Coeur Mining, Inc. (“Coeur” or the "Company") (NYSE: CDE) today

reported companywide all-in sustaining costs (AISC) per average

spot silver equivalent1 ounce (AgEqOz) of $15.18 for third quarter

2017, 4% lower quarter-over-quarter and driven by a 7% increase in

silver equivalent1 production. These improvements over the prior

quarter were primarily due to 25% higher silver equivalent1

production and a 14% decline in adjusted costs applicable to sales

per average spot AgEqOz1 from Palmarejo and 21% higher gold

production from Wharf.

Third quarter revenue of 176.0 million was up 1%

quarter-over-quarter, cash flow from operating activities was

unchanged at $29.4 million, while adjusted EBITDA1 increased 18% to

$39.5 million. Third quarter net loss of $16.7 million, or $0.09

per share, was impacted by higher income and mining tax expense

mostly due to non-cash increases in deferred tax estimates,

increased exploration expense driven by ongoing success from

drilling programs at the Palmarejo and Kensington mines, and higher

costs at the San Bartolomé mine due to continued drought conditions

and reduced third-party ore purchases during the quarter.

Highlights

- Higher quarterly silver

equivalent1 production - Third quarter silver and

gold production were 4.0 million ounces and 93,293 ounces,

respectively, or 9.5 million AgEqOz1, representing an increase of

7% quarter-over-quarter and 10% year-over-year. Higher companywide

production was driven primarily by Palmarejo, where higher mining

rates and silver grades delivered 25% quarter-over-quarter and 89%

year-over-year increases in AgEqOz1 production. At Wharf, mining at

the higher-grade Golden Reward deposit during the quarter drove a

21% increase in its gold production

- Lower third quarter costs per

ounce - Third quarter companywide AISC and adjusted AISC per

average spot AgEqOz1 of $15.30 and $15.18, respectively, were 4%

and 3% lower quarter-over-quarter primarily due to lower unit costs

at Palmarejo, partially offset by higher unit costs at San

Bartolomé as well as increased sustaining capital expenditures and

exploration expense

- Major milestones achieved at key

capital projects - At Palmarejo, Rochester, and Kensington,

important milestones were achieved in key capital projects during

the quarter. Following a multi-year development and ramp-up period,

the targeted mining rate of 4,500 tons per day was achieved one

quarter ahead of schedule at Palmarejo. At Rochester, the new Stage

IV leach pad expansion was successfully commissioned on-schedule

after three years of permitting and ten months of construction. At

Kensington, development ore was mined and stockpiled from the

high-grade Jualin deposit after two years of underground

development activities

- Acquisition of high-grade Silvertip

mine announced - Announced acquisition of newly-constructed

Silvertip silver-zinc-lead operation located in British Columbia on

September 11, 2017, which closed on October 17, 2017. Underground

drilling and development activities are now underway and mill

commissioning is proceeding on-schedule. Production is expected to

begin during the first quarter of 2018 and average approximately

ten million AgEqOz1 per year at an average AISC per AgEqOz1 of

$10.50 - $11.50, generating average annual EBITDA1 of $70 million

over its initial 7.5-year mine life

- Modifications to full-year

guidance - Full-year production guidance was revised on October

5, 2017 for San Bartolomé to reflect the impact of ongoing drought

conditions in the Potosí region of Bolivia. San Bartolomé's cost

guidance has been increased as a result. The Company has also

increased cost guidance for Rochester due to higher processing

costs induced by the residual effects of record rainfall earlier in

the year and at Kensington to reflect higher year-to-date unit

costs driven by lower-than-expected gold grades. Companywide AISC

guidance has been revised accordingly while full-year capital

expenditure guidance has been increased to reflect anticipated

investments in the newly-acquired Silvertip mine. Finally,

full-year exploration expense guidance has been raised to reflect

the higher investment levels at Palmarejo and Kensington and to

incorporate anticipated exploration expense at Silvertip during the

fourth quarter.

"During the third quarter, the Company delivered higher

production and cash flow, lower costs, and realized key objectives

at several major, multi-year growth projects," said Mitchell J.

Krebs, Coeur's President and Chief Executive Officer. "Palmarejo

and Wharf were the strongest performers during the quarter,

delivering strong production growth and generating combined free

cash flow of nearly $25 million.

"We announced and recently completed the acquisition of the

high-grade Silvertip mine in British Columbia for US$200 million of

upfront consideration, which we expect will meaningfully grow our

production and cash flow beginning next year. Our team is applying

the same approach to Silvertip that has been successful at our

existing operations and with recent acquisitions such as Wharf to

position our newest mine for long-term success.

"Our third quarter results were negatively impacted by higher

costs at San Bartolomé, lower-than-expected gold grades at

Kensington, and significantly higher income and mining tax expense

mostly attributable to changes in deferred tax estimates. Given San

Bartolomé's high costs and short mine life, we are evaluating

several alternatives for this operation. In the meantime, we

reduced San Bartolomé’s workforce by 23%, which resulted in a

one-time severance expense of $2.2 million during the quarter and

is expected to yield significant savings going forward. Although

Kensington’s grades have been lower than expected, we anticipate

significantly higher grades in the fourth quarter as mining

activities accelerate in the higher-grade Raven and Jualin

zones.

"Importantly, we are maintaining our significantly higher level

of exploration investment, especially in near-mine drilling

programs at Palmarejo and Kensington, due to the ongoing success of

these programs and the lack of drilling these assets have received

historically."

Financial and Operating Highlights

(Unaudited)

(Amounts in millions, except per share amounts, gold

ounces produced & sold, and per-ounce metrics) 3Q

2017 2Q 2017 1Q 2017 4Q

2016 3Q 2016 Revenue $ 176.0

$ 173.4 $ 206.1 $ 159.2 $ 176.2

Costs Applicable to Sales

$ 118.9 $ 125.6 $ 132.7 $ 102.0 $ 105.4

General

and Administrative Expenses $ 7.4 $ 7.0 $ 10.1 $

6.6 $ 7.1

Net Income (Loss) $ (16.7 ) $

(11.0 ) $ 18.7 $ (8.3 ) $ 69.6

Net Income (Loss) Per Share

$ (0.09 ) $ (0.06 ) $ 0.10 $ (0.03 ) $ 0.42

Adjusted Net Income (Loss)1 $ (18.4

) $ (2.5 ) $ 7.0 $ 2.8 $ 38.6

Adjusted Net Income

(Loss)1 Per Share $ (0.10 )

$ (0.01 ) $ 0.04 $ 0.01 $ 0.23

Weighted Average Shares

Outstanding 179.3 179.2 183.1 178.6 165.8

EBITDA1 $ 35.0 $ 23.6 $ 73.4 $ 27.4 $

50.9

Adjusted EBITDA1 $ 39.5 $ 33.4 $

56.6 $ 44.0 $ 62.7

Cash Flow from Operating Activities

$ 29.4 $ 29.3 $ 55.3 $ 25.5 $ 47.8

Capital

Expenditures $ 29.5 $ 37.5 $ 24.0 $ 29.9 $ 25.6

Free Cash Flow1 $ — $ (8.2 ) $ 31.3 $

(4.5 ) $ 14.6

Cash, Equivalents & Short-Term Investments

$ 236.2 $ 250.0 $ 210.0 $ 162.2 $ 222.5

Total

Debt2 $ 288.9 $ 284.8 $ 219.1 $ 210.9 $

401.7

Average Realized Price Per Ounce – Silver $

16.86 $ 16.98 $ 17.61 $ 16.64 $ 19.61

Average Realized

Price Per Ounce – Gold $ 1,240 $ 1,206 $ 1,149 $

1,170 $ 1,317

Silver Ounces Produced 4.0 4.0 3.9 3.9

3.5

Gold Ounces Produced 93,293 82,819 88,218 102,500

84,871

Silver Equivalent Ounces Produced1 9.5

8.9 9.2 10.0 8.6

Silver Ounces Sold 3.8 4.1 4.5 3.4

3.4

Gold Ounces Sold 89,972 86,194 110,874 87,108

83,389

Silver Equivalent Ounces Sold1 9.2 9.3

11.1 8.6 8.4

Silver Equivalent Ounces Sold (Average

Spot)1 10.6 10.4 12.2 9.6 9.1

Adjusted CAS per

AgEqOz1 $ 12.08 $ 12.91 $ 11.38 $ 12.05 $

12.10

Adjusted CAS per Average Spot AgEqOz1 $

11.01 $ 12.00 $ 10.63 $ 11.34 $ 11.64

Adjusted CAS per

AuEqOz1 $ 843 $ 860 $ 791 $ 676 $ 712

Adjusted AISC per AgEqOz1 $ 17.54 $

17.64 $ 15.02 $ 16.13 $ 16.46

Adjusted AISC per Average Spot

AgEqOz1 $ 15.18 $ 15.73 $ 13.66 $

14.52 $ 15.23

Financial Results

Third quarter revenue of 176.0 million was up 1%

quarter-over-quarter. Silver sales contributed 37% of third quarter

revenue and gold sales contributed 63%. The Company's U.S.

operations generated 55% of the quarter's revenue. Average realized

silver and gold prices were $16.86 and $1,240 per ounce,

respectively, representing a decrease of 1% and an increase of 3%

quarter-over-quarter. The average realized gold price reflects the

sale of 9,400 ounces to Franco-Nevada at a price of $800 per ounce

under the gold stream at Palmarejo.

