Kite Realty Group Trust (NYSE:KRG) (the “Company”) announced today

its operating results for the third quarter ended September 30,

2017. Financial statements, exhibits, and reconciliations of

non-GAAP measures attached to this release include the details of

the Company’s results.

Third Quarter Highlights

- Net loss attributable to common shareholders was $0.6 million,

or $0.01 per diluted common share.

- Funds From Operations of the Operating Partnership (“FFO”), as

defined by NAREIT, was $41.8 million, or $0.49 per diluted

share.

- Same-Property Net Operating Income (“NOI”) increased 3.6% for

the comparable operating portfolio, or 3.9% excluding the impact of

the Company’s Redevelopment, Repurpose and Reposition (“3-R”)

initiative, in each case compared to the same period in the prior

year.

- Small shop leased percentage increased 100 basis points to

89.7% from the same period in the prior year.

- The aggregate rent spread on comparable new and renewal leases

was 11.1% on a cash basis and 17.0% on a GAAP basis.

- Construction commenced on Phase II of Eddy Street Commons at

the University of Notre Dame.

“Our portfolio and operating results

continue to be strong, as evidenced by another excellent quarter,”

said John Kite, Chief Executive Officer. “We remain committed to

our long-term strategic goals, which we are demonstrating by

continuing to execute on high-quality projects in our 3-R

initiative, driving strong same-store results, and increasing small

shop leasing, which increased by another 100 basis points compared

to last year to reach 89.7%.”

Financial & Portfolio

Results

Financial Results

Net loss attributable to common shareholders for

the three months ended September 30, 2017, was $0.6 million,

compared to a net loss of $1.7 million for the same period in

2016.

For the three months ended September 30, 2017, FFO,

as defined by NAREIT, was $41.8 million, or $0.49 per diluted

share, compared to $43.6 million, or $0.51 per diluted share, for

the same period in the prior year. For the three months ended

September 30, 2017, FFO, as adjusted, was $41.8 million, or $0.49

per diluted share, compared to $44.7 million, or $0.52 per diluted

share, for the same period in the prior year. The

year-over-year decline in FFO was primarily due to the sale of four

operating properties and the use of the resulting proceeds to pay

down debt.

Portfolio Operations

As of September 30, 2017, the Company owned

interests in 117 operating and redevelopment properties totaling

approximately 23.1 million square feet and two development projects

currently under construction. The owned gross leasable area in the

Company’s retail operating portfolio was 94.5% leased as of

September 30, 2017, and the Company’s total portfolio was 94.6%

leased. We continue to increase our small-shop leased percentage,

and hit a new high of 89.7% leased in the third quarter, an

increase of 100 basis points year over year.

Same-property NOI, which includes 104 operating

properties, increased 3.6% in the third quarter compared to the

same period in the prior year, or 3.9% excluding the impact of the

Company’s 3-R initiative. The leased percentage of properties

included in the same-property pool was 94.4% at September 30, 2017,

compared to 95.1% at September 30, 2016, while the economic

occupancy percentage increased to 93.5% from 92.8% year over

year.

The Company executed 86 leases totaling 432,814

square feet during the third quarter of 2017, including 65

comparable new and renewal leases for 384,816 square feet. Cash

rent spreads on comparable new and renewal leases executed in the

quarter were 18.9% and 9.7%, respectively, for a blended cash rent

spread of 11.1%. The blended leasing spread on a straight-line

basis, which includes periodic contractual rent increases over the

term of the lease, was 17.0%.

The majority of the 35 tenants opening for business

in the third quarter were in the food, fitness, entertainment, and

service sectors. Openings this quarter included a new Publix

Supermarket at Burnt Store Promenade (one of our 3-R projects),

Ulta Salon, Pet Supermarket, Tuesday Morning, and Le Creuset.

