By Lynn Cook

One of the early centers of American shale drilling is roaring

back to life, boosted by a building boom of petrochemical plants,

fertilizer factories and gas-export terminals along the Gulf

Coast.

The Haynesville Shale, a giant natural-gas field in northwest

Louisiana, was one of fracking's hottest spots a decade ago. But it

fizzled out about five years ago as gas prices plunged and drillers

focused on finding oil next door in Texas. Now, the Haynesville is

being reborn as companies with longstanding positions in the area,

such as Chesapeake Energy Corp., and newcomers seeking opportunity

rush back in and drill again.

Gas production from the Haynesville has risen more than 20% so

far this year, to more than 7 billion cubic feet a day from less

than 6 billion in January, according to the U.S. Energy Department.

The number of rigs active in northern Louisiana parishes and the

Texas portion of the field has more than tripled in the past year

to 44, according to oil field services company Baker Hughes

Inc.

"The Haynesville is where it began," said Frank Patterson,

Chesapeake Energy's vice president of exploration and

production.

The company has been learning how to get more out of the ground

by drilling and fracking longer wells, Mr. Patterson told investors

earlier this month. Chesapeake, which now produces more than 1.2

billion cubic feet of gas each day in the Haynesville, plans to

ramp up efforts to re-frack old wells where production is starting

to peter out to squeeze more out of them, using newer

technology.

QEP Resources Inc. is also re-fracking 30 Haynesville wells this

quarter and plans to drill more in the Bossier formation in

northern Louisiana, which overlaps parts of the Haynesville but at

a different depth.

"The payouts on these wells are extremely attractive at $3 gas,"

said Charles Stanley, QEP's chairman and chief executive. Gas this

year has averaged roughly $3 per million cubic feet at Louisiana's

Henry Hub, a benchmark for U.S. prices.

A new report by the U.S. Geological Survey estimates the

Haynesville and Bossier shales contain more than 300 trillion cubic

feet of natural gas, up from roughly 70 trillion cubic feet in its

last survey in 2010.

Private companies have piled into the Haynesville over the past

15 to 18 months, thanks to backing from private-equity firms.

Dallas-based Covey Park, backed by Denham Capital, and Vine Oil

& Gas LP, backed by Blackstone Group LP, have collectively

spent billions buying property in the area from Royal Dutch Shell

PLC, Exxon Mobil Corp. and others.

"If you have Haynesville acreage, it's a good time to drill,"

said Clay Lightfoot, an analyst with energy consulting firm Wood

Mackenzie.

Driving the trend is a dramatic reduction in costs. Three years

ago, the Haynesville had the most expensive well costs in the Lower

48 States, in part because its fuel-bearing rocks are the deepest

in the U.S., some more than 15,000 feet underground. But in 2014,

when oil prices started to plunge from over $100 to less than $50,

some companies refocused on natural gas and began experimenting

with technology such as long lateral wells that has helped improve

the economics of extraction.

Rising demand for gas has boosted the area's prospects. The U.S.

Energy Department forecasts that between now and 2040, consumption

of natural gas will increase more than that of any other fuel

source, as demand from big industrial users rises and power plants

rapidly replace coal-fired facilities.

Regional producers can now also export their liquefied natural

gas. Cheniere Energy Inc.'s Sabine Pass LNG plant, a major

exporting facility that opened in Louisiana last year, is sending

cargoes of liquefied natural gas to Asia, Europe and South America.

A dozen other LNG projects are under construction or are permitted

and planned in Texas, Louisiana, Mississippi and Maryland.

That's a potential drawback for industrial users in the area,

such as petrochemical plants, of which there are almost 80 under

construction along the Gulf Coast. They fear the price of gas --

their main feedstock -- could rise as America ships more to foreign

buyers.

But the flexibility of domestic as well as foreign customers is

making gas production in the area more attractive to investors.

Since 2016, Castleton Commodities International LLC spent more

than a $1 billion to buy 160,000 acres of Anadarko Petroleum

Corp.'s Haynesville land in East Texas, where it operates nearly

2,000 wells. It recently got an equity investment from Tokyo Gas

America Ltd., the biggest utility in Japan and one of the largest

LNG players in Asia.

Tellurian Inc., whose founder Charif Souki started Cheniere,

recently bought Haynesville acreage. The company says the cost of

producing gas there and moving it to an export terminal will be

$2.25 per million cubic feet -- a big discount to the daily LNG

price for the Gulf of Mexico, which was $7.66 per million Btu last

week, according to S&P Global Platts.

Albert Huddleston, founder and managing partner of Aethon

Energy, a private company based in Dallas, began buying into the

Haynesville three years ago, taking over Noble Energy Inc.'s

position. Then, he kept buying. It was a contrarian strategy at the

time, said Mr. Huddleston.

"I'm a big believer once you find an area that meets your

objectives, you continue to buy in that neighborhood," he said.

(END) Dow Jones Newswires

October 17, 2017 05:44 ET (09:44 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

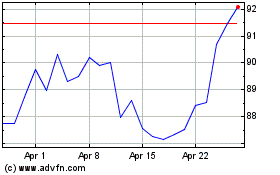

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

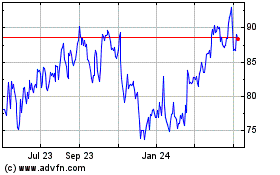

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024