Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National,” or

the “Company”) today announced financial results for the three

months ended September 30, 2017 and established 2017 fourth quarter

guidance.

Timothy J. Wilmott, Chief Executive Officer, commented: “The

third quarter marked another period of strong spend per visit

trends across all three of our operating segments, leading to

consolidated positive same facility revenue and adjusted EBITDA

growth that exceeded guidance.

“The continued ramp of our newer properties and business

segments has been fundamental to our recent growth and confidence

in further Adjusted EBITDA expansion. All three of our operating

segments generated adjusted EBITDA margins increases over the prior

year. Our Ohio, Nevada, Massachusetts, Prairie State Gaming and

Penn Interactive Ventures operations each grew third quarter

adjusted EBITDA by over 10% on a year over year basis. At

Plainridge Park, which recently celebrated its third year of

operation, refinements in our marketing strategies are allowing us

to effectively drive more profitable visitation. In Ohio, all four

of our properties continue to build momentum, both with respect to

top-line growth and margin improvements. Our casinos in Columbus

and Toledo are benefiting from a continued ramp in awareness and

the success of our Marquee Rewards program. Toledo has also seen a

resumption of revenue growth due to less road construction impacts.

Similarly, our two Ohio racinos have experienced strong market

demand and continue to drive increased revenues and win per unit

with their expanded machine counts. Additionally, results continue

to improve at M Resort and Tropicana Las Vegas in Nevada.”

2017 Third Quarter Financial Highlights:

- Net Revenues of $806.2 million exceeded

guidance by $15.3 million, or 2%, as all three of the company’s

operating segments generated net revenue growth during the

period

- Income from Continuing Operations grew

by $4.4 million, or 3%, to $143.7 million

- Adjusted EBITDA increased by $10.5

million, or 5%, to $221.8 million

- Adjusted EBITDA after Master Lease

payments was $107.3 million - an increase of 6% or $5.7 million

over the third quarter of 2016

- Adjusted EBITDA for the trailing four

quarters from the Company’s operations not subject to the Master

Lease was 14.7% of total Adjusted EBITDA, or $126.5 million,

compared to 12.3%, or $104.7 million, in the prior year

- Third quarter 2017 adjusted EBITDA

contributions from the non-Master Lease assets grew approximately

21% compared to the prior year

- The Company reduced traditional net

debt by $60.5 million compared to June 30, 2017, while also

repurchasing approximately $19 million of common shares during the

quarter

Continued Improvements to Industry-Leading Margins

Wilmott continued, “Our consistency in extracting operating

efficiencies drove consolidated third quarter 2017 Adjusted EBITDA

margins to 27.5%, an improvement over last year when excluding

volatility related to the cash-settled stock-based awards. Notably,

we remain committed to leveraging our scale, purchasing power and

distribution capabilities to drive further margin improvements

through ongoing refinements in procurement, marketing and labor. To

that end, we have engaged third party consultants to help us

validate and quantify a new set of strategic initiatives which we

expect will improve our already industry-leading property level

operating margins in the coming years. This effort encompasses both

revenue and cost saving initiatives throughout the organization. A

link to a presentation describing this initiative may be found

here.

Cash Flow Generation and Capital Allocation

“Penn National’s solid third quarter operating cash flows

allowed the Company to reduce traditional net debt by over $60

million in the third quarter. Our traditional net debt to total

Adjusted EBITDA after Master Lease payments ratio declined to

approximately 2.59x at September 30, 2017 from 2.95x at December

31, 2016. We remain on pace to reduce our net traditional leverage,

absent additional strategic growth activity, to the mid 2x range

with total gross leverage inclusive of the Master Lease expected to

be in the mid 5x range at the end of this year.

“Pursuant to our current authorization, during the 2017 third

quarter, we repurchased over 847,000 shares for approximately $19

million. Year-to-date, the Company has repurchased more than 1.25

million shares. With the operating momentum across our business and

significant and growing free cash flow, Penn National has the

financial flexibility to select from a range of alternatives to

further enhance shareholder value, including additional share

repurchases, leverage reduction and pursuing opportunistic,

accretive tuck-in acquisitions.”

2017 Third Quarter Financial Statement Impacts

- Corporate overhead expenses increased

by $4.4 million primarily due to cash-settled stock compensation

charges from a higher Penn stock price of $1.3 million, higher

acquisition and development costs of $1.4 million and higher bonus

accrual expense of $1.3 million due to the Company’s better overall

performance against its budget;

- Contingent purchase price obligation

benefit of $22.2 million driven by the recent resolution of the

Rocket Speed earnout;

- Income from continuing operations

includes $18.0 million of goodwill impairment charges, the majority

of which was triggered by our deferred tax valuation allowance

reversal;

- Hollywood Casino Jamul-San Diego

continues to drive quarterly sequential operating improvements.