Development and Redevelopment

As of September 30, 2017, we had two development

projects under construction. The expansion of Phase II of Holly

Springs is 100% pre-leased or committed, with projected costs of

$2.7 million. Phase II of Eddy Street Commons is a mixed-use

development at the University of Notre Dame that will include a

retail component, apartments, townhomes, and a community

center. The total projected costs for the project are

currently $89.2 million. We are in the final stages of entering

into a ground sublease with a multi-family developer who will fund

the majority of these costs, leaving our share of the projected

costs at $8.5 million. The Company has also begun construction of a

full-service hotel in Phase I of Eddy Street Commons, which we

project will cost $46.0 million to construct. We are in the final

stages of negotiating to form and retain a minority interest in an

unconsolidated joint venture that will complete and own this hotel.

Funding for both Eddy Street Commons projects will include a total

of $22.1 million in net tax increment financing proceeds.

The Company’s 3-R program currently includes eight

projects under various stages of construction, with estimated

combined costs ranging from $72.5 to $79.0 million and an estimated

combined annualized return ranging from 8.0% to 9.0%. During the

quarter, the Company commenced construction on one new project at

Centennial Center (Las Vegas, NV).

2017 Earnings Guidance

The Company is updating its guidance for 2017 FFO,

as defined by NAREIT, to a range of $2.03 to $2.05 from $2.01 to

$2.05 per diluted share. Please refer to the full list of guidance

assumptions on page 38 of the Company’s third quarter

supplemental.

| Guidance Range

For Full Year 2017 |

Low |

High |

| Consolidated net income

per diluted common share |

$ |

0.16 |

|

|

$ |

0.18 |

|

|

| Add: Depreciation,

amortization and other |

1.96 |

|

|

1.96 |

|

|

| Less: Gain on sale of

operating property |

(0.18 |

) |

|

(0.18 |

) |

|

| Add: Impairment of

operating property |

0.09 |

|

|

0.09 |

|

|

| FFO, as defined

by NAREIT, per diluted share |

$ |

2.03 |

|

|

$ |

2.05 |

|

|

Earnings Conference Call

The Company will conduct a conference call to

discuss its financial results on Friday, October 27, 2017, at 11:00

a.m. Eastern Time. A live webcast of the conference call will

be available online on the Company’s corporate website at

www.kiterealty.com. The dial-in numbers are (844) 309-0605

for domestic callers and (574) 990-9933 for international callers

(passcode 93988642). In addition, a webcast replay link will

be available on the corporate website.

About Kite Realty Group Trust

Kite Realty Group Trust is a full-service,

vertically integrated real estate investment trust (REIT) engaged

primarily in the ownership and operation, acquisition, development

and redevelopment of high-quality neighborhood and community

shopping centers in select markets in the United States. As of

September 30, 2017, we owned interests in 117 operating and

redevelopment properties totaling approximately 23.1 million square

feet and two development projects currently under construction.

Our strategy is to maximize the cash flow of our

operating properties, successfully complete the construction and

lease-up of our redevelopment and development portfolio, and

identify additional opportunities to acquire or dispose of

properties to further strengthen the Company. New investments are

focused in the shopping center sector primarily in markets where we

believe we can leverage our existing infrastructure and

relationships to generate attractive risk-adjusted returns or

otherwise in desirable trade areas. Dispositions are generally

designed to increase the quality of our portfolio and to strengthen

the Company’s balance sheet.

Safe Harbor

Certain statements in this document that are not

historical fact may constitute forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

are based on assumptions and expectations that may not be realized

and are inherently subject to risks, uncertainties and other

factors, many of which cannot be predicted with accuracy and some

of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or

otherwise, may differ materially from the results, performance,

transactions or achievements, financial or otherwise, expressed or

implied by the forward-looking statements. Risks, uncertainties and

other factors that might cause such differences, some of which

could be material, include, but are not limited to: national and

local economic, business, real estate and other market conditions,

particularly in light of low growth in the U.S. economy as well as

economic uncertainty caused by fluctuations in the prices of oil

and other energy sources; financing risks, including the

availability of, and costs associated with, sources of liquidity;

