This prospectus relates to the sale of

up to 20,534,898 shares of our common stock, par value $0.001 per share, of Ekso Bionics Holdings, Inc., a Nevada corporation,

by the selling stockholder named in this prospectus. The shares being offered were issued and sold to accredited investors

in a private placement offering, or the 2017 Private Placement, which closed on September 11, 2017. Shares of common stock issued

in the 2017 Private Placement were sold at a purchase price of $1.00 per share.

The shares offered by this prospectus may

be sold by the selling stockholder from time to time in the open market, through privately negotiated transactions or a combination

of these methods, at market prices prevailing at the time of sale or at negotiated prices. See the disclosure under the heading

“Plan of Distribution” elsewhere in this prospectus for more information about how the selling stockholder may sell

or otherwise dispose of its shares of common stock hereunder.

The selling stockholder may sell any, all

or none of the securities offered by this prospectus and we do not know when or in what amount the selling stockholder may sell

its shares of common stock hereunder following the effective date of this registration statement.

We will not receive any proceeds from the

sale of our common stock by the selling stockholder in the offering described in this prospectus. We will bear all expenses of

registration incurred in connection with this offering, but all selling and other expenses incurred by the selling stockholder

will be borne by the selling stockholder.

Our common stock is listed on the Nasdaq

Capital Market under the symbol “EKSO.” On September 28, 2017, the last reported sale price for our common stock was

$1.25 per share. Prospective purchasers of our securities are urged to obtain current information as to the market prices of our

securities, where applicable.

You should rely only on the information

contained in this prospectus or any prospectus supplement or amendment thereto. We have not authorized anyone to provide you with

different information. This prospectus may only be used where it is legal to sell these securities. The information in this prospectus

is only accurate on the date of this prospectus, regardless of the time of any sale of securities.

This prospectus is dated October 19,

2017.

ABOUT THIS PROSPECTUS

You should rely

only on the information contained in this prospectus or in any prospectus we may authorize to be delivered to you. We have not

authorized anyone to provide you with information other than that contained in this prospectus. We are not, and the selling stockholder

is not, making an offer of securities in any state or other jurisdiction where it is not permitted. You should assume that the

information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial

condition, results of operations and prospects may have changed since that date. Further, you should not consider any information

in this prospectus to be investment, legal or tax advice. We encourage you to consult your own counsel, accountant and other advisors

for legal, tax, business, financial and related advice regarding an investment in our securities.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference

in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for

the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty

or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless the context otherwise requires, “Ekso

Bionics,” “the Company,” “we,” “us,” “our” and similar terms refer to Ekso

Bionics Holdings, Inc. and our subsidiaries.

Note Regarding Reverse Stock Split

Effective May 4, 2016, the Company effected a one-for-seven

reverse split of its common stock. As a result of the reverse stock split, every seven shares of issued and outstanding common

stock were converted into one share of issued and outstanding common stock. Historical share and per share amounts reflected in

this prospectus have been adjusted to reflect the reverse stock split.

PROSPECTUS SUMMARY

The following is a summary of what we

believe to be the most important aspects of our business and the offering of our securities under this prospectus. We urge you

to read this entire prospectus, including the more detailed consolidated financial statements, notes to the consolidated financial

statements and other information incorporated by reference from our other filings with the SEC or included in any applicable prospectus

supplement. Investing in our securities involves risks. Therefore, you should carefully consider the risk factors set forth in

any prospectus supplements and in our most recent annual and quarterly filings with the SEC, as well as other information in this

prospectus and any prospectus supplements and the documents incorporated by reference herein or therein, before purchasing our

securities. Each of the risk factors could adversely affect our business, operating results and financial condition, as well as

adversely affect the value of an investment in our securities.

Company Overview

Ekso Bionics designs, develops and sells

exoskeletons that augment human strength, endurance, and mobility. Our exoskeleton technology serves multiple markets and can be

used both by able-bodied users as well as by persons with physical disabilities. We have sold, rented or leased devices that (a)

enable individuals with neurological conditions affecting gait (stroke and spinal cord injury) to rehabilitate and to walk again

and (b) allow industrial workers to perform heavy duty work for extended periods.

Additional Information

For additional information related to our

business and operations, please refer to the reports incorporated herein by reference, including our Annual Report on Form 10-K

for the year ended December 31, 2016, as described under the caption “Incorporation of Documents by Reference” on page

10 of this prospectus.