Costs applicable to sales were $118.9 million for the quarter,

decreasing 5% quarter-over-quarter due primarily to lower unit

costs at Palmarejo, partially offset by higher unit costs at San

Bartolomé. General and administrative expenses were $7.4 million,

$0.4 million higher than in the second quarter and largely

attributable to higher professional service costs. Interest

expense, net of capitalized interest, decreased 56% to $3.6 million

compared to $8.1 million in the third quarter of 2016 due to lower

debt levels and a lower interest rate on the Company's senior

notes, which were refinanced in the second quarter of 2017.

Pre-development, reclamation, and other expenses increased

quarter-over-quarter and year-over-year to $8.0 million due to the

ongoing evaluation of the at La Preciosa project, acquisition costs

related to the Silvertip acquisition, and the one-time severance

expenses at San Bartolomé of $2.2 million as a result of a 23%

reduction in the workforce during the quarter.

The Company's income and mining tax expense increased to $14.2

million driven mostly by non-cash increases in deferred tax

estimates.

During the quarter, the Company established a four-year $200

million revolving credit facility (the "Facility"). Subsequent to

the quarter-end, the Company drew $100 million under the Facility

to partially fund the acquisition of the Silvertip mine at a rate

of 3.5%, which was based on the one-month LIBOR rate plus a margin

of 2.25%.

At quarter-end, cash and cash equivalents totaled $236.2

million, and 181.4 million common shares were issued and

outstanding. After giving effect to the closing of the acquisition

of the Silvertip mine, the Company would have had a pro forma cash

balance of approximately $180 million. In addition, 4.2 million new

shares were issued in connection with the Silvertip closing,

representing a 2.3% increase in common shares on an undiluted basis

and bringing total shares outstanding to 185.6 million.

Operations

Highlights of third quarter 2017 results for each of the

Company's operating segments are provided below.

Palmarejo, Mexico

(Dollars in millions, except per ounce amounts) 3Q

2017 2Q 2017 1Q 2017 4Q

2016 3Q 2016 Tons milled 413,086

335,428 360,383 287,569 274,644

Average silver grade (oz/t)

5.53 4.98 4.91 4.95 3.98

Average gold grade (oz/t)

0.08 0.08 0.09 0.09 0.08

Average recovery rate – Ag

83.6% 87.3% 86.5% 89.1% 85.5%

Average recovery rate –

Au 83.1% 91.1% 93.7% 90.4% 77.7%

Silver ounces

produced (000's) 1,908 1,457 1,531 1,269 933

Gold

ounces produced 28,948 24,292 30,792 23,906 16,608

Silver equivalent ounces produced1 (000's)

3,644 2,914 3,378 2,703 1,930

Silver ounces sold

(000's) 1,794 1,484 1,965 937 778

Gold ounces

sold 26,554 25,191 41,045 15,558 11,410

Silver

equivalent ounces sold1 (000's) 3,387

2,996 4,427 1,872 1,462

Silver equivalent ounces

sold1 (average spot) (000's) 3,809 3,324

4,837 2,042 1,555

Metal sales $60.7 $53.2 $77.7 $32.5

$30.7

Costs applicable to sales $33.3 $33.9 $43.0

$20.9 $16.0

Adjusted CAS per AgEqOz1

$9.76 $11.21 $9.68 $11.01 $10.70

Adjusted CAS per average

spot AgEqOz1 $8.68 $10.11 $8.87 $10.11 $10.05

Exploration expense $4.5 $3.1 $1.6 $2.4 $1.3

Cash

flow from operating activities $18.5 $18.8 $50.5 $(1.7)

$13.7

Sustaining capital expenditures (excludes capital lease

payments) $6.5 $6.1 $5.0 $3.9 $6.7

Development

capital expenditures $(1.0) $5.1 $1.2

$4.2 $3.3

Total capital expenditures

$5.5 $11.2 $6.2 $8.1 $10.0

Free cash flow (before

royalties) $13.0 $7.6 $44.3 $(9.8) $3.7

Gold

production royalty payments $— $— $—

$— $7.6

Free cash flow1 $13.0

$7.6 $44.3 $(9.8) $(3.9)

- Silver equivalent1 production increased

25% quarter-over-quarter and 89% year-over-year to 3.6 million,

driven by higher mining rates and silver grades. Average mining

rates during the quarter reached the year-end target of 4,500 tons

per day ahead of schedule due to higher-than-budgeted mining rates

at Independencia during the quarter. Mining rates in the fourth

quarter are expected to remain comparable to third quarter

levels

- Average silver grade increased 11%

quarter-over-quarter and 39% year-over-year as a result of mining

higher grade stopes in the Independencia deposit that became

accessible following the installation of additional ground support

during the second quarter of 2017

- Third quarter adjusted CAS per average

spot AgEqOz1 of $8.68 were 14% lower both quarter-over-quarter and

year-over-year, bringing year-to-date adjusted CAS per average spot

AgEqOz1 to $9.13

- Lower quarter-over-quarter recovery

rates were driven primarily by an increase in mill inventory at

quarter-end, which is expected to normalize in the fourth

quarter

- Near-mine exploration activity was

expanded due to encouraging drilling results and the identification

of several new structures, which contributed to increased

exploration expense of $4.5 million

- Quarterly free cash flow1 was $13.0

million, bringing year-to-date free cash flow1 to $64.9

million

- Full-year guidance remains unchanged

with production expected to be 6.5 - 7.0 million ounces of silver

and 110,000 - 120,000 ounces of gold, or 13.1 -14.2 million

AgEqOz1, at CAS per AgEqOz1 of $10.00 - $10.50 on a 60:1 silver

equivalent basis and $9.00 - $9.50 on a spot price equivalent

basis

Rochester, Nevada

(Dollars in millions, except per ounce amounts) 3Q

2017 2Q 2017 1Q 2017 4Q

2016 3Q 2016 Ore tons placed

4,262,011 4,493,100 3,513,708 3,878,487 4,901,039

Average

silver grade (oz/t) 0.53 0.53 0.58 0.57 0.54

Average

gold grade (oz/t) 0.004 0.003 0.002 0.002 0.003

Silver ounces produced (000's) 1,070 1,156 1,127

1,277 1,161

Gold ounces produced 10,955 10,745 10,356

14,231 12,120

Silver equivalent ounces produced1

(000's) 1,727 1,801 1,749 2,131 1,888

Silver

ounces sold (000's) 1,050 1,135 1,289 1,205 1,163

Gold ounces sold 10,390 10,658 13,592 12,988 11,751

Silver equivalent ounces sold1 (000's)

1,674 1,774 2,104 1,984 1,868

Silver equivalent ounces

sold1 (average spot) (000's) 1,839 1,913

2,240 2,128 1,963

Metal sales $31.2 $32.8 $39.0 $36.2

$37.9

Costs applicable to sales $23.3 $24.2 $26.4

$23.7 $21.8

Adjusted CAS per AgEqOz1

$13.69 $13.54 $12.57 $11.99 $11.56

Adjusted CAS per

average spot AgEqOz1 $12.46 $12.56 $11.81 $11.16

$11.02

Exploration expense $0.5 $0.3 $0.1 $0.4 $0.1

Cash flow from operating activities $1.6 $(1.1) $5.7

$7.6 $9.5

Sustaining capital expenditures (excludes capital

lease payments) $0.5 $1.1 $0.2 $1.5 $1.2

Development

capital expenditures $9.2 $12.7 $10.4

$4.3 $2.2

Total capital expenditures

$9.7 $13.8 $10.6 $5.8 $3.4

Free cash flow1

$(8.1) $(14.9) $(4.9) $1.8 $6.1

- Silver equivalent1 production decreased

4% quarter-over-quarter and 9% year-over-year to 1.7 million ounces

due to lower tons placed resulting from crusher downtime related to

planned annual maintenance, integration of the crusher into the

Stage IV system, and a brief power disruption caused by a nearby

wildfire

- Leaching off the newly-expanded Stage

IV leach pad, which began in mid-September, is expected to drive

higher fourth quarter production. Gold production is expected to

additionally benefit from the placement of higher gold grade ore

during the third quarter

- Adjusted CAS per average spot AgEqOz1

were relatively flat quarter-over-quarter and up 13% year-over-year

at $12.46, bringing year-to-date adjusted CAS per average spot

AgEqOz1 to $12.24. Increased year-over-year unit costs resulted

from lower production levels, higher waste tons mined to access

higher-grade ore, and higher blasting, cyanide and hauling

expenses

- Negative quarterly free cash flow1 of

$8.1 million was largely attributable to fewer ounces sold as well

as a temporary increase in inventory on the new Stage IV leach pad.