the Company’s ability to refinance, or extend the maturity dates

of, its indebtedness; the level and volatility of interest rates;

the financial stability of tenants, including their ability to pay

rent and the risk of tenant bankruptcies; the competitive

environment in which the Company operates; acquisition,

disposition, development and joint venture risks; property

ownership and management risks; the Company’s ability to maintain

its status as a real estate investment trust for federal income tax

purposes; potential environmental and other liabilities; impairment

in the value of real estate property the Company owns; the impact

of online retail and the perception that such retail has on the

value of shopping center assets; risks related to the geographical

concentration of the Company’s properties in Florida, Indiana and

Texas; insurance costs and coverage; risks associated with

cybersecurity attacks and the loss of confidential information and

other business interruptions; and other factors affecting the real

estate industry generally. The Company refers you to the documents

filed by the Company from time to time with the SEC, specifically

the section titled “Risk Factors” in the Company’s and the

Operating Partnership’s Annual Report on Form 10-K for the fiscal

year ended December 31, 2016, which discuss these and other factors

that could adversely affect the Company’s results. The Company

undertakes no obligation to publicly update or revise these

forward-looking statements, whether as a result of new information,

future events or otherwise.

| Kite Realty Group Trust |

| Consolidated Balance Sheets |

| (Unaudited) |

| |

| ($ in

thousands) |

|

|

|

|

| |

|

September 30, 2017 |

|

December 31, 2016 |

|

Assets: |

|

|

|

|

| Investment properties,

at cost |

|

$ |

3,955,928 |

|

|

$ |

3,996,065 |

|

| Less:

accumulated depreciation |

|

(635,583 |

) |

|

(560,683 |

) |

| |

|

3,320,345 |

|

|

3,435,382 |

|

| |

|

|

|

|

| Cash and cash

equivalents |

|

32,465 |

|

|

19,874 |

|

| Tenant and other

receivables, including accrued straight-line rent of $30,956 and

$28,703 respectively, net of allowance for uncollectible

accounts |

|

53,271 |

|

|

53,087 |

|

| Restricted cash and

escrow deposits |

|

8,878 |

|

|

9,037 |

|

| Deferred costs and

intangibles, net |

|

115,623 |

|

|

129,264 |

|

| Prepaid and other

assets |

|

12,810 |

|

|

9,727 |

|

| Total

Assets |

|

$ |

3,543,392 |

|

|

$ |

3,656,371 |

|

| Liabilities and

Shareholders’ Equity: |

|

|

|

|

| Mortgage and other

indebtedness, net |

|

$ |

1,681,676 |

|

|

$ |

1,731,074 |

|

| Accounts payable and

accrued expenses |

|

101,574 |

|

|

80,664 |

|

| Deferred revenue and

other liabilities |

|

101,066 |

|

|

112,202 |

|

| Total

Liabilities |

|

1,884,316 |

|

|

1,923,940 |

|

| Commitments and

contingencies |

|

|

|

|

| Limited Partners’

interests in the Operating Partnership and other redeemable

noncontrolling interests |

|

73,454 |

|

|

88,165 |

|

| Shareholders’

Equity: |

|

|

|

|

|

Kite Realty Group Trust Shareholders’ Equity: |

|

|

|

|

| Common

Shares, $.01 par value, 225,000,000 shares authorized, 83,594,068

and 83,545,398 shares issued and outstanding at September 30, 2017

and December 31, 2016, respectively |

|

836 |

|

|

835 |

|

|

Additional paid in capital |

|

2,068,636 |

|

|

2,062,360 |

|

|

Accumulated other comprehensive loss |

|

1,050 |

|

|

(316 |

) |

|

Accumulated deficit |

|

(485,598 |

) |

|

(419,305 |

) |

|

Total Kite Realty Group Trust Shareholders’