Negotiations continue with the Tribe and its other lenders to

restructure their debt obligations, including our Term Loan C

facility. Based on the facts and circumstances to date, we recorded

an impairment charge of $6.3 million associated with our loan;

- As a result of strong recent

performance, future prospects, and significant levels of historical

earnings, the Company reversed the majority of its valuation

allowance on its deferred tax assets which resulted in a non-cash

tax benefit during the quarter of $766.2 million.

Summary of Third Quarter Results

(in millions, except per share data) Three Months

Ended

September 30,

2017 Actual 2017 Guidance (3)

2016 Actual Net revenues $ 806.2 $ 790.9 $ 765.6

Net income (1) $ 789.3 $ 18.6 $ 46.5

Adjusted EBITDA

(2) $ 221.8 $ 220.4 $ 211.3 Less: Master Lease payments

114.5 114.0 109.7

Adjusted EBITDA after Master

Lease payments (2) $ 107.3 $ 106.4 $ 101.6

Diluted earnings per common share $ 8.43 $ 0.20 $

0.51

1) Includes $766.2 million benefit from the reversal of the

deferred tax asset valuation allowance reversal.

2) Adjusted EBITDA is income (loss) from operations, excluding

the impact of stock compensation, debt extinguishment and financing

charges, impairment charges, insurance recoveries and deductible

charges, depreciation and amortization, changes in the estimated

fair value of our contingent purchase price obligations, gain or

loss on disposal of assets, and other income or expenses. Adjusted

EBITDA is also inclusive of income or loss from unconsolidated

affiliates, with our share of the non-operating items added back

for our joint venture in Kansas Entertainment, LLC (“Kansas

Entertainment” or “Kansas JV”). Adjusted EBITDA excludes payments

pursuant to the Company’s Master Lease (the “Master Lease”) with

Gaming and Leisure Properties, Inc. (“GLPI”), as the transaction

was accounted for as a financing obligation. See below for

reconciliation of the difference between guidance and actual for

the current quarterly period.

3) The guidance figures in the table above present the guidance

Penn National provided on July 27, 2017 for the three months ended

September 30, 2017.

Review of Third Quarter 2017 Results vs. Guidance

Three Months Ended September 30, 2017

Pre-tax After-tax (in thousands)

(unaudited) Income, per guidance (1) $ 33,731 $ 18,552

Adjusted EBITDA variances: Favorable operating segment

variance 2,860 2,003 Cash-settled stock-based awards variance

(1,583 ) (1,006 ) Other variance 70 44

1,347 1,041 Net contingent

liability variance, mostly due to Rocket Speed 21,151 13,406

Impairment of goodwill primarily due to deferred tax valuation

allowance reversal (18,026 ) (11,501 ) Impairment of Jamul note

receivable (6,291 ) (3,997 ) Interest expense variance (1,537 )

(976 ) Other variance (99 ) (69 ) Tax variance

772,884 Income, as reported $ 30,276 $ 789,340

(1) The guidance figure in the table above presents the guidance

Penn National provided on July 27, 2017 for the three months ended

September 30, 2017.

Financial Guidance for the 2017 Fourth Quarter and Full

Year:

Reflecting the current operating and competitive environment,

the table below sets forth fourth quarter and updates full year

2017 guidance targets for financial results based on the following

assumptions:

- MGM National Harbor opened on December

8, 2016, impacting Hollywood Casino at Charles Town Races;

- A full year contribution from the

Company’s management contract for Casino Rama;

- Does not anticipate any Adjusted EBITDA

contribution from the Company’s agreements with Jamul Indian

Village;

- Full year corporate overhead expenses

of $89.0 million, with $18.0 million to be incurred in the fourth

quarter;

- Depreciation and amortization charges

of $268.6 million, with $62.9 million in the fourth quarter;

- Full year payments to GLPI of $455.2

million (inclusive of $6.0 million attributable to the Tunica

assets acquired in the 2017 second quarter), with $114.4 million in

the fourth quarter;

- Maintenance capital expenditures of

$78.1 million, with $31.5 million in the fourth quarter;

- Cash interest on traditional debt of

$56.3 million, with $8.3 million in the fourth quarter;

- Interest expense of $466.8 million,

with $116.8 million in the fourth quarter, inclusive of interest

expense related to the Master Lease financing obligation with

GLPI;

- Our rent coverage ratio for year four

of the Master Lease at September 30, 2017 is 1.83 and we expect to

incur a rent escalation of $4.0 million at October 31, 2017, which

is the conclusion of year four of the Master Lease, of which $0.7

million will be incurred in 2017 and is reflected in interest

expense;

- Our share of non-operating items (such

as depreciation and amortization expense) associated with our

Kansas JV will total $5.8 million, with $1.3 million to be incurred

in the fourth quarter;

- Estimated non-cash stock compensation

expenses of $7.8 million, with $2.0 million to be incurred in the

fourth quarter;

- LIBOR is based on the forward yield

curve;

- A diluted share count of approximately

92.9 million shares for the full year; and,

- There will be no material changes in

applicable legislation, regulatory environment, world events,

weather, recent consumer trends, economic conditions, oil prices,

competitive landscape (other than listed above) or other

circumstances beyond our control that may adversely affect the

Company’s results of operations.