Higher production and lower capital expenditures are expected to

drive positive free cash flow1 in the fourth quarter

- Production guidance for the full year

remains unchanged at 4.2 - 4.7 million ounces of silver and 47,000

- 52,000 ounces of gold, or 7.0 - 7.8 million AgEqOz1. The Company

is revising its cost guidance from CAS per AgEqOz1 of $11.50 -

$12.00 to $12.50 - $13.00 on a 60:1 silver equivalent basis and

from $10.50 - $11.00 to $11.50 - $12.00 on a spot price equivalent

basis

Kensington, Alaska

(Dollars in millions, except per ounce amounts) 3Q

2017 2Q 2017 1Q 2017 4Q

2016 3Q 2016 Tons milled 172,038

163,163 165,895 163,410 140,322

Average gold grade (oz/t)

0.17 0.17 0.17 0.22 0.20

Average recovery rate

94.1% 93.2% 94.0% 94.4% 94.8%

Gold ounces produced

27,541 26,424 26,197 33,688 26,459

Gold ounces sold

29,173 29,031 32,144 28,864 30,998

Metal sales

$36.6 $35.6 $38.0 $34.2 $40.2

Costs applicable to

sales $27.7 $28.0 $28.4 $23.0 $26.7

Adjusted CAS per

AuOz1 $946 $952 $884 $801 $859

Exploration

expense $3.0 $2.0 $0.8 $1.3 $1.2

Cash flow from

operating activities $9.3 $7.0 $4.5 $11.4 $18.0

Sustaining capital expenditures (excludes capital lease

payments) $6.5 $3.7 $2.5 $8.9 $5.2

Development

capital expenditures $3.6 $4.9 $3.0

$3.7 $3.4

Total capital expenditures $10.1

$8.6 $5.5 $12.6 $8.6

Free cash flow1 $(0.8)

$(1.6) $(1.0) $(1.2) $9.4

- Third quarter gold production of 27,541

ounces was 4% higher both quarter-over-quarter and year-over-year

due to higher mill throughput. Higher anticipated grades are

expected to drive strong production in the fourth quarter

- Initial development ore was mined at

Jualin during the quarter, marking an important milestone following

two years of underground development

- Adjusted CAS per AuOz1 decreased 1%

quarter-over-quarter and increased 10% year-over-year to $946,

bringing year-to-date adjusted CAS per AuOz1 to $928. Higher

anticipated grades and production in the fourth quarter are

expected to result in lower unit costs for the full-year

- Increased investment in exploration of

50% quarter-over-quarter and 150% year-over-year was due to ongoing

positive results from Jualin and a focus on accelerating

exploration activities in higher-grade areas of the Raven and

Kensington Main deposits

- Higher capital expenditures related to

the continued development of Jualin and the replacement of

Kensington's diesel generators resulted in negative third quarter

free cash flow1 of $0.8 million. The new diesel generators are

expected to deliver annual fuel savings of $1.5 million

- Production guidance for the full year

remains unchanged at 120,000 - 125,000 ounces of gold. Kensington's

cost guidance has been revised higher from CAS per AuOz1 of $800 -

$850 to $850 - $900

Wharf, South Dakota

(Dollars in millions, except per ounce amounts) 3Q

2017 2Q 2017 1Q 2017 4Q

2016 3Q 2016 Ore tons placed

1,150,308 993,167 1,292,181 1,178,803 1,199,008

Average

silver grade (oz/t) 0.21 0.19 0.22 0.29 0.24

Average

gold grade (oz/t) 0.029 0.024 0.027 0.027 0.033

Gold

ounces produced 25,849 21,358 20,873 30,675 29,684

Silver ounces produced (000's) 15 13 20 32 25

Gold

equivalent ounces produced1 26,096 21,568 21,207

31,202 30,106

Silver ounces sold (000's) 14 11 33 30

17

Gold ounces sold 23,855 21,314 24,093 29,698

29,230

Gold equivalent ounces sold1 24,085

21,495 24,636 30,204 29,508

Metal sales $31.3 $27.0

$30.3 $35.5 $39.3

Costs applicable to sales $17.3

$15.8 $16.3 $16.9 $19.7

Adjusted CAS per AuEqOz1

$719 $737 $670 $556 $559

Exploration expense

$0.2 $— $— $— $—

Cash flow from operating activities

$15.0 $8.8 $8.6 $15.4 $21.1

Sustaining capital

expenditures (excludes capital lease payments) $1.8 $1.5

$0.9 $1.3 $0.6

Development capital expenditures $1.3

$— $— $— $—

Total capital

expenditures $3.1 $1.5 $0.9 $1.3 $0.6

Free cash

flow1 $11.9 $7.3 $7.7 $14.1 $20.5

- Gold production increased 21%

quarter-over-quarter and decreased 13% year-over-year to 25,849

ounces, primarily driven by mining from the higher-grade Golden

Reward deposit, which was mined for an abbreviated season and is

now complete

- Tons placed during the quarter were 16%

higher than in the second quarter, with tons placed for the full

year on track to reach 4.5 million, up from 4.3 million in 2016 and

3.6 million in 2015

- Adjusted CAS per AuEqOz1 were down 2%

quarter-over-quarter and up 29% year-over-year at $719, bringing

year-to-date adjusted CAS per AuEqOz1 to $708. Higher

year-over-year costs were mostly driven by lower grades compared to

the same period one year ago

- During the quarter, Wharf generated

$11.9 million of free cash flow1, bringing year-to-date free cash

flow1 to $26.9 million and cumulative free cash flow1 since Wharf's

acquisition in February 2015 for $99 million to $113.3 million

- Full-year production and cost guidance

remain unchanged from improvements made to production and cost

guidance in July, with gold production of 90,000 - 95,000 ounces

and CAS per AuEqOz1 of $700 - $750 expected for 2017

San Bartolomé, Bolivia

(Dollars in millions, except per ounce amounts) 3Q

2017 2Q 2017 1Q 2017 4Q

2016 3Q 2016 Tons milled 365,554

417,784 384,267 368,131 450,409

Average silver grade (oz/t)

3.01 3.31 3.49 3.96 3.43

Average recovery rate

87.0% 92.8% 90.7% 86.3% 88.7%

Silver ounces produced

(000's) 957 1,285 1,215 1,259 1,370

Silver ounces

sold (000's) 951 1,398 1,148 1,218 1,391

Metal

sales $16.0 $23.8 $20.6 $19.9 $27.5

Costs applicable

to sales $17.4 $23.4 $18.2 $17.3 $20.8

Adjusted CAS

per AgOz1 $17.58 $15.96 $15.88 $13.97 $14.40

Exploration expense $— $— $— $— $—

Cash flow from

operating activities $(7.9) $5.2 $11.3 $4.1 $8.6

Sustaining capital expenditures (excludes capital lease

payments) $0.5 $0.4 $0.4 $1.8 $3.0

Development

capital expenditures $— $— $— $—

$—

Total capital expenditures $0.5 $0.4 $0.4

$1.8 $3.0

Free cash flow1 $(8.4) $4.8 $10.9

$2.3 $5.6

- Third quarter production declined 26%

quarter-over-quarter and 30% year-over-year to 1.0 million silver

ounces, primarily due to persistent drought conditions in the

Potosí region of Bolivia and lower third-party ore purchases

- Adjusted CAS per silver ounce (AgOz)1

rose 10% quarter-over-quarter and 22% year-over-year to $17.58 due

to lower grades and mill throughput

- Among the cost-saving measures

undertaken, the Company reduced the mine's workforce by 23% and

subsequently incurred one-time employee severance expenses of $2.2

million, which contributed to a negative free cash outflow1 of $8.4

million for the quarter. The workforce reduction is expected to

result in annual labor cost savings of approximately $3.8

million

- On October 5, 2017, full-year

production guidance was lowered to 4.50 - 4.75 million ounces of

silver from 5.0 - 5.4 million ounces due to ongoing processing

challenges related to persistent drought conditions. Cost guidance

is accordingly increased from CAS per AgOz1 of $15.75 - $16.25 to

$16.50 - $17.00

Exploration

Coeur further expanded its success-based exploration program

during the third quarter based on encouraging drill results from

its near-mine exploration efforts. In particular, drilling activity

at Palmarejo and Kensington were significantly expanded with

quarter-over-quarter increases in exploration expense of 45% and

50%, respectively. Companywide exploration expense totaled $9.8

million, 26% higher than the prior quarter and more than double the

same period in 2016. Capitalized exploration also increased from

$2.9 million in the second quarter to $5.1 million in the third

quarter.

