Sites built during the

third quarter |

|

15 |

|

|

119 |

|

|

134 |

|

| Sites

reclassified/decommissioned during the third quarter |

|

(48 |

) |

|

(2 |

) |

|

(50 |

) |

| Sites

owned at September 30, 2017 |

|

15,949 |

|

|

10,815 |

|

|

26,764 |

|

| |

|

|

|

|

|

|

|

|

|

Segment Operating Profit and Segment Operating

Profit Margin

Domestic site leasing and International site

leasing are the two segments within our site leasing

business. Segment operating profit is a key business metric

and one of our two measures of segment profitability. The

calculation of Segment operating profit for each of our segments is

set forth below.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic Site Leasing |

|

Int'l Site Leasing |

|

Site Development |

| |

|

For the three months |

|

For the three months |

|

For the three months |

| |

|

ended September 30, |

|

ended September 30, |

|

ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

| Segment revenue |

|

$ |

328,395 |

|

|

$ |

319,109 |

|

|

$ |

80,143 |

|

|

$ |

69,059 |

|

|

$ |

25,407 |

|

|

$ |

23,151 |

|

| Segment cost of

revenues (excluding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

depreciation, accretion, and amort.) |

|

|

(65,226 |

) |

|

|

(65,353 |

) |

|

|

(25,125 |

) |

|

|

(21,001 |

) |

|

|

(21,117 |

) |

|

|

(19,114 |

) |

| Segment

operating profit |

|

$ |

263,169 |

|

|

$ |

253,756 |

|

|

$ |

55,018 |

|

|

$ |

48,058 |

|

|

$ |

4,290 |

|

|

$ |

4,037 |

|

| Segment

operating profit margin |

|

|

80.1 |

% |

|

|

79.5 |

% |

|

|

68.6 |

% |

|

|

69.6 |

% |

|

|

16.9 |

% |

|

|

17.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures

The press release contains non-GAAP financial

measures including (i) Cash Site Leasing Revenue; (ii) Tower Cash

Flow and Tower Cash Flow Margin; (iii) Adjusted EBITDA, Annualized

Adjusted EBITDA, and Adjusted EBITDA Margin; (iv) Net Debt, Net

Secured Debt, Leverage Ratio, and Secured Leverage Ratio

(collectively, our “Non-GAAP Debt Measures”); (v) Funds from

Operations (“FFO”), Adjusted Funds from Operations (“AFFO”), and

AFFO per share; and (vi) certain financial metrics after

eliminating the impact of changes in foreign currency exchange

rates (collectively, our “Constant Currency

Measures”).

We have included these non-GAAP financial measures because we

believe that they provide investors additional tools in

understanding our financial performance and condition.

Specifically, we believe that:

(1) Cash Site Leasing Revenue and Tower

Cash Flow are useful indicators of the performance of our site

leasing operations;

(2) Adjusted EBITDA is useful to investors

or other interested parties in evaluating our financial

performance. Adjusted EBITDA is the primary measure used by

management (1) to evaluate the economic productivity of our

operations and (2) for purposes of making decisions about

allocating resources to, and assessing the performance of, our

operations. Management believes that Adjusted EBITDA helps

investors or other interested parties meaningfully evaluate and

compare the results of our operations (1) from period to period and

(2) to our competitors, by excluding the impact of our capital

structure (primarily interest charges from our outstanding debt)

and asset base (primarily depreciation, amortization and accretion)

from our financial results. Management also believes Adjusted

EBITDA is frequently used by investors or other interested parties

in the evaluation of REITs. In addition, Adjusted EBITDA is similar

to the measure of current financial performance generally used in

our debt covenant calculations. Adjusted EBITDA should be

considered only as a supplement to net income computed in

accordance with GAAP as a measure of our performance;

