General Electric Has a Long-Term Care Problem. It Isn't Alone

October 23 2017 - 5:59AM

Dow Jones News

By Leslie Scism

Worries about the health of the long-term-care insurance

industry have nettled investors for years. General Electric Co.'s

comments show the problem isn't going away soon.

The Boston company on Friday cut its earnings forecast for the

year, citing poor results at units including its power division.

The company also said results could be hit by a reassessment of an

insurance unit's prospects -- a remark that came as a surprise to

some, given that GE years ago spun out a business closely

identified with long-term care, now known as Genworth Financial

Inc.

A GE executive on the company's conference call Friday morning

said the firm has actuaries combing through its long-term-care

insurance reserves in "a very complex exercise" to figure out if

they are deficient.

GE still has billions of dollars in reinsurance obligations on

its books from coverage it sold to other insurers that had sold

policies to consumers. By doing so, GE took on some of those

carriers' responsibilities for paying claims, according to

analysts. The risk for GE and others is whether carriers that sold

long-term care policies have adequate reserves to pay future

claims.

Until the review is completed, GE is halting dividends from its

GE Capital unit to the parent, which has fueled concerns about

whether the company will maintain its common-stock dividend. GE is

aiming to conclude the review before year-end.

If GE proceeds with an outsize charge, it "may result in a

negative read across" a wide range of other companies with

long-term-care reserves, said analysts at securities firm Evercore

ISI in a recent report. Their report followed GE's disclosure this

summer of the review, when it noted "adverse claims

experience."

Evercore said long-term-care is "one of the larger balance-sheet

concerns" at insurers including Genworth, Manulife Financial Corp.

and Unum Group. The three companies declined to comment.

Evercore said its analysis of GE's regulatory filings indicates

the company likely has "a deficiency of 20% or more" in its

long-term-care reserves, which could mean a charge of $2.5 billion

or more.

Long-term-care insurance took off in the early 1990s. The

policies had strong appeal to older people, and many insurers

thought they had the perfect product to profit from people's

concerns about becoming unable to care for themselves and outliving

their savings.

In general, the policies pay for nursing homes, assisted living

facilities or health-care aides in people's private residences.

Such care generally isn't paid by the Medicare health-insurance

program for older people, while the state-federal Medicaid program

is for the poor.

Some early versions of long-term-care policies provided lifetime

benefits.

But by the mid 2000s, many insurers were rapidly ratcheting back

the benefits, concluding they had badly miscalculated how many

people would file claims and how long they would draw benefits

before dying, among other things.

Many insurers have obtained regulatory approval for double-digit

premium-rate increases on existing policyholders. Insurers say that

even those increases generally fall short of what is needed to

bring their older books of business back to break even in

profitability.

Industrywide, insurers have taken billions of dollars of charges

over the past decade. Genworth, which was spun off from GE in 2004,

has tallied losses from its older long-term-care policies of $2.5

billion since 2006.

GE assumed the liabilities it now is analyzing through a series

of reinsurance agreements, Evercore said. GE quit selling

reinsurance policies some years ago.

GE said Friday that its long-term-care reserves total about $12

billion, about half of its total insurance reserves.

Evercore said its analysis of GE's regulatory filings with state

insurance departments showed that claims were running far higher

than GE had expected.

"While this is not the worst block out there, we still view it

as one of the riskier ones given that these policies were likely

written in the late 1980s/early 1990s," Evercore said of one large

part of GE's book of business.

Aside from miscalculations about claims volume, insurers are

also battling the impact of ultralow interest rates. Insurers count

on investing premiums until needed to pay claims, and

long-term-care premiums typically are invested for years, if not

decades, before customers file their claims. Genworth has said it

priced many older policies on the assumption the company would earn

7.5% a year on invested premiums. But new premiums are being

invested today at about 4.25%.

Write to Leslie Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

October 23, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

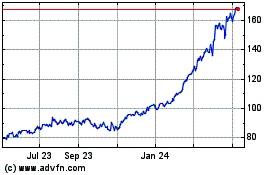

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Mar 2024 to Apr 2024

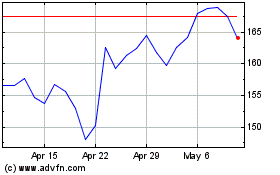

GE Aerospace (NYSE:GE)

Historical Stock Chart

From Apr 2023 to Apr 2024