The Company had approximately 20 drill rigs active in July and

August and 16 in September, including as many as nine drill rigs at

Palmarejo and five at Kensington. This compares to twelve active

drill rigs during the third quarter of 2016. Total feet drilled

during the quarter increased 37% compared to the same period last

year.

Exploration efforts at Palmarejo constituted over 40% of total

drilling activity during the quarter with a focus on resource

expansion at the Nación-Dana deposit, which is located between the

Guadalupe and Independencia deposits. Drilling activity also

targeted resource conversion and expansion at the Guadalupe and

Independencia deposits, resource expansion at the La Bavisa vein

located northeast of Independencia, and definition of five

newly-discovered veins east and west of the Guadalupe deposit.

Drilling at Kensington accounted for over 20% of total feet

drilled during the quarter with a focus on both resource conversion

and expansion of the Jualin deposit as well as resource conversion

at Raven.

At Silvertip, a drill plan totaling approximately 100,000 meters

has been initiated with a focus on underground development drilling

and resource conversion and expansion. Results of this drill

program will be included in an updated technical report expected in

the second half of 2018.

Full-Year 2017 Outlook

Coeur's 2017 production guidance remains unchanged from the

revised guidance published October 5, 2017. Revised cost guidance

is shown in the table below.

2017 Production Outlook

(silver and silver equivalent ounces in thousands)

Silver Gold Silver

Equivalent1 Palmarejo 6,500 - 7,000

110,000 - 120,000 13,100 - 14,200

Rochester 4,200 -

4,700 47,000 - 52,000 7,020 - 7,820

San Bartolomé 4,500 -

4,750 — 4,500 - 4,750

Endeavor 107 — 107

Kensington —

120,000 - 125,000 7,200 - 7,500

Wharf — 90,000

- 95,000 5,400 - 5,700

Total 15,307 - 16,557

367,000 - 392,000 37,327 - 40,077

2017 Cost Outlook

Original Guidance (if changed) Current

Guidance (dollars in millions, except per ounce amounts)

60:1 70:1 Spot 60:1

70:1 Spot CAS per AgEqOz1 –

Palmarejo $10.00 - $10.50 $9.00 - $9.50

CAS

per AgEqOz1 – Rochester $11.50 - $12.00 $10.50 -

$11.00 $12.50 - $13.00 $11.50 - $12.00

CAS per AgOz1

– San Bartolomé $14.00 - $14.50 $16.50 - $17.00

CAS per

AuOz1 – Kensington $800 - $850 $850 - $900

CAS

per AuEqOz1 – Wharf $775 - $825 $700 - $750

Capital Expenditures $115 - $135 $120 - $140

General and

Administrative Expenses $28 - $32

Exploration Expense

$23 - $25 $32 - $36

AISC per AgEqOz1 $15.75 - $16.25

$14.25 - $14.75 $16.25 - $16.75 $14.75-$15.25

Financial Results and Conference Call

There will be a conference call on Coeur's financial results for

third quarter of 2017 on October 26, 2017 at 11:00 a.m. Eastern

Time.

Dial-In Numbers: (855)

560-2581 (US) (855) 669-9657 (Canada) (412) 542-4166

(International) Conference ID: Coeur Mining

Hosting the call will be Mitchell J. Krebs, President and Chief

Executive Officer of Coeur, who will be joined by Peter C.

Mitchell, Senior Vice President and Chief Financial Officer, Frank

L. Hanagarne, Jr., Senior Vice President and Chief Operating

Officer, Hans Rasmussen, Senior Vice President of Exploration, and

other members of management. A replay of the call will be available

through November 9, 2017.

Replay numbers: (877)

344-7529 (US) (855) 669-9658 (Canada) (412) 317-0088

(International) Conference ID: 101 11 361

About Coeur

Coeur Mining, Inc. is a well-diversified, growing precious

metals producer with six mines in the Americas employing

approximately 2,300 people. Coeur’s wholly-owned operations include

the Palmarejo silver-gold complex in Mexico, the Silvertip

silver-zinc-lead mine in British Columbia, the Rochester

silver-gold mine in Nevada, the Kensington gold mine in Alaska, the

Wharf gold mine in South Dakota, and the San Bartolomé silver mine

in Bolivia. In addition, the Company owns the La Preciosa project

in Mexico, a silver-gold exploration stage project. Coeur conducts

exploration activities in North and South America.

Cautionary Statements

This news release contains forward-looking statements within the

meaning of securities legislation in the United States and Canada,

including statements regarding anticipated production, costs,

expenses, expectations regarding Silvertip, grades, exploration

efforts, expectations regarding La Preciosa, recovery rates,

returns, fuel savings, high-return growth opportunities, and the

impact of continued drought conditions and labor cost savings in

Bolivia. Such forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause Coeur's

actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

factors include, among others, the risk that expectations regarding

Silvertip are not realized, the risk that anticipated production,

cost, and expense levels are not attained, the risks and hazards

inherent in the mining business (including risks inherent in

developing large-scale mining projects, environmental hazards,

industrial accidents, weather or geologically related conditions),

changes in the market prices of gold and silver and a sustained

lower price environment, the uncertainties inherent in Coeur's

production, exploratory and developmental activities, including

risks relating to permitting and regulatory delays, ground

conditions, grade variability, any future labor disputes or work

stoppages, the uncertainties inherent in the estimation of gold and

silver reserves, changes that could result from Coeur's future

acquisition of new mining properties or businesses, the loss of any

third-party smelter to which Coeur markets silver and gold, the

effects of environmental and other governmental regulations, the

risks inherent in the ownership or operation of or investment in

mining properties or businesses in foreign countries, the political

risks and uncertainties associated with operations in Bolivia,

Coeur's ability to raise additional financing necessary to conduct

its business, make payments or refinance its debt, as well as other

uncertainties and risk factors set out in filings made from time to

time with the United States Securities and Exchange Commission, and

the Canadian securities regulators, including, without limitation,

Coeur's most recent reports on Form 10-K or Form 10-Q. Actual

results, developments and timetables could vary significantly from

the estimates presented. Readers are cautioned not to put undue

reliance on forward-looking statements. Coeur disclaims any intent

or obligation to update publicly such forward-looking statements,

whether as a result of new information, future events or otherwise.

Additionally, Coeur undertakes no obligation to comment on

analyses, expectations or statements made by third parties in

respect of Coeur, its financial or operating results or its

securities.

Coeur's management prepared certain unaudited financial

projections, some portions of which are included in this news

release. These projections were prepared to give effect to the

acquisition of the Silvertip project. These projections were not

prepared with a view toward complying with published guidelines of

the SEC, the guidelines established by the American Institute of

Certified Public Accountants with respect to prospective financial

information, or GAAP, but, in the view of Coeur's management, were

prepared on a reasonable basis, reflect the best then-available

estimates and judgments, and present, to the best of management's

knowledge and belief at the time, the expected course of action and

the expected future financial performance of Coeur. However, this

information is not fact and should not be relied upon as

necessarily indicative of actual future results, and readers of

this news release are cautioned not to place undue reliance on

these projections. These projections have been prepared by, and are

the responsibility of, Coeur's management. Neither Coeur's

independent auditors, nor any other independent accountants, have

compiled, examined, or performed any procedures with respect to

these projections, nor have they expressed any opinion or any other

form of assurance on such information or its achievability, and

assume no responsibility for, and disclaim any association with,

such projections.

The assumptions and estimates underlying these projections are

inherently uncertain and, although considered reasonable by the

management of Coeur as of the date of their preparation, are

subject to a wide variety of significant business, economic, and

competitive risks and uncertainties that could cause actual results

to differ materially from those contained in these projections,

including, among others, risks and uncertainties relating to

Coeur's businesses (including its ability to achieve strategic

goals, objectives and targets over applicable periods), industry

performance, the regulatory environment, general business and

economic conditions, and other factors described above.