(3) FFO, AFFO and AFFO per share, which

are metrics used by our public company peers in the communication

site industry, provide investors useful indicators of the financial

performance of our business and permit investors an additional tool

to evaluate the performance of our business against those of our

two principal competitors. FFO, AFFO, and AFFO per share are also

used to address questions we receive from analysts and investors

who routinely assess our operating performance on the basis of

these performance measures, which are considered industry

standards. We believe that FFO helps investors or other interested

parties meaningfully evaluate financial performance by excluding

the impact of our asset base (primarily depreciation, amortization

and accretion). We believe that AFFO and AFFO per share help

investors or other interested parties meaningfully evaluate our

financial performance as they include (1) the impact of our capital

structure (primarily interest expense on our outstanding debt) and

(2) sustaining capital expenditures and exclude the impact of our

(1) asset base (primarily depreciation, amortization and accretion)

and (2) certain non-cash items, including straight-lined revenues

and expenses related to fixed escalations and rent free periods and

the non-cash portion of our reported tax provision. GAAP requires

rental revenues and expenses related to leases that contain

specified rental increases over the life of the lease to be

recognized evenly over the life of the lease. In accordance with

GAAP, if payment terms call for fixed escalations, or rent free

periods, the revenue or expense is recognized on a straight-lined

basis over the fixed, non-cancelable term of the contract. We only

use AFFO as a performance measure. AFFO should be considered only

as a supplement to net income computed in accordance with GAAP as a

measure of our performance and should not be considered as an

alternative to cash flows from operations or as residual cash flow

available for discretionary investment. We believe our definition

of FFO is consistent with how that term is defined by the National

Association of Real Estate Investment Trusts (“NAREIT”) and that

our definition and use of AFFO and AFFO per share is consistent

with those reported by the other communication site companies;

(4) Our Non-GAAP Debt Measures provide

investors a more complete understanding of our net debt and

leverage position as they include the full principal amount of our

debt which will be due at maturity and, to the extent that such

measures are calculated on Net Debt are net of our cash and cash

equivalents, short-term restricted cash, and short-term

investments; and

(5) Our Constant Currency Measures provide

management and investors the ability to evaluate the performance of

the business without the impact of foreign currency exchange rate

fluctuations.

In addition, Tower Cash Flow, Adjusted EBITDA,

and our Non-GAAP Debt Measures are components of the calculations

used by our lenders to determine compliance with certain covenants

under our Senior Credit Agreement and indentures relating to our

2014 Senior Notes, 2016 Senior Notes, and 2017 Senior Notes.

These non-GAAP financial measures are not intended to be an

alternative to any of the financial measures provided in our

results of operations or our balance sheet as determined in

accordance with GAAP.

Financial Metrics after Eliminating the Impact

of Changes In Foreign Currency Exchange Rates

We eliminate the impact of changes in foreign

currency exchange rates for each of the following financial metrics

by dividing the current period’s financial results by the average

monthly exchange rates of the prior year period. The table

below provides the reconciliation of the reported growth rate

year-over-year of each of the following measures to the growth rate

after eliminating the impact of changes in foreign currency

exchange rates to such measure: (1) total site leasing revenue,

total cash site leasing revenue, and International cash site

leasing revenue, (2) total site leasing segment operating profit

and International site leasing segment operating profit, (3) total

Tower Cash Flow and International Tower Cash Flow, (4) Net income,

(5) diluted earnings per share, (6) Adjusted EBITDA, and (7) AFFO

and AFFO per share.