Three Months Ending December 31, Full Year

Ending December 31,

2017 Guidance

2016 Actual

2017 Revised Guidance

2017 Prior Guidance (1)

2016 Actual

(in millions, except per share data) Net revenues

$ 756.6 $ 742.9 $ 3,135.6

$ 3,120.3 $ 3,034.4 Net

income $ 16.2 $ 5.0 $

827.7 $ 54.2 $ 109.3 Income tax

provision 6.6 2.2 (744.0 ) 34.6 11.3 Other - (0.3 ) 25.6 25.4 1.7

Income from unconsolidated affiliates (5.1 ) (2.7 ) (19.4 ) (19.7 )

(14.3 ) Interest income (0.2 ) (4.1 ) (3.4 ) (3.3 ) (24.2 )

Interest expense 116.8 113.7

466.8 465.2 459.2

Income from

operations $ 134.3 $ 113.8 $

553.3 $ 556.4 $ 543.0 Loss

(gain) on disposal of assets 0.2 1.0 0.3 0.3 (2.5 ) Impairment

losses - - 30.0 5.6 - Insurance recoveries - - - - (0.7 ) Charge

for stock compensation 2.0 2.3 7.8 8.1 6.9 Contingent purchase

price 0.3 2.4 (16.5 ) 4.7 1.3 Depreciation and amortization 62.9

71.1 268.6 266.7 271.2 Income from unconsolidated affiliates 5.1

2.7 19.4 19.7 14.3 Non-operating items for Kansas JV 1.3

2.6 5.8 5.9

10.3

Adjusted EBITDA $ 206.1 $

195.9 $ 868.7 $ 867.4 $

843.8 Master Lease payments (114.4 ) (110.4 )

(455.2 ) (454.8 ) (442.3 )

Adjusted EBITDA,

after Master Lease payments $ 91.7 $

85.5 $ 413.5 $ 412.6 $

401.5 Diluted earnings per common share $ 0.17

$ 0.05 $ 8.91 $ 0.59 $ 1.19

(1) The guidance figures in this column in the table above

present the guidance Penn National provided on July 27, 2017 for

the full year ended December 31, 2017. Our revised full year

guidance includes the current quarter actual results.

(2) The guidance table above includes prior period actual

performance for the comparative period.

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIES

Segment Information – Operations

(in thousands) (unaudited)

NET REVENUES INCOME FROM

OPERATIONS ADJUSTED EBITDA Three Months Ended

September 30, Three Months Ended September 30, Three

Months Ended September 30, 2017 2016 2017

2016 2017 2016 Northeast (1) $

401,818 $ 395,748 $ 106,575 $ 101,752 $ 127,644 $ 124,421

South/West (2) 160,153 135,169 4,772 19,337 35,046 28,506 Midwest

(3) 232,051 221,172 60,005 56,343 76,044 71,644 Other (4)

12,225 13,508 (27,689 ) (38,132 )

(16,947 ) (13,311 )

Total $ 806,247

$ 765,597 $ 143,663 $

139,300 $ 221,787 $

211,260 NET REVENUES INCOME FROM

OPERATIONS ADJUSTED EBITDA Nine Months Ended

September 30, Nine Months Ended September 30, Nine

Months Ended September 30, 2017 2016 2017

2016 2017 2016 Northeast (1) $ 1,200,382 $

1,190,469 $ 317,327 $ 306,368 $ 384,094 $ 374,165 South/West (2)

453,123 411,245 51,952 72,944 106,436 99,703 Midwest (3) 685,236

662,506 180,818 172,013 229,640 219,900 Other (4) 40,193

27,250 (131,158 ) (122,157 ) (57,535 )

(45,843 )

Total $ 2,378,934 $

2,291,470 $ 418,939 $

429,168 $ 662,635 $

647,925

(1) The Northeast reportable segment consists of the following

properties: Hollywood Casino at Charles Town Races, Hollywood

Casino Bangor, Hollywood Casino at Penn National Race Course,

Hollywood Casino Toledo, Hollywood Casino Columbus, Hollywood

Gaming at Dayton Raceway, Hollywood Gaming at Mahoning Valley Race

Course, and Plainridge Park Casino. It also includes the Company’s

Casino Rama management service contract.

(2) The South/West reportable segment consists of the following

properties: Zia Park Casino, Hollywood Casino Tunica, Hollywood

Casino Gulf Coast, Boomtown Biloxi, the M Resort, Tropicana Las

Vegas, and 1st Jackpot Casino Tunica (f/k/a Bally’s Casino Tunica)

and Resorts Casino Tunica, which were acquired on May 1, 2017, as

well as our management contract with Hollywood Casino Jamul-San

Diego, which opened on October 10, 2016. The South/West segment

Adjusted EBITDA includes contributions from our May 1, 2017

acquisition of 1st Jackpot/Resorts in Tunica. It also includes

impairment charges of $21.1 million and $26.7 million for the three

and nine months ended September 30, 2017. Our South/West segment

results for the nine months ended September 30, 2016 include a $3.5

million benefit from a litigation settlement gain at the Tropicana

Las Vegas, which is partially offset by severance charges and

gaming floor disruption. The South/West segment year-to-date

results for the prior year also include additional expenses of $1.6

million, which is primarily due to insurance accrual

adjustments.