Corporate Information

We were incorporated under the laws of

the State of Nevada in January 2012 under the name PN Med Group, Inc. and changed our name to Ekso Bionics Holdings, Inc. in December

2013. Ekso Bionics, Inc. was incorporated under the laws of the State of Delaware in January 19, 2005 and in January 2014 completed

a reverse merger transaction with and became a wholly-owned subsidiary of Ekso Bionics Holdings, Inc. In connection with the reverse

merger transaction and pursuant to a split-off agreement and general release, we transferred our pre-merger assets and liabilities

to our pre-merger majority stockholders, in exchange for the surrender by them and cancellation of 2,497,586 shares of our common

stock. As a result of the merger and split-off, we discontinued our pre-merger business and acquired the business of Ekso Bionics,

and have continued the existing business operations of Ekso Bionics as a publicly-traded company under the name Ekso Bionics Holdings,

Inc.

Our principal executive offices are located

at 1414 Harbour Way South, Suite 1201, Richmond, California 94804 and our telephone number is (510) 984-1761. Our website address

is

www.eksobionics.com

. The information on, or that can be accessed through, our website is not part of this prospectus.

We make available free of charge on or

through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments

to those reports as soon as reasonably practicable after they are electronically filed with, or furnished to, the SEC. Copies of

our annual reports on Form 10-K will be furnished without charge to any person who submits a written request directed to the attention

of our Secretary, at our offices located at 1414 Harbour Way South, Suite 1201, Richmond, California, 94804. The SEC maintains

an internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding

issuers that file electronically with the SEC.

About This Offering

This prospectus relates to the public offering,

which is not being underwritten, by the selling stockholder listed in this prospectus, of up to 20,534,898 shares of our common

stock. The shares being offered were issued and sold to accredited investors in a private placement offering, or the

2017 Private Placement, which closed on September 11, 2017. Shares of common stock issued in the 2017 Private Placement were sold

at a purchase price of $1.00 per share. The shares offered by this prospectus may be sold by the selling stockholder from time

to time after the 12-month anniversary of the closing of the 2017 Private Placement in the open market, through negotiated transactions

or otherwise at market prices prevailing at the time of sale or at negotiated prices. We will receive none of the proceeds

from the sale of the shares by the selling stockholder. We will bear all expenses of registration incurred in connection

with this offering, but all selling and other expenses incurred by the selling stockholder will be borne by the selling stockholder.

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion

in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our

Business Startups, or JOBS, Act enacted in April 2012. An emerging growth company may take advantage of reduced reporting requirements

that are otherwise applicable to public companies. These provisions include, but are not limited to:

|

|

·

|

not being required to comply with the auditor attestation

requirements of Section 404 of the Sarbanes Oxley Act of 2002;

|

|

|

·

|

reduced disclosure obligations regarding executive

compensation in our periodic reports, proxy statements and registration statements; and

|

|

|

·

|

exemptions from the requirements of holding a nonbinding

advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

|

We may take advantage of these provisions

for up to five years after the first sale of our common equity securities pursuant to an effective registration statement under

the Securities Act of 1933, as amended (the “Securities Act”). However, if certain events occur prior to the end of

such five year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1 billion

or we issue more than $1 billion of non-convertible debt in any three year period, we would cease to be an emerging growth company

prior to the end of such five year period. We will cease being an emerging growth company as of December 31, 2017.

We may choose to take advantage of some

but not all of these reduced burdens. We have taken advantage of certain of the reduced disclosure obligations regarding executive

compensation in this registration statement and may elect to take advantage of other reduced burdens in future filings. As a result,

the information that we provide to our stockholders may be different than you might receive from other public reporting companies

in which you hold equity interests.

Under the JOBS Act, emerging growth companies

can delay adopting new or revised accounting standards until such time as those standards apply to private companies. However,

we have irrevocably elected not to avail ourselves of this extended transition period for complying with new or revised accounting

standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are

not emerging growth companies.

