UPS Profit Falls Amid Higher Costs

October 26 2017 - 9:24AM

Dow Jones News

By Allison Prang

Earnings at United Parcel Service Inc. fell slightly for the

third quarter as higher costs from expanding Saturday package

delivery and recent natural disasters weighed on its U.S.

business.

The results come just a day after the company announced it would

increase U.S. shipping rates as it attempts to recoup the higher

costs associated with e-commerce shipments. The rate hike, which

could come as welcome news for investors waiting for UPS to better

compete on pricing against FedEx Corp., are slated to go into

effect Dec. 24.

Similar to how brick-and-mortar retail has struggled with the

demise of physical storefronts, the consumer shift toward online

shopping has also affected shipping companies like UPS that are

tasked with making deliveries to people's homes that, in comparison

to large store shipments, are more expensive.

UPS, which has raised prices in the past, also announced in June

it was increasing its holiday shipping costs. FedEx, one of UPS's

main competitors, has increased prices, but isn't going to apply a

holiday price hike for most of its shipments.

Net income at UPS for the third quarter was $1.26 billion, or

$1.45 a share, down 0.7% from the year-ago period. Both metrics

were in line with analysts' expectations. The company's earnings

report also follows a torturous hurricane season that disrupted the

shipping industry in multiple U.S. states.

Shares in UPS were down 0.6% to $117.87 in premarket

trading.

Revenue excluding currency impacts rose by 7% to $15.98 billion.

Analysts were predicting revenue of $15.62 billion. Operating

expenses were $13.94 billion, up 8.1%.

Average revenue per shipment excluding currency impacts rose

2.8% to $10.78. Due to Hurricane Maria, for the bulk of this month

UPS cut ground shipping rates for parcels going from the U.S. to

Puerto Rico and other places by 35%.

Revenue excluding currency costs from the company's

international business grew at a 12% clip, faster than its domestic

segment growth of 3.9%. The company gets about 60% of revenue from

its domestic operations.

Supply chain and freight revenue excluding currency impacts rose

by 13% to $2.97 billion.

In addition to higher costs associated with e-commerce, UPS and

its competitors could be negatively affected further by companies

like Amazon.com Inc., which is testing a delivery service called

Seller Flex where it would deliver goods from sellers to

buyers.

For the full year, UPS now expects adjusted per-share profit to

be between $5.85 and $6.10, compared with its prior guidance of

$5.80 to $6.10.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

October 26, 2017 09:09 ET (13:09 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

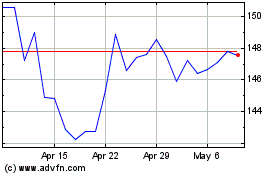

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

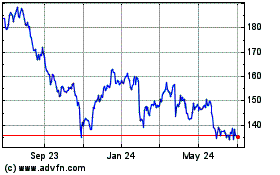

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Apr 2023 to Apr 2024