Accordingly, there can be no assurance that these projections are

indicative of the future performance of Coeur or that actual

results will not differ materially from those presented. Inclusion

of these projections in this news release should not be regarded as

a representation by any person that the results contained in these

projections will be achieved. Coeur does not intend to update or

otherwise revise these projections to reflect circumstances

existing since their preparation or to reflect the occurrence of

unanticipated events, even in the event that any or all of the

underlying assumptions are shown to be in error. Furthermore, Coeur

does not intend to update or revise these projections to reflect

changes in general economic or industry conditions.

Christopher Pascoe, Coeur's Director, Technical Services and a

qualified person under Canadian National Instrument 43-101,

approved the scientific and technical information concerning

Coeur's mineral projects in this news release. For a description of

the key assumptions, parameters and methods used to estimate

mineral reserves and resources, as well as data verification

procedures and a general discussion of the extent to which the

estimates may be affected by any known environmental, permitting,

legal, title, taxation, socio-political, marketing or other

relevant factors, Canadian investors should refer to the Technical

Reports for each of Coeur's properties as filed on SEDAR at

www.sedar.com.

Non-U.S. GAAP Measures

We supplement the reporting of our financial information

determined under United States generally accepted accounting

principles (U.S. GAAP) with certain non-U.S. GAAP financial

measures, including EBITDA, adjusted EBITDA, adjusted net income

(loss), costs applicable to sales per silver equivalent ounce (or

per gold equivalent ounce or per average spot silver equivalent

ounce), adjusted costs applicable to sales per silver equivalent

ounce (or per gold equivalent ounce or per average spot silver

equivalent ounce), adjusted costs applicable to sales per silver

ounce (or per gold ounce), all-in sustaining costs, and adjusted

all-in sustaining costs. We believe that these adjusted measures

provide meaningful information to assist management, investors and

analysts in understanding our financial results and assessing our

prospects for future performance. We believe these adjusted

financial measures are important indicators of our recurring

operations because they exclude items that may not be indicative

of, or are unrelated to our core operating results, and provide a

better baseline for analyzing trends in our underlying businesses.

We believe EBITDA, adjusted EBITDA, adjusted net income (loss),

costs applicable to sales per silver equivalent ounce (or per gold

equivalent ounce or per average spot silver equivalent ounce),

adjusted costs applicable to sales per silver equivalent ounce (or

per gold equivalent ounce or per average spot silver equivalent

ounce), adjusted costs applicable to sales per silver ounce (or per

gold ounce), all-in sustaining costs, and adjusted all-in

sustaining costs are important measures in assessing the Company's

overall financial performance. For additional explanation regarding

our use of non-U.S. GAAP financial measures, please refer to our

Form 10-K for the year ended December 31, 2016 and our quarterly

report on Form 10-Q for the quarter ended September 30, 2017.

Notes

- EBITDA, adjusted EBITDA, adjusted net

income (loss), costs applicable to sales per silver equivalent

ounce (or per gold equivalent ounce or per average spot silver

equivalent ounce), adjusted costs applicable to sales per silver

equivalent ounce (or per gold equivalent ounce or per average spot

silver equivalent ounce), adjusted costs applicable to sales per

silver ounce (or per gold ounce), all-in sustaining costs, and

adjusted all-in sustaining costs are non-GAAP measures. Please see

tables in the Appendix for the reconciliation to U.S. GAAP. For

purposes of silver and gold equivalence, a 60:1 silver to gold

ratio is assumed except where noted as average spot prices. Please

see table below for average silver and gold spot prices during the

period and the silver-to-gold ratio. For purposes of silver

equivalence in the context of Silvertip's initial mine plan, metal

prices of $1,250/oz gold, $17.50/oz silver, $1.13/lb lead, and

$1.40/lb zinc are assumed. For additional information regarding

Silvertip's initial mine plan, including underlying assumptions,

please refer to the Company's press release dated September 11,

2017. Free cash flow is defined as cash flow from operating

activities less capital expenditures and gold production royalty

payments. Please see table in Appendix for the calculation of

consolidated free cash flow.

- Includes capital leases. Net of debt

issuance costs and premium received.

Average Spot Prices

3Q 2017 2Q 2017

1Q 2017 4Q 2016 3Q 2016

Average Silver Spot Price Per Ounce $ 16.84 $ 17.21 $ 17.42

$ 17.19 $ 19.61

Average Gold Spot Price Per Ounce $ 1,278 $

1,257 $ 1,219 $ 1,222 $ 1,335

Average Silver to Gold Spot

Equivalence 76:1 73:1 70:1 71:1 68:1

For Additional Information

Coeur Mining, Inc. 104 S. Michigan Avenue, Suite 900 Chicago, IL

60603 Attention: Courtney Lynn, Vice President, Investor Relations

and Treasurer Phone: (312) 489-5910

www.coeur.com

Coeur Mining, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Income (Loss)

(Unaudited) Three months ended Nine months

ended September 30, September 30, 2017

2016 2017 2016

Notes In thousands, except share data

Revenue 3 $ 175,963 $ 176,247 $ 555,455 $ 506,641 COSTS AND

EXPENSES Costs applicable to sales(1) 3 118,924 105,408 377,257

307,428 Amortization 33,830 27,763 106,880 93,232 General and

administrative 7,412 7,113 24,587 22,789 Exploration 9,814 3,706

22,879 7,669 Write-downs — — — 4,446 Pre-development, reclamation,

and other 7,961 4,491 16,908 13,059

Total costs and expenses 177,941 148,481 548,511 448,623 OTHER

INCOME (EXPENSE), NET Loss on debt extinguishment 17 — (10,040 )

(9,342 ) (10,040 ) Fair value adjustments, net 10 — (961 ) (864 )

(13,235 ) Interest expense, net of capitalized interest 17 (3,606 )

(8,068 ) (10,941 ) (30,063 ) Other, net 7 3,164 6,405

28,439 5,862 Total other income (expense), net (442 )

(12,664 ) 7,292 (47,476 ) Income (loss) before income and

mining taxes (2,420 ) 15,102 14,236 10,542 Income and mining tax

(expense) benefit 8 (14,232 ) 54,455 (23,180 ) 53,118

NET INCOME (LOSS) $ (16,652 ) $ 69,557 $ (8,944 ) $ 63,660

OTHER COMPREHENSIVE INCOME (LOSS), net of tax: Unrealized

gain (loss) on equity securities, net of tax of $997 and ($1,177)

for the three and nine months September 30, 2016, respectively

1,066 1,387 (1,134 ) 4,533 Reclassification adjustments for

impairment of equity securities — — 426 20 Reclassification

adjustments for realized (gain) loss on sale of equity securities

32 (2,965 ) 1,300 (2,691 ) Other comprehensive income

(loss) 1,098 (1,578 ) 592 1,862 COMPREHENSIVE

INCOME (LOSS) $ (15,554 ) $ 67,979 $ (8,352 ) $ 65,522

NET INCOME (LOSS) PER SHARE 9 Basic $ (0.09 ) $ 0.43

$ (0.05 ) $ 0.41 Diluted $ (0.09 ) $ 0.42

$ (0.05 ) $ 0.40

Coeur Mining, Inc. and

Subsidiaries Condensed Consolidated Statements of Cash Flows

(Unaudited) Three months ended Nine months

ended September 30, September 30,

2017 2016 2017 2016

Notes In thousands CASH FLOWS FROM OPERATING

ACTIVITIES: Net income (loss) $ (16,652 ) $ 69,557

(8,944 ) 63,660 Adjustments: Amortization 33,830 27,763 106,880

93,232 Accretion 2,691 2,184 7,798 8,201 Deferred taxes 1,940

(49,463 ) (1,529 ) (66,738 ) Loss on debt extinguishment — 10,040

9,342 10,040 Fair value adjustments, net — 961 864 13,235

Stock-based compensation 2,585 2,312 8,127 7,534 Gain on sale of

the Joaquin project — — (21,138 ) — Write-downs — — — 4,446 Other

(3,157 ) (5,236 ) (8,979 ) (4,743 ) Changes in operating assets and

liabilities: Receivables 6,529 19,672 17,719 10,751 Prepaid

expenses and other current assets (3,195 ) (2,816 ) (3,882 ) (2,435

) Inventory and ore on leach pads (2,874 ) (8,900 ) 10,421 (24,408

) Accounts payable and accrued liabilities 7,735 (18,262 )

(2,697 ) (12,407 ) CASH PROVIDED BY OPERATING ACTIVITIES

29,432 47,812 113,982 100,368

CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (29,461

) (25,627 ) (90,922 ) (71,087 ) Acquisitions, net — (1,427 ) —

(1,427 ) Proceeds from the sale of assets 1,083 4,802 16,538 16,104

Purchase of investments (3,595 ) (21 ) (13,559 ) (120 ) Sale of

investments 403 5,432 11,321 7,077 Other (5,850 ) (1,299 ) (7,457 )