Equity |

|

1,584,924 |

|

|

1,643,574 |

|

| Noncontrolling

Interests |

|

698 |

|

|

692 |

|

| Total

Equity |

|

1,585,622 |

|

|

1,644,266 |

|

| Total

Liabilities and Shareholders' Equity |

|

$ |

3,543,392 |

|

|

$ |

3,656,371 |

|

| Kite Realty Group Trust |

| Consolidated Statements of

Operations |

| For the Three and Nine Months Ended September

30, 2017 and 2016 |

| (Unaudited) |

| |

| ($ in

thousands, except per share data) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Revenue: |

|

|

|

|

|

|

|

|

| Minimum

rent |

|

$ |

67,585 |

|

|

$ |

69,518 |

|

|

$ |

204,926 |

|

|

$ |

205,436 |

|

| Tenant

reimbursements |

|

17,657 |

|

|

17,531 |

|

|

54,748 |

|

|

52,691 |

|

| Other

property related revenue |

|

1,896 |

|

|

2,073 |

|

|

10,226 |

|

|

7,120 |

|

| Total

revenue |

|

87,138 |

|

|

89,122 |

|

|

269,900 |

|

|

265,247 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

| Property

operating |

|

11,859 |

|

|

11,916 |

|

|

36,950 |

|

|

35,454 |

|

| Real

estate taxes |

|

10,826 |

|

|

10,690 |

|

|

32,384 |

|

|

32,327 |

|

| General,

administrative, and other |

|

5,431 |

|

|

5,081 |

|

|

16,389 |

|

|

15,228 |

|

|

Transaction costs |

|

— |

|

|

— |

|

|

— |

|

|

2,771 |

|

|

Impairment charge |

|

— |

|

|

— |

|

|

7,411 |

|

|

— |

|

|

Depreciation and amortization |

|

42,793 |

|

|

45,543 |

|

|

131,333 |

|

|

131,625 |

|

| Total

expenses |

|

70,909 |

|

|

73,230 |

|

|

224,467 |

|

|

217,405 |

|

| Operating

income |

|

16,229 |

|

|

15,892 |

|

|

45,433 |

|

|

47,842 |

|

| Interest

expense |

|

(16,372 |

) |

|

(17,139 |

) |

|

(49,250 |

) |

|

(47,964 |

) |

| Income

tax benefit (expense) of taxable REIT subsidiary |

|

33 |

|

|

(15 |

) |

|

64 |

|

|

(763 |

) |

| Other

expense, net |

|

(94 |

) |

|

— |

|

|

(314 |

) |

|

(94 |

) |

| Loss from

continuing operations |

|

(204 |

) |

|

(1,262 |

) |

|

(4,067 |

) |

|

(979 |

) |

| Gains on

sales of operating properties |

|

— |

|

|

— |

|

|

15,160 |

|

|

194 |

|

| Net (loss)

income |

|

(204 |

) |

|

(1,262 |

) |

|

11,093 |

|

|

(785 |

) |

| Net

income attributable to noncontrolling interests |

|

(418 |

) |

|

(420 |

) |

|

(1,528 |

) |

|

(1,391 |

) |

| Net (loss)