(3) The Midwest reportable segment consists of the following

properties: Hollywood Casino Aurora, Hollywood Casino Joliet,

Argosy Casino Alton, Argosy Casino Riverside, Hollywood Casino

Lawrenceburg, Hollywood Casino St. Louis, Prairie State

Gaming, and includes the Company’s 50% investment in Kansas

Entertainment, which owns the Hollywood Casino at Kansas

Speedway.

(4) The Other category consists of the Company’s standalone

racing operations, namely Sanford-Orlando Kennel Club, and the

Company’s joint venture interests in Sam Houston Race Park, Valley

Race Park, and Freehold Raceway. If the Company is successful in

obtaining gaming operations at these locations, they would be

assigned to one of the Company’s regional executives and reported

in their respective reportable segment. The Other category also

includes Penn Interactive Ventures, the Company’s interactive

division which represents Penn National’s social gaming

initiatives, including Rocket Speed, Inc. During the three months

ended September 30, 2017, Penn Interactive Ventures settled the

contingent purchase price obligation for Rocket Speed which

resulted in a $22.2 million benefit

The Other category also includes the Company’s corporate

overhead costs, which were $21.0 million and $71.0 million for the

three and nine months ended September 30, 2017, respectively, as

compared to corporate overhead costs of $16.6 million and $51.2

million for the three and nine months ended September 30, 2016,

respectively. See table below for reconciliation of corporate

overhead variances.

Corporate Overhead Variance

Reconciliation

Three Months Ended

Nine Months Ended

September 30,

(in millions)

Cash-settled, stock-based compensation $ 1.3 $ 13.8 Development and

acquisition costs 1.4 2.7 Bonus expense 1.3 2.9 Other 0.4

0.4

Year over year variance $ 4.4

$ 19.8

Reconciliation of Comparable GAAP

Financial Measures To

Adjusted EBITDA

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIES

(in thousands) (unaudited)

Three Months Ended

September 30, June 30, March 31,

December 31, September 30, 2017

2017 2017 2016 2016 Net income

$ 789,340 $ 17,079 $

5,104 $ 5,032 $ 46,535 Income

tax provision (benefit) (759,064 ) 6,225 2,198 2,242 (9,473 ) Other

(1) 236 173 25,183 (299 ) (404 ) Income from unconsolidated

affiliates (4,781 ) (5,021 ) (4,548 ) (2,675 ) (3,505 ) Interest

income (304 ) (235 ) (2,646 ) (4,147 ) (8,202 ) Interest expense

118,236 116,768 114,996

113,695 114,349

Income from

operations $ 143,663 $ 134,989

$ 140,287 $ 113,848 $

139,300 Loss (gain) on disposal of assets 96 52 (45 ) 969

(2,781 ) Charge for stock compensation 1,853 1,801 2,173 2,317

1,517 Contingent purchase price (20,716 ) 1,362 2,560 2,388 (30 )

Impairment charges (2) 24,317 5,635 - - - Depreciation and

amortization 66,483 68,969 70,236 71,109 67,903 Insurance

recoveries - - - - (726 ) Income from unconsolidated affiliates

4,781 5,021 4,548 2,675 3,505 Non-operating items for Kansas JV

1,310 1,309 1,951

2,598 2,572

Adjusted EBITDA $

221,787 $ 219,138 $ 221,710

$ 195,904 $ 211,260 Master Lease

payments (114,489 ) (113,968 ) (112,450 )

(110,420 ) (109,710 )

Adjusted EBITDA, after

Master Lease payments $ 107,298 $

105,170 $ 109,260 $

85,484 $ 101,550

1) March 31, 2017 figures include debt extinguishment and

financing charges of $25.1 million.

2) The Company’s goodwill was tested for impairment during the

third quarter, before the next annual impairment test date October

1, 2017, due to a significant tax valuation allowance reversal

which resulted in an increase to the carrying amounts of some of

its reporting units. In accordance with ASC 805 “Business

Combinations”, the Company’s allocation of purchase price for

Tropicana Las Vegas, which was acquired in August 2015, included a

significant amount of net operating losses which at that time

required a full valuation allowance resulting in the recording of

goodwill in the amount of $14.8 million. As of September 30, 2017,

Tropicana Las Vegas failed the quantitative goodwill impairment

test, due to the reversal of the Company’s tax valuation allowance.