(4,218 ) CASH USED IN INVESTING ACTIVITIES (37,420 ) (18,140

) (84,079 ) (53,671 ) CASH FLOWS FROM FINANCING ACTIVITIES:

Issuance of common stock — 49,513 — 122,584 Issuance of notes and

bank borrowings, net of issuance costs 17 (2,257 ) — 242,701 —

Payments on debt, capital leases, and associated costs 17 (3,344 )

(107,868 ) (195,501 ) (120,551 ) Gold production royalty payments —

(7,563 ) — (27,155 ) Other (6 ) 1,051 (3,726 ) 323

CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES (5,607 )

(64,867 ) 43,474 (24,799 ) Effect of exchange rate

changes on cash and cash equivalents (222 ) 121 662

(95 ) INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

(13,817 ) (35,074 ) 74,039 21,803 Cash and cash equivalents at

beginning of period 250,038 257,591 162,182

200,714 Cash and cash equivalents at end of period $

236,221 $ 222,517 $ 236,221 $ 222,517

Coeur Mining, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets September

30, 2017 (Unaudited) December 31, 2016

ASSETS Notes In thousands, except

share data CURRENT ASSETS Cash and cash equivalents $ 236,221 $

162,182 Receivables 13 66,415 60,431 Inventory 14 72,329 106,026

Ore on leach pads 14 78,801 64,167 Prepaid expenses and other

20,360 17,981 474,126 410,787 NON-CURRENT ASSETS

Property, plant and equipment, net 15 235,058 216,796 Mining

properties, net 16 536,201 558,455 Ore on leach pads 14 69,805

67,231 Restricted assets 12 20,953 17,597 Equity and debt

securities 12 29,125 4,488 Receivables 13 13,461 30,951 Other

23,363 12,604 TOTAL ASSETS $ 1,402,092 $

1,318,909

LIABILITIES AND STOCKHOLDERS’ EQUITY

CURRENT LIABILITIES Accounts payable $ 60,188 $ 53,335 Accrued

liabilities and other 50,593 42,743 Debt 17 14,375 12,039 Royalty

obligations 10 — 4,995 Reclamation 4 3,604 3,522

128,760 116,634 NON-CURRENT LIABILITIES Debt 17 274,523 198,857

Royalty obligations 10 — 4,292 Reclamation 4 104,505 95,804

Deferred tax liabilities 77,190 74,798 Other long-term liabilities

52,577 60,037 508,795 433,788 STOCKHOLDERS’ EQUITY

Common stock, par value $0.01 per share; authorized 300,000,000

shares, issued and outstanding 181,428,717 at September 30, 2017

and 180,933,287 at December 31, 2016 1,814 1,809 Additional paid-in

capital 3,318,987 3,314,590 Accumulated other comprehensive income

(loss) (1,896 ) (2,488 ) Accumulated deficit (2,554,368 )

(2,545,424 ) 764,537 768,487 TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY $ 1,402,092 $ 1,318,909

Adjusted EBITDA Reconciliation

(Dollars in thousands except per share amounts)

LTM3Q 2017

3Q 2017 2Q 2017 1Q 2017 2016

4Q 2016

LTM3Q 2016

3Q 2016 Net income (loss) $ (17,250 ) $ (16,652 ) $ (10,955

) $ 18,663 $ 55,352 $ (8,306 ) $ (239,342 ) $ 69,557 Interest

expense, net of capitalized interest 17,798 3,606 3,749 3,586

36,920 6,857 41,821 8,068 Income tax provision (benefit) 22,058

14,232 (2,098 ) 11,046 (54,239 ) (1,122 ) (70,928 ) (54,455 )

Amortization 136,809 33,830 32,946

40,104 123,161 29,929 129,422

27,763

EBITDA 159,415 35,016 23,642 73,399 161,194

27,358 (139,027 ) 50,933 Fair value adjustments, net (790 ) — (336

) 1,200 11,581 (1,654 ) 11,689 961 Impairment of equity securities

1,109 — 305 121 703 683 337 — Foreign exchange (gain) loss 857 (229

) (1,000 ) (1,349 ) 10,720 3,435 9,882 1,466 Gain on sale of

Joaquin project (21,138 ) — — (21,138 ) — — — — (Gain) loss on sale

of assets and securities (225 ) (2,117 ) (513 ) 2,066 (11,334 ) 339

(11,841 ) (7,462 ) Gain on repurchase of Rochester royalty (2,332 )

— (2,332 ) — — — — — (Gain) loss on debt extinguishment 20,667 —

9,342 — 21,365 11,325 (6,147 ) 10,040 San Bartolomé workforce

severance 2,175 2,175 — — — — — — Corporate reorganization costs —

— — — — — 133 — Transaction-related costs 820 819 — — 1,199 1 1,297

26 Asset retirement obligation accretion 9,498 2,511 2,450 2,390

8,369 2,147 8,510 2,096 Inventory adjustments and write-downs 2,092

1,302 1,796 (104 ) 6,917 389 9,083 4,665 Write-downs — —

— — 4,446 —

317,783 —

Adjusted EBITDA $ 172,148 $

39,477 $ 33,354 $ 56,585 $ 215,160

$ 44,023 $ 201,699 $ 62,725

Adjusted Net Income (Loss)

Reconciliation

(Dollars in thousands except per share amounts)

3Q

2017 2Q 2017 1Q 2017 4Q 2016 3Q

2016 Net income (loss) $ (16,652 ) $ (10,955 ) $ 18,663 $

(8,306 ) $ 69,557 Fair value adjustments, net — (336 ) 1,200 (1,654

) 961 Impairment of marketable securities — 305 121 683 — Inventory

write-downs — — — — 3,689 Gain on sale of Joaquin project — —

(21,138 ) — — (Gain) loss on sale of assets and securities (2,117 )

(513 ) 2,066 339 (7,462 ) Gain on repurchase of Rochester royalty —

(2,332 ) — — — Loss on debt extinguishment — 9,342 — 11,325 10,040

San Bartolomé workforce severance 2,175 — — — — Transaction costs

819 — — 1 26 Deferred tax on reorganization — — — — (40,767 )

Foreign exchange (gain) loss (1,660 ) 1,972 4,268 351 2,549 Tax

effect of adjustments (990 ) — 1,807 —

(38 )

Adjusted net income (loss) $ (18,425 ) $ (2,517 )

$ 6,987 $ 2,739 $ 38,555

Adjusted net income (loss) per share - Basic $ (0.10 ) $

(0.01 ) $ 0.04 $ 0.01 $ 0.24

Adjusted net income (loss) per

share - Diluted $ (0.10 ) $ (0.01 ) $ 0.04 $ 0.01 $ 0.23

Consolidated Free Cash Flow

Reconciliation

(Dollars in thousands)

3Q 2017 2Q 2017 1Q

2017 4Q 2016 3Q 2016 Cash flow from operating

activities $ 29,432 $ 29,279 $ 55,271 $ 25,449 $ 47,812 Capital

expenditures (29,461 ) (37,482 ) (23,979 ) (29,926 ) (25,627 ) Gold

production royalty payments — — — —

(7,563 ) Free cash flow (29 ) (8,203 ) 31,292 (4,477 )

14,622

Reconciliation of All-in

Sustaining Costs per Silver Equivalent Ounce for Nine Months

Ended September 30, 2017 Silver Gold

Total In thousands except per ounce amounts

Palmarejo Rochester

SanBartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 161,145 $ 89,220

$ 64,032 $ 1,045 $ 315,442 $ 109,478 $

58,301 $ 167,779 $ 483,221

Amortization 50,995

15,345 5,053 301 71,694 25,389

8,883 34,272 105,966

Costs applicable to

sales $ 110,150 $ 73,875 $ 58,979 $ 744 $ 243,748 $ 84,089 $

49,418 $ 133,507 $ 377,255

Silver equivalent ounces sold

10,809,932 5,551,913 3,497,263 107,026 19,966,134 29,599,974

Gold equivalent ounces sold

90,348 70,216 160,564

Costs

applicable to sales per ounce $ 10.19 $ 13.31 $ 16.86 $ 6.95 $

12.21 $ 931 $ 704 $ 831 $ 12.75

Inventory adjustments (0.04

) (0.09 ) (0.22 ) — (0.09 ) (3 ) 4 — (0.06 )

Adjusted costs applicable to sales per ounce $ 10.15 $ 13.22

$ 16.64 $ 6.95

$ 12.12 $ 928 $ 708

$

831 $ 12.69

Costs applicable to sales per

average spot ounce $ 9.17 $ 12.32 $ 11.28 $ 11.33

Inventory

adjustments (0.04 ) (0.08 ) (0.08 ) (0.05 )