income attributable to Kite Realty Group Trust common

shareholders |

|

$ |

(622 |

) |

|

$ |

(1,682 |

) |

|

$ |

9,565 |

|

|

$ |

(2,176 |

) |

| |

|

|

|

|

|

|

|

|

| (Loss) income

per common share - basic |

|

$ |

(0.01 |

) |

|

(0.02 |

) |

|

0.11 |

|

|

(0.03 |

) |

| (Loss) income

per common share - diluted |

|

$ |

(0.01 |

) |

|

$ |

(0.02 |

) |

|

$ |

0.11 |

|

|

$ |

(0.03 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average common

shares outstanding - basic |

|

83,594,163 |

|

|

83,474,348 |

|

|

83,581,847 |

|

|

83,399,813 |

|

| Weighted average common

shares outstanding - diluted |

|

83,594,163 |

|

|

83,474,348 |

|

|

83,689,590 |

|

|

83,399,813 |

|

| Cash dividends

declared per common share |

|

$ |

0.3025 |

|

|

$ |

0.2875 |

|

|

$ |

0.9075 |

|

|

$ |

0.8625 |

|

| |

|

|

|

|

|

|

|

|

| Kite Realty Group Trust |

| Funds From Operations |

| For the Three and Nine Months Ended September

30, 2017 and 2016 |

| (Unaudited) |

| |

| ($ in

thousands, except per share data) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

|

2017 |

|

2016 |

|

2017 |

|

2016 |

| Funds From

Operations |

|

|

|

|

|

|

|

|

| Consolidated net (loss)

income |

|

$ |

(204 |

) |

|

$ |

(1,262 |

) |

|

$ |

11,093 |

|

|

$ |

(785 |

) |

| Less: net income

attributable to noncontrolling interests in properties |

|

(432 |

) |

|

(461 |

) |

|

(1,302 |

) |

|

(1,383 |

) |

| Less: gains on sales of

operating properties |

|

— |

|

|

— |

|

|

(15,160 |

) |

|

(194 |

) |

| Add: impairment

charge |

|

— |

|

|

— |

|

|

7,411 |

|

|

— |

|

| Add: depreciation and

amortization of consolidated entities, net of noncontrolling

interests |

|

42,474 |

|

|

45,310 |

|

|

129,890 |

|

|

130,909 |

|

| FFO of

the Operating Partnership1 |

|

41,838 |

|

|

43,587 |

|

|

131,932 |

|

|

128,547 |

|

| Less: Limited Partners'