As a result, the Company determined that the goodwill for the

Tropicana Las Vegas reporting unit was fully impaired and as such

has recorded an impairment charge of $14.8 million within its

South/West segment. Additionally, the Company’s Sanford Orlando

Kennel Club reporting unit within the Other category failed the

quantitative goodwill impairment test as of September 30, 2017,

and, as such, a partial impairment charge of $3.2 million was

recorded. Finally, impairment charges of $6.3 million and $5.6

million for the three months ended September 30, 2017 and the three

months ended June 30, 2017, respectively, were recorded against the

Company’s loan to the Jamul Tribe.

Nine Months Ended September 30, 2017

2016 Net income $ 811,523

$ 104,278 Income tax provision (750,641 ) 9,065 Other

(1) 25,592 1,978 Income from unconsolidated affiliates (14,350 )

(11,662 ) Interest income (3,185 ) (20,039 ) Interest expense

350,000 345,548

Income from

operations $ 418,939 $ 429,168 Gain

(loss) on disposal of assets 103 (3,440 ) Charge for stock

compensation 5,827 4,554 Contingent purchase price (16,794 ) (1,111

) Impairment charges 29,952 - Depreciation and amortization 205,688

200,105 Insurance recoveries - (726 ) Income from unconsolidated

affiliates 14,350 11,662 Non-operating items for Kansas JV

4,570 7,713

Adjusted EBITDA $

662,635 $ 647,925 Master Lease payments

(340,907 ) (331,867 )

Adjusted EBITDA, after Master Lease

payments $ 321,728 $ 316,058

Reconciliation of Comparable GAAP

Financial Measures To

Adjusted EBITDA By Segment

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIES

(in thousands) (unaudited)

Three Months Ended September 30,

2017

Northeast

South/West Midwest Other Total Income

(loss) from operations $ 106,575 $ 4,772 $ 60,005 $ (27,689 )

$ 143,663 Charge for stock compensation - - - 1,853

1,853 Impairment losses - 21,111 - 3,206

24,317

Depreciation and amortization 19,661 9,224 9,560 28,038

66,483 Contingent purchase price 1,480 - (44 ) (22,152 )

(20,716 ) (Gain) loss on disposal of assets (72 ) (61

) 56 173

96 Income (loss) from unconsolidated affiliates - -

5,157 (376 )

4,781 Non-operating items for Kansas JV (1)

- - 1,310 -

1,310 Adjusted EBITDA $

127,644 $ 35,046 $

76,044 $ (16,947 ) $

221,787

Three Months Ended September 30,

2016

Northeast South/West Midwest Other

Total Income (loss) from operations $ 101,752 $ 19,337 $

56,343 $ (38,132 )

$ 139,300 Charge for stock

compensation - - - 1,517

1,517 Depreciation and amortization

22,975 9,097 9,593 26,238

67,903 Contingent purchase price

(293 ) - - 263

(30 ) Loss (gain) on disposal of

assets (13 ) 72 64 (2,904 )

(2,781 ) Insurance

recoveries - - (726 ) -

(726 ) Income from

unconsolidated affiliates - - 3,798 (293 )

3,505

Non-operating items for Kansas JV (1) - -

2,572 -

2,572

Adjusted EBITDA $ 124,421 $

28,506 $ 71,644 $ (13,311

) $ 211,260

Nine Months Ended September 30,

2017

Northeast

South/West Midwest Other Total Income

(loss) from operations $ 317,327 $ 51,952 $ 180,818 $ (131,158 )

$ 418,939 Charge for stock compensation - - - 5,827

5,827 Impairment losses - 26,746 - 3,206

29,952

Depreciation and amortization 64,209 27,794 28,739 84,946

205,688 Contingent purchase price 2,662 - (19 ) (19,437 )

(16,794 ) (Gain) loss on disposal of assets (104 )

(56 ) 85 178

103 Income (loss) from unconsolidated

affiliates - - 15,447 (1,097 )

14,350 Non-operating items

for Kansas JV - - 4,570

-

4,570 Adjusted EBITDA

$ 384,094 $ 106,436

$ 229,640 $ (57,535 )

$ 662,635

Nine Months Ended September 30,

2016

Northeast

South/West Midwest Other Total Income

(loss) from operations $ 306,368 $ 72,944 $ 172,013 $ (122,157 )

$ 429,168 Charge for stock compensation - - - 4,554

4,554 Depreciation and amortization 69,177 26,701 28,621

75,606

200,105

Contingent purchase price

(1,374 ) - - 263

(1,111 ) (Gain) loss on disposal of

assets (6 ) 58 18 (3,510 )

(3,440 ) Insurance

recoveries - - (726 ) -

(726 ) Income (loss) from

unconsolidated affiliates - - 12,261 (599 )

11,662

Non-operating items for Kansas JV - -

7,713 -

7,713 Adjusted

EBITDA $ 374,165 $ 99,703

$ 219,900 $ (45,843 )

$ 647,925

(1) Adjusted EBITDA excludes our share of the impact of

non-operating items (such as depreciation and amortization) from

our joint venture in Kansas Entertainment.