THE OFFERING

This prospectus relates to the resale from time to time by the

selling stockholder identified herein of up to 20,534,898 shares of our common stock. We are not offering any shares for sale under

the registration statement of which this prospectus is a part.

|

Common stock currently outstanding

|

|

59,903,876 shares

(1)(2)

|

|

|

|

|

|

Common stock offered by the Company

|

|

None

|

|

|

|

|

|

Common stock offered by the selling stockholder

|

|

20,534,898 shares

|

|

|

|

|

|

Use of proceeds

|

|

We will not receive any of the proceeds from the sales of our common stock offered by the selling stockholder under this prospectus. See “Use of Proceeds.”

|

|

|

|

|

|

NASDAQ symbol

|

|

EKSO

|

|

|

|

|

|

Risk Factors

|

|

Investing in our common stock

involves a high degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion

of factors that you should consider carefully before deciding to invest in our common stock.

|

|

|

(1)

|

As of September 28, 2017.

|

|

|

(2)

|

Excludes 4,852,499 shares of our common stock reserved for issuance under our 2014 Amended and Restated Equity Plan, or 2014

Plan, and our Employee Stock Purchase Plan, or ESPP. As of September 28, 2017, there were 3,463,761 unissued shares of common stock

subject to outstanding options and restricted stock units pursuant to the 2014 Plan and the ESPP.

|

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated

by reference herein, contain forward-looking statements. Any and all statements contained in this prospectus that are not statements

of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,”

“should,” “could,” “project,” “estimate,” “pro-forma,” “predict,”

“potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,”

“help,” “believe,” “continue,” “intend,” “expect,” “future,”

and terms of similar import (including the negative of any of the foregoing) may be intended to identify forward-looking statements.

However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this

prospectus may include, without limitation, statements regarding (i) the plans and objectives of management for future operations,

including plans or objectives relating to the design, development and commercialization of human exoskeletons, (ii) a projection

of income (including income/loss), earnings (including earnings/loss) per share, capital expenditures, dividends, capital structure

or other financial items, (iii) our future financial performance, including any such statement contained in a discussion and analysis

of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities

and Exchange Commission (the “SEC”), (iv) our beliefs regarding the potential for commercial opportunity for exoskeleton

technology in general and our exoskeleton products in particular, (v) our beliefs regarding potential clinical and other health

benefits of our medical devices, and (vi) the assumptions underlying or relating to any statement described in points (i), (ii),

(iii), (iv) or (v) above.

The forward-looking statements are not

meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based

upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of

risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events

and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties.

Factors that may influence or contribute to the inaccuracy of the forward-looking statements or cause actual results to differ

materially from expected or desired results may include, without limitation, our inability to obtain adequate financing, the significant

length of time and resources associated with the development of our products and related insufficient cash flows and resulting

illiquidity, our inability to expand our business, significant government regulation of medical devices and the healthcare industry,

the results of clinical studies or trials, lack of product diversification, volatility in the price of our raw materials, existing

or increased competition, results of arbitration and litigation, stock volatility and illiquidity, and our failure to implement

our business plans or strategies. A description of some of the risks and uncertainties that could cause our actual results to differ

materially from those described by the forward-looking statements in this prospectus appears in the section captioned “Risk

Factors” and elsewhere in this prospectus.

Readers are cautioned not to place undue

reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim

any obligation to update the forward-looking statements contained in this prospectus to reflect any new information or future events

or circumstances or otherwise.

Readers should read this prospectus in

conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto

in this prospectus, and other documents which we may file from time to time with the SEC.

RISK FACTORS

An investment in shares of our common stock

is highly speculative and involves a high degree of risk. We face a variety of risks that may affect our operations

or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing

in our common stock you should carefully consider the

risks and uncertainties and all other

information contained in or incorporated by reference in this prospectus, including the risks and uncertainties discussed in our

Annual Report on Form 10-K for the year ended December 31, 2016, together with any material changes or additions thereto contained

in subsequent filed Quarterly Reports on Form 10-Q and those contained in our other filings with the SEC, which are incorporated

herein by reference. For a description of these reports and documents, and information about where you can find them, see “

Where

You Can Find More Information

” and “

Incorporation of Certain Documents By Reference

.”

If any of these risks actually occurs,

our business, prospects, financial condition and results of operations could be materially adversely affected. In that

case, the trading price of our common stock would likely decline and you may lose all or a part of your investment. Only

those investors who can bear the risk of loss of their entire investment should invest in our common stock.