interests in FFO |

|

(949 |

) |

|

(918 |

) |

|

(2,995 |

) |

|

(2,708 |

) |

| FFO

attributable to Kite Realty Group Trust common shareholders1 |

|

$ |

40,889 |

|

|

$ |

42,669 |

|

|

$ |

128,937 |

|

|

$ |

125,839 |

|

| FFO, as defined by

NAREIT, per share of the Operating Partnership - basic |

|

$ |

0.49 |

|

|

$ |

0.51 |

|

|

$ |

1.54 |

|

|

$ |

1.51 |

|

| FFO, as defined by

NAREIT, per share of the Operating Partnership - diluted |

|

$ |

0.49 |

|

|

$ |

0.51 |

|

|

$ |

1.54 |

|

|

$ |

1.50 |

|

| |

|

|

|

|

|

|

|

|

| FFO of the Operating

Partnership1 |

|

$ |

41,838 |

|

|

$ |

43,587 |

|

|

$ |

131,932 |

|

|

$ |

128,547 |

|

| Add: accelerated

amortization of debt issuance costs (non-cash) |

|

— |

|

|

1,121 |

|

|

— |

|

|

1,121 |

|

| Add: transaction

costs |

|

— |

|

|

— |

|

|

— |

|

|

2,771 |

|

| Add: severance

charge |

|

— |

|

|

— |

|

|

— |

|

|

500 |

|

| FFO, as adjusted, of

the Operating Partnership |

|

$ |

41,838 |

|

|

$ |

44,708 |

|

|

$ |

131,932 |

|

|

$ |

132,939 |

|

| FFO, as adjusted, per

share of the Operating Partnership - basic |

|

$ |

0.49 |

|

|

$ |

0.52 |

|

|

$ |

1.54 |

|

|

$ |

1.56 |

|

| FFO, as adjusted, per

share of the Operating Partnership - diluted |

|

$ |

0.49 |

|

|

$ |

0.52 |

|

|

$ |

1.54 |

|

|

$ |

1.56 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average common

shares outstanding - basic |

|

83,594,163 |

|

|

83,474,348 |

|

|

83,581,847 |

|

|

83,399,813 |

|

| Weighted average common

shares outstanding - diluted |

|

83,708,719 |

|

|

83,565,227 |

|

|

83,689,590 |

|

|

83,488,618 |

|

| Weighted average common

shares and units outstanding - basic |

|

85,580,993 |

|

|

85,417,753 |

|

|

85,561,343 |

|

|

85,336,859 |

|

| Weighted average common

shares and units outstanding - diluted |

|

85,695,549 |

|

|

85,580,632 |

|

|

85,669,087 |

|

|

85,425,664 |

|

| |

|

|

|

|

|

|

|

|

| FFO, as defined by

NAREIT, per diluted share |

|

|

|

|

|

|

|

|

| Consolidated net (loss)

income |

|

$ |

— |

|

|

$ |

(0.01 |

) |

|

$ |

0.13 |

|

|

$ |

(0.01 |

) |

| Less: net income

attributable to noncontrolling interests in properties |

|

(0.01 |

) |

|

(0.01 |

) |

|

(0.02 |

) |

|

(0.02 |

) |

| Less: gains on sales of

operating properties |

|

— |

|

|

— |

|

|

(0.18 |

) |

|

— |

|

| Add: impairment

charge |

|

— |

|

|

— |

|

|

0.09 |

|

|

— |

|

| Add: depreciation and

amortization of consolidated entities, net of noncontrolling

interests |

|

0.50 |

|

|

0.53 |

|

|

1.52 |

|

|

1.53 |

|

| FFO, as defined by

NAREIT, of the Operating Partnership per diluted share1 |

|

$ |

0.49 |

|

|

$ |

0.51 |

|

|

$ |

1.54 |

|

|

$ |

1.50 |

|

| |

|

|

|

|

|

|

|

|

| Add: accelerated

amortization of debt issuance costs |

|

— |

|

|

0.01 |

|

|

— |

|

|

0.01 |

|

| Add: transaction

costs |

|

— |

|

|

— |

|

|

— |

|

|

0.04 |

|

| Add: severance

charge |

|

— |

|

|

— |

|

|

— |

|

|

0.01 |

|

| FFO, as adjusted, of

the Operating Partnership per diluted share |

|

$ |

0.49 |

|

|

$ |

0.52 |

|

|

$ |

1.54 |

|

|

$ |

1.56 |

|

|

____________________ |

| 1 |

“FFO of the Operating

Partnership" measures 100% of the operating performance of the

Operating Partnership’s real estate properties. “FFO attributable

to Kite Realty Group Trust common shareholders” reflects a

reduction for the redeemable noncontrolling weighted average

diluted interest in the Operating Partnership. |

Funds from Operations (FFO) is a widely used

performance measure for real estate companies and is provided here

as a supplemental measure of operating performance. The Company

calculates FFO, a non-GAAP financial measure, in accordance with

the best practices described in the April 2002 National Policy

Bulletin of the National Association of Real Estate Investment

Trusts ("NAREIT"). The NAREIT white paper defines FFO as net income

(determined in accordance with GAAP), excluding gains (or losses)

from sales and impairments of depreciated property, plus

depreciation and amortization, and after adjustments for

unconsolidated partnerships and joint ventures.

Considering the nature of our business as a real

estate owner and operator, the Company believes that FFO is helpful

to investors in measuring our operational performance because it

excludes various items included in net income that do not relate to

or are not indicative of our operating performance, such as gains

or losses from sales of depreciated property and depreciation and

amortization, which can make periodic and peer analyses of

operating performance more difficult. For informational purposes,

the Company has also provided FFO adjusted for accelerated

amortization of debt issuance costs, transaction costs and a

severance charge in 2016. The Company believes this

supplemental information provides a meaningful measure of our

operating performance. The Company believes our presentation of

FFO, as adjusted, provides investors with another financial measure

that may facilitate comparison of operating performance between

periods and among our peer companies. FFO should not be considered

as an alternative to net income (determined in accordance with

GAAP) as an indicator of our financial performance, is not an

alternative to cash flow from operating activities (determined in

accordance with GAAP) as a measure of our liquidity, and is not

indicative of funds available to satisfy our cash needs, including

our ability to make distributions. Our computation of FFO may not

be comparable to FFO reported by other REITs that do not define the

term in accordance with the current NAREIT definition or that

interpret the current NAREIT definition differently than we do.

