Former HSBC Executive Convicted of Fraud for Front-Running -- Update

October 23 2017 - 2:16PM

Dow Jones News

By Rebecca Davis O'Brien

A federal jury in Brooklyn on Monday found a former high-ranking

HSBC Holdings PLC executive guilty on charges that he misused

information about a client's $3.5 billion currency trade to make

millions of dollars for the bank.

Mark Johnson, HSBC's former global head of foreign-exchange cash

trading, was the first banker to face criminal charges stemming

from a U.S. Justice Department probe into foreign exchange rate

manipulations. He was convicted on eight counts of wire fraud and

one count of wire-fraud conspiracy; he was acquitted on a ninth

wire-fraud count.

Lawyers for Mr. Johnson couldn't immediately be reached for

comment. A spokesman for the Brooklyn U.S. attorney's office didn't

immediately have a comment on the verdict.

A spokesman for HSBC didn't immediately respond to requests for

comment. Mr. Johnson left HSBC earlier this year.

Mr. Johnson, a British citizen, wasn't accused of rigging

exchange rates, the main focus of the broader Justice Department

probe.

Instead, he and a colleague, Stuart Scott -- HSBC's former

European head of currency trading -- were charged in connection

with a practice known as front-running, in which someone with

advance knowledge of a major market order buys for their own

account, then earns a profit when the larger transaction drives up

the price.

Mr. Scott, who left HSBC in 2014, is in the U.K. fighting

extradition and wasn't tried alongside Mr. Johnson. A lawyer for

Mr. Scott couldn't immediately be reached for comment.

In 2011, HSBC won the bidding to handle the conversion of $3.5

billion worth of dollars into British pounds on behalf of Cairn

Energy PLC, an Edinburgh, Scotland-based oil and gas company,

according to evidence presented at trial.

Prosecutors alleged that the days and hours leading up to the

transaction, HSBC traders in London and New York stockpiled

millions of pounds in HSBC accounts, at Mr. Johnson's direction. At

trial, jurors heard recordings of phone calls that prosecutors said

showed Mr. Johnson using coded language to fellow currency traders

to set off the buying spree.

When the transaction went through, on Dec. 7, 2011, Messrs.

Johnson and Scott executed it in a way that drove up the price of

the pound, prosecutors alleged, allowing them to sell HSBC's

stockpiled currency at a higher price, while Cairn's proceeds from

the exchange shrunk.

"This is not a coincidence -- this is a conspiracy," Brian

Young, a trial attorney for the Department of Justice, said in the

prosecution's closing arguments.

The scheme netted $3 million in trading profits and $5 million

in fees for HSBC, prosecutors said.

Prosecutors used cooperating witnesses and the bank's recordings

of Mr. Johnson's phone calls to argue he and others had conspired

to use the client's confidential information to make money for HSBC

and secure larger bonuses. "This is not how people talk when they

are engaged in honest business transactions," Mr. Young said in

closing arguments.

When Cairn noticed the rising price of the pound that day,

another HSBC employee blamed it on purchases by a "Russian buyer,"

according to evidence presented at trial.

In one phone call recorded by HSBC and played at trial, Mr.

Johnson said to Mr. Scott, "I think we got away with it." Mr.

Johnson's lawyer said the statement reflected concern about the

other employee's "misrepresentation" about the Russian

transaction.

During the trial, lawyers for Mr. Johnson argued that he had

been acting in the client's best interest, that prosecutors were

trying to criminalize normal currency trading activity and had

twisted their client's words to create the illusion of a

conspiracy. In closing arguments, defense lawyer John Wing said

prosecutors hadn't found "evidence of anything remotely close to

criminal conduct."

Mr. Johnson, who was arrested at John F. Kennedy airport in New

York in July 2016, testified in his own defense at trial, at times

seeking to explain comments he made in the recorded calls as jokes

or misunderstandings.

Earlier in October, the U.S. Federal Reserve fined HSBC $175

million for failing to adequately supervise its foreign-exchange

trading business, citing the alleged conduct by Messrs. Johnson and

Scott as examples of the lack of oversight.

In 2012, the bank avoided criminal money-laundering charges by

entering into a $1.9 billion settlement and a five-year deferred

prosecution agreement with the Justice Department. In 2014, the

bank paid $614 million to settle allegations that it rigged

benchmark currency rates.

Write to Rebecca Davis O'Brien at rebecca.obrien@wsj.com

(END) Dow Jones Newswires

October 23, 2017 14:01 ET (18:01 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

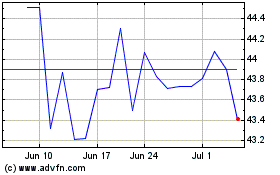

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

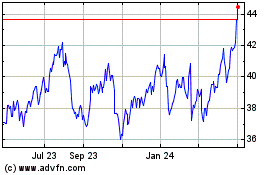

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024