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIES

Consolidated Statements of Operations

(in thousands, except per share data)

(unaudited)

Three Months Ended September 30, Nine

Months Ended September 30, 2017 2016

2017 2016 Revenues Gaming $

691,028 $ 654,591 $ 2,033,263 $ 1,974,618 Food, beverage, hotel and

other 153,833 147,554 453,722 429,792 Management service and

licensing fees 3,550 3,130 8,809 8,567 Reimbursable management

costs 6,679 5,965 19,824

8,820 Revenues 855,090 811,240 2,515,618 2,421,797

Less promotional allowances (48,843 ) (45,643 )

(136,684 ) (130,327 ) Net revenues 806,247

765,597 2,378,934

2,291,470

Operating expenses Gaming 350,847

336,669 1,028,056 1,011,187 Food, beverage, hotel and other 107,057

102,110 313,363 302,062 General and administrative 107,201 114,376

363,112 340,854 Depreciation and amortization 66,483 67,903 205,688

200,105 Reimbursable management costs 6,679 5,965 19,824 8,820

Impairment charges 24,317 - 29,952 - Insurance recoveries -

(726 ) - (726 ) Total operating

expenses 662,584 626,297

1,959,995 1,862,302 Income from operations

143,663 139,300 418,939

429,168

Other income (expenses)

Interest expense (118,236 ) (114,349 ) (350,000 ) (345,548 )

Interest income 304 8,202 3,185 20,039 Income from unconsolidated

affiliates 4,781 3,505 14,350 11,662 Loss on early extinguishment

of debt - - (23,390 ) - Other (236 ) 404

(2,202 ) (1,978 ) Total other expenses

(113,387 ) (102,238 ) (358,057 ) (315,825 )

Income from operations before income taxes 30,276

37,062 60,882 113,343 Income tax provision (759,064 )

(9,473 ) (750,641 ) 9,065

Net income $

789,340 $ 46,535 $ 811,523 $ 104,278

Earnings per common share: Basic earnings per common

share $ 8.68 $ 0.52 $ 8.93 $ 1.16 Diluted earnings per common share

$ 8.43 $ 0.51 $ 8.74 $ 1.14

Weighted-average common

shares outstanding: Basic 90,913 83,065 90,865 81,917 Diluted

93,589 91,422 92,903 91,330

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIES

Supplemental information

(in thousands) (unaudited)

September 30, 2017 June 30, 2017

March 31, 2017 December 31, 2016 Cash

and cash equivalents $ 264,907 $ 224,399 $ 259,488 $ 229,510

Bank Debt $ 798,608 $ 812,002 $ 896,439 $ 962,703 Notes 399,229

399,208 399,227 296,895 Other long term obligations (1)

120,855 127,488 127,437 155,936 Total

Traditional Debt $ 1,318,692 $ 1,338,698 $ 1,423,103 $ 1,415,534

Traditional net debt $ 1,053,785 $ 1,114,299 $ 1,163,615 $

1,186,024

1) Other long-term obligations at September 30, 2017 include

$105.4 million for the present value of the relocation fees due for

both Hollywood Gaming at Dayton Raceway and Hollywood Gaming at

Mahoning Valley Race Course, and $13.8 million related to our

repayment obligation on a hotel and event center located near

Hollywood Casino Lawrenceburg.

The Company’s definition of Adjusted EBITDA adds back our share

of the impact of non-operating items (such as depreciation and

amortization) at our joint ventures that have gaming operations. At

this time, Kansas Entertainment, the operator of Hollywood Casino

at Kansas Speedway, is Penn National’s only joint venture that

meets this definition. Kansas Entertainment does not currently

have, nor has it ever had, any indebtedness. The table below

presents cash flow distributions we have received from this

investment for the three and nine months ended September 30, 2017

and 2016.

Three Months Ended September 30, Nine

Months Ended September 30, 2017 2016

2017 2016 Cash flow distributions $

8,200 $ 8,150 $ 21,200 $ 21,500

The table below summarizes certain cash expenditures incurred by

the Company during the periods presented in this earnings

release.

Three Months Ended September 30, Nine

Months Ended September 30, 2017 2016

2017 2016 Master Lease rental payments

114,489 109,710 340,907 331,867 Cash income tax (refunds)/payments

(15,793 ) 413 (21,452 ) (11,720 ) Cash interest expense on

traditional debt 22,927 12,242 47,429 44,457 Maintenance capital

expenditures 18,344 18,888 46,631 51,431

Share Repurchase Program

During the 2017 third quarter, Penn National repurchased 847,263

shares of its common stock at an average price of $22.41 per share.

In the nine month period ended September 30, 2017, the Company

repurchased a total of 1,264,149 common shares for $24,770,470. As

a result, Penn National has the authority to repurchase an

additional $75.2 million by February 2019. Any future share

repurchases will be made in open market or private transactions at

prevailing market prices.