| Kite Realty Group Trust |

| Same Property Net Operating

Income |

| For the Three and Nine Months Ended September

30, 2017 and 2016 |

| (Unaudited) |

| |

| ($ in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

| |

2017 |

|

2016 |

|

% Change |

|

2017 |

|

2016 |

|

% Change |

| Number of properties

for the quarter1 |

|

104 |

|

|

|

104 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Leased

percentage at period end |

94.4 |

% |

|

95.1 |

% |

|

|

|

94.4 |

% |

|

95.1 |

% |

|

|

| Economic

Occupancy percentage2 |

93.5 |

% |

|

92.8 |

% |

|

|

|

93.7 |

% |

|

92.9 |

% |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Minimum rent |

$ |

58,806 |

|

|

$ |

56,997 |

|

|

|

|

$ |

175,615 |

|

|

$ |

170,713 |

|

|

|

| Tenant recoveries |

16,014 |

|

|

15,320 |

|

|

|

|

49,073 |

|

|

46,961 |

|

|

|

| Other income |

385 |

|

|

457 |

|

|

|

|

839 |

|

|

721 |

|

|

|

| |

75,205 |

|

|

72,774 |

|

|

|

|

225,527 |

|

|

218,395 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Property operating

expenses |

(10,136 |

) |

|

(10,041 |

) |

|

|

|

(29,883 |

) |

|

(28,956 |

) |

|

|

| Real estate taxes |

(9,820 |

) |

|

(9,413 |

) |

|

|

|

(29,808 |

) |

|

(28,923 |

) |

|

|

| |

(19,956 |

) |

|

(19,454 |

) |

|

|

|

(59,691 |

) |

|

(57,879 |

) |

|

|

| Same Property

NOI3 |

$ |

55,249 |

|

|

$ |

53,320 |

|

|

3.6 |

% |

|

$ |

165,836 |

|

|

$ |

160,516 |

|

|

3.3 |

% |

| Same Property

NOI - excluding the impact of the 3-R initiative4 |

|

|

|

|

3.9 |

% |

|

|

|

|

|

3.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Same

Property NOI to Most Directly Comparable GAAP Measure: |

|

|

|

|

|

|

|

|

|

|

|

| Net operating income -

same properties |

$ |

55,249 |

|

|

$ |

53,320 |

|

|

|

|

$ |

165,836 |

|

|

$ |

160,516 |

|

|

|

| Net operating income -

non-same activity5 |

9,614 |

|

|

13,561 |

|

|

|

|

36,611 |

|

|

38,191 |

|

|

|

| Provision for bad debts

- same properties |

(410 |

) |

|

(365 |

) |

|

|

|

(1,881 |

) |

|

(1,241 |

) |

|

|

| Other expense, net |

(61 |

) |

|

(15 |

) |

|

|

|

(250 |

) |

|

(857 |

) |

|

|

| General, administrative

and other |

(5,431 |

) |

|

(5,081 |

) |

|

|

|

(16,389 |

) |

|

(15,228 |

) |

|

|

| Transaction costs |

— |

|

|

— |

|

|

|

|

— |

|

|

(2,771 |

) |

|

|

| Impairment charge |

— |

|

|

— |

|

|

|

|

(7,411 |

) |

|

— |

|

|

|

| Depreciation and

amortization expense |

(42,793 |

) |

|

(45,543 |

) |

|

|

|

(131,333 |

) |

|

(131,625 |

) |

|

|

| Interest expense |

(16,372 |

) |

|

(17,139 |

) |

|

|

|

(49,250 |

) |

|

(47,964 |

) |

|

|

| Gains on sales of

operating properties |

— |

|

|

— |

|

|

|

|

15,160 |

|

|

194 |

|

|

|

| Net income attributable

to noncontrolling interests |

(418 |

) |

|

(420 |

) |

|

|

|

(1,528 |

) |

|

(1,391 |

) |

|

|

| Net (loss) income

attributable to common shareholders |

$ |

(622 |

) |

|

$ |

(1,682 |

) |

|

|

|

$ |

9,565 |

|

|

$ |

(2,176 |

) |

|

|

|

____________________ |

| 1 |

Same Property NOI

excludes eight properties in redevelopment, the recently completed

Northdale Promenade redevelopment as well as office properties