| |

|

|

|

|

|

|

| |

|

|

|

|

|

Growth |

| |

|

Third quarter |

|

|

|

excluding |

| |

|

2017 year |

|

Foreign |

|

foreign |

| |

|

over year |

|

currency |

|

currency |

| |

|

growth rate |

|

impact |

|

impact |

| |

|

|

|

|

|

|

| Total site leasing

revenue |

|

5.2 |

% |

|

0.3 |

% |

|

4.9 |

% |

| Total cash site leasing

revenue |

|

6.1 |

% |

|

0.4 |

% |

|

5.7 |

% |

| Int'l cash site leasing

revenue |

|

19.2 |

% |

|

2.3 |

% |

|

16.9 |

% |

| Total site leasing

segment operating profit |

|

5.4 |

% |

|

0.3 |

% |

|

5.1 |

% |

| Int'l site leasing

segment operating profit |

|

14.5 |

% |

|

2.1 |

% |

|

12.4 |

% |

| Total site leasing

tower cash flow |

|

6.2 |

% |

|

0.3 |

% |

|

5.9 |

% |

| Int'l site leasing

tower cash flow |

|

18.6 |

% |

|

2.1 |

% |

|

16.5 |

% |

| Net income |

|

419.5 |

% |

|

121.0 |

% |

|

298.5 |

% |

| Earnings per share -

diluted |

|

441.7 |

% |

|

133.4 |

% |

|

308.3 |

% |

| Adjusted EBITDA |

|

7.0 |

% |

|

0.3 |

% |

|

6.7 |

% |

| AFFO |

|

10.3 |

% |

|

0.4 |

% |

|

9.9 |

% |

| AFFO per share |

|

14.4 |

% |

|

0.7 |

% |

|

13.7 |

% |

| |

|

|

|

|

|

|

|

|

|

Cash Site Leasing Revenue, Tower Cash Flow, and

Tower Cash Flow Margin

The tables below set forth the reconciliation of

Cash Site Leasing Revenue and Tower Cash Flow to their most

comparable GAAP measurement and Tower Cash Flow Margin, which is

calculated by dividing Tower Cash Flow by Cash Site Leasing

Revenue.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Domestic Site Leasing |

|

Int'l Site Leasing |

|

Total Site Leasing |

| |

|

For the three months |

|

For the three months |

|

For the three months |

| |

|

ended September 30, |

|

ended September 30, |

|

ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

| Site leasing

revenue |

|

$ |

328,395 |

|

|

$ |

319,109 |

|

|

$ |

80,143 |

|

|

$ |

69,059 |

|

|

$ |

408,538 |

|

|

$ |

388,168 |

|

| Non-cash straight-line

leasing revenue |

|

|

(503 |

) |

|

|

(2,280 |

) |

|

|

(3,873 |

) |

|

|

(5,054 |

) |

|

|

(4,376 |

) |

|

|

(7,334 |

) |

| Cash site

leasing revenue |

|

|

327,892 |

|

|

|

316,829 |

|

|

|

76,270 |

|

|

|

64,005 |

|

|

|

404,162 |

|

|

|

380,834 |

|

| Site leasing cost of

revenues (excluding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

depreciation, accretion, and amortization) |

|

|

(65,226 |

) |

|

|

(65,353 |

) |

|

|

(25,125 |

) |

|

|

(21,001 |

) |

|

|

(90,351 |

) |

|

|

(86,354 |

) |

| Non-cash straight-line

ground lease expense |

|

|

6,774 |

|

|

|

7,420 |

|

|

|

924 |

|

|

|

903 |

|

|

|

7,698 |

|

|

|

8,323 |

|

| Tower

Cash Flow |

|

$ |

269,440 |

|

|

$ |

258,896 |

|

|

$ |

52,069 |

|

|

$ |

43,907 |

|

|

$ |

321,509 |

|

|

$ |

302,803 |

|

| Tower

Cash Flow Margin |

|

|

82.2 |

% |

|

|

81.7 |

% |

|

|

68.3 |

% |

|

|

68.6 |

% |

|

|

79.5 |

% |

|

|

79.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecasted Tower Cash Flow for Full Year

2017

The table below sets forth the reconciliation of

forecasted Tower Cash Flow set forth in the Outlook section to its

most comparable GAAP measurement for the full year 2017:

| |

|

|

|

|

|

| |

Full Year 2017 |

| |

|

|

|

|

|

|

|

(in millions) |

| Site leasing

revenue |

$ |

1,613.0 |

|

to |

$ |

1,623.0 |

|

| Non-cash straight-line

leasing revenue |

|

(16.5 |

) |

to |

|

(11.5 |

) |

| Cash site

leasing revenue |

|

1,596.5 |

|

to |

|

1,611.5 |

|

| Site leasing cost of

revenues (excluding |

|

|

|

|

|

|

depreciation, accretion, and amortization) |

|

(353.5 |

) |

to |

|

(363.5 |

) |

| Non-cash straight-line

ground lease expense |

|

28.0 |

|

to |

|

33.0 |

|

| Tower

Cash Flow |

$ |

1,271.0 |

|

to |

$ |

1,281.0 |

|

Adjusted EBITDA, Annualized Adjusted EBITDA, and

Adjusted EBITDA Margin

The table below sets forth the reconciliation of

Adjusted EBITDA to its most comparable GAAP measurement.