USE OF PROCEEDS

We are registering the shares of common stock issued to the

selling stockholder in the 2017 Private Placement to permit the resale of these shares of common stock by the selling stockholder

from time to time after the 12-month anniversary of the closing of the 2017 Private Placement. We will not receive any proceeds

from the sale of our common stock offered by the selling stockholder under this prospectus.

We will bear all fees and expenses incident

to our obligation to register the shares of our common stock being offered for resale hereunder by the selling stockholder.

DETERMINATION OF OFFERING PRICE

The selling stockholder will determine

at what price it may sell the offered shares, and such sales may be made at prevailing market prices or at privately negotiated

prices. See “

Plan of Distribution

” below for more information.

SELLING STOCKHOLDER

This prospectus covers the resale from

time to time by the selling stockholder identified in the table below of up to 20,534,898 outstanding shares of common stock sold

to the selling stockholder in the 2017 Private Placement. Pursuant to the Purchase Agreement entered into in connection with the

2017 Private Placement, the investors, including the selling stockholder listed in the table below, are prohibited from selling,

pledging or otherwise disposing of the shares of common stock acquired by them in the 2017 Private Placement for a period of 12

months following the closing of the 2017 Private Placement, other than in connection with a bona fide gift of such shares approved

by the Company or pursuant to a transfer without consideration.

Pursuant to the Registration Rights Agreement

entered into with the investor in the 2017 Private Placement, we are filing with the SEC the registration statement of which this

prospectus forms a part to register such resales of our common stock under the Securities Act. We have also agreed to cause this

registration statement to become effective and to keep such registration statement effective within and for the time periods set

forth in the Registration Rights Agreement. Our failure to satisfy the filing or effectiveness deadlines set forth in the Registration

Rights Agreement may subject us to payment of certain monetary penalties pursuant to the terms of the Registration Rights Agreement.

The selling stockholder identified in the

table below may from time to time (subject to the 12-month lock-up discussed above) offer and sell under this prospectus any or

all of the shares of common stock described under the column “Shares of Common Stock Being Offered in this Offering”

in the table below. The table below has been prepared based upon information furnished to us by the selling stockholder as of the

date of this prospectus. The selling stockholder may have sold, transferred or otherwise disposed of some or all of its shares

since the date on which the information in the following table is presented in transactions exempt from or not subject to the registration

requirements of the Securities Act. Information concerning the selling stockholder may change from time to time and, if necessary,

we will amend or supplement this prospectus accordingly.

We have assumed that all shares of common

stock reflected in the table as being offered in the offering covered by this prospectus will be sold from time to time in this

offering. We cannot give an estimate as to the number of shares of common stock that will actually be held by the selling stockholder

upon termination of this offering because the selling stockholder may offer some or all of its common stock under the offering

contemplated by this prospectus or acquire additional shares of common stock. The total number of shares that may be

sold hereunder will not exceed the number of shares offered hereby. Please read the section entitled “Plan of

Distribution” in this prospectus.

The following table sets forth the name

of the selling stockholder, the nature of any position, office or other material relationship, if any, that the selling stockholder

has had within the past three years with us or with any of our predecessors or affiliates, the number of shares of our common stock

beneficially owned by such stockholder before this offering, the number of shares to be offered for such stockholder’s

account and the number and the percentage of the class to be beneficially owned by such stockholder after completion of the offering.

The number of shares owned are those beneficially owned, as determined under the rules of the SEC, and such information is not

necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares

of our common stock as to which a person has sole or shared voting power or investment power and any shares of common stock which

the person has the right to acquire within 60 days after September 28, 2017 (the “Determination Date”), through the

exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a power

of attorney or revocation of a trust, discretionary account or similar arrangement, and such shares are deemed to be beneficially

owned and outstanding for computing the share ownership and percentage of the person holding such options, warrants or other rights,

but are not deemed outstanding for computing the percentage of any other person.

|

Selling Stockholder

|

|

Shares of

Common Stock

Beneficially

Owned

Prior to

the Offering

|

|

|

Shares of

Common

Stock Being

Offered in

this Offering

|

|

|

Shares of

Common Stock

Beneficially

Owned Upon

Completion

of the Offering

1

|

|

|

Percentage of

Common Stock

Beneficially

Owned Upon

Completion

of the Offering

2

|

|

|

Puissance Cross-Border Opportunities II LLC

(3)

|

|

|

20,534,898

|

|

|

|

20,534,898

|

|

|

|

0

|

|

|

|

0

|

%

|

|

|

1

|

Assumes all of the shares of common stock to be registered on the registration statement of which this prospectus is a part

are sold in the offering and that shares of common stock beneficially owned by such selling stockholder but not being registered

by this prospectus (if any) are not sold.