Adjusted costs

applicable to sales per average spot ounce $ 9.13 $ 12.24

$ 11.20 $ 11.28

Costs

applicable to sales $ 377,255

Treatment and refining

costs 4,312

Sustaining capital(1) 47,795

General and administrative 24,587

Exploration 22,879

Reclamation 12,279

Project/pre-development costs

5,903

All-in sustaining costs $ 495,010

Silver equivalent ounces sold 19,966,134

Kensington and

Wharf silver equivalent ounces sold 9,633,840

Consolidated silver equivalent ounces sold 29,599,974

All-in sustaining costs per silver equivalent ounce $

16.72 Inventory adjustments $

(0.06 ) Adjusted all-in sustaining costs per

silver equivalent ounce $ 16.66

Consolidated silver equivalent ounces sold (average spot)

33,311,575

All-in sustaining costs per average spot

silver equivalent ounce $ 14.86

Inventory adjustments $ (0.05 )

Adjusted all-in

sustaining costs per average spot silver equivalent ounce

$ 14.81 Reconciliation

of All-in Sustaining Costs per Silver Equivalent Ounce for

Three Months Ended September 30, 2017 Silver

Gold Total In thousands except per ounce

amounts Palmarejo Rochester

SanBartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 49,669 $ 27,866

$ 18,795 $ 59 $ 96,389 $ 35,522 $

20,553 $ 56,075 $ 152,464

Amortization 16,414

4,591 1,430 20 22,455 7,864

3,223 11,087 33,542

Costs applicable to

sales $ 33,255 $ 23,275 $ 17,365 $ 39 $ 73,934 $ 27,658 $

17,330 $ 44,988 $ 118,922

Silver equivalent ounces sold

3,386,963 1,673,704 951,219 8,027 6,019,913 9,215,393

Gold

equivalent ounces sold

29,173 24,085 53,258

Costs

applicable to sales per ounce $ 9.82 $ 13.91 $ 18.26 $ 4.86 $

12.28 $ 948 $ 720 $ 845 $ 12.90

Inventory adjustments (0.06

) (0.22 ) (0.68 ) — (0.20 ) (2 ) (1 ) (2 ) (0.14 )

Adjusted costs applicable to sales per ounce $ 9.76 $ 13.69

$ 17.58 $ 4.86

$ 12.08 $ 946 $ 719

$

843 $ 12.76

Costs applicable to sales per

average spot ounce $ 8.73 $ 12.66 $ 11.19 $ 11.17

Inventory

adjustments (0.05 ) (0.20 ) (0.18 ) (0.12 )

Adjusted costs

applicable to sales per average spot ounce $ 8.68 $ 12.46

$ 11.01 $ 11.05

Costs

applicable to sales $ 118,922

Treatment and refining

costs 1,408

Sustaining capital 18,626

General and

administrative 7,412

Exploration 9,814

Reclamation 4,364

Project/pre-development costs 2,337

All-in sustaining costs $ 162,883

Silver equivalent ounces sold 6,019,913

Kensington and

Wharf silver equivalent ounces sold 3,195,480

Consolidated silver equivalent ounces sold 9,215,393

All-in sustaining costs per silver equivalent ounce $

17.68 Inventory adjustments $ (0.14 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 17.54 Consolidated silver

equivalent ounces sold (average spot) 10,645,948

All-in sustaining costs per average spot silver equivalent

ounce $ 15.30 Inventory adjustments

$ (0.12 )

Adjusted all-in sustaining costs per average spot

silver equivalent ounce $ 15.18

Reconciliation of All-in Sustaining Costs per

Silver Equivalent Ounce for Three Months Ended June 30,

2017 Silver Gold Total In

thousands except per ounce amounts Palmarejo

Rochester

SanBartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 48,325 $ 29,099

$ 25,604 $ 586 $ 103,614 $ 36,335 $

18,317 $ 54,652 $ 158,266

Amortization 14,431

4,938 2,212 168 21,749 8,347

2,549 10,896 32,645

Costs applicable to

sales $ 33,894 $ 24,161 $ 23,392 $ 418 $ 81,865 $ 27,988 $

15,768 $ 43,756 $ 125,621

Silver equivalent ounces sold

2,995,623 1,774,000 1,398,038 59,234 6,226,895 9,258,455

Gold

equivalent ounces sold

29,031 21,495 50,526

Costs

applicable to sales per ounce $ 11.31 $ 13.62 $ 16.73 $ 7.06 $

13.15 $ 964 $ 734 $ 866 $ 13.57

Inventory adjustments (0.10

) (0.08 ) (0.77 ) — (0.24 ) (12 ) 3 (6 ) (0.19 )

Adjusted costs applicable to sales per ounce $ 11.21 $ 13.54

$ 15.96 $ 7.06

$ 12.91 $ 952 $ 737

$

860 $ 13.38

Costs applicable to sales per

average spot ounce $ 10.20 $ 12.63 $ 12.23 $ 12.10

Inventory

adjustments (0.09 ) (0.07 ) (0.23 ) (0.17 )

Adjusted costs

applicable to sales per average spot ounce $ 10.11 $ 12.56

$ 12.00 $ 11.93

Costs

applicable to sales $ 125,621

Treatment and refining

costs 1,288

Sustaining capital 17,569

General and

administrative 7,042

Exploration 7,813

Reclamation 4,096

Project/pre-development costs 1,677

All-in sustaining costs $ 165,106

Silver equivalent ounces sold 6,226,895

Kensington and

Wharf silver equivalent ounces sold 3,031,560

Consolidated silver equivalent ounces sold 9,258,455

All-in sustaining costs per silver equivalent ounce $

17.83 Inventory adjustments $ (0.19 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 17.64 Consolidated silver

equivalent ounces sold (average spot) 10,384,025

All-in sustaining costs per average spot silver equivalent

ounce $ 15.90 Inventory adjustments

$ (0.17 )

Adjusted all-in sustaining costs per average spot

silver equivalent ounce $ 15.73

Reconciliation of All-in Sustaining Costs per

Silver Equivalent Ounce for Three Months Ended March 31,

2017 Silver Gold Total In

thousands except per ounce amounts Palmarejo

Rochester

SanBartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 63,151 $ 32,255

$ 19,633 $ 400 $ 115,439 $ 37,621 $

19,431 $ 57,052 $ 172,491

Amortization 20,150

5,816 1,411 113 27,490 9,178

3,111 12,289 39,779

Costs applicable to sales

$ 43,001 $ 26,439 $ 18,222 $ 287 $ 87,949 $ 28,443 $ 16,320 $

44,763 $ 132,712

Silver equivalent ounces sold 4,427,346

2,104,209 1,148,006 39,765 7,719,326 11,126,126

Gold equivalent

ounces sold 32,144

24,636 56,780

Costs applicable to sales per

ounce $ 9.71 $ 12.56 $ 15.87 $ 7.22 $ 11.39 $ 885 $ 662 $ 788 $

11.93

Inventory adjustments (0.03 ) 0.01 0.01

— (0.01 ) (1 ) 8 3 0.01

Adjusted costs

applicable to sales per ounce $ 9.68 $ 12.57 $ 15.88 $ 7.22

$ 11.38 $ 884 $ 670

$ 791 $

11.94

Costs applicable to sales per average spot

ounce $ 8.89 $ 11.80 $ 10.64 $ 10.85

Inventory

adjustments (0.02 ) 0.01 (0.01 ) 0.01

Adjusted costs

applicable to sales per average spot ounce $ 8.87 $ 11.81

$ 10.63 $ 10.86

Costs applicable to

sales $ 132,712

Treatment and refining costs 1,616

Sustaining capital 11,600

General and administrative

10,133

Exploration 5,252

Reclamation 3,818

Project/pre-development costs 1,889

All-in sustaining

costs $ 167,020 Silver equivalent ounces

sold 7,719,326

Kensington and Wharf silver equivalent ounces

sold 3,406,800

Consolidated silver equivalent ounces

sold 11,126,126

All-in sustaining costs per silver

equivalent ounce $ 15.01 Inventory

adjustments $ 0.01

Adjusted all-in sustaining costs per

silver equivalent ounce $ 15.02

Consolidated silver equivalent ounces sold (average spot)