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

For the three months |

| |

|

|

|

|

ended September 30, |

| |

|

|

|

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

(in thousands) |

| Net income

(loss) |

|

$ |

49,161 |

|

|

$ |

(15,370 |

) |

| Non-cash straight-line leasing revenue |

|

|

(4,376 |

) |

|

|

(7,334 |

) |

| Non-cash straight-line ground lease expense |

|

|

7,698 |

|

|

|

8,323 |

|

| Non-cash compensation |

|

|

9,423 |

|

|

|

8,076 |

|

| Loss from extinguishment of debt, net |

|

|

— |

|

|

|

34,512 |

|

| Other (income) expense |

|

|

(20,062 |

) |

|

|

1,139 |

|

| Acquisition related adjustments and expenses |

|

|

1,583 |

|

|

|

2,970 |

|

| Asset impairment and decommission costs |

|

|

9,417 |

|

|

|

2,305 |

|

| Interest income |

|

|

(2,505 |

) |

|

|

(3,101 |

) |

| Total interest expense (1) |

|

|

87,039 |

|

|

|

89,456 |

|

| Depreciation, accretion, and amortization |

|

|

161,907 |

|

|

|

160,111 |

|

| Provision for taxes (2) |

|

|

3,835 |

|

|

|

2,123 |

|

| Adjusted EBITDA |

|

$ |

303,120 |

|

|

$ |

283,210 |

|

| Annualized Adjusted EBITDA (3) |

|

$ |

1,212,480 |

|

|

$ |

1,132,840 |

|

| |

|

|

|

|

|

|

|

|

(1) Total interest expense includes

interest expense, non-cash interest expense, and amortization of

deferred financing fees.(2) For the three months ended

September 30, 2017 and 2016, these amounts included $457 and $549,

respectively, of franchise and gross receipts taxes reflected in

the Statements of Operations in selling, general and administrative

expenses.(3) Annualized Adjusted EBITDA is calculated as

Adjusted EBITDA for the most recent quarter multiplied by four.

The calculation of Adjusted EBITDA Margin is as

follows:

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

For the three months |

| |

|

|

|

|

ended September 30, |

| |

|

|

|

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

(in thousands) |

| Total revenues |

|

|

|

|

$ |

433,945 |

|

|

$ |

411,319 |

|

| Non-cash straight-line

leasing revenue |

|

|

|

|

|

(4,376 |

) |

|

|

(7,334 |

) |

| Total

revenues minus non-cash straight-line leasing revenue |

|

|

|

|

$ |

429,569 |

|

|

$ |

403,985 |

|

| Adjusted

EBITDA |

|

|

|

|

$ |

303,120 |

|

|

$ |

283,210 |

|

| Adjusted

EBITDA Margin |

|

|

|

|

|

70.6 |

% |

|

|

70.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Forecasted Adjusted EBITDA for Full Year

2017

The table below sets forth the reconciliation of

the forecasted Adjusted EBITDA set forth in the Outlook section to

its most comparable GAAP measurement for the full year 2017:

| |

|

|

|

|

|

| |

Full Year 2017 |

| |

|

|

|

|

|

|

|

(in millions) |

| Net income |

$ |

94.5 |

|

to |

$ |

129.5 |

|

| Non-cash

straight-line leasing revenue |

|

(16.5 |

) |

to |

|

(11.5 |

) |

| Non-cash

straight-line ground lease expense |

|

28.0 |

|

to |

|

33.0 |

|

| Non-cash

compensation |

|

39.0 |

|

to |

|

34.0 |

|

| Loss from

extinguishment of debt, net |

|

2.0 |

|

to |

|

2.0 |

|

| Other

(income) expense |

|

(8.0 |

) |

to |

|

(13.0 |

) |

|

Acquisition related adjustments and expenses |

|

12.0 |

|

to |

|

8.0 |

|

| Asset

impairment and decommission costs |

|

36.0 |

|

to |

|

32.0 |

|

| Interest

income |

|

(12.0 |

) |

to |

|

(10.0 |

) |

| Total

interest expense (1) |

|

352.0 |

|

to |

|

345.0 |

|

|

Depreciation, accretion, and amortization |

|

650.0 |

|

to |

|

640.0 |

|

| Provision

for taxes (2) |

|

18.0 |

|

to |

|

16.0 |

|

| Adjusted

EBITDA |

$ |

1,195.0 |

|

to |

$ |

1,205.0 |

|

| |

|

|

|

|

|

|

|

(1) Total interest expense includes

interest expense, non-cash interest expense, and amortization of

deferred financing fees.(2) Includes projections for

franchise taxes and gross receipts taxes which will be reflected in

the Statement of Operations in Selling, general, and administrative

expenses.