|

|

|

2

|

Percentages are based on 59,903,876 shares of common stock issued and outstanding as of the Determination Date. Beneficial

ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect

to securities. Shares of common stock underlying shares of preferred stock, options or warrants currently exercisable or convertible,

or exercisable or convertible within 60 days after the Determination Date are deemed outstanding for computing the percentage of

the person holding such shares of preferred stock, options or warrants but are not deemed outstanding for computing the percentage

of any other person.

|

|

|

3

|

Puissance Capital Management LP, or PCM, is the investment manager of the selling stockholder. Puissance Capital Fund (GP)

LLC and Puissance Capital Management (GP) LLC are the general partners of PCM. Theodore T. Wang, Ph.D. is the managing member of

the general partners and may be deemed to have voting and investment power over the shares held by the selling stockholder. Dr.

Wang has been a member of our board of directors since September 19, 2017.

|

PLAN OF DISTRIBUTION

The selling stockholder may, from time

to time (subject to the 12-month lock-up discussed above), sell any or all of its shares of our common stock on any stock exchange,

market or trading facility on which the shares are traded or in private transactions. If the shares of common stock are sold through

underwriters, the selling stockholder will be responsible for underwriting discounts or commissions or agent’s commissions.

These sales may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time

of sale or at negotiated prices. The selling stockholder may use any one or more of the following methods when selling shares:

|

|

·

|

any national securities exchange or quotation service on which the securities may be listed or

quoted at the time of sale;

|

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

transactions other than on exchanges or systems or in the over-the-counter market;

|

|

|

·

|

through the writing of options, whether such options are listed on an options exchange or otherwise;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

·

|

privately negotiated transactions;

|

|

|

·

|

broker-dealers may agree with the selling stockholder to sell a specified number of such shares

at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale; and

|

|

|

·

|

any other method permitted pursuant to applicable law.

|

The selling stockholder may also sell shares

under Rule 144 under the Securities Act, if available, rather than under this prospectus. We were at one time designated as a “shell

company” under SEC regulations and consequently persons who wish to sell under Rule 144 must comply with additional requirements.

Pursuant to Rule 144(i), securities issued by a current or former shell that otherwise meet the holding period and other requirements

of Rule 144 nevertheless cannot be sold in reliance on Rule 144 unless at the time of a proposed sale pursuant to Rule 144, the

issuer has satisfied certain reporting requirements under the Securities Exchange Act of 1934, as amended (the “Exchange

Act’).

The selling stockholder may also engage

in short sales against the box, puts and calls and other transactions in our securities or derivatives of our securities and may

sell or deliver shares in connection with these trades.

Broker-dealers engaged by the selling stockholder

may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated.

The selling stockholder does not expect these commissions and discounts to exceed what is customary in the types of transactions

involved. Any profits on the resale of shares of common stock by a broker-dealer acting as principal might be deemed to be underwriting

discounts or commissions under the Securities Act. Discounts, concessions, commissions and similar selling expenses, if any, attributable

to the sale of shares will be borne by the selling stockholder. The selling stockholder may agree to indemnify any agent, dealer

or broker-dealer that participates in transactions involving sales of the shares if liabilities are imposed on that person under

the Securities Act.

In connection with the sale of the shares

of our common stock or otherwise, the selling stockholder may enter into hedging transactions with broker-dealers, which may in

turn engage in short sales of the shares of common stock in the course of hedging in positions they assume. The selling stockholder

may also sell shares of common stock short and deliver shares of common stock covered by this prospectus to close out short positions

and to return borrowed shares in connection with such short sales. The selling stockholder may also loan or pledge shares of common

stock to broker-dealers that in turn may sell such shares.

The selling stockholder may from time to

time pledge or grant a security interest in some or all of the shares of our common stock owned by it and, if the selling stockholder

defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell the shares of our common

stock from time to time under this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or other

applicable provision of the Securities Act amending the list of selling stockholders to include the pledgee, transferee or other

successors in interest as selling stockholders under this prospectus.