(Thirty South Meridian and Eddy Street Commons). |

| 2 |

Excludes leases that

are signed but for which tenants have not yet commenced the payment

of cash rent. Calculated as a weighted average based on the

timing of cash rent commencement and expiration during the

period. |

| 3 |

Same Property NOI

excludes net gains from outlot sales, straight-line rent revenue,

bad debt expense and recoveries, lease termination fees,

amortization of lease intangibles and significant prior period

expense recoveries and adjustments, if any. |

| 4 |

See pages 27 and 28 of

Q3 2017 supplemental for further detail of the properties included

in the 3-R initiative. |

| 5 |

Includes non-cash

activity across the portfolio as well as net operating income from

properties not included in the same property pool. |

The Company uses same property NOI ("Same Property

NOI"), a non-GAAP financial measure, to evaluate the performance of

our properties. Same Property NOI excludes properties that have not

been owned for the full period presented. It also excludes net

gains from outlot sales, straight-line rent revenue, bad debt

expense and recoveries, lease termination fees, amortization of

lease intangibles and significant prior period expense recoveries

and adjustments, if any. The Company believes that Same Property

NOI is helpful to investors as a measure of our operating

performance because it includes only the NOI of properties that

have been owned for the full period presented, which eliminates

disparities in net income due to the acquisition or disposition of

properties during the particular period presented and thus provides

a more consistent metric for the comparison of our properties. The

year to date results represent the sum of the individual quarters,

as reported.

NOI and Same Property NOI should not, however, be

considered as alternatives to net income (calculated in accordance

with GAAP) as indicators of our financial performance. Our

computation of NOI and Same Property NOI may differ from the

methodology used by other REITs, and therefore may not be

comparable to such other REITs.

When evaluating the properties that are included in

the same property pool, the Company has established specific

criteria for determining the inclusion of properties acquired or

those recently under development. An acquired property is included

in the same property pool when there is a full quarter of

operations in both years subsequent to the acquisition date.

Development and redevelopment properties are included in the same

property pool four full quarters after the properties have been

transferred to the operating portfolio. A redevelopment property is

first excluded from the same property pool when the execution of a

redevelopment plan is likely and the Company begins recapturing

space from tenants. For the quarter ended September 30, 2017,

the Company excluded eight redevelopment properties and the

recently completed Northdale Promenade redevelopment from the same

property pool that met these criteria and were owned in both

comparable periods.

Contact Information: Dan Sink EVP & CFO (317)

577-5609 dsink@kiterealty.com

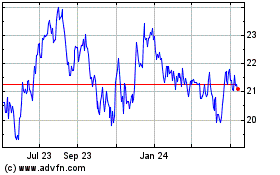

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Mar 2024 to Apr 2024

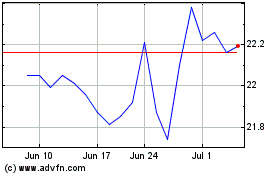

Kite Realty (NYSE:KRG)

Historical Stock Chart

From Apr 2023 to Apr 2024