Funds from Operations (“FFO”) and Adjusted Funds

from Operations (“AFFO”)

The tables below set forth the reconciliations

of FFO and AFFO to their most comparable GAAP measurement.

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

For the three months |

| |

|

|

|

|

ended September 30, |

| (in

thousands, except per share amounts) |

|

2017 |

|

2016 |

| |

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

$ |

49,161 |

|

|

$ |

(15,370 |

) |

| Real estate

related depreciation, amortization, and accretion |

|

|

160,995 |

|

|

|

158,863 |

|

| Adjustments

for unconsolidated joint ventures |

|

|

260 |

|

|

|

— |

|

| FFO |

|

$ |

210,416 |

|

|

$ |

143,493 |

|

| Adjustments

to FFO: |

|

|

|

|

|

|

| Non-cash straight-line leasing revenue |

|

|

(4,376 |

) |

|

|

(7,334 |

) |

| Non-cash straight-line ground lease expense |

|

|

7,698 |

|

|

|

8,323 |

|

| Non-cash compensation |

|

|

9,423 |

|

|

|

8,076 |

|

| Adjustment for non-cash portion of tax provision |

|

|

(620 |

) |

|

|

(1,163 |

) |

| Non-real estate related depreciation, amortization, and

accretion |

|

|

912 |

|

|

|

1,248 |

|

| Amortization of deferred financing costs and debt

discounts |

|

|

5,682 |

|

|

|

6,030 |

|

| Loss from extinguishment of debt, net |

|

|

— |

|

|

|

34,512 |

|

| Other (income) expense |

|

|

(20,062 |

) |

|

|

1,139 |

|

| Acquisition related adjustments and expenses |

|

|

1,583 |

|

|

|

2,970 |

|

| Asset impairment and decommission costs |

|

|

9,417 |

|

|

|

2,305 |

|

| Non-discretionary cash capital expenditures |

|

|

(9,082 |

) |

|

|

(8,059 |

) |

| Adjustments for unconsolidated joint ventures |

|

|

260 |

|

|

|

— |

|

| AFFO |

|

$ |

211,251 |

|

|

$ |

191,540 |

|

| Weighted

average number of common shares (1) |

|

|

121,026 |

|

|

|

125,381 |

|

| AFFO per

share |

|

$ |

1.75 |

|

|

$ |

1.53 |

|

| |

|

|

|

|

|

|

|

|

(1) For purposes of the AFFO per

share calculation, the basic weighted average number of common

shares has been adjusted to include the dilutive effect of stock

options and restricted stock units.

Forecasted AFFO for the Full Year 2017

The table below sets forth the reconciliation of

the forecasted AFFO and AFFO per share set forth in the Outlook

section to its most comparable GAAP measurement for the full year

2017:

| |

|

|

|

|

|

| (in millions,

except per share amounts) |

Full Year 2017 |

| |

|

|

|

|

|

| Net income |

$ |

94.5 |

|

to |

$ |

129.5 |

|

| Real estate related

depreciation, amortization, and accretion |

|

642.0 |

|

to |

|

634.0 |

|

| Adjustments for

unconsolidated joint ventures |

|

0.5 |

|

to |

|

1.5 |

|

| FFO |

$ |

737.0 |

|

to |

$ |

765.0 |

|

| Adjustments to

FFO: |

|

|

|

|

|

| Non-cash

straight-line leasing revenue |

|

(16.5 |

) |

to |

|

(11.5 |

) |

| Non-cash

straight-line ground lease expense |

|

28.0 |

|

to |

|

33.0 |

|

| Non-cash

compensation |

|

39.0 |

|

to |

|

34.0 |

|

| Non-real

estate related depreciation, amortization, and accretion |

|

8.0 |

|

to |

|

6.0 |

|

| Amort. of

deferred financing costs and debt discounts |

|

25.0 |

|

to |

|

25.0 |

|

| Loss from

extinguishment of debt, net |

|

2.0 |

|

to |

|

2.0 |

|

| Other

(income) expense |

|

(8.0 |

) |

to |

|

(13.0 |

) |

|

Acquisition related adjustments and expenses |

|

12.0 |

|

to |

|

8.0 |

|

| Asset

impairment and decommission costs |

|

36.0 |

|

to |

|

32.0 |

|

|

Non-discretionary cash capital expenditures |

|

(37.5 |

) |

to |

|

(32.5 |

) |

|

Adjustments for unconsolidated joint ventures |

|

0.5 |

|

to |

|

1.5 |

|

| AFFO |

$ |

825.5 |

|

to |

$ |

849.5 |

|

| Weighted average number

of common shares (1) |

|

121.1 |

|

|

|

121.1 |

|

| AFFO per share |

$ |

6.82 |

|

to |

$ |

7.01 |

|

| |

|

|

|

|

|

|

|

(1) Our assumption for weighted average

number of common shares does not contemplate any additional

repurchases of the Company’s stock during 2017 other than those

repurchases completed as of the date of this press release.

Net Debt, Net Secured Debt, Leverage Ratio, and

Secured Leverage Ratio

Net Debt is calculated using the notional

principal amount of outstanding debt. Under GAAP policies, the

notional principal amount of the Company's outstanding debt is not

necessarily reflected on the face of the Company's financial

statements.

The Net Debt and Leverage calculations are as

follows:

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

September 30, |

| |

|

|

|

|

|

|

|

|

|

2017 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

(in thousands) |

| 2013-1C

Tower Securities |

|

$ |

425,000 |

|

| 2013-2C

Tower Securities |

|

|

575,000 |

|

| 2013-1D

Tower Securities |

|

|

330,000 |

|

| 2014-1C

Tower Securities |

|

|

920,000 |

|

| 2014-2C

Tower Securities |

|

|

620,000 |

|

| 2015-1C

Tower Securities |

|

|

500,000 |

|

| 2016-1C

Tower Securities |

|

|

700,000 |

|

| 2017-1C

Tower Securities |

|

|

760,000 |

|

| Revolving

Credit Facility |

|

|

430,000 |

|

| 2014 Term

Loan |

|

|

1,451,250 |

|

| 2015 Term

Loan |

|

|

488,750 |

|

| Total secured debt |

|

|

7,200,000 |

|

| 2014

Senior Notes |

|

|

750,000 |

|

| 2016

Senior Notes |

|

|

1,100,000 |

|

| Total unsecured debt |

|

|

1,850,000 |

|

| Total debt |

|

$ |

9,050,000 |

|

|

|

|

|

|

| Leverage

Ratio |

|

|

|

| Total

debt |

|

$ |

9,050,000 |

|

| Less: Cash

and cash equivalents, short-term restricted cash and short-term

investments |

|

|

(170,111 |

) |

| Net debt |

|

$ |

8,879,889 |

|

| Divided

by: Annualized Adjusted EBITDA |

|

$ |

1,212,480 |

|

| Leverage

Ratio |

|

|

7.3x |

|

|

|

|

|

|

| Secured

Leverage Ratio |

|

|

|

| Total

secured debt |

|

$ |

7,200,000 |

|

| Less: Cash

and cash equivalents, short-term restricted cash and short-term

investments |

|

|

(170,111 |

) |

| Net Secured Debt |

|

$ |

7,029,889 |

|

| Divided

by: Annualized Adjusted EBITDA |

|

$ |

1,212,480 |

|

| Secured

Leverage Ratio |

|

|

5.8x |

|

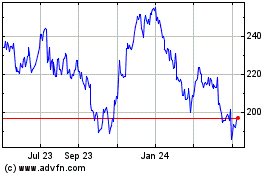

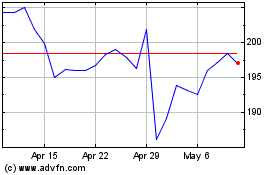

SBA Communications (NASDAQ:SBAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

SBA Communications (NASDAQ:SBAC)

Historical Stock Chart

From Apr 2023 to Apr 2024