12,235,897

All-in sustaining costs per average spot silver

equivalent ounce $ 13.65 Inventory

adjustments $ 0.01

Adjusted all-in sustaining costs per

average spot silver equivalent ounce $ 13.66

Reconciliation of All-in Sustaining Costs

per Silver Equivalent Ounce for Three Months Ended December

31, 2016 Silver Gold Total In

thousands except per ounce amounts Palmarejo

Rochester

SanBartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 29,667 $ 29,581

$ 18,514 $ 557 $ 78,319 $ 31,577 $ 21,861 $

53,438 $ 131,757

Amortization 8,784 5,844

1,303 148 16,079 8,584 4,982

13,566 29,645

Costs applicable to sales $

20,883 $ 23,737 $ 17,211 $ 409 $ 62,240 $ 22,993 $ 16,879 $ 39,872

$ 102,112

Silver equivalent ounces sold 1,871,178 1,983,393

1,217,659 57,903 5,130,133 8,674,273

Gold equivalent ounces

sold 28,864 30,205

59,069

Costs applicable to sales per

ounce $ 11.16 $ 11.97 $ 14.13 $ 7.06 $ 12.13 $ 797 $ 559 $ 675

$ 11.77

Inventory adjustments (0.15 ) 0.02 (0.16 ) —

(0.08 ) 4 (3 ) 1 (0.04 )

Adjusted costs

applicable to sales per ounce $ 11.01 $ 11.99 $ 13.97 $ 7.06

$ 12.05 $ 801 $ 556

$ 676 $

11.73

Costs applicable to sales per average spot

ounce $ 10.24 $ 11.14 $ 11.42 $ 10.59

Inventory

adjustments (0.13 ) 0.02 (0.08 ) (0.04 )

Adjusted

costs applicable to sales per average spot ounce $ 10.11 $

11.16

$ 11.34 $ 10.55

Costs

applicable to sales $ 102,112

Treatment and refining

costs 1,261

Sustaining capital 19,850

General and

administrative 6,587

Exploration 5,261

Reclamation 3,537

Project/pre-development costs 1,693

All-in sustaining costs $ 140,301

Silver equivalent ounces sold 5,130,133

Kensington and

Wharf silver equivalent ounces sold 3,544,140

Consolidated silver equivalent ounces sold 8,674,273

All-in sustaining costs per silver equivalent ounce $

16.17 Inventory adjustments $ (0.04 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 16.13 Consolidated silver

equivalent ounces sold (average spot) 9,636,058

All-in sustaining costs per average spot silver equivalent

ounce $ 14.56 Inventory adjustments

$ (0.04 )

Adjusted all-in sustaining costs per average spot

silver equivalent ounce $ 14.52

Reconciliation of All-in Sustaining Costs per

Silver Equivalent Ounce for Three Months Ended September 30,

2016 Silver Gold Total In

thousands except per ounce amounts Palmarejo

Rochester

SanBartolomé

Endeavor Total Kensington

Wharf Total Costs applicable to sales,

including amortization (U.S. GAAP) $ 21,794 $ 27,027

$ 22,536 $ 486 $ 71,843 $ 34,755 $ 26,158 $

60,913 $ 132,756

Amortization 5,761 5,244

1,723 113 12,841 8,046 6,461

14,507 27,348

Costs applicable to sales $

16,033 $ 21,783 $ 20,813 $ 373 $ 59,002 $ 26,709 $ 19,697 $ 46,406

$ 105,408

Silver equivalent ounces sold 1,462,401 1,868,085

1,390,552 46,069 4,767,107 8,397,467

Gold equivalent ounces

sold 30,998 29,508

60,506

Costs applicable to sales per

ounce $ 10.96 $ 11.66 $ 14.97 $ 8.10 $ 12.38 $ 862 $ 668 $ 649

$ 12.55

Inventory adjustments (0.26 ) (0.10 ) (0.57 ) —

(0.28 ) (3 ) (109 ) (55 ) (0.56 )

Adjusted costs

applicable to sales per ounce $ 10.70 $ 11.56 $ 14.40 $ 8.10

$ 12.10 $ 859 $ 559

$ 712 $

11.99

Costs applicable to sales per average spot

ounce $ 10.29 $ 11.11 $ 11.91 $ 11.62

Inventory

adjustments (0.24 ) (0.09 ) (0.27 ) (0.52 )

Adjusted costs

applicable to sales per average spot ounce $ 10.05 $ 11.02

$ 11.64 $ 11.10

Costs

applicable to sales $ 105,408

Treatment and refining

costs 761

Sustaining capital 19,762

General and

administrative 7,113

Exploration 3,706

Reclamation 4,036

Project/pre-development costs 2,133

All-in sustaining costs $ 142,919

Silver equivalent ounces sold 4,767,107

Kensington and

Wharf silver equivalent ounces sold 3,630,360

Consolidated silver equivalent ounces sold 8,397,467

All-in sustaining costs per silver equivalent ounce $

17.02 Inventory adjustments $ (0.56 )

Adjusted all-in sustaining costs per silver equivalent ounce

$ 16.46 Consolidated silver

equivalent ounces sold (average spot) 9,074,222

All-in sustaining costs per average spot silver equivalent

ounce $ 15.75 Inventory adjustments

$ (0.52 )

Adjusted all-in sustaining costs per average spot

silver equivalent ounce $ 15.23

Reconciliation of All-in Sustaining Costs per

Silver Equivalent Ounce for 2017 Guidance

Silver Gold In thousands except per ounce

amounts Palmarejo Rochester San

Bartolomé Endeavor

TotalSilver

Kensington Wharf Total

Gold

TotalCombined

Costs applicable to sales, including amortization (U.S.

GAAP) $ 215,400 $ 118,700 $ 86,000 $ 1,044

$ 421,144 $ 153,800 $ 83,600 $ 237,400 $

658,544

Amortization 67,800 20,500

7,800 300 96,400

38,800 12,800 51,600

148,000

Costs applicable to sales $ 147,600 $ 98,200 $

78,200 $ 744 $ 324,744 $ 115,000 $ 70,800 $ 185,800 $ 510,544

Silver equivalent ounces sold 14,500,000 7,690,000 4,700,000

107,000 26,997,000 40,557,000

Gold equivalent ounces sold

131,000 95,000 226,000

Costs applicable to sales per ounce $10.00

- $10.50 $12.50 - $13.00 $16.50 - $17.00 $850

- $900 $700 - $750 Costs applicable to

sales $ 510,544

Treatment and refining costs 5,100

Sustaining capital, including capital lease payments 70,000

General and administrative 32,000

Exploration 33,000

Reclamation 16,000

Project/pre-development costs

7,000

All-in sustaining costs $ 673,644

Silver equivalent

ounces sold 26,997,000

Kensington and Wharf silver

equivalent ounces sold 13,560,000

Consolidated silver

equivalent ounces sold 40,557,000

All-in sustaining costs

per silver equivalent ounce $16.25 - $16.75

Reconciliation of All-in Sustaining Costs per 70:1 Spot

Silver Equivalent Ounce for 2017 Guidance

Silver Gold In thousands except per ounce

amounts Palmarejo Rochester San

Bartolomé Endeavor

TotalSilver

Kensington Wharf Total Gold

TotalCombined

Costs applicable to sales, including amortization (U.S.

GAAP) $ 215,400 $ 118,700 $ 86,000 $ 1,044 $ 421,144 $ 153,800

$ 83,600 $ 237,400 $ 658,544

Amortization 67,800

20,500 7,800 300 96,400 38,800

12,800 51,600 148,000

Costs applicable to

sales $ 147,600 $ 98,200 $ 78,200 $ 744 $ 324,744 $ 115,000 $

70,800 $ 185,800 $ 510,544

Silver equivalent ounces sold

15,700,000 8,200,000 4,700,000 107,000 28,707,000 44,527,000

Gold equivalent ounces sold

131,000 95,000 226,000

Costs

applicable to sales per ounce guidance $9.00 - $9.50

$11.50 - $12.00 $16.50 - $17.00 $850 - $900

$700 - $750 Costs applicable to sales $

510,544

Treatment and refining costs 5,100

Sustaining

capital, including capital lease payments 70,000

General and

administrative 32,000

Exploration 33,000

Reclamation 16,000

Project/pre-development costs

7,000

All-in sustaining costs $ 673,644

Silver equivalent

ounces sold 28,707,000

Kensington and Wharf silver

equivalent ounces sold 15,820,000

Consolidated silver

equivalent ounces sold 44,527,000

All-in sustaining costs

per silver equivalent ounce guidance $14.75 - $15.25

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171025006378/en/

Coeur Mining, Inc.Courtney Lynn, (312) 489-5910Vice President,

Investor Relations and Treasurerwww.coeur.com

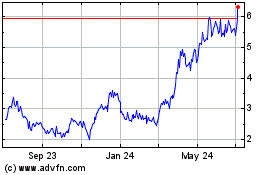

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

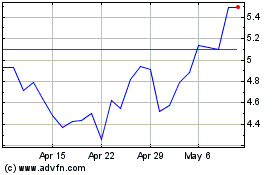

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2023 to Apr 2024