Reconciliation of GAAP to Non-GAAP Measures

In addition to GAAP financial measures, adjusted EBITDA is used

by management as an important measure of the Company’s operating

performance. We define adjusted EBITDA as earnings before interest,

taxes, stock compensation, debt extinguishment and financing

charges, impairment charges, insurance recoveries and deductible

charges, depreciation and amortization, changes in the estimated

fair value of our contingent purchase price obligations, gain or

loss on disposal of assets, and other income or expenses. Adjusted

EBITDA is also inclusive of income or loss from unconsolidated

affiliates, with our share of non-operating items (such as

depreciation and amortization) added back for our joint venture in

Kansas Entertainment. Adjusted EBITDA excludes payments associated

with our Master Lease agreement with GLPI as the transaction was

accounted for as a financing obligation. Adjusted EBITDA has

economic substance because it is used by management as a

performance measure to analyze the performance of our business, and

is especially relevant in evaluating large, long lived casino

projects because they provide a perspective on the current effects

of operating decisions separated from the substantial

non-operational depreciation charges and financing costs of such

projects. We also present adjusted EBITDA because it is used by

some investors and creditors as an indicator of the strength and

performance of ongoing business operations, including our ability

to service debt, fund capital expenditures, acquisitions and

operations. These calculations are commonly used as a basis for

investors, analysts and credit rating agencies to evaluate and

compare operating performance and value companies within our

industry. In addition, gaming companies have historically reported

adjusted EBITDA as a supplement to financial measures in accordance

with GAAP. In order to view the operations of their casinos on a

more stand-alone basis, gaming companies, including us, have

historically excluded from their adjusted EBITDA calculations

certain corporate expenses that do not relate to the management of

specific casino properties. However, adjusted EBITDA is not a

measure of performance or liquidity calculated in accordance with

GAAP. Adjusted EBITDA information is presented as a supplemental

disclosure, as management believes that it is a widely used measure

of performance in the gaming industry, is used in the valuation of

gaming companies, and that it is considered by many to be a key

indicator of the Company’s operating results. Management uses

adjusted EBITDA as an important measure of the operating

performance of its segments, including the evaluation of operating

personnel. Adjusted EBITDA should not be construed as an

alternative to operating income, as an indicator of the Company’s

operating performance, as an alternative to cash flows from

operating activities, as a measure of liquidity, or as any other

measure of performance determined in accordance with GAAP. The

Company has significant uses of cash flows, including capital

expenditures, interest payments, taxes and debt principal

repayments, which are not reflected in adjusted EBITDA. It should

also be noted that other gaming companies that report adjusted

EBITDA information may calculate adjusted EBITDA in a different

manner than the Company and therefore, comparability may be

limited.

Adjusted EBITDA after Master Lease payments is a measure we

believe provides useful information to investors because it is an

indicator of the performance of ongoing business operations after

incorporating the cash flow impact of Master Lease payments to

GLPI. Finally, adjusted EBITDA after Master Lease payments is the

metric that our executive management team is measured against for

incentive based compensation purposes.

A reconciliation of the Company’s net income (loss) per GAAP to

adjusted EBITDA, as well as the Company’s income (loss) from

operations per GAAP to adjusted EBITDA, is included above.

Additionally, a reconciliation of each segment’s income (loss) from

operations to adjusted EBITDA is also included above. On a segment

level, income (loss) from operations per GAAP, rather than net

income (loss) per GAAP is reconciled to adjusted EBITDA due to,

among other things, the impracticability of allocating interest

expense, interest income, income taxes and certain other items to

the Company’s segments on a segment by segment basis. Management

believes that this presentation is more meaningful to investors in

evaluating the performance of the Company’s segments and is

consistent with the reporting of other gaming companies.

Management Presentation, Conference Call, Webcast and Replay

Details

Penn National Gaming is hosting a conference call and

simultaneous webcast at 9:00 am ET today, both of which are open to

the general public. During the call, management will review a

presentation describing its margin initiatives which may be

accessed here. The conference call number is 212/231-2909. Please

call five minutes in advance to ensure that you are connected prior

to the presentation. Questions will be reserved for call-in

analysts and investors. Interested parties may also access the live

call on the Internet at www.pngaming.com. Please allow 15 minutes

to register and download and install any necessary software. A

replay of the call can be accessed for thirty days on the Internet

at www.pngaming.com.

This press release, which includes financial information to be

discussed by management during the conference call and disclosure

and reconciliation of non-GAAP financial measures, is available on

the Company’s web site, www.pngaming.com, in the “Investors”

section (select link for “Press Releases”).