The selling stockholder also may transfer

the shares of common stock in other circumstances, in which case the transferees, pledgees or other successors in interest will

be the selling beneficial owners for purposes of this prospectus and may sell the shares of common stock from time to time under

this prospectus after we have filed an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities

Act amending the list of selling stockholders to include the pledgees, transferees or other successors in interest as selling stockholders

under this prospectus. The selling stockholder also may transfer and donate the shares of common stock in other circumstances in

which case the transferees, donees, pledgees or other successors in interest will be the selling beneficial owners for purposes

of this prospectus.

The selling stockholder and any broker-dealers

or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions paid, or any discounts or concessions allowed to, such broker-dealers

or agents and any profit realized on the resale of the shares purchased by them may be deemed to be underwriting commissions or

discounts under the Securities Act. At the time a particular offering of the shares of common stock is made, a prospectus supplement,

if required, will be distributed which will set forth the aggregate amount of shares of common stock being offered and the terms

of the offering, including the name or names of any broker-dealers or agents, any discounts, commissions and other terms constituting

compensation from the selling stockholder and any discounts, commissions or concessions allowed or re-allowed or paid to broker-dealers.

Under the securities laws of some states, the shares of common stock may be sold in such states only through registered or licensed

brokers or dealers. In addition, in some states the shares of common stock may not be sold unless such shares have been registered

or qualified for sale in such state or an exemption from registration or qualification is available and is complied with. There

can be no assurance that any selling stockholder will sell any or all of the shares of our common stock registered pursuant to

the registration statement of which this prospectus forms a part.

The selling stockholder has informed us

that it does not have any agreement or understanding, directly or indirectly, with any person to distribute our common stock.

We are required to pay all fees and expenses

incident to the registration of the shares of common stock. Except as provided for indemnification of the selling stockholder,

we are not obligated to pay any of the expenses of any attorney or other advisor engaged by the selling stockholder. We have agreed

to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities

Act.

If we are notified by the selling stockholder

that any material arrangement has been entered into with a broker-dealer for the sale of shares of common stock, we will file a

post-effective amendment to the registration statement. If the selling stockholder uses this prospectus for any sale of the shares

of our common stock, they will be subject to the prospectus delivery requirements of the Securities Act.

The anti-manipulation rules of Regulation

M under the Exchange Act may apply to sales of our common stock and activities of the selling stockholder, which may limit the

timing of purchases and sales of any of the shares of common stock by the selling stockholder and any other participating person.

Regulation M may also restrict the ability of any person engaged in the distribution of the shares of common stock to engage in

passive market-making activities with respect to the shares of common stock. Passive market making involves transactions in which

a market maker acts as both our underwriter and as a purchaser of our common stock in the secondary market. All of the foregoing

may affect the marketability of the shares of common stock and the ability of any person or entity to engage in market-making activities

with respect to the shares of common stock.

Once sold under the registration statement,

of which this prospectus forms a part, the shares of common stock will be freely tradable in the hands of persons other than our

affiliates.

LEGAL MATTERS

Nutter, McClennen and Fish, LLP, Boston,

Massachusetts, will pass upon the validity of the issuance of the securities to be offered by this prospectus.

EXPERTS

The

financial statements and schedule incorporated by reference in this prospectus and elsewhere in the registration statement have

been so incorporated in reliance on the report of OUM & Co., LLP, independent registered public accountants, upon authority

of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the reporting requirements of the Exchange

Act and file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy

these reports, proxy statements and other information at the SEC’s public reference facilities at 100 F Street, N.E., Room

1580, Washington, D.C. 20549. You can request copies of these documents by writing to the SEC and paying a fee for the copying

cost. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the public reference facilities. SEC filings

are also available at the SEC’s web site at http://www.sec.gov.

We have filed with the SEC a registration statement under the

Securities Act relating to the offering of these securities. The registration statement, including the attached exhibits, contains

additional relevant information about us and the securities. This prospectus does not contain all of the information set forth

in the registration statement. You can obtain a copy of the registration statement, at prescribed rates, from the SEC at the address

listed above.

The registration statement and the documents referred to below

under “Incorporation by Reference” are also available on our Internet website www.eksobionics.com. We have not incorporated

by reference into this prospectus the information on our website, and you should not consider it to be a part of this prospectus.