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests

in gaming and racing facilities and video gaming terminal

operations with a focus on slot machine entertainment. We have also

recently expanded into social online gaming offerings via our Penn

Interactive Ventures, LLC division and our recent acquisition of

Rocket Speed, Inc. At September 30, 2017, the Company operated

twenty-nine facilities in seventeen jurisdictions, including

California, Florida, Illinois, Indiana, Kansas, Maine,

Massachusetts, Mississippi, Missouri, Nevada, New Jersey, New

Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario,

Canada. At September 30, 2017, in aggregate, Penn National Gaming

operated approximately 36,700 gaming machines, 820 table games and

4,800 hotel rooms.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements can be identified by the use of forward

looking terminology such as “expects,” “believes,” “estimates,”

“projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or

“anticipates” or the negative or other variations of these or

similar words, or by discussions of future events, strategies or

risks and uncertainties. Specifically, forward-looking statements

may include, among others, statements concerning: our expectations

of future results of operations and financial condition;

expectations for our properties or our development projects; the

timing, cost and expected impact of planned capital expenditures on

our results of operations; our expectations with regard to the

impact of competition; our expectations with regard to acquisitions

and development opportunities, as well as the integration of any

companies we have acquired or may acquire; the outcome and

financial impact of the litigation in which we are or will be

periodically involved; the actions of regulatory, legislative,

executive or judicial decisions at the federal, state or local

level with regard to our business and the impact of any such

actions; our ability to maintain regulatory approvals for our

existing businesses and to receive regulatory approvals for our new

businesses; our expectations relative to margin improvement

initiatives; our expectations regarding economic and consumer

conditions; and our expectations for the continued availability and

cost of capital. As a result, actual results may vary materially

from expectations. Although the Company believes that its

expectations are based on reasonable assumptions within the bounds

of its knowledge of its business, there can be no assurance that

actual results will not differ materially from our expectations.

Meaningful factors that could cause actual results to differ from

expectations include, but are not limited to, risks related to the

following: the assumptions included in our financial guidance; the

ability of our operating teams to drive revenue; the impact of

significant competition from other gaming and entertainment

operations; our ability to obtain timely regulatory approvals

required to own, develop and/or operate our facilities, or other

delays, approvals or impediments to completing our planned

acquisitions or projects, construction factors, including delays,

and increased costs; the passage of state, federal or local

legislation (including referenda) that would expand, restrict,

further tax, prevent or negatively impact operations in or adjacent

to the jurisdictions in which we do or seek to do business (such as

a smoking ban at any of our facilities or the award of additional

gaming licenses proximate to our facilities); the effects of local

and national economic, credit, capital market, housing, and energy

conditions on the economy in general and on the gaming and lodging

industries in particular; the activities of our competitors and the

rapid emergence of new competitors (traditional, internet, social,

sweepstakes based and VGTs in bars and truck stops); increases in

the effective rate of taxation for any of our operations or at the

corporate level; our ability to identify attractive acquisition and

development opportunities (especially in new business lines) and to

agree to terms with, and maintain good relationships with

partners/municipalities for such transactions; the costs and risks

involved in the pursuit of such opportunities and our ability to

complete the acquisition or development of, and achieve the

expected returns from, such opportunities; our ability to maintain

market share in established markets and to continue to ramp up

operations at our recently opened facilities; our expectations for

the continued availability and cost of capital; the impact of

weather; changes in accounting standards; the risk of failing to

maintain the integrity of our information technology infrastructure

and safeguard our business, employee and customer data; factors

which may cause the Company to curtail or suspend the share

repurchase program; with respect to Hollywood Casino Jamul-San

Diego, particular risks associated with the repayment, default or

subordination of our loans to the Jamul Indian Village Development

Corporation (“JIV”), the subordination of our management and

intellectual property license fees (including the prohibition on

payment of those fees during any default under JIV’s credit

facilities), sovereign immunity, local opposition (including

several pending lawsuits), access, and the impact of

well-established regional competition on property performance; with

respect to our Plainridge Park Casino in Massachusetts, the

ultimate location and timing of the other gaming facilities in the

state and the region; with respect to our social and other

interactive gaming endeavors, including our acquisition of Rocket

Speed, Inc., risks related to the social gaming industry, employee

retention, cyber-security, data privacy, intellectual property and

legal and regulatory challenges, as well as our ability to

successfully develop innovative new games that attract and retain a

significant number of players in order to grow our revenues and

earnings; with respect to Illinois Gaming Investors, LLC, d/b/a

Prairie State Gaming, risks relating to recent acquisitions of

additional assets and the integration of such acquisitions,

potential changes in the VGT laws, our ability to successfully

compete in the VGT market, our ability to retain existing customers

and secure new customers, risks relating to municipal authorization

of VGT operations and the implementation and the ultimate success

of the products and services being offered; with respect to our

recent acquisitions in Tunica, risks related to the successful

integration of such acquisitions and our ability to realize

potential synergies or projected financial results from such

acquisitions; and other factors as discussed in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2016,

subsequent Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K, each as filed with the United States Securities and

Exchange Commission. The Company does not intend to update publicly

any forward-looking statements except as required by law. In light

of these risks, uncertainties and assumptions, the forward-looking

events discussed in this press release may not occur.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171026005428/en/

Penn National Gaming, Inc.William J. Fair, Chief Financial

Officer, 610/373-2400orJCIRJoseph N. Jaffoni, Richard

Land212/835-8500 or penn@jcir.com

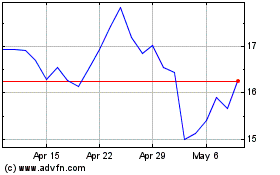

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024