Incorporation

of documents by reference

The

SEC allows us to incorporate by reference into this prospectus certain information we file with it, which means that we can disclose

important information by referring you to those documents. The information incorporated by reference is considered to be a part

of this prospectus, and information that we file later with the SEC will automatically update and supersede information contained

in this prospectus and any accompanying prospectus supplement. We incorporate by reference the documents listed below that we have

previously filed with the SEC (excluding any portions of any Form 8-K that are not deemed “filed” pursuant to

the General Instructions of Form 8-K):

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2016 filed on March

15, 2017;

|

|

|

·

|

the portions of our definitive proxy statement on Schedule 14A filed on April 28, 2017 that are

deemed “filed” with the SEC under the Exchange Act;

|

|

|

·

|

our Quarterly Reports on Form 10-Q for the fiscal quarter ended March 31, 2017, filed on May 9,

2017, and the fiscal quarter ended June 30, 2017, filed on August 7, 2017;

|

|

|

·

|

our Current Reports on Form 8-K filed on January 6, 2017, March 23, 2017, April 5, 2017, April

26, 2017, May 23, 2017, June 23, 2017, July 25, 2017, August 17, 2017, September 8, 2017, September 19, 2017 and September 22,

2017;

|

|

|

·

|

the description of our common stock contained in our Registration Statement on Form 8-A, filed

on May 6, 2015 pursuant to Section 12(b) of the Exchange Act, which incorporates by reference the description of the shares of

our common stock contained in our Registration Statement on Form S-1 (File No. 333-195783) filed on May 7, 2014 and declared effective

by the SEC on June 20, 2014, and any amendment or report filed with the SEC for purposes of updating such description; and

|

|

|

·

|

all reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14

and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination or completion of the offering

of securities under this prospectus shall be deemed to be incorporated by reference in this prospectus and to be a part hereof

from the date of filing such reports and other documents.

|

Any statement contained in this prospectus

or in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded

for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document

that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified

or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide to each person, including

any beneficial owner, to whom this prospectus is delivered, upon written or oral request, at no cost to the requester, a copy of

any or all of the information that is incorporated by reference in this prospectus. Requests for such documents should be directed

to: Investor Relations, Ekso Bionics Holdings, Inc., 1414 Harbour Way South, Suite 1201, Richmond, California 94804, (510) 984-1761.

You may also access the documents incorporated

by reference in this prospectus through our website at www.eksobionics.com. Except for the specific incorporated documents listed

above, no information available on or through our website shall be deemed to be incorporated in this prospectus or the registration

statement of which it forms a part.

This prospectus may contain information

that updates, modifies or is contrary to information in one or more of the documents incorporated by reference in this prospectus.

You should rely only on the information incorporated by reference or provided in this prospectus. We have not authorized anyone

else to provide you with different information. You should not assume that the information in this prospectus is accurate as of

any date other than the date of this prospectus or the date of the documents incorporated by reference in this prospectus.

DISCLOSURE OF COMMISSION POSITION ON

INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

Under the Nevada Revised Statutes, our

directors and officers are not individually liable to us or our stockholders for any damages as a result of any act or failure

to act in their capacity as an officer or director unless it is proven that:

|

|

·

|

His or her act or failure to act constituted a breach of his or her fiduciary duty as a director

or officer; and

|

|

|

·

|

His or her breach of these duties involved intentional misconduct, fraud or a knowing violation

of law.

|

Nevada law allows corporations to provide

broad indemnification to its officers and directors. At the present time, our Articles of Incorporation and Bylaws also

provide for broad indemnification of our current and former directors, trustees, officers, employees and other agents.

Insofar as indemnification for liabilities

arising under the Securities Act may be permitted to our directors, officers and controlling persons, we have been advised that

in the opinion of the SEC, such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable.

Ekso

Bionics Holdings, Inc.

20,534,898 Shares of Common Stock

PROSPECTUS

October 19,

2017

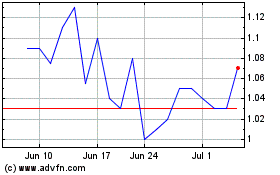

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ekso Bionics (NASDAQ:EKSO)

Historical Stock Chart

From Apr 2023 